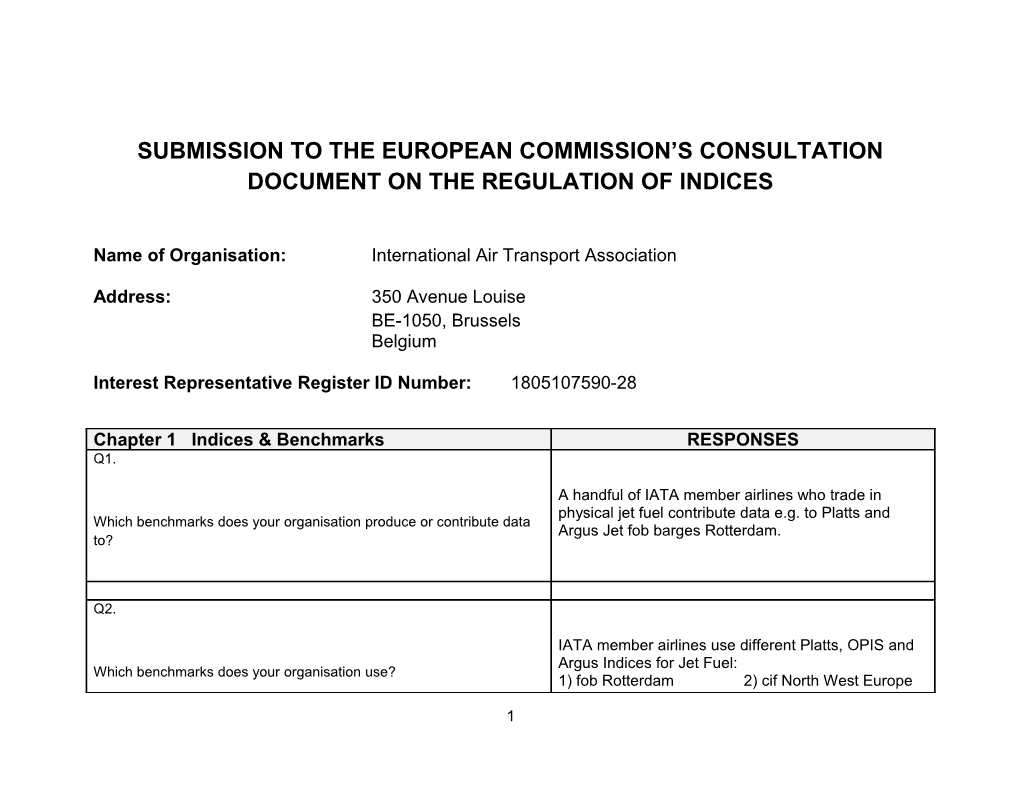

SUBMISSION TO THE EUROPEAN COMMISSION’S CONSULTATION DOCUMENT ON THE REGULATION OF INDICES

Name of Organisation: International Air Transport Association

Address: 350 Avenue Louise BE-1050, Brussels Belgium

Interest Representative Register ID Number: 1805107590-28

Chapter 1 Indices & Benchmarks RESPONSES Q1.

A handful of IATA member airlines who trade in physical jet fuel contribute data e.g. to Platts and Which benchmarks does your organisation produce or contribute data Argus Jet fob barges Rotterdam. to?

Q2.

IATA member airlines use different Platts, OPIS and Argus Indices for Jet Fuel: Which benchmarks does your organisation use? 1) fob Rotterdam 2) cif North West Europe

1 3) Mediterranean fob 4) ICE Brent future 5) US-Gulf Coast fip 6) New York Harbour fob 7) Los Angeles 8) San Francisco 9) Caribbean fob 10) fob Arab Gulf 11) Singapore fob 12) C+f Japan

Hence this submission is mainly focused on indices related to jet fuel and to a lesser degree to crude oil.

These benchmarks are used as price basis for physical procurements as well as for settlement of derivative contracts.

Platts indices have been the main ones used by airlines but in the recent past, a number of airlines have added OPIS and Argus indices for diversity reasons.

What do you use each of these benchmarks for?

Has your organisation adopted different benchmarks recently and if so why?

Q3.

2 Some airlines have started using a price basket of Platts and Argus indices to better cover the market Have you recently launched a new benchmark or discontinued existing and methodologies. ones?

Q4.

There are several thousands. How many contracts are referenced to benchmarks in your sector? IATA member airlines in general.

For defining the purchase price of Jet fuel and for the Which persons or entities use these contracts? pricing of a settlement price for derivatives.

And for which purposes?

Q5.

Smaller airlines especially use these benchmarks for the pricing of a settlement price for derivatives. To what extent are these benchmarks used to price financial instruments? The list of benchmarks include Platts fob Rotterdam, Platts Cif NWE, Platts Singapore fob, Platts US-Gulf Coast fip and Platts New York harbor. The notional Please provide a list of benchmarks which are used for pricing financial value is estimated to be around USD 100 billion. instruments and if possible estimates of the notional value of financial instruments referenced to them.

3 Q6.

Benchmarks are set based on real transactions, if available, including bid and offer price levels for a How are benchmarks in your sector set? Are they based on real certain time period as defined by the Price Reporting transactions, offered rates or quotes, tradable prices, panel Agencies or PRAs (e.g. Platts, Argus and OPIS). submissions, samples? The relevant pages on the websites of the PRAs provide this information.

Please provide a description of the benchmark setting methodology.

Q7.

Important factors include: - Transparency of methodology What factors do you consider to be the most important in choosing a - Data used for assessment that is based on a reliable benchmark? full trading day not on a limited time window during a trading day. - Priority given to actual trades, excluding bids and offers (because in an illiquid market bids and offers can be abused to move prices). - PRA’s must have accountability and a structured mechanism to react to concerns and queries - in this respect, the stakeholders (buyers and sellers) need the opportunity to see a monitored and policed (auditing entity) process.

4 No example on jet fuel indices come to mind. PRAs have in some ways failed to address stakeholders’ concerns to date and have largely shown a lack of motivation to do so.

Could you provide examples of benchmarks which incorporate these factors?

Chapter 2 Calculation of Benchmarks: Governance RESPONSES and Transparency Q8.

What kinds of data are used for the construction of the main Physical trades, if available, including bids and offers indices used in your sector? Which benchmarks use actual data are used. The dominant PRA uses forward curves and which use a mixture of actual and estimated data? and freight rates assessed in house - although public rates are available - to calculate a reported price.

Q9.

Do you consider that indices that do not use actual data have No. particular informational or other advantages over indices based on actual data?

5 Q10.

What do you consider are the advantages and disadvantages of The advantage is that this approach encompasses as using a mixture of actual transaction data and other data in a much information as possible to leverage accuracy. tiered approach? The risk/ disadvantage (observed) is incorrect prioritization of less relevant information e.g. actual trades (which is a good indicator of market price) are sometimes being ignored whereas less reliable information such as bids are given greater relevance.

Q11.

What do you consider are the costs and benefits of using actual The benefit is that we see this as a more realistic transactions data for benchmarks in your sector? Please provide reflection of market price. The cost arises in the examples and estimates. situation where during no-trade periods (particularly in less liquid markets), bids are being used (which are observed normally to be to the detriment of accuracy). Considering trades for the full trading day would improve the situation.

Q12.

What specific transparency and governance arrangements are Governance should be set up with the target of necessary to ensure the integrity of benchmarks? ensuring transparency and accountability.

A suitable independent third party organization could be tasked to supervise the PRAs.

Specifically for the Brent crude oil benchmark, the current situation of transparency and governance

6 needs to be improved. - The companies that are equity owners of the North Sea fields have immediate access to critical information that the wider market does not have. This places the rest of the market at a decided disadvantage. - There should be explicit Chinese wall style separation between the activities on the production side and the trading side. - Operators of the North Sea fields whose output is used to price the Brent benchmark should be under a continuous disclosure requirement to the market of production information.

Q13.

What are the advantages and disadvantages of imposing Self-regulation only works if complemented by governance and transparency requirements through regulation or external audits. The preference is therefore for self-regulation? “external” regulation undertaken by an independent third party in line with our answer to Q12.

Q.14

What are the advantages and disadvantages of making Advantages: contributing data or estimates to produce benchmarks a regulated - Ensures that all actual trades are reported and activity? Please provide your arguments. taken into consideration for price assessment. - Ensure that any data used for assessment is explained and justified so that only relevant and accurate data are used.

Disadvantage:

7 - It would be costly to administer.

Q15.

Who in your sector submits data for inclusion in benchmarks? Traders, reported trades (brokers), market participants (suppliers, consumers etc.).

What are the current eligibility requirements for benchmarks' No strict eligibility requirements are set other than that contributors? they are “active” in the market.

Q16.

How should panels be chosen? Should safeguards be provided A static collection of panel members/persons is not for the selection of panel members, and if so which safeguards? preferred as it could limit the provision of market data in a not very liquid market. It is key that as much trades as possible are taken into account.

Trading data are cross checked by the PRA’s by asking the other involved trading counterparty. This should be sufficient.

Q17.

How should surveys of data used in benchmarks be performed? Data to be collected in an agreed process (with well- defined boundaries).

What safeguards are necessary to ensure the representativeness - Comparison of data of all PRA’s in a data room and integrity of data gathered in this way? available to the market. - Cross checking and corrections of data break outs (peaks and troughs) to be secured.

8 Q18.

What are the advantages and disadvantages of large panels? Advantages: - Good representation of the market if many trades are reported. - As trades have to be cross checked at least two parties are involved.

Disadvantage: Slow decision process (if too large).

Even in the case of large panels could one panel member A large panel reduces (but not eliminates) the risk influence the benchmark? that a panel member delivers the only trading data, which is then used to define the price. Specifically, in the Jet Rotterdam market, around 6 active market players define the price. One party with a big long or short position can have a substantial impact on the market price.

Q19.

What would be the main advantages and disadvantages of Advantages: auditing of panels? Please provide examples. - It ensures that trade data provided had been submitted correctly. - It can validate that reported deals have indeed been transacted.

Q20.

Where indices rely on voluntary contributions, do you consider In the oil market, trades are concluded in a private that there are factors which may discourage the making of these and confidential manner and not reported mainly to contributions and if so why? protect the interests of the parties concerned. There

9 are more private and confidential deals than there are officially reported deals.

The exclusion of those trades does reduce the viability of the price assessment. Nevertheless, one needs to enable a retrospective process for including all deals (within a defined number of days after the trade) to enable validation and improvement of a PRA’s assessment over time.

A transparent and fair market must be the goal and any party that has been influencing the market has to be identified.

Q21.

What do you consider to be the advantages and disadvantages of Advantage: Increased viability and liquidity of price mandatory reporting of data? Please provide examples. assessments which leads to more accurate values.

Disadvantage. Time consuming.

Q22.

For entities contributing to benchmarks which are regulated by It depends on the financial regulation that is specific financial regulation, what would be the advantages and to the entity and benchmark. Generally, the disadvantages of bringing their benchmark submissions under the responses in Q21 should be applicable. scope of this framework?

Q23.

Do you consider that responsibility for making adjustments if The responsibility of data adjustments should be

10 inadequate data is available should rest with the contributor of the borne by the index provider who should verify the data, the index provider or the user of the index? correctness and completeness of the data

Q24.

What is the formal process that you use to audit the submissions For prices reported by the PRA, it is extremely difficult and calculations? to verify the correctness of the assessed prices as the calculation process is very complicated or poorly explained.

Q25.

If there are any weaknesses identified in the audit, who are they There is no external audit in place. Queries are often reported to and how are they addressed? neglected.

Is there a follow up process in place? There is no follow up process in place and a response from the PRAs is not guaranteed.

Q26.

How often are submissions audited, internally or externally and by We are not aware of any external audit. what means?

Do you consider the current audit controls are sufficient? What No, current audit controls are insufficient. An external additional validation procedures would you suggest? audit and complain procedure, handling of complains should be implemented. Reported price data should be compared regularly with the ones from other PRAs (to understand and defend large discrepancies).

11 Q27.

What are the advantages and disadvantages of a validation Validation is beneficial as it has been noticed quite procedure? Please provide examples. often that there are distinct price differences between the PRAs.

Q28.

Who should have the responsibility for auditing contributed data, An independent auditor which would ensure that the index provider or an independent auditor or supervisor? mistakes are duly corrected.

Q29.

What are the advantages and disadvantages of making Advantage: benchmarks a regulated activity? Please provide your arguments. To ensure confidence in the market, enhance the quality of PRA reporting and improve accuracy as a reflection of the actual market price. PRA’s cannot change their price reporting approach based on their own decision/ own interest only. PRAs cannot structure a market in their own interests or move the market in a certain direction. In most cases, markets can be influenced by parties with the most market power (e.g. Oil Companies)

Chapter 3 The Purpose and Use of Benchmarks RESPONSES Q30.

12 Is it possible and desirable to restrict the use of benchmarks? If Restriction of use is not desirable. Benchmarks are so, how, and what are the associated costs and benefits? Please needed for markets which do not have enough provide estimates. liquidity on their own. Benchmarks help to clarify price levels and reduce negotiation costs. The goal should be better transparency and fairness – restricting the use of benchmarks could undermine this.

Q31.

Should specific benchmarks be used for particular activities? By There should be no restriction on who can use whom? Please provide examples. specific benchmarks and how. It should be the choice of the market participants to select benchmark suitable for their needs.

Q32.

Should benchmarks developed for wholesale purposes be used Not applicable for our market segment in retail contracts such as mortgages? How should non-financial benchmarks used in financial contracts be controlled? data to?

Q33.

Who should have the responsibility for ensuring that indices used Benchmarks should be defined by the PRA and as benchmarks are fit for purpose, the provider, the user (firms approved by the regulator issuing contracts referenced to benchmarks), the trading venues or regulators?

13 Chapter 4 Provision of Benchmarks by Private or RESPONSES Public Bodies Q34.

Do you consider some or all indices to be public goods? Please Yes, all. state your reasons.

Q35.

Which role do you think public institutions should play in Public institutions could: governance and provision of benchmarks? - Ensure that benchmarks are properly setup according to their targets - Be an independent and unbiased body - Provide full transparency

Q36.

What do you consider to be the advantages and disadvantages of Advantages: the provision of indices by public bodies? - Process would be unbiased as there is no financial interest involved - Approach is more secured - Fair pricing of services

Disadvantages: - Slow adjustment process - Slower response to changes of market conditions

Q37. 14

Which indices, if any, would be best provided by public bodies? All

Chapter 5 Impact of Potential Regulation: RESPONSES Transition, Continuity and International Issues Q38.

What conflicts of interest would arise in the provision of indices by By having a bias which is driven by politics. public bodies?

What would be the best way of avoiding these conflicts of - Segregation of political and economic interest. interest? - Proficient, independent and experienced members are a must (knowledge of the respective markets)

Q39.

What are the likely transition challenges, costs and timelines for There is nothing currently in existence or identified relevant benchmarks? Please provide examples. that would be accountable to take charge and setup a new public system. Good ideas only get implemented properly when linked to a responsible organization and people. Who is accountable to get this started and to run it (according to the observations and answers already given) – this is the weak link in the commentary to date. This should be addressed.

15 Q40.

How do you consider that the adoption of new benchmarks could - By having independent panels in place be ensured? Is this best framed in terms of encouraging or following and analyzing market developments. mandating the use of particular benchmarks? - Proposing new indices or removing unnecessary ones (after proper consultation with stakeholders only) - that is a missing aspect currently.

Q41.

How can reforms of the regulation of benchmarks be most easily Firstly, one needs clarity and transparency. Then, an implemented? independent, representative panel of market participants should make and communicate decisions.

Q42.

What positive or negative impacts, if any, do you see on small We do not see any significant negative impacts on and medium-sized enterprises of the possible regulation of small and medium-sized enterprises. Regulation of indices, and how could any negative impacts be mitigated? indices would lead to more reliable pricing information and enterprises of all sizes using the indices would benefit from the greater accuracy and reliability.

Q43.

Are there other impacts which should be considered? If so please None specify the nature of these impacts and provide evidence.

16 Q44.

In which countries are benchmarks used in your sector Global produced? From which countries are data used for the production of benchmarks in your sector? In which countries are benchmarks used in your sector?

Q45.

Are there non-EU benchmarks which could serve as substitutes? No – we are looking at the global market anyhow but Are there non-EU benchmark providers which could produce still need regional EU specific market assessments similar benchmarks?

Q46.

Are there international benchmarks which could serve as We are using international benchmarks only substitutes for national benchmarks?

17