ChangeWave Research: Consumer Smart Phone Trends

Consumer Smart Phones: 90 Day Outlook The Battle for Market Dominance – Apple vs. Samsung

Jean Crumrine

Overview: A ChangeWave survey of 3,942 consumers has taken a fresh look at smart phone industry trends – including customer satisfaction, OS preferences and future demand. As Samsung and Apple battle for dominance, are other manufacturers posing a competitive threat?

The June 20 - July 3 survey also looks at the growing consumer demand for ‘phablets’, along with the potential interest for a next generation iPhone and other Apple products expected to be released later this year.

We note that this survey focuses primarily on the North American smart phone market – with 87% of respondents from the U.S. ChangeWave Research is a service of 451 Research.

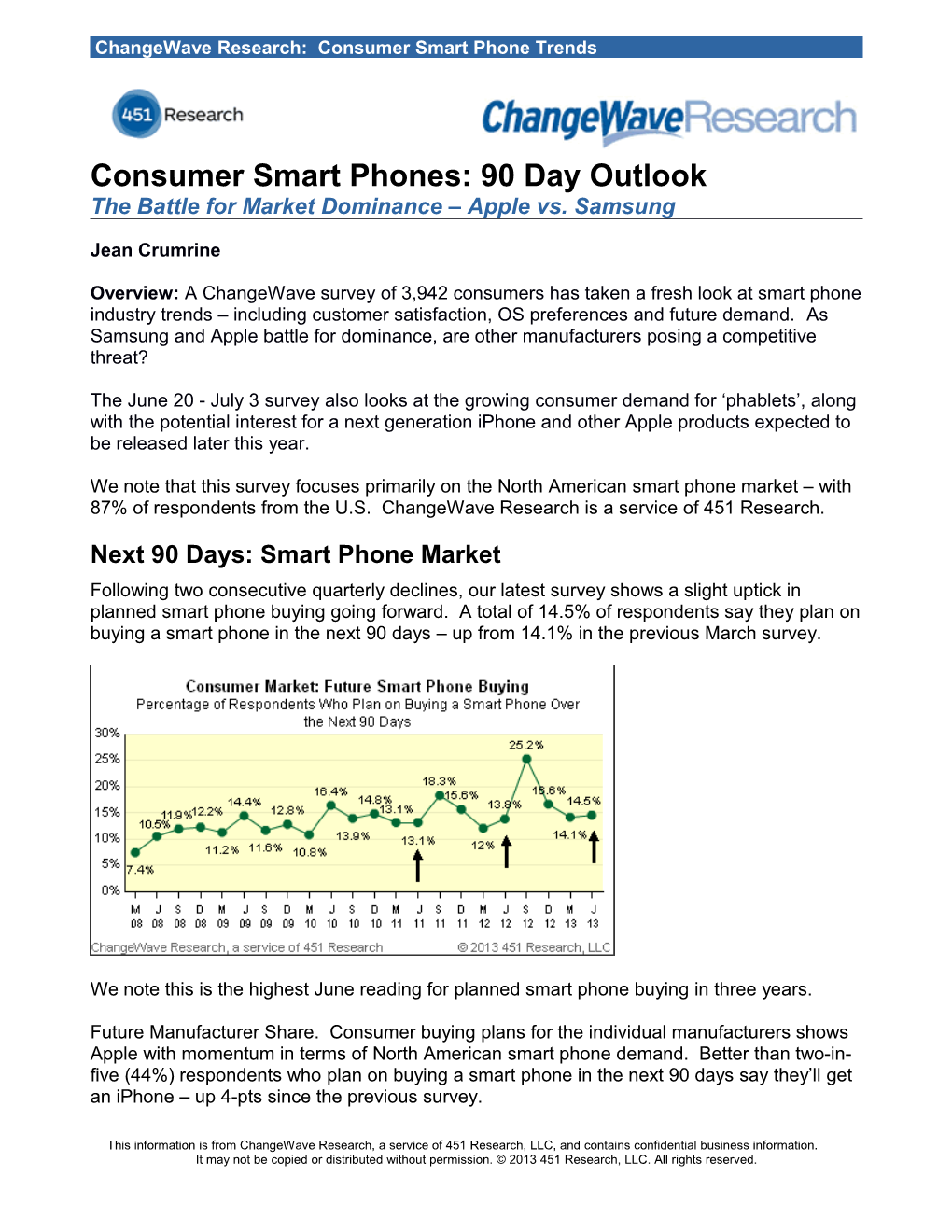

Next 90 Days: Smart Phone Market Following two consecutive quarterly declines, our latest survey shows a slight uptick in planned smart phone buying going forward. A total of 14.5% of respondents say they plan on buying a smart phone in the next 90 days – up from 14.1% in the previous March survey.

We note this is the highest June reading for planned smart phone buying in three years.

Future Manufacturer Share. Consumer buying plans for the individual manufacturers shows Apple with momentum in terms of North American smart phone demand. Better than two-in- five (44%) respondents who plan on buying a smart phone in the next 90 days say they’ll get an iPhone – up 4-pts since the previous survey.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. ChangeWave Research: Consumer Smart Phone Trends

As the following chart shows, the 4-pt uptick in Apple planned buying is impressive considering it’s occurring a full nine months after their most recent release (iPhone 5) and with no announced new smart phone product on the immediate horizon. While rumors continue to circulate regarding a next gen iPhone launch later this year – and nothing is certain prior to an official announcement – consumer anticipation of a new release is already contributing to Apple’s current momentum.

When we asked consumers who plan on purchasing Apple smart phones to tell us which model they’re most interested in buying, the iPhone 5 (63%) dominates but 28% say they’ll choose another model. Virtually all of this group identifies the “iPhone 5S” or next gen iPhone as their intended purchase.

Samsung. After an unprecedented rise over the past 18 months – including a 6-pt surge last quarter that corresponded with the Galaxy S 4 launch – Samsung planned buying (26%) remains just 1-pt below their highest level ever. This represents a huge five-fold leap in the past two years.

2 ChangeWave Research: Consumer Smart Phone Trends

When we look at the breakdown of Samsung models consumers plan on buying in the next 90 days, the newest Galaxy S 4 (54%) is by far the most popular. And while there is still significant demand for the Galaxy S III (21%), the next generation Note III (18%) – expected in Fall 2013 – is also garnering strong interest among planned Samsung buyers. Consumer buying plans are less encouraging for the other manufacturers, as they continue to struggle in the face of stiff competition from Apple and Samsung. BlackBerry. Only a few months after launching new devices that were expected to help re- energize the company, momentum for BlackBerry has slowed (from 7% in March to 4% in the current survey).

While we saw encouraging signs for BlackBerry in previous surveys, as we said in our March report “the road back for BlackBerry remains a long, uphill battle.” For now at least, our survey shows BlackBerry has been unable to sustain its positive movement – corroborated by their latest disappointing earnings announcement. These results offer little encouragement that the latest BlackBerry models will help bolster a comeback. Other Manufacturers. Nokia (3%) is still not seeing major momentum for its Windows Phone 8 Lumia devices, although for the second time in three surveys it has managed a 1-pt uptick among planned buyers. HTC (3%), which recently launched several new models – including the HTC One – is also up 1-pt in the current survey. This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 3 ChangeWave Research: Consumer Smart Phone Trends

Consumer planned buying of Motorola smart phones (1%) has dropped 4-pts to its lowest level since the dawn of the Android explosion back in December 2009. Customer Satisfaction. As in previous ChangeWave surveys, the Apple iPhone maintains its industry leading customer satisfaction ranking, with 67% of iPhone owners saying they’re Very Satisfied with their phone. We note among iPhone 5 owners, the Very Satisfied rating jumps to 77%, and has actually ticked 1-pt higher since the previous survey. In contrast, there has been a marked decline in satisfaction among customers with older iPhone models – as one might expect in an industry driven by demand for the latest new technologies and features. Percentage of Respondents Very Satisfied with their Smart Phone – By Manufacturer

Samsung is a strong second in terms of satisfaction, with a highly respectable 54% of its customers saying they’re Very Satisfied. Motorola (42%), Nokia (38%) and HTC (32%) are bunched within a 10-pt range of each other. The uptick in customer satisfaction that BlackBerry (26%) experienced in our previous surveys has proven short-lived. They now rank last on this measure – down 6-pts from March. Mobile Operating Systems Among consumers planning to buy a smart phone in the next 90 days, the Apple iOS is the number one preference, with 45% saying they’d prefer to have iOS on their new phone – a 7- pt jump since previously. Android OS (32%) is still firmly in second, although down 3-pts since last quarter. In an encouraging sign for Microsoft, Windows Phone 8 (6%) has regained its momentum after slipping last quarter – up 2-pts since March and just shy of the high of six months ago immediately after their new OS release. In contrast, BlackBerry’s share of OS preference (4%) has dropped 3-pts since the burst of momentum it experienced following the new BlackBerry 10 OS release.

4 ChangeWave Research: Consumer Smart Phone Trends OS Customer Satisfaction. We also took a look at OS customer satisfaction ratings based upon the operating system consumers have on their smart phones. Apple remains the clear leader – with 69% of customers using the Apple iOS saying they’re Very Satisfied. The Android OS (46%) has regained second in customer satisfaction, narrowly edging out Windows Phone (45%) operating system – though both remain well ahead of the rating for BlackBerry OS (27%).

Demand for Big Screen Smart Phones Previous ChangeWave surveys have shown a strong interest in large screen smart phones, and the current results show this trend is continuing to gain momentum.

A total of 36% of planned smart phone buyers say they’re most interested in buying a 5 inch or larger screen – up 3-pts from previously. While several manufacturers now offer, or plan to release, larger-screen size ‘phablet’ devices, Samsung is currently best positioned for this demand trend – with its Galaxy Note II (5.5 inch screen), Galaxy S 4 (5”), and Galaxy Mega (6.3”) already available, and a next generation Galaxy Note III (5.7”) expected later this year. Indeed, nearly one-in-two planned Samsung buyers (45%) say they’re most interested in purchasing a 5 inch screen or larger device – more than double the percentage among Non- Samsung planned buyers (20%).

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 5 ChangeWave Research: Consumer Smart Phone Trends

Focusing on respondents who already own a ‘phablet’, nearly three-quarters (72%) say they’re using their device primarily as a smart phone and another 21% are using it equally as both a smart phone and tablet. ChangeWave surveys have always found customer satisfaction to be a good indicator of industry demand, and here the findings are very positive for ‘phablet’ devices overall. Three- in-five ‘phablet’ owners (60%) report they’re Very Satisfied with their device. Another 32% say they’re Somewhat Satisfied. One attraction of ‘phablet’ devices is an easier and more enjoyable visual experience for web browsing and multimedia viewing. Thus, it’s not surprising that screen intensive activities such as Watching TV Shows/Movies, Reading eBooks and Editing Documents/Spreadsheets stand out as being more popular among ‘phablet’ owners than non-owners. Advanced Demand: Apple “iPhone 5S” We looked at advanced demand for a next generation “iPhone 5S” that Apple is expected to release later this year. After presenting consumers with a description of probable “iPhone 5S” features, we asked them how likely they would be to buy one when it becomes available. Some analysts think Apple will release its next generation “iPhone 5S” later this year. New features would likely include a faster processor, improved camera and battery life, fingerprint scanner and the new iOS 7 operating system. The “iPhone 5S” is expected to cost $199 for the 16GB model, $299 for the 32GB model, $399 for the 64GB model and $499 for the 128GB model, with a 2-year contract on most of the major carriers. How likely is it that you will buy a new Apple "iPhone 5S" for yourself or someone else (e.g., a family member) in the future?

6 ChangeWave Research: Consumer Smart Phone Trends The results show very strong advanced interest for a next generation iPhone – three-in-ten (30%) consumers say they’re likely to buy a new “iPhone 5S” in the future (11% Very Likely and 19% Somewhat Likely). This is one of the highest demand levels for an unannounced Apple model ever seen in a ChangeWave survey. By comparison, a similar question on future demand for the iPhone 5 – taken several months before it was officially announced – showed 14% Very Likely and 17% Somewhat Likely to purchase the iPhone 5, a product which shattered all previous iPhone model sales records. iPhone Owners vs. Non-iPhone Owners. As we’ve found with past releases, there’s a major difference between iPhone owners and non-owners in terms of likelihood of buying an iPhone 5S. More than half of current iPhone owners (55%) say they’re likely to purchase an “iPhone 5S” when it becomes available (24% Very Likely; 31% Somewhat Likely). An impressive 15% of non-iPhone owners say they’re likely to purchase an “iPhone 5S” (3% Very Likely; 12% Somewhat Likely). BlackBerry owners (28%) are most likely to say they’ll purchase an “iPhone 5S”, while Samsung owners (11%) are least likely. Impact of iTunes Radio and iOS 7 Announcement

In June Apple made several product announcements at its annual World Wide Developers Conference (WWDC). Although a next gen iPhone was not among the announcements, two highlights were a new music streaming service (iTunes Radio) and the biggest Apple smart phone operating system update (iOS 7) since the introduction of the iPhone. iTunes Radio. With iTunes Radio, Apple joins Pandora, Spotify and other services which have been in existence for years, as well as recently launched music services from Apple’s smart phone industry competitors – Microsoft Xbox Music and Google Play Music All Access.

We provided consumers with a brief description of the new iTunes Radio service and asked how likely it is they’ll use it when it becomes available.

Apple’s new iTunes Radio will feature streaming radio stations that learn the types of music you like and become more personalized as you listen. iTunes Radio will be free to use (ad supported), but those who subscribe to iTunes Match can listen without ads. How likely are you to use iTunes Radio once it becomes available? Current Survey Jun ‘13 Very Likely 11% Somewhat Likely 22% Unlikely 53% Don't Know 15%

The survey results show exceptionally strong consumer interest for iTunes Radio – with one- third of respondents (33%) saying they’re likely to use the service when it becomes available (11% Very Likely and 22% Somewhat Likely).

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 7 ChangeWave Research: Consumer Smart Phone Trends Of course the Apple brand and existing customer base represent a powerful base to help launch a new product. Not surprisingly, Apple iPhone Owners (25% Very Likely; 37% Somewhat Likely) are much more likely to say they’ll use iTunes Radio compared to Non- iPhone owners (2% Very Likely; 12% Somewhat Likely).

All-in-all, these survey results show strong potential for the new Apple product.

Apple iOS 7. We also looked at the iOS 7 upgrade announcement – asking iPhone owners how likely they will be to install the new operating system when it becomes available.

Apple recently announced their new iOS 7 operating system, with features including iTunes Radio, a Control Center screen to launch commonly used apps, and AirDrop for wireless sharing of photos and other files to nearby devices, among other things. The iOS 7 operating system will become available for download this fall. How likely are you to install the new iOS 7 on your current iPhone once it becomes available? Current Survey Jun ‘13 Very Likely 57% Somewhat Likely 23% Unlikely 11% Don't Know 9%

Four-in-five iPhone owners (80%) say they’re likely to install the new “iOS 7” operating system when it becomes available (57% Very Likely; 23% Somewhat Likely).

Bottom Line: The June ChangeWave survey shows a slight uptick in smart phone buying plans going forward. Nine months after the iPhone 5 release, Apple has the greatest momentum among respondents planning to buy a new smart phone. There is clear evidence that Apple’s momentum is at least partially being driven by demand for a next gen iPhone – although as yet there has been no official announcement of a new model release from Apple.

Samsung is also continuing to outperform. After an explosive leap over the previous two quarters Samsung consumer buying plans are just 1-pt off their record high reached last quarter at the time of the Galaxy S 4 launch.

The results for other major smart phone manufacturers are less encouraging. HTC and Nokia have each registered a slight uptick, but both are just marginally above their lows. Motorola barely registers in terms of planned buying – falling to their lowest level ever.

After promising results in the past two surveys, BlackBerry’s situation now appears more problematic. The latest findings show BlackBerry has been unable to sustain its positive movement and provides a warning sign that their newest models may not be compelling enough to help bolster a comeback.

The transformational shift of increased consumer interest in large-screen smart phones is continuing. Better than one-in-five planned buyers saying they’re most interested in a larger- screen size phone. Samsung remains best positioned to gain from this trend, but we’ll be paying close attention to see which other manufacturers capitalize on it going forward.

8 ChangeWave Research: Consumer Smart Phone Trends Summary of Key Findings

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 9 ChangeWave Research: Consumer Smart Phone Trends Table of Contents

Summary of Key Findings...... 9

The Findings 11

Overall Smart Phone Purchasing 11

Next 90 Days: Smart Phone Manufacturer Demand 12

Smart Phone Customer Satisfaction 16

Mobile Operating Systems 17

Demand for Big Screen Smart Phones 19

Advance Demand Trends: “iPhone 5S”, iTunes Radio and iOS 7 21

Other Smart Phone Findings 25

ChangeWave Research Methodology...... 29

About ChangeWave Research...... 29 About 451 Research...... 29

10 ChangeWave Research: Consumer Smart Phone Trends The Findings

Introduction: A ChangeWave survey of 3,942 consumers has taken a fresh look at smart phone industry trends – including customer satisfaction, OS preferences and future demand. As Samsung and Apple battle for dominance, are other manufacturers posing a competitive threat?

The June 20 - July 3 survey also looks at the growing consumer demand for ‘phablets’, along with the potential interest for a next generation iPhone and other Apple products expected to be released later this year.

We note that this survey focuses primarily on the North American smart phone market – with 87% of respondents from the U.S. ChangeWave Research is a service of 451 Research. (A) Overall Smart Phone Purchasing

Following two consecutive quarterly declines, our latest survey shows a slight uptick in planned smart phone buying going forward. A total of 14.5% of respondents say they plan on buying a smart phone in the next 90 days – up from 14.1% in the previous March survey.

We note this is the highest June reading for planned smart phone buying in three years.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 11 ChangeWave Research: Consumer Smart Phone Trends (B) Next 90 Days: Smart Phone Manufacturer Demand

Future Manufacturer Share. Consumer buying plans for the individual manufacturers shows Apple with momentum in terms of North American smart phone demand. Better than two-in- five (44%) respondents who plan on buying a smart phone in the next 90 days say they’ll get an iPhone – up 4-pts since the previous survey.

As the following chart shows, the 4-pt uptick in Apple planned buying is impressive considering it’s occurring a full nine months after their most recent release (iPhone 5) and with no announced new smart phone product on the immediate horizon. While rumors continue to circulate regarding a next gen iPhone launch later this year – and nothing is certain prior to an official announcement – consumer anticipation of a new release is already contributing to Apple’s current momentum.

When we asked consumers who plan on purchasing Apple smart phones to tell us which model they’re most interested in buying, the iPhone 5 (63%) dominates but 28% say they’ll choose another model. Virtually all of this group identifies the “iPhone 5S” or next gen iPhone as their intended purchase.

12 ChangeWave Research: Consumer Smart Phone Trends For those who plan on buying an Apple smart phone, which specific model are you most interested in buying?

Planned Apple Current Buyers: Survey Next 90 Days Jun ‘13 Apple iPhone 5 63% Apple iPhone 4S/4 9% Other Apple 28%

Samsung. After an unprecedented rise over the past 18 months – including a 6-pt surge last quarter that corresponded with the Galaxy S 4 launch – Samsung planned buying (26%) remains just 1-pt below their highest level ever. This represents a huge five-fold leap in the past two years.

When we look at the breakdown of Samsung models consumers plan on buying in the next 90 days, the newest Galaxy S 4 (54%) is by far the most popular. And while there is still significant demand for the Galaxy S III (21%), the next generation Note III (18%) – expected in Fall 2013 – is also garnering strong interest among planned Samsung buyers.

Planned Samsung Current Buyers: Survey Next 90 Days Jun ‘13 Samsung Galaxy S 4 54% Samsung Galaxy S III 21% Samsung Galaxy Note III 18% (expected Fall 2013) Other Samsung 7%

Consumer buying plans are less encouraging for the other manufacturers, as they continue to struggle in the face of stiff competition from Apple and Samsung.

BlackBerry. Only a few months after launching new devices that were expected to help re- energize the company, momentum for BlackBerry has slowed (from 7% in March to 4% in the current survey).

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 13 ChangeWave Research: Consumer Smart Phone Trends

While we saw encouraging signs for BlackBerry in previous surveys, as we said in our March report “the road back for BlackBerry remains a long, uphill battle.” For now at least, our survey shows BlackBerry has been unable to sustain its positive movement – corroborated by their latest disappointing earnings announcement. These results offer little encouragement that the latest BlackBerry models will help bolster a comeback.

We note demand for the more recently released Q10 model – featuring a physical keyboard – is still edging out the Z10 among BlackBerry planned buyers (55% Q10 vs. 45% Z10).

Planned BlackBerry Current Buyers: Survey Next 90 Days Jun ‘13 BlackBerry Q10 55% BlackBerry Z10 45%

Other Manufacturers. Nokia (3%) is still not seeing major momentum for its Windows Phone 8 Lumia devices, although for the second time in three surveys it has managed a 1-pt uptick among planned buyers.

HTC (3%), which recently launched several new models – including the HTC One – is also up 1-pt in the current survey.

14 ChangeWave Research: Consumer Smart Phone Trends Consumer planned buying of Motorola smart phones (1%) has dropped 4-pts to its lowest level since the dawn of the Android explosion back in December 2009.

Who is the manufacturer of the Smart Phone you plan on buying?

Previou Previou Previ s Survey s Survey ous Current Previous Previous Dec ‘12 Sep ‘12 Surv Survey Survey Survey ey Jun ‘13 Mar ‘13 Mar ‘12 Jun ‘12 Apple (e.g., iPhone) 44% 40% 50% 71% 50% 56% Samsung (e.g., Galaxy S 4, Galaxy 26% 27% 21% 13% 19% 13% S 4 Mini, Note III) BlackBerry (e.g., Q10, Z10) 4% 7% 4% 1% 2% 3% HTC (e.g., One, First, Windows 3% 2% 2% 1% 3% 3% Phone 8X) Nokia (e.g., Lumia 928, Lumia 822) 3% 2% 3% 2% 2% 1% LG (e.g., Google Nexus 4, Optimus 2% 1% 3% 0% 1% 1% G Pro) Motorola (e.g., Moto X, Droid Razr 1% 5% 4% 2% 4% 6% Maxx HD) Sony (e.g., Xperia SP, Xperia L) 0% 0% 0% 0% 1% 0% Don't Know /Other 16% 16% 14% 11% 18% 16%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 15 ChangeWave Research: Consumer Smart Phone Trends (C) Smart Phone Customer Satisfaction As in previous ChangeWave surveys, the Apple iPhone maintains its industry leading customer satisfaction ranking, with 67% of iPhone owners saying they’re Very Satisfied with their phone. We note among iPhone 5 owners, the Very Satisfied rating jumps to 77%, and has actually ticked 1-pt higher since the previous survey. In contrast, there has been a marked decline in satisfaction among customers with older iPhone models – as one might expect in an industry driven by demand for the latest new technologies and features. Percentage of Respondents Very Satisfied with their Smart Phone – By Manufacturer

Samsung is a strong second in terms of satisfaction, with a highly respectable 54% of its customers saying they’re Very Satisfied. Motorola (42%), Nokia (38%) and HTC (32%) are bunched within a 10-pt range of each other. The uptick in customer satisfaction that BlackBerry (26%) experienced in our previous surveys has proven short-lived. They now rank last on this measure – down 6-pts from March.

16 ChangeWave Research: Consumer Smart Phone Trends (D) Mobile Operating Systems

Among consumers planning to buy a smart phone in the next 90 days, the Apple iOS is the number one preference, with 45% saying they’d prefer to have iOS on their new phone – a 7- pt jump since previously.

Android OS (32%) is still firmly in second, although down 3-pts since last quarter.

In an encouraging sign for Microsoft, Windows Phone 8 (6%) has regained its momentum after slipping last quarter – up 2-pts since March and just shy of the high of six months ago immediately after their new OS release.

*In surveys prior to Sep ‘12 the response choice was either Windows Phone 7 or Windows Mobile

In contrast, BlackBerry’s share of OS preference (4%) has dropped 3-pts since the burst of momentum it experienced following the new BlackBerry 10 OS release.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 17 ChangeWave Research: Consumer Smart Phone Trends OS Customer Satisfaction

We also took a look at OS customer satisfaction ratings based upon the operating system consumers have on their smart phones. Apple remains the clear leader – with 69% of customers using the Apple iOS saying they’re Very Satisfied.

The Android OS (46%) has regained second in customer satisfaction, narrowly edging out Windows Phone (45%) operating system – though both remain well ahead of the rating for BlackBerry OS (27%).

A closer look at Windows Phone OS satisfaction shows the Very Satisfied rating for the newer Windows Phone 8 OS (52%) is substantially higher than that of the older Windows Phone 7 (30%).

18 ChangeWave Research: Consumer Smart Phone Trends (E) Demand for Big Screen Smart Phones

Previous ChangeWave surveys have shown a strong interest in large screen smart phones, and the current results show this trend is continuing to gain momentum.

A total of 36% of planned smart phone buyers say they’re most interested in buying a 5 inch or larger screen – up 3-pts from previously.

What screen size are you most interested in buying? Curren Previous Previous t Survey Survey Survey Mar ‘13 Dec ‘12 Jun ‘13 Less Than 3 Inch Screen 2% 1% 3% 3.0-3.9 Inch Screen 12% 14% 18% 4.0-4.9 Inch Screen 51% 52% 52% 5 Inch Screen or Larger 36% 33% 27%

While several manufacturers now offer, or plan to release, larger-screen size ‘phablet’ devices, Samsung is currently best positioned for this demand trend – with its Galaxy Note II (5.5 inch screen), Galaxy S 4 (5”), and Galaxy Mega (6.3”) already available, and a next generation Galaxy Note III (5.7”) expected later this year. Indeed, nearly one-in-two planned Samsung buyers (45%) say they’re most interested in purchasing a 5 inch screen or larger device – more than double the percentage among Non- Samsung planned buyers (20%).

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 19 ChangeWave Research: Consumer Smart Phone Trends

Focusing on respondents who already own a ‘phablet’, nearly three-quarters (72%) say they’re using their device primarily as a smart phone and another 21% are using it equally as both a smart phone and tablet.

For those of you who currently own a “Phablet” (i.e., hybrid smart phone/ tablet with a 5” screen or larger), which of the following best describes how you primarily use the device?

Current Survey Jun ‘13 Use Primarily as a Smart Phone 72% Use Primarily as a Tablet 7% Equally as Both 21%

ChangeWave surveys have always found customer satisfaction to be a good indicator of industry demand, and here the findings are very positive for ‘phablet’ devices overall. Three- in-five ‘phablet’ owners (60%) report they’re Very Satisfied with their device. Another 32% say they’re Somewhat Satisfied.

‘Phablet’ Owner Satisfaction Ratings

Current Survey Jun ‘13 Very Satisfied 60% Somewhat Satisfied 32% Somewhat Unsatisfied 5% Very Unsatisfied 1% Don't Know 2%

20 ChangeWave Research: Consumer Smart Phone Trends (F) Advance Demand Trends: “iPhone 5S”, iTunes Radio & iOS 7

Apple “iPhone 5S”

We looked at advanced demand for a next generation “iPhone 5S” that Apple is expected to release later this year. After presenting consumers with a description of probable “iPhone 5S” features, we asked them how likely they would be to buy one when it becomes available.

Some analysts think Apple will release its next generation “iPhone 5S” later this year. New features would likely include a faster processor, improved camera and battery life, fingerprint scanner and the new iOS 7 operating system. The “iPhone 5S” is expected to cost $199 for the 16GB model, $299 for the 32GB model, $399 for the 64GB model and $499 for the 128GB model, with a 2-year contract on most of the major carriers. How likely is it that you will buy a new Apple "iPhone 5S" for yourself or someone else (e.g., a family member) in the future?

The results show very strong advanced interest for a next generation iPhone – three-in-ten (30%) consumers say they’re likely to buy a new “iPhone 5S” in the future (11% Very Likely and 19% Somewhat Likely). This is one of the highest demand levels for an unannounced Apple model ever seen in a ChangeWave survey.

By comparison, a similar question on future demand for the iPhone 5 – taken several months before it was officially announced – showed 14% Very Likely and 17% Somewhat Likely to purchase the iPhone 5, a product which shattered all previous iPhone model sales records. iPhone Owners vs. Non-iPhone Owners. As we’ve found with past releases, there’s a major difference between iPhone owners and non-owners in terms of likelihood of buying an iPhone 5S. More than half of current iPhone owners (55%) say they’re likely to purchase an “iPhone 5S” when it becomes available (24% Very Likely; 31% Somewhat Likely).

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 21 ChangeWave Research: Consumer Smart Phone Trends Likelihood of Buying an Apple “iPhone 5S” – iPhone Owners vs. Non-iPhone Owners: Apple Non-Apple iPhone iPhone Owners Owners Very Likely 24% 3% Somewhat Likely 31% 12%

An impressive 15% of non-iPhone owners say they’re likely to purchase an “iPhone 5S” (3% Very Likely; 12% Somewhat Likely). BlackBerry owners (28%) are most likely to say they’ll purchase an “iPhone 5S”, while Samsung owners (11%) are least likely.

Likelihood of Buying an Apple “iPhone 5S” – by Manufacturer

Other Non- BlackBerr Smart Smart Total Apple HTC Motorola Samsung y Phone Phone Owners Owners Very Likely 11% 24% 5% 4% 1% 2% 4% 3% Somewhat Likely 19% 31% 23% 13% 13% 9% 8% 11%

22 ChangeWave Research: Consumer Smart Phone Trends Impact of iTunes Radio and iOS 7 Announcement

In June Apple made several product announcements at its annual World Wide Developers Conference (WWDC). Although a next gen iPhone was not among the announcements, two highlights were a new music streaming service (iTunes Radio) and the biggest Apple smart phone operating system update (iOS 7) since the introduction of the iPhone. iTunes Radio. With iTunes Radio, Apple joins Pandora, Spotify and other services which have been in existence for years, as well as recently launched music services from Apple’s smart phone industry competitors – Microsoft Xbox Music and Google Play Music All Access.

We provided consumers with a brief description of the new iTunes Radio service and asked how likely it is they’ll use it when it becomes available.

Apple’s new iTunes Radio will feature streaming radio stations that learn the types of music you like and become more personalized as you listen. iTunes Radio will be free to use (ad supported), but those who subscribe to iTunes Match can listen without ads. How likely are you to use iTunes Radio once it becomes available? Current Survey Jun ‘13 Very Likely 11% Somewhat Likely 22% Unlikely 53% Don't Know 15%

The survey results show exceptionally strong consumer interest for iTunes Radio – with one- third of respondents (33%) saying they’re likely to use the service when it becomes available (11% Very Likely and 22% Somewhat Likely).

Of course the Apple brand and existing customer base represent a powerful base to help launch a new product. Not surprisingly, Apple iPhone Owners (25% Very Likely; 37% Somewhat Likely) are much more likely to say they’ll use iTunes Radio compared to Non- iPhone owners (2% Very Likely; 12% Somewhat Likely).

Likelihood of Using Apple iTunes Radio – iPhone Owners vs. Non-iPhone Owners:

Non- iPhone iPhone Owners Owners Very Likely 25% 2% Somewhat Likely 37% 12%

All-in-all, these survey results show strong potential for the new Apple product.

Apple iOS 7. We also looked at the iOS 7 upgrade announcement – asking iPhone owners how likely they will be to install the new operating system when it becomes available.

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 23 ChangeWave Research: Consumer Smart Phone Trends Apple recently announced their new iOS 7 operating system, with features including iTunes Radio, a Control Center screen to launch commonly used apps, and AirDrop for wireless sharing of photos and other files to nearby devices, among other things. The iOS 7 operating system will become available for download this fall. How likely are you to install the new iOS 7 on your current iPhone once it becomes available? Current Survey Jun ‘13 Very Likely 57% Somewhat Likely 23% Unlikely 11% Don't Know 9%

Four-in-five iPhone owners (80%) say they’re likely to install the new “iOS 7” operating system when it becomes available (57% Very Likely; 23% Somewhat Likely).

24 ChangeWave Research: Consumer Smart Phone Trends (G) Other Smart Phones Industry Trends

Importance of OS Consistency Among Electronic Devices by Current OS Used

We also asked respondents how important it is for all of their electronic devices to run the same operating system.

How important to you - if at all - is it for all of your electronic devices (e.g., computer, tablet, smart phone) to run the same operating system?

Current Smart Phone OS Total Windows BlackBerry iOS Android Phone OS Very Important 17% 24% 9% 18% 6% Somewhat Important 35% 37% 34% 32% 30% Not Very Important 32% 28% 38% 35% 37% Not Important At All 12% 8% 15% 8% 23% Don't Know /No Answer 5% 5% 4% 6% 4%

A total of 17% of all smart phone owners say it’s Very Important that all their electronic devices run the same operating system. But smart phone owners currently using iOS (24%) or Windows Phone (18%) are much more likely to say it’s Very Important than are users of either Android (9%) or BlackBerry (6%) OS.

A Closer Look at Customer Satisfaction With Specific Aspects of Smart Phones

Here’s a look at satisfaction ratings for specific smart phone and operating system features:

How satisfied are you with each of the following aspects of your current smart phone?

Customers Very Satisfied With Specific Aspects of Smart Phone by Operating System BlackBerry Windows iOS Android Total OS Phone OS (Apple) (Google) (BlackBerry) (Microsoft) # of Apps Available 74% 88% 68% 8% 28% Frequency of OS Updates 35% 45% 22% 14% 27% Security Features 38% 43% 29% 47% 39% Capability to Perform Work Tasks 29% 32% 26% 23% 42% Compatibility with Other Devices 38% 43% 33% 13% 40%

Customers Very Satisfied With Specific Aspects of Smart Phone by Manufacturer BlackBerr Total Apple Samsung Motorola HTC Nokia y Ease of Use 61% 75% 51% 38% 49% 43% 50% Screen Size 36% 30% 60% 12% 40% 37% 50% Processor Speed 36% 43% 37% 14% 24% 22% 49% Digital Assistant/Voice 27% 29% 28% 6% 29% 20% 23% Commands Battery Life 24% 25% 20% 31% 29% 13% 21% This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 25 ChangeWave Research: Consumer Smart Phone Trends

Quality of Video Streaming 35% 40% 37% 8% 21% 24% 51% How are Consumers Using Smart Phones?

We asked consumers what they use their smart phones for and Making/ Receiving Phone Calls (97%), Sending/Receiving Text Messages (89%) and Sending/ Receiving Email (84%) still top the list. Other popular uses include Surfing the Web (76%), Getting News/Weather (73%), Taking/Editing Pictures (65%) and Using Apps (64%).

In which of the following ways do you currently use your smart phone? (Check All That Apply) Current Previous Previous Survey Survey Survey Jun ‘13 Dec ‘12 Sep ‘12 Making/Receiving Phone Calls 97% 99% 99% Sending/Receiving Text Messages 89% 88% 89% Sending/Receiving Email 84% 88% 86% Surfing the Web 76% 79% 79% Getting News/Weather 73% 74% 74% Taking/Editing Pictures 65% 65% 71% Using Apps 64% 64% 65% GPS Navigation/Directions 62% 62% 62% Calendar/Scheduling Features 56% 58% 56% Listening to Music 43% 43% 45% Sharing Pictures/Video with Others 43% 42% 41% Playing Games 32% 33% 32% Social Networking (e.g., Facebook, Twitter) 30% 31% 30% Recording Video 30% 32% 37% Working Away From the Office 29% 31% 26% Price Comparison Shopping While Inside a Store 28% 28% 27% Online Shopping 24% 25% 24% Digital Assistant/Voice Commands (e.g., Siri, S Voice, 23% 22% 17% Google Voice Search) Reading eBooks 16% 16% 17% Using Business Applications 15% 15% 16% Storing/Managing Files in the Cloud 12% 13% 14% Making Mobile Payments (i.e., use like a credit card) 11% 10% 9% Watching TV Shows/Movies 9% 8% 10% Video Conferencing 7% 6% 5% Editing Documents/ Spreadsheets 6% 6% 5% Remote Desktop Connections 6% 6% 5% Other 3% 2% 2%

A Closer Look at Usage By Operating System. We took a closer look at usage by the type of OS running on the smart phone and found some interesting differences. Beyond the top uses mentioned previously, Calendar/ Scheduling, Listening to Music, Online Shopping, and Sharing Pictures/Video with Others stand out as activities more popular among iPhone owners than owners running either Android or Windows Phone.

Storing/Managing Files in the Cloud and Using Business Applications are activities Windows Phone OS owners are more likely to use their phone for than iPhone or Android owners,

26 ChangeWave Research: Consumer Smart Phone Trends while activities they’re less likely than other OS owners to use their phone for include Listening to Music and Online Shopping.

Here is a look at the results by Smart Phone Operating System:

All Apple Android Windows Smart Phone Phone Phone Phone Owners Owners Owners Owners Making/Receiving Phone Calls 97% 99% 98% 97% Sending/Receiving Text Messages 89% 93% 87% 94% Sending/Receiving Email 84% 89% 81% 75% Surfing the Web 76% 82% 77% 72% Getting News/Weather 73% 82% 71% 58% Taking/Editing Pictures 65% 72% 63% 58% Using Apps 64% 75% 63% 52% GPS Navigation/Directions 62% 68% 64% 58% Calendar/Scheduling Features 56% 65% 50% 51% Listening to Music 43% 55% 35% 29% Sharing Pictures/Video with Others 43% 50% 41% 34% Playing Games 32% 38% 30% 22% Social Networking (e.g., Facebook, Twitter) 30% 34% 28% 23% Recording Video 30% 37% 28% 23% Working Away From the Office 29% 31% 26% 23% Price Comparison Shopping While Inside a Store 28% 33% 27% 14% Online Shopping 24% 30% 21% 12% Digital Assistant/Voice Commands (e.g., Siri, S 23% 30% 20% 12% Voice, Google Voice Search) Reading eBooks 16% 18% 18% 17% Using Business Applications 15% 16% 15% 17% Storing/Managing Files in the Cloud 12% 14% 12% 17% Making Mobile Payments (i.e., use like a credit card) 11% 14% 10% 3% Watching TV Shows/Movies 9% 11% 9% 6% Video Conferencing 7% 10% 6% 5% Editing Documents/Spreadsheets 6% 5% 7% 8% Remote Desktop Connections 6% 7% 5% 5% Other 3% 3% 3% 3%

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 27 ChangeWave Research: Consumer Smart Phone Trends A Closer Look at Usage Among ‘Phablet’ Owners. One attraction of ‘phablet’ devices is an easier and more enjoyable visual experience for web browsing and multimedia viewing. Thus, it’s not surprising that screen intensive activities such as Watching TV Shows/Movies, Reading eBooks and Editing Documents/Spreadsheets stand out as being more popular among ‘phablet’ owners than non-owners.

All Smart ‘Phablet’ Phone Owners Owners Making/Receiving Phone Calls 97% 99% Sending/Receiving Text Messages 89% 84% Sending/Receiving Email 84% 87% Surfing the Web 76% 86% Getting News/Weather 73% 77% Taking/Editing Pictures 65% 71% Using Apps 64% 68% GPS Navigation/Directions 62% 74% Calendar/Scheduling Features 56% 66% Listening to Music 43% 41% Sharing Pictures/Video with Others 43% 51% Playing Games 32% 38% Social Networking (e.g., Facebook, Twitter) 30% 39% Recording Video 30% 38% Working Away From the Office 29% 34% Price Comparison Shopping While Inside a Store 28% 32% Online Shopping 24% 37% Digital Assistant/Voice Commands (e.g., Siri, S 23% 28% Voice, Google Voice Search) Reading eBooks 16% 37% Using Business Applications 15% 21% Storing/Managing Files in the Cloud 12% 23% Making Mobile Payments (i.e., use like a credit 11% 19% card) Watching TV Shows/Movies 9% 19% Video Conferencing 7% 9% Editing Documents/ Spreadsheets 6% 17% Remote Desktop Connections 6% 8% Other 3% 4%

28 ChangeWave Research: Consumer Smart Phone Trends ChangeWave Research Methodology

This report presents the findings of a ChangeWave Research survey on consumer demand trends within the Smart Phone market. The survey was conducted June 20-July 3, 2013 and a total of 3,942 consumers participated.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members of its research network.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies, and consumer and business trends in key market sectors, along with an in- depth perspective of the macro economy – well in advance of other available sources. About ChangeWave Research

ChangeWave Research, a service of 451 Research, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

451 Research, LLC, including its ChangeWave Research service, does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report. About 451 Research

451 Research, a division of The 451 Group, is a leading global analyst and data company focused on the business of enterprise IT innovation. Clients of 451 Research – at end-user, service-provider, vendor, and investor organizations – rely on 451 Research’s insight through a range of syndicated research and advisory services to support both strategic and tactical decision-making. For additional information on 451 Research, go to: 451research.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 240-200-3988 Suite 1301 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

This information is from ChangeWave Research, a service of 451 Research, LLC, and contains confidential business information. It may not be copied or distributed without permission. © 2013 451 Research, LLC. All rights reserved. 29