City County Insurance Services (CIS) Appointment of Reinsurance Broker for CIS Trust (Proposals accepted until October 1, 2005)

The CIS Trust is a joint self-insurance pool providing property, liability and workers’ compensation coverage to cities, counties and other eligible local governments in Oregon. Established by the League of Oregon Cities (LOC) and the Association of Oregon Counties (AOC) in 1980, the CIS Trust provides risk financing and risk management services to over 90% of the cities and 70% of the counties in the state.

In April, 2005, following A. M. Best’s downgrade of the Trust’s reinsurer (NLC MIC) to a B+ rating, the Trust proceeded with broker selection under emergency provisions. The Arthur J. Gallagher Company was appointed to place coverage with “A” rated reinsurers for the 2005-06 coverage year with the understanding that, following renewals, the Trust would go through a formal RFP process to select a broker(s) for a multi-year assignment commencing with the 2006-07 coverage year.

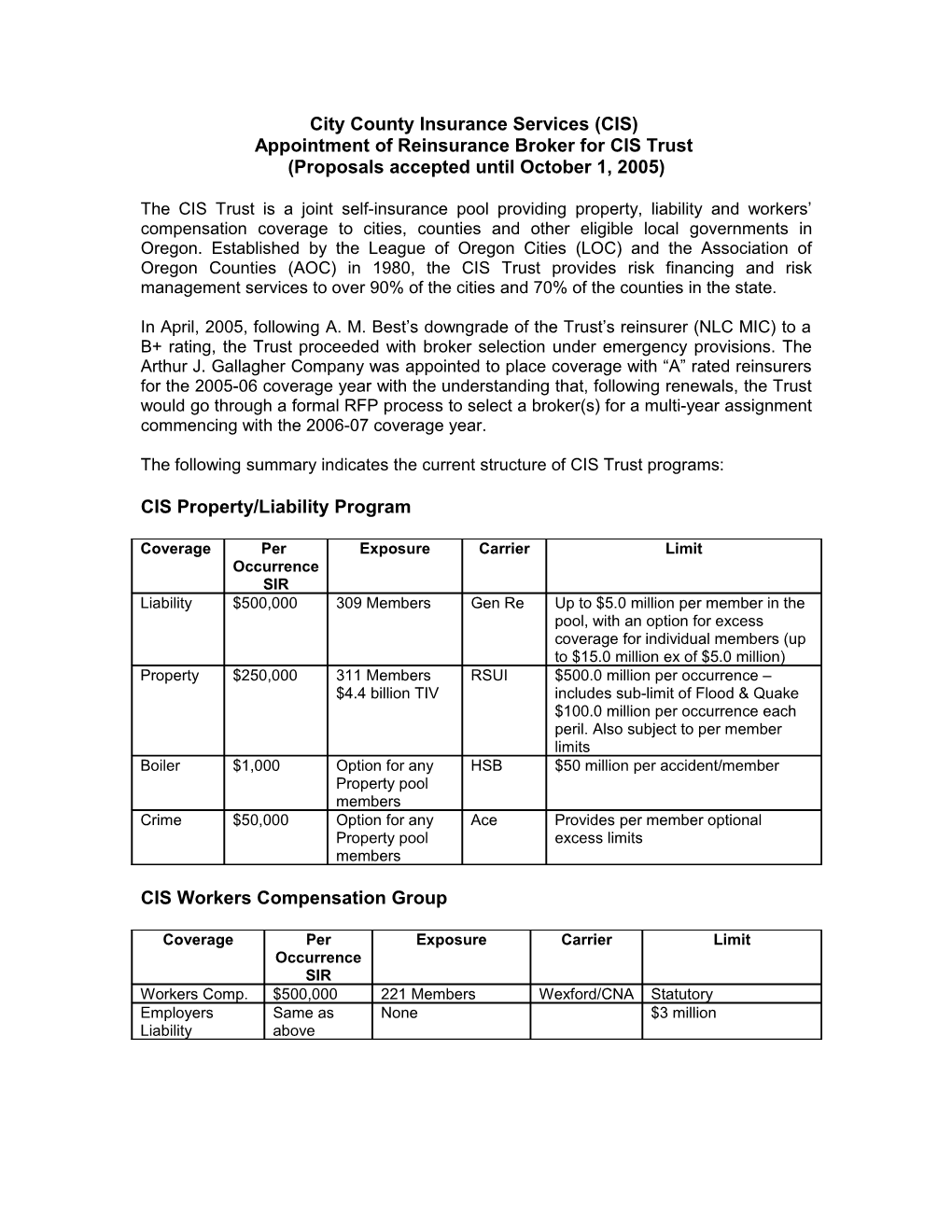

The following summary indicates the current structure of CIS Trust programs:

CIS Property/Liability Program

Coverage Per Exposure Carrier Limit Occurrence SIR Liability $500,000 309 Members Gen Re Up to $5.0 million per member in the pool, with an option for excess coverage for individual members (up to $15.0 million ex of $5.0 million) Property $250,000 311 Members RSUI $500.0 million per occurrence – $4.4 billion TIV includes sub-limit of Flood & Quake $100.0 million per occurrence each peril. Also subject to per member limits Boiler $1,000 Option for any HSB $50 million per accident/member Property pool members Crime $50,000 Option for any Ace Provides per member optional Property pool excess limits members

CIS Workers Compensation Group

Coverage Per Exposure Carrier Limit Occurrence SIR Workers Comp. $500,000 221 Members Wexford/CNA Statutory Employers Same as None $3 million Liability above Requirements

Our primary goal and selection criteria in choosing a broker to place CIS Trust reinsurance is to find a person/firm with: 1. Experience in placing reinsurance for public sector pooling organizations, 2. A track record of working with public entities and pooling organizations in Oregon, 3. Access to markets and the ability to find and/or create market opportunities that meet the needs of Oregon’s cities and counties, and 4. The ability to work with CIS to assemble options and alternatives that follow CIS forms and that can be compared with current coverage, as well as the demonstrated capability to market our needs on a worldwide basis if necessary. 5. The ability to provide the aforementioned services at a competitive compensation level. Though not a primary focus of the assignment, we are interested in learning about other peripheral consulting services that you make available to your clients.

The following outline provides a guide for the conversation we’d like to have with the broker(s) we select to interview: 1. Identify the person or persons who will be assigned to work with the CIS Trust. Provide details of their experience working with public entities and pools similar to CIS, in Oregon and elsewhere, with particular reference to the brokering of the types of reinsurance we seek.

2. Outline your approach for placement of reinsurance for CIS Trust programs – Property, Liability and Workers’ Compensation. Provide information about the reinsurance companies you work with and, on the basis of that experience, discuss what you believe might represent the best fit for CIS.

3. Outline the basis of compensation and/or other financial arrangements that your firm would usually expect for placement of property, liability and workers’ compensation coverage for the CIS Trust?

4. Review how you propose to go about the following tasks:

. Selecting a list of reinsurers to approach (including NLC MIC).

. Evaluating their proposals.

. Setting a timeline to finalize issues.

. Developing recommendations to CIS for the most appropriate provider(s).

. Evaluating the financial stability of recommended reinsurers.

5. Discuss other ways in which you might assist CIS members and/or their agents with placement of specialized coverage not available through the Pool. It is our intent to interview selected candidates during the month of October and to make an appointment no later than November 1, 2005. CIS reserves the right to split broker assignments for different lines of coverage.

Additional information about this assignment can be obtained from CIS Underwriting Manager, Bob Kahl at [email protected] and by visiting the CIS website at www.cciservices.com

If your firm would like to be considered for this assignment please respond to the address below by October 1, 2005 providing relevant background information about your firm and a rationale for why you think you firm is best suited to address the CIS Trust requirements listed above. Please provide five (5) copies of your response.

City County Insurance Services 1212 Court Street NE Salem, Oregon 97301 Attention: Bob Kahl, Underwriting Manager

Noel J. Klein CIS Executive Director September 15, 2005