Con Law I – Barron (Spring 2006)

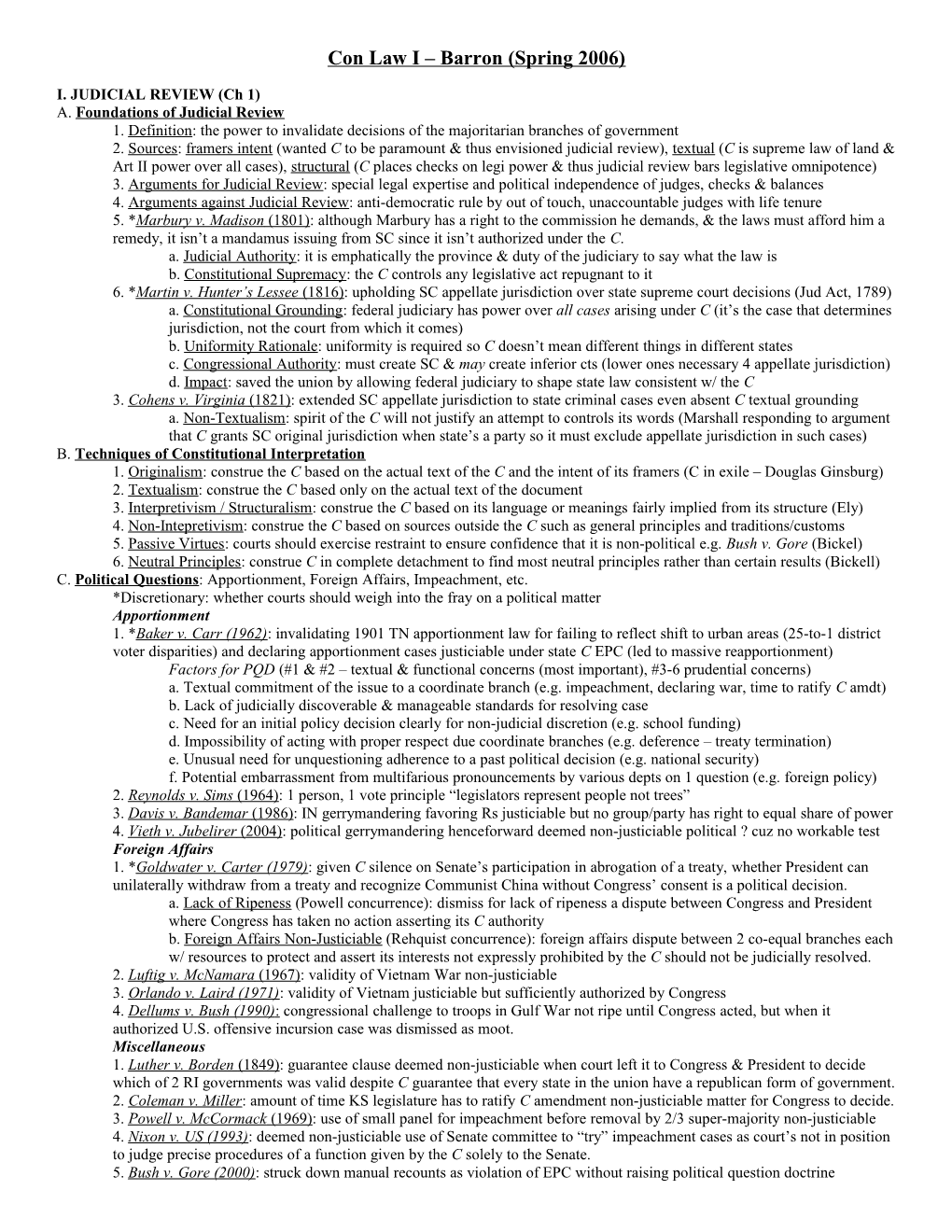

I. JUDICIAL REVIEW (Ch 1) A. Foundations of Judicial Review 1. Definition: the power to invalidate decisions of the majoritarian branches of government 2. Sources: framers intent (wanted C to be paramount & thus envisioned judicial review), textual (C is supreme law of land & Art II power over all cases), structural (C places checks on legi power & thus judicial review bars legislative omnipotence) 3. Arguments for Judicial Review: special legal expertise and political independence of judges, checks & balances 4. Arguments against Judicial Review: anti-democratic rule by out of touch, unaccountable judges with life tenure 5. * Marbury v. Madison (1801): although Marbury has a right to the commission he demands, & the laws must afford him a remedy, it isn’t a mandamus issuing from SC since it isn’t authorized under the C. a. Judicial Authority: it is emphatically the province & duty of the judiciary to say what the law is b. Constitutional Supremacy: the C controls any legislative act repugnant to it 6. * Martin v. Hunter’s Lessee (1816): upholding SC appellate jurisdiction over state supreme court decisions (Jud Act, 1789) a. Constitutional Grounding: federal judiciary has power over all cases arising under C (it’s the case that determines jurisdiction, not the court from which it comes) b. Uniformity Rationale: uniformity is required so C doesn’t mean different things in different states c. Congressional Authority: must create SC & may create inferior cts (lower ones necessary 4 appellate jurisdiction) d. Impact: saved the union by allowing federal judiciary to shape state law consistent w/ the C 3. Cohens v. Virginia (1821): extended SC appellate jurisdiction to state criminal cases even absent C textual grounding a. Non-Textualism: spirit of the C will not justify an attempt to controls its words (Marshall responding to argument that C grants SC original jurisdiction when state’s a party so it must exclude appellate jurisdiction in such cases) B. Techniques of Constitutional Interpretation 1. Originalism: construe the C based on the actual text of the C and the intent of its framers (C in exile – Douglas Ginsburg) 2. Textualism: construe the C based only on the actual text of the document 3. Interpretivism / Structuralism: construe the C based on its language or meanings fairly implied from its structure (Ely) 4. Non-Intepretivism: construe the C based on sources outside the C such as general principles and traditions/customs 5. Passive Virtues: courts should exercise restraint to ensure confidence that it is non-political e.g. Bush v. Gore (Bickel) 6. Neutral Principles: construe C in complete detachment to find most neutral principles rather than certain results (Bickell) C. Political Questions: Apportionment, Foreign Affairs, Impeachment, etc. *Discretionary: whether courts should weigh into the fray on a political matter Apportionment 1. *Baker v. Carr (1962): invalidating 1901 TN apportionment law for failing to reflect shift to urban areas (25-to-1 district voter disparities) and declaring apportionment cases justiciable under state C EPC (led to massive reapportionment) Factors for PQD (#1 & #2 – textual & functional concerns (most important), #3-6 prudential concerns) a. Textual commitment of the issue to a coordinate branch (e.g. impeachment, declaring war, time to ratify C amdt) b. Lack of judicially discoverable & manageable standards for resolving case c. Need for an initial policy decision clearly for non-judicial discretion (e.g. school funding) d. Impossibility of acting with proper respect due coordinate branches (e.g. deference – treaty termination) e. Unusual need for unquestioning adherence to a past political decision (e.g. national security) f. Potential embarrassment from multifarious pronouncements by various depts on 1 question (e.g. foreign policy) 2. Reynolds v. Sims (1964): 1 person, 1 vote principle “legislators represent people not trees” 3. Davis v. Bandemar (1986): IN gerrymandering favoring Rs justiciable but no group/party has right to equal share of power 4. Vieth v. Jubelirer (2004): political gerrymandering henceforward deemed non-justiciable political ? cuz no workable test Foreign Affairs 1. *Goldwater v. Carter (1979): given C silence on Senate’s participation in abrogation of a treaty, whether President can unilaterally withdraw from a treaty and recognize Communist China without Congress’ consent is a political decision. a. Lack of Ripeness (Powell concurrence): dismiss for lack of ripeness a dispute between Congress and President where Congress has taken no action asserting its C authority b. Foreign Affairs Non-Justiciable (Rehquist concurrence): foreign affairs dispute between 2 co-equal branches each w/ resources to protect and assert its interests not expressly prohibited by the C should not be judicially resolved. 2. Luftig v. McNamara (1967): validity of Vietnam War non-justiciable 3. Orlando v. Laird (1971): validity of Vietnam justiciable but sufficiently authorized by Congress 4. Dellums v. Bush (1990) : congressional challenge to troops in Gulf War not ripe until Congress acted, but when it authorized U.S. offensive incursion case was dismissed as moot. Miscellaneous 1. Luther v. Borden (1849): guarantee clause deemed non-justiciable when court left it to Congress & President to decide which of 2 RI governments was valid despite C guarantee that every state in the union have a republican form of government. 2. Coleman v. Miller: amount of time KS legislature has to ratify C amendment non-justiciable matter for Congress to decide. 3. Powell v. McCormack (1969): use of small panel for impeachment before removal by 2/3 super-majority non-justiciable 4. Nixon v. US (1993): deemed non-justiciable use of Senate committee to “try” impeachment cases as court’s not in position to judge precise procedures of a function given by the C solely to the Senate. 5. Bush v. Gore (2000): struck down manual recounts as violation of EPC without raising political question doctrine II. LIMITATIONS ON JUDICIAL REVIEW (Ch 11) A. Congressional Control of Federal Court Jurisdiction 1. Congressional Power: can limit SC’s appellate jurisdiction (Art III §2 Exceptions Clause) but not its original jurisdiction 2. * Ex Parte McCardle (1869): upheld Congress’ act revoking SC’s appellate jurisdiction over habeus corpus review of southern sympathizer arrested w/o habeus corpus (detention w/o being told charges) (Importance: SC’s appellate power over cases is in control of Congress under the Exceptions Clause, e.g. desegregation, abortion) 3. Ex Parte Yerger: where habeas petition accepted cuz petitioner claiming other habeas statute gives SC jurisdiction B. Case & Controversy Requirement (Art III §2) 1. Factors: adverse parties & actual controversy (determination on enforcement of rights or prevention/redress of wrongs) 2. Policy: limit unelected branch’s assertions of power, put control in democratic political process, avoid premature decisions 3. Muskrat v. US (1911): case & controversy requirement not met in internal property squabble between Cherokee Indians so federal courts do not have jurisdiction and it is not the judiciary’s duty to advise. C. Standing: looking for the best P and avoiding an abstract P 1. Jurisdiction: requires Art III case and controversy (difficult to change if based in C) 2. Prudential: judge-made determination about standing (easy to change if just a judge-made rule) 3. * Frothingham v. Mellon (1923): no standing for MA or an MA taxpayer in suit over federal Maternity Act cuz MA doesn’t represent US citizens/have any injured interest & merely being a federal taxpayer isn’t enough for standing (taxpayer rule) 4. Doremus v. Bd of Ed (1952): no standing for taxpayer challenge to NJ law requiring school Bible reading cuz no $ injury 5. * Simon v. E. KY Welfare Org (1976): association of indigents lacked standing to sue IRS for allowing favorable tax treatment to hospitals that offer limited service to indigents absent remedy to redress problem by IRS over 3rd party hospital. 6. * Lujan v. Defenders of Wildlife (1992): Ps lacked standing to challenge narrowing of Endangered Species Act consultation to apply only to US projects cuz theoretical future trips abroad to see animals only a speculative injury, not one in fact. A. Constitutional requirements for standing 1. Injury in fact (concrete and particularized and actual or imminent not hypothetical or conjectural) 2. Causation (“but for”) – fairly traceable to the actions of the defendant 3. Redressible by a court 7. * Friends of the Earth v. Laidlaw (2000): neighbors of wastewater treatment plant had standing under Clean Water Act when claiming their recreational opportunities were curtailed cuz fear of ongoing pollution even w/o actual pollution. A. More Direct Injury: neighbors who use nearby land vs. someday intentions to visit other side of globe (Lujan) *Laidlaw takes a more generous approach to what constitutes injury in fact than Lujan B. Ongoing Violations: threat of unabated violations w/o penalties vs. seeking fines for wholly past acts (Steel Co.) C. Redressability: civil fines deter Laidlaw’s polluting, though minority thinks they don’t redress actual injury to Ps D. Association Standing: org has standing so long as members would otherwise have standing to sue, injury is relevant to org’s purpose, claims asserted don’t require participation of individual members E. 1 Time Choking: fear of repetition of being choked by police too speculative for injury in fact (Lyons 1983) 8. 3 rd Party Standing Rule: party #1 can’t generally sue to assert the rights of party #2 A. Requirements: close relationship and a hindrance to P’s ability to protect his own interests (policy: patients may be chilled from bringing suit) B. Tileston v. Ullman (1943): Dr.’s suit over CT marital contraception ban dismissed cuz only 3rd party issues C. Griswold v. CT (1965): invalidating CT marital contraception ban cuz Dr.’s relationships & thus rights impacted *Reconciling Tileseton and Griswold: standing doctrine used tactically to avoid decision on contraceptive bans D. Singelton v. Wulff (1976): Drs. have standing on abortion reimbursement cuz of $ interest from state payment, close professional relationship between doctor and patient, and doctor’s direct involvement in abortion decisions. 9. Elk Grove SD v. Newdow: ducked Cal pledge of allegiance question in custody dispute w/ atheist father by dismissing case for lack of standing allegedly to avoid domestic relations matter and whether father’s interests paralleled daughter’s. 10. Kowalski v. Tesmer : attorneys lack 3rd party standing to bring suit on behalf of hypothetical future clients D. Mootness: cuz of factual changes a court’s decision would have no practical effect in achieving desired result originally sought 1. High standard: a case must not be moot at every stage of suit, though some argue only hurdle’s when case is initially filed 2. Voluntary Cessation Exception: D can’t make a case moot by voluntarily stopping illegal activity (unless D can’t possibly continue illegal activity, e.g. selling/closing polluting plant) 3. Capable of Repetition Yet Evading Review Exception: D can’t make case moot when capable of repetition (e.g. Roe) 4. Collateral Consequences: case will not be rendered moot if unsettled important collateral consequences remain on litigant (e.g. criminal who served prison term & brings suit can’t be dismissed for mootness cuz other rights at stake like voting right) 5. Class Action: mootness is avoided if it is capable of repetition yet evading review for any member of the class 6. * DeFunis v. Odegaard (1974): dismissed as moot DeFunis’ challenge to law school’s affirmative action program under EPC because student was admitted and only 1 semester away from graduating 7. Roe v. Wade (1973): that pregnancy will likely end before appeal does not make case moot cuz its capable of repetition 8. Sosna v. IA (1975): challenge to 1 year residency requisite for IA divorces overcame mootness cuz brought as class action III. NATIONAL POWERS AND FEDERALISM (Ch 2) A. Nature of Federal Power: every action must fall w/in C powers and not violate any C limitation 1. Enumerated Powers: 10th amdt provides fed. govt. only w/ specified powers leaving rest to the states 2. Benefits of Federalism: decentralized power, representative of community/regional differences, social experimentation 3. Drawbacks of Federalism: lack of state incentives to avoid or cure externalities, race to the bottom in commercial and environmental regulations, departs from a broader national moral consensus 4. Barron’s Federalism Terms a. Compact Theory: C’s an instrument emanating from/created by states & superior to fed govt (state dominance) b. Inherent Power: consistent w/ idea of limited government Congress lacks inherent domestic legislative powers c. Enumerated Power: C is experiment in limited fed govt & power not given to fed is reserved to states by 10th amdt d. Implied Powers: Congress has un-enumerated powers to facilitate carrying out enumerated ones (e.g. N&P) e. Necessary & Proper: to make all laws N&P for carrying into execution foregoing powers (let end be legitimate) f. Pretext Principle (has not endured): judicial review to strike down unC leg cong enacted but not entrusted to fed g. Taxation - A Concurrent Power: a power both states and federal government can undertake h. Intergovernmental Immunities: power of state to regulate/tax fed govt & power of fed to regulate/tax states j. Process Theory: preserve dem process by barring leg of 1 state from placing special burdens on citizens of others 5. Foundations of Federal Power / State Limitations a. Congress Has Un-Enumerated Powers To Carry Out Enumerated Ends: Congress has un-enumerated implied powers to use any means reasonably calculated to accomplish an enumerated end such as chartering a bank (e.g. lay taxes, borrow $) since N&P clause doesn’t say “absolutely necessary” * McCulloch v. MD (1819) b. States Can’t Tax Fed: MD can’t tax natl bank cuz it would destroy fed (supremacy clause) * McCulloch (1819) c. States Lack Power Respecting Fed Unless C Expressly Delegates It: striking down AR term limits for Congress (dissent: states can exercise any powers not expressly withheld) U.S. Term Limits v. Thornton (1995) d. Fed Can Use N&P Clause Absent Pretext for Federal Power Grab Jinks v. Richland County (2003) B. Commerce Clause Powers 1. Text (Art I §8): Congress shall have the power to regulate commerce among the several states (not between them) 2. Rationales: framers concerned about state fighting over economic interests a. Political Check Theory: reps in Congress safeguard state/city interests (criticism: rise of national media/lobbying dilute it) b. Judicial Check: courts should protect against real intrusions on states by fed (criticism: political process should handle) c. Enumerated Powers: C is an experiment in limited fed govt & anything not given to fed is reserved to states by 10th amdt d. Implied Powers: Congress has un-enumerated powers to facilitate carrying out enumerated ones (e.g. N&P, supremacy) 3. Basic Requirements Channels or Instrumentalities of Interstate Commerce (e.g. highways, navigable waters, boats, cars, trains) a. Navigable Waters: holding in case on steamboat in NY-NJ waters that Congress can regulate cross-state activity or internal state activities affecting more than 1 state (organic theory of commerce) & commerce includes navigation Gibbons (1824) b. Interstate Shipping: vessel operating solely within MI waters nevertheless within scope of Congress’ commerce powers cuz ship transported goods to and from other states. The Daniel Ball (1871) c. Interstate Rail: upheld equalizing of in & out of state charges on cotton cuz substantial relation to interstate traffic where TX growers sent cotton to far-away Dallas, TX cuz cheaper than nearby Shreveport, LA. Shreveport Rate Cases (1914) d. Past Interstate Shipment: upholding Congress’ power to regulate articles that completed interstate shipment even if future sales are purely local/intrastate (if goods cross state lines, subsequent intra-state sales irrelevant) US v. Sullivan (1948) e. Road Safety: upholding Cong act barring admission into evidence of roads states identify to feds as highly dangerous for getting fed $ as channel of commerce needing confidential candor for greater road safety Pierce County v. Guillen (2003) Activities With Substantial (Economic) Effect on IC (rational basis: affirmed by Raich in 2005) a. Commercial / Economic in Character Commercial / Economic (consider cumulative effects for intrastate commerce e.g. Wickard/Darby/Raich) i. Homegrown Wheat: upholding wheat quotas even on wheat wholly for home consumption by Congress where findings show there’s a substantial cumulative economic effect of many similarly situated farmers * Wickard (1942) ii. Intrastate Loans: upholding CC application of fed arbitration act to lending by bank w/ natl biz given broad impact on natl economy even though loan at issue by bank to biz was fully in AL Citizens Bank v. Alafabco (2003) iii. Local Loan Shark: cumulatively effects IC crime based on cong findings even if this 1 guy didn’t Perez (1971) iv. Homegrown Medical Pot: upholding regs on homegrown medical pot cuz part of comprehensive scheme w/ rational basis that leaving pot out of fed control would cumulatively affect market even w/o findings Raich (2005) a. Bounds of CC: just as state acquiescence to fed regs cannot expand bounds of CC (Morrison – 38 states asked for fed intervention), so too state action can’t circumscribe congs’ plenary commerce power (Darby). b. Dissent (O’Connor): majority extinguishes role of states as laboratories w/o any proof that personal use of medical marijuana if even economic has substantial effect on IC & perversely invites invasive broad regs c. Dilemma: court won’t enforce limits on fed power or declare 10th amdt a dead letter (Thomas) Not Commercial / Economic i. Guns Near Schools: exceeds CC power absent cong findings of substantial econ effect US v. Lopez (1995) ii. Gender Violence: exceeds CC power even w/ cong findings of IC impact cuz violent crime’s a police power area traditionally left to states US v. Morrison (2000) (criticism Souter: VAWA had huge cong data: 4 years of hearings, 21 state task forces, vast econ impact – 4K killed & 100K lose jobs at $3 billion yearly) 90s violence=60s discrim) b. Express Jurisdictional Nexus (expressly limited to IC) i. Barring Private Discrimination (not ok) struck down 1875 CRA cuz can’t ban private discrim Civil Rights Cases ii. Barring Discrimination Linked To IC (ok): 1964 CRA barred public & private discrim in public accommodation places but carefully limited to areas w/ direct, substantial relation to state action & interstate flow of goods & people c. Congressional Findings of Substantial Effects on IC (not determinative) i. Absence of Findings: struck down guns near schools in Lopez cuz no cong findings, but upheld regulation of homegrown pot in Raich even w/o cong findings ii. Presence of Findings: upheld regs on cumulative effect of homegrown wheat in Wickard, but struck down VAWA in Morrison even w/ extensive findings on vast econ impact of domestic violence d. Closeness Regulated Activity & Effect on IC i. Too Attenuated: struck down guns near schools cuz no clear effect of regulation guns near schools on IC Lopez ii. Sufficiently Close: State Sovereignty Limitation to Congress’ Power a. Commandeering States’ Legislative Process: striking down provision requiring states to take title of waste by certain date cuz Congress can’t simply commandeer states’ legislative process by compelling enactment of fed regs NY v. US (1992) i. Rationale: state officials would bear wreath of electorate while federal legislators would be immune ii. Unfunded Mandates: take credit for addressing problems without requiring constituents to pay for the solutions b. Conscripting State Officers: invalidating Brady Act for requiring state/local law enforcement to conduct background checks that transfers fed exec power to state officials w/o meaningful presidential control * Printz v. US (1997) i. Dissent: Congress can impose temporary ministerial duties on state/local officials (e.g. tax collection), & SC should defer to leg cuz bar on enlisting state officials will lead to aggrandizing through vast natl bureaucracies c. Traditional Areas of State Power / Decisions i. State Capital: invalidating Congress’ condition that OK keep capital in fixed location Coyle v. Smith (1911) ii. Violent Crime: invalidating reg on gender violence cuz a police power traditionally left to states Morrison (2000) iii. Education: invalidating reg on guns near schools cuz education’s a local matter Lopez (1995) iv. Fiscal Burden (overruled): hours/wages imposed on states National League of Cities (1976) v. Arson - Private Homes: avoid reading fed arson act to cover all private homes cuz too broad Jones v. US (2000) vi. Domestic Relations: dismissed for lack of standing custody dispute cuz domestic relations matter Newdow (2004) d. Plain Statement Rule: to impose burden Congress must do so by a clear, unequivocal statement Gregory v. Ashcroft (1991) *Limits on State Sovereignty: see state sovereignty cases below

4. Evolution of CC Powers & Limits a. Affectation Doctrine (1824- ): commerce affecting more states than 1 is w/in Congress’ reach Gibbons (1824) (NY-NJ waters) b. Harmful Commodities Doctrine (1903-18): Congress can regulate harmful commodity (e.g. lottery Champion v. Ames (1903) c. Banning Social Welfare Legislation (1918-1937): labor conditions like child labor, hours & wages purely local matter even if goods were for IC Hammer (1918), Schechter Poultry (1935), Carter Coal (1936) unless in stream of commerce Stafford v. Wallace (1922) (stockyard wages/hours), Swift v. US (1905) (ban on price fixing by meat dealers getting cows from 1 state & shipping to others) d. Substantial Effects Test (With Deference to Congress: 1937-95): Congress can regulate labor conditions, civil rights, & for virtually any other police power purpose so long as commerce affects more than one state & there’s a rational basis for action i. Labor Practices: can regulate huge steel biz cuz intrastate acts had close & substantial relation to IC NLRB v. J&L (1937) ii. Hours & Wages: can regulate in lumber production even intrastate, non-harmful goods if affects 1+ state Darby (1941) iii. Cumulative Effects of Local Activity: can regulate home-grown wheat cuz substantial economic effect Wickard (1942) iv. Civil Rights: can regulate racial discrim by motel w/ rational basis to protect interstate travel (75% out of state guests) Heart of Atlanta (1964) or small restaurant w/ some non-AL food cuz of substantial econ effect on IC Katzenbach (1964) e. State Sovereignty (1976-85): regulating states as states, in areas indisputably attributes of state sovereignty, and compliance would directly impair state’s ability to structure integral operations in areas of traditional govt functions (Hodel) i. Fiscal Burdens: striking down fed min wage & max hour mandates on states cuz it imposes fiscal burden & threatens states’ ability as employer in areas such as fire, police, health, sanitation, parks & rec National League of Cities (1976) ii. Federal Aid: upholding fed overtime & min wage cuz state transit gets massive fed $, past standard’s unworkable & invites policy judgments, & federalism balance should be left to political process Garcia (1985) (overrules Natl. League of Cities) iii. Permissible Uses of Federal Power -Override WY mandatory age 55 retirement law EEOC v. WY (1983) -Require use of fed procedures by state courts/agencies FERC v. MS (1982) -Include states as employers under Title VII of CRA 1964 Fitzpatrick v. Bitzer (1976) -Apply fed regs to state/local voting requirements in light of Civil War amdts City of Rome v.US (1980) -Bar state disclosure of drivers’ personal info absent consent cuz merely a prohibition Reno v. Condon (2000) -Drop fed tax exemptions from certain state bonds to prevent drug funding South Carolina v. Baker (1988) -Allow strikes after failed negotiations thus overriding NY law barring strikes United Trans.Union v. LIRR (1982) -Imposing coal mining regs on miners allowed cuz not on states as states Hodel v. VA Mining (1981) f. Substantial Economic Effects (Less Deference to Congress: 1995-Present) i. Guns Near Schools: exceeds CC power absent cong findings of substantial econ effect US v. Lopez (1995) ii. Gender Violence: exceeds CC power even w/ cong findings of IC impact cuz crime’s a state police power Morrison (2000) C. Taxing and Spending Powers 1. Text (Art I §8): cong has power to lay & collect taxes to pay debts & provide for common defense & gen welfare of US a. Narrow (Madison): cong can repay debts/spend only if they could regulate that area by some other section in C b. Broad (Hamilton): gen welfare clause expands spending powers & simply requires leg target public as a whole c. Broadest (modern view): meaning of the general welfare is within the sole discretion of Congress to determine 2. Requirements a. For the General Welfare (substantial deference to Congress) b. Clear Notice To States About Conditions c. Restriction’s Related to Federal Interest d. No Independent Cal Prohibition 3. Overly Coercive or Regulatory: (power to confer or w/hold unlimited benefits is power to coerce or destroy Butler 1936) a. Child Labor Tax: struck down 10% tax on profits of certain businesses employing child labor cuz it was not really a tax but a regulatory control beyond power of Congress and reserved to states Bailey v. Drexel Furniture (1922) b. Price Fixing: struck down Ag Act of 1938’s increased prices for farmers’ products as invading state rights beyond powers of fed (power to confer or w/hold unlimited benefits is power to coerce or destroy * U.S. v. Butler (1936) Cases 4. Veazie Bank v. Fenno (1869) upheld fed tax on banknotes of state banks cuz Congress has power to coin $ so tax is part of N&P means of exercising a delegated power even if a penalty for regulatory purposes rather than a revenue raising measure. 5. McCray v. US (1904): upheld 10 cent tax on colored margarine & tax of only ¼ cent on white margarine to drive colored margarine off the market due to pressure from dairy industry but not too expansive cuz w/in cong enumerated IC power 6. U.S. v. Doremus (1919): upheld $1 licensing tax on sellers of narcotics even though revenue objectives were minimal compared to regulatory aspects cuz legislation’s within enumerated Congressional powers and not arbitrary or unreasonable. New Deal Cases 7. * Steward Machine v. Davis (1937): upheld payroll tax on employees during Depression to deal with unemployment cuz $ incentive is not coercion when states can reject opportunity to participate if they so chose. Post-New Deal Cases 8. US v. Kahriger (1953): upheld Internal Revenue Act tax on gambling that also required them to register with the IRS despite protests that it violated provision against self-incrimination. 9. Buckley v. Valeo: rejected challenge to public financing of election campaigns on the grounds that it was contrary to the general welfare (expansive view of spending power, only limited by C text). Conditional Grants with Regulatory Effects 10. OK v. US Civil Service (1947): upheld requirement that state employees comply with Hatch Act provisions prohibiting on-the-job political activities as a condition for receiving federal highway $. 11. * South Dakota v. Dole (1987): upholding fed w/holding of highway $ from states that allow drinking under 21 since it is for the general welfare (substantial deference to Congress), clear notice is given to states about conditions, restriction’s related to the federal interest, and there’s no independent Cal prohibition. a. Key Factors: states have choice to reject $, lose only 5% if they do, drinking & driving is a general welfare problem, and Congress outlined clear conditions to the states reasonably calculated to address particular problem. b. Dissent (O’Connor): agrees with court’s framework but minimum drinking age not sufficiently related to goal of highway construction so as to justify broad spending power that allows feds to trample state jurisdiction. c. Spending v. CC: Congress has greater power to spend for general welfare than it could legislate under the CC. 12. Gonzaga v. Doe (2002): students tried to sue under Educational Privacy Act when records were released but court held that Congress didn’t clearly state an intent to confer an individual enforceable right (no implied right of action) 13. Sabri v. US (2004): upholding Congress’ authority to ensure taxpayer $ aren’t frittered awat in graft in case of contractor convicted of federal crime for bribing local officials when city received millions of federal funding. D. Federal Legislation in Aid of Civil Rights and Liberties 1. Basic Idea: grants can be conditioned on acceptance by states of conditions unrelated to the grant such as compliance with standards on civil rights, air pollution, or treatment of persons with disabilities. 2. Limitation: grants probably can not be conditioned on state enforcement of matters as to which Congress claims no regulatory power such as domestic relations law (intrusion into states’ core jurisdiction). 3. Dilemma: sanctions for civil rights violations results in cutting off $ for agencies providing social services to poor/needy 4. Pennhurst v. Halderman (1981): states receiving fed $ subject to suit for failure to comply with an act for educating the handicapped in least restrictive environment. 5. Atascadero v. Scanlon (1983): Congress was not sufficiently explicit in Rehab Act to subject state hospital to suit for refusing to hire handicapped applicant. 6. Dellmuth v. Muth (1989): Congress was not sufficiently explicit about intent to abrogate state’s constitutionally secured sovereign immunity from suit under Education of Handicapped Act. 7. Papasan v. Allain (1986): 11th amdt barred suit seeking to reinstate income from public school lands sold by the state. 8. * Katzenbach v. Morgan (1966): upholding Voting Rights Act and Congress’ right to define the scope of the EPC in overriding NY law requiring English literacy in order to vote barred Puerto Ricans living in NY 9. * City of Boerne v. Flores (1997): invalidating RFRA cuz Congress exceeded its Cal power by trying to change meaning of 1st amdt by leg fiat (reinstating compelling state interest Sherbert test rather than generally applicable neutral law test from Smith), abridging state sovereignty in police power matters absent leg record of religious bigotry. E. Sovereign Immunity and the 11 th Amendment 1. C Text: the judicial power of the U.S. doesn’t extend to any suit commenced or prosecuted against one of the United States by citizens of another state or by citizens or subjects of any foreign state. 2. Limitations: 11th amdt doesn’t apply to municipalities or counties 3. Key Ideas: 11th amdt places some limits on Congress’ power to subject states to suit (can’t use CC, but can use spending powers), and injunctive relief against a state for a C violation is possible (Ex Parte Young is still good law) 4. Chisholm v. Georgia (1793): citizen of state A was allowed to sue state B in fed court, leading to movement for 11th amdt to ensure that sovereign was not subject to suit in a forum in which it does not consent. 5. Hams v. Louisiana (1890): citizen of state A cannot sue state A in federal court without state’s consent (expansion of 11th amdt through implied sovereign immunity protection) 6. * Ex Parte Young (1908): upholding injunction for railroad shareholders against state official acting unCally by enacting rate reductions for shipping grain and large fines for violation in support of farmer dominated MN leg cuz not protected by 11th amdt under legal fiction that officials can’t choose to act unlawfully (makes cases like Brown & Baker v. Carr possible). 7. Edelman v. Jordan (1974): unlike injunction, $ liability against state barred for disabled shortchanged by soc. security law. 8. Milliken v. Bradley (1977): injunctive relief sought to enforce desegregation decree not precluded by Edelman. 9. Fitzpatrick v. Bitzer (1976): in civil rights actions where federal statute provides for damages against states, Congress may abrogate state immunity if done pursuant to a valid exercise of its 14th amendment powers. 10. Pennsylvania v. Union Gas (1989): [NOTHING ON THIS???] 11. Seminole Tribe v. FL (1996): Congress lacks authority to ok CC suits by private parties vs. state (overruled Union Gas) 12. Pennhurst: states waive sovereign immunity if Congress unmistakably authorizes suits against them thru spending power 13. NV Dept. Human Resources v. Gibbs (2003): under Family Medical Leave Act [NOTHING ON THIS???]

IV. STATE POWER IN AMERICAN FEDERALISM (Ch 3) A. State Power to Regulate Commerce 1. Broad Issue: whether states can regulate if Congress has the authority to regulate in the area of commerce 2. Exclusiveness Theory (Dormant Power): state regulation is invalid in any area where Congress has the authority to act, even if it chooses not to (ultimate assertion of federal power) 3. Concurrent Theory: states & fed both have authority to regulate & where Congress doesn’t regulate commerce the states can (e.g. states and feds can both tax) *Marshall rejects this theory as states aren’t given the power to regulate commerce 4. Mutual Exclusiveness Theory: states have the police power, the federal government has the commerce clause, and the Supreme Court umpires in such cases of conflict *Marshall adopts this theory 5. Selective Exclusiveness Theory: power of Congress to regulate commerce is selectively determined based on subject of regulation 6. * Gibbons v. Ogden (1824): state health regulations may influence commerce but they don’t regulate commerce per se 7. Wilson v. Black Bird Creek Marsh (1829): upheld DE law authorizing a dam across a navigable creek given importance of such state regulation for flood control (rejected idea of exclusive federal power) 8. Cooley v. Board of Wardens (1851): PA can regulate port piloting cuz no need for national uniformity, but generally Congress can’t authorize states to regulate an area exclusively granted to Congress (weigh need/issue: uniformity vs. laboratories)

B. Dormant Commerce Clause - Discrimination: Purpose, Means, Effects Background / Rationales 1. Source of DCC: no provision in the C explicitly prohibits states from burdening IC, but CC power to Congress implies it 2. Purpose: bar states from regulating commerce in a discriminatory or provincial manner & preserves congressional authority over IC 3. Key Distinction: even-handed state regs (likely to be upheld) vs. state regs that discriminate against out-of-staters (rarely upheld) 4. Process Theory: suspicion of state regs putting all burdens on out of staters unrepresented in state leg who can do so w/o pain Categories 1. Discriminatory Purpose (facially discriminatory): legislation that discriminates against interstate commerce is per se invalid a. Hoarding Natural Resources: invalidating laws satisfying local consumers first before exporting coal (WV) or natural gas (OK) to other states cuz discriminates against interstate commerce. b. Discriminatory Tariffs & Subsidies: invalidating laws imposing tariffs on out of state goods Baldwin v. GAF Seelig (1935) (NY milk law), West Lynn Creamery (1994) (MA tax & subsidy for in-state dairy farmers) 2. Discriminatory Means: apply strictest scrutiny of local purpose & ok only absent less restrictive or non-discriminatory alternatives a. Banning Only Out of State Waste: invalidating bans on out-of-state trash cuz solution can’t be put only on out-of-staters to avoid natl problem instead of less discriminatory alternatives Philadelphia v. NJ (1978) (NJ law), Chemical Waste v. Hunt (1992) (AL law) Fort Gratiot (1992) (MI county plan), OR Waste (1994) (300% differential in OR surcharges) i. Dissents (Rehnquist): states have legit health/safety reason & shouldn’t be required to take on more waste ii. Footnote: no opinion on NJ’s power to restrict to spend state $ solely on behalf of state residents and businesses. b. No Less Restrictive Means: rare upholding of state discrimination against IC banning importation of live baitfish from out of state cuz of threat of imports to Maine’s fisheries & absence of less restrictive means * Maine v. Taylor (1986) 3. Even-Handed Regulation: where act regulates evenhandedly to advance a legitimate local public interest, & its effects on IC are incidental, it will be upheld unless burden imposed on such commerce is clearly excessive in relation to asserted local benefits (Pike) a. Restricting Truck Lengths: invalidating laws restricting longer trucks for alleged safety concerns under ad hoc balancing approach cuz degree of interference w/ IC outweighs local purpose Raymond Motor (1980) (WI law illusory safety concerns given local dairy industry exemptions), Kassel (1981) (IA law invalid even w/ safety record) i. Dissents (presume validity): don’t balance interests, just ask if state purpose is illusory/pre-text for discrimination b. Tenuous Local Benefit: invalidating laws where tenuous local interest is outweighed by burden on IC Pike v. Bruce Church (1970) (reputation of in-state growers outweighed by IC harm of ban on transport of un-labeled cantaloupes), Carbone (1994) (flow control ordinance for local $ outweighed by less restrictive burden on IC like uniform safety regs) 4. Market Participant Doctrine: state spending/restrictions on access to state-owned resources to serve its residents per se valid (NJ) a. State Cement Plant: upheld SD plant honoring in-state Ks first cuz nothing prohibits a state under CC in absence of cong action from participating in market & exercising right to favor its own citizens over others * Reeves v. Stake (1980) i. Dissent (Powell): SD’s policy is the sort of economic protectionism that the CC was intended to prevent, & here SD hasn’t procured goods/services in an area of traditional govt functions (allowed) but participated in marketplace as a private firm would in a way that would impede the flow of interstate commerce (not allowed). b. $ For Junk Cars: upheld MD offers of $ for junk cars where documentation was more difficult for out of staters to avoid having taxpayers pay for out of state junk cars when goal was clean up of MD highways. Hughes v. Alexandria (1976): c. Local Hiring: upheld mayoral order requiring all construction projects be performed by at least 50% of Boston residents cuz state/local govt entering market as a participant not subject to CC restraints * White v. MA Council of Construction (1983) i. Dissent: MA law directly restricts the ability of private employers to hire non-residents.

C. Interstate Privilege and Immunities 1. Comity Clause (Article IV, Section II): citizens of each state shall be entitled to all P&I of citizens in the several states 2. Rationale: protects out-of-state citizens from unreasonable discrimination in regard to their fundamental national interests which concern the nation’s vitality as a single entity (e.g. states can’t treat out-of-staters wholly like aliens) 3. Limitations: market participant doctrine doesn’t apply to P&I and corporations can’t avail themselves of the P&I clause 4. Requirements: where discrimination concerns fundamental interest, non-residents must be the source of problem and there must be a reasonable relationship between discrimination against out-of-state residents & problem state’s trying to solve. 5. Permissible Differences: in-state tuition (tax $), hunting/fishing fees (if not too disparate $25 v. $2K commercial shrimp Toomer) a. Hunting License Fees Disparities: upheld MT hunting license law requiring $225 fee for out of staters as opposed to $30 for local residents because recreational right to hunt is not fundamental * Baldwin v. Fish &Game (1978) 6. Impermissible Differences a. Residency for Bar Admission: striking down residency requirements for bar admission cuz discrimination involves fundamental right to practice law & states failed to show substantial relationship for restriction * SC of NH v. Piper (1985), SC of VA v. Friedman (1988), Barnard v. Thorstenn (1989) (Virgin Islands residency/intent to stay) b. No Link To Unemployment Problem: struck down AK law requiring private preferential hiring of locals under P&I cuz no evidence non-residents are source of unemployment problem (culprits: geographic remoteness/lack of education) or reasonable relationship between discrimination & alleged problem * Hicklin v. Orbeck (1978) c. Non-Resident Discrimination: CA’s price controls though not facially discriminatory against non-residents, still unC since its effect is to discriminate against non-residents w/ legit purpose Hillside Dairy v. Lyons (2003) 7. Remanded: to determine reasons Camden required private projects to use 40% city residents as employees (distinguish White upheld 50% Boston residents in city $ projects under CC MPC) * United Building v. City of Camden (1984)

D. When Congress Speaks: Legitimizing State Burdens on Interstate Commerce 1. Basic Idea: Congress can authorize states to enact regulations/taxes a state alone couldn’t sustain under the CC a. Upheld 3% So. Carolina tax on non-state insurance companies cuz Congress authorized Prudential v. Benjamin (1946) 2. Determination: is state law an obstacle to execution of full purposes & objectives of Congress Hines v. Davidowitz (1941) a. Federal Prevails: need for uniformity in regs, pervasiveness of fed regulation indicating intent to regulate the whole field, existence of admin agency to provide supervision over area in question, area historically dominated by federal government b. State Prevails: area historically dominated by states

V. SEPARATION OF POWERS: EXECUTIVE AND CONGRESSIONAL RELATIONS (Ch 4) A. Formalism and Functionalism: The Judicial Role in Separation of Powers Analysis 1. Functionalism: emphasizes checks & balances principles more than strict separation and tolerates a more fluid approach (criticism: fails to provide clear standards) 2. Formalism: C establishes bright lines separating the powers and responsibilities of the three branches 3. Framers: separated legislative, executive, and judicial powers, but with some overlapping powers 4. Rationale: concern for unchecked and arbitrary power, while ensuring effective performance of govt. business 5. Examples: prez veto yet Congressional veto override, prez appointment of officials and authority to make treaties only w/ Senate concurrence, Courts’ power to invalidate laws but judges appointed by Prez w/ Senate approval 6. Sources of Presidential Power a. Vestiture Clause (Art II §1): exec power shall be vested in a US prez (identifies prez vs. implied grant of power) b. Commander in Chief (Art II §2): prez is commander in chief c. Faithfully Executed (Art II §3): prez shall take care that the laws be faithfully executed B. Perspectives on Executive Power: Stewardship Theory, Taft Theory, Vestiture Clause 1. Stewardship Theory: T Roosevelt’s belief Prez could do anything unless specifically forbidden by law from doing it 2. Taft Theory: Pres could only act w/ specific Cal or Congressional authority 3. In Re Neagle (1890): expansive view of “faithfully executed” clause giving US Marshall Neagle immunity from prosecution after killing a man to protect Justice Field absent a congressional statute 4. In Re Debs (1895): upholding DOJ’s power to enjoin Debs and others from obstructing IC & the mail even in the absence of a congressional statute cuz of existing statutes about general commerce and mail powers. 5. US v. Midwest Oil Co (1915): broad precedent for executive power upholding Prez Taft’s withdrawal of public land to prevent depletion of oil reserves although congressional statute indicated public lands were to be open to public entry when mineral deposits were found, Prez Taft ordered withdrawal of land to prevent depletion of oil reserved and court found adequate authority given congressional acquiescence in not taking action to enforce law C. Allocating the Lawmaking Power 1. * Youngstown v. Sawyer (1952) (formalist): even during war C doesn’t grant Prez power to take possession of private property in order to keep labor disputes from stopping production (prez power must stem from act of Congress or the C) a. Jackson Concurrence (functionalist): Prez powers are not fixed, but fluctuate depending upon their disjunction or conjunction with those of Congress. i. Maximum Authority: when Prez acts pursuant to express/implied authorization of Congress his authority’s at max & includes all possessed on his own & all Congress can delegate (widest latitude). ii. Mid-Level Authority: when Prez acts in absence of either congressional grant or denial of authority, relies only on own independent powers, but in zone of twilight in which he & Congress have concurrent authority or distribution is uncertain (test of power: imperatives of events & contemporary imponderables). iii. Least Authority: when Prez takes measures incompatible w/ express/implied will of Congress his power is at its lowest ebb for he can rely only upon his own C powers minus any C powers of Congress over the matter (scrutinized with caution) *seizure falls into this category *Concerns: framers suspected that emergency powers would tend to kindle emergencies and unauthorized grants are a slippery slope especially in foreign affairs where Prez power is so largely uncontrolled b. Dissenting: emergency doesn’t create power, but it may furnish occasion for its use when all US steel production would shut down such that prez can act to faithfully execute law for natl security until Congress could act. D. Congressional Lawmaking: Limitations and Responsibilities – Delegation of Legislative Power 1. Reality: public policy increasingly made by executive & independent agencies rather than in Congress 2. Legislative Veto: allows Congress to delegate power but reserve ability to review exec action pursuant to law 3. Non-Delegation Doctrine: powers delegated cannot be re-delegated (e.g. Congress to Executive) a. Reality: executive agencies make regulations all the time b. Pro: exec agencies are not responsive/accountable to the electorate, legislative power is vested in Congress c. Con: more transparency in open exec process, admin agency staff are mostly appointed by prez who is as representative as Congress, no Congress has expertise/time to create regs in complex policy arenas d. Intelligible Principle: so long as Congress charges agency w/ an overarching intelligible principle, it may appropriately make rules to fill in gaps & advance underlying purpose (e.g. Mistretta sentencing commission) 4. * INS v. Chadha (1983) (formalist): 1 house leg veto over exec branch orders involving deportation of aliens is unC cuz leg in character, bypasses exec presentment & bicameral requirements intended to ensure carefully & fully considered legislation a. Concurring (Powell): overbroad decision strikes down hundreds of statutes when it could just strike down this one as Congress assuming judicial function reviewing magistrate deportation order in violation of SOP b. Dissenting (White): leg veto helps ensure accountability of exec and striking it down will either lead to Congress not delegating power or abdicating all responsibility to exec branch (functionalist) E. Appointment and Removal Power 1. Text: C’s silent on removal power 2. Reality: for purely executive officers prez has power to remove as implied from related power of appointment 3. Myers v. US (1926): upheld President Taft’s removal of Post Master General before his term had lapsed since he served at the pleasure of the President because the president’s appointment power implied removal power. 4. Humphreys Executor v. US (1935): rejected presidential removal of FTC commissioner since he wasn’t a purely executive officer but exercises quasi-legislative/judicial powers & power of removal threatened FTC’s independence. 3. * Morrison v. Olson (1988) (functionalist): upholding AG’s power to select an independent counsel, an inferior rather than a principal officer, to investigate & prosecute government officials for purposes of accountability where Congress is not merely trying to increase its own powers at executive’s expense a. New Test: whether restrictions are of such a nature that they impede Prez’s ability to perform his Cal duties b. Dissent (Scalia): Prez power over exec functions is complete/exclusive & act taking only ‘some’ exec no good c. Rare Expansion of C al Structure: new independent counsel office is a rare time when structure of C is expanded upon (as opposed to just expanding rights which happens more frequently) 4. Mistretta v. US (1989) (functionalist): upholding Congress’ creation of independent sentencing commission in judiciary cuz doesn’t enhance Congress’ power but merely removes a burden on it & non-judicial duties can be imposed on courts (e.g. Jackson at Nuremberg trials, Warren on Kennedy assassination investigation, Roberts in Pearl Harbor investigation) 5. Return to Functionalism: Morrison and Mistretta illustrate SC’s abandonment of rigid formalism used in Chadha and Bowsher in favor of a more functionalist approach (blending of jud/leg/exec functions may be upheld) 6. Unitary Executive Theorists: exercise of discretionary executive power by independent agencies / counsels is unC cuz only the Prez is allowed to delegate such power, but otherwise retains it all. 7. Power Grab vs. Add Checks: SC seems to strike down acts aggrandizing branch’s power (concern for power grab: Chadha & Bowsher), while upholding acts limiting another branch’s power (less concern cuz adds checks: Morrison & Mistretta) F. War Power: Persian Gulf Crisis, Defining War & War Power, Undeclared Wars, War Powers Resolution 1. Congress’ Powers: war powers of Congress are extensive, explicit, & clear (e.g. declare war, make rules of capture, raise & support armies, provide/maintain navy, calling forth militia to suppress insurrections and repel invasions, provide for organizing, arming, and disciplining the militia) 2. Prez’s Powers: prez’s war powers are only vague & implied (e.g. commander in chief, execute the laws, make treaties) 3. Framers: wiser to have Congress (large group) decide when military force should be used than 1 individual like the prez 4. Rise of Imperial Prez: in late 20th century its executive that’s dominant in matters of war powers a. Congressional Acquiescence: has not chosen to assert powers & merely ratifies troop use (wants to be patriotic?) b. Information Disparity: exec agencies have intelligence info & courts reluctant to wade into political questions 5. War Powers Resolution (1973): gave Congress greater control over dispatch of troops by Prez (e.g. requiring report by Prez w/in 90 days allowing Congress to disapprove or authorize such use of force) but still rarely limits unilateral prez action 6. Presidential Defiance: many recent presidents have asserted that they don’t need congressional authorization to act G. Privileges and Immunities in Separation of Powers – Executive Privilege 1. Text: not mentioned in C explicitly, but exec argues it can be inferred from C for purposes of candor 2. * US v. Nixon (1974): absent military, diplomatic, or national security secrets, prez is not entitled to general privilege over subpoena when weighed against need for full disclosure in criminal prosecution to ensure demands of due process & justice a. Functionalist Goal: preserve essential functions of each branch – executive candor not hurt by infrequent need for info in criminal prosecution, but allowing privilege to w/hold evidence would gravely impair basic court functions b. Executive Privilege: privilege exists as implied in C (Art II requires candor) but weighed against need for info 3. Nixon v. Sirica (DC Cir. 1973): where congressional cmtee issues subpoena its claim for materials (tapes) is as justifiable as subpoena issued in judicial proceedings, but judge wouldn’t order subpoena cuz criminal proceedings were going forward 4. Congressional Subpoena: whether prez must respond to cong committee subpoena is an open matter though in Watkins SC held every American has an obligation to testify before Congress when called upon (House Un-American Activities matter) 5. Nixon v. Administrator of GSA (1977) (functionalist): upholding Prez Materials Preservation Act since exec was party to its enactment (Ford signed it), exec retained great control over materials, & didn’t stop exec from achieving its C functions a. Dissents (Burger/Rehnquist): act is exercise of exec not leg power & could frustrate candid exec discourse 6. Cheney v. US District Court (2004): executive privilege of VP outweighs broad and un-targeted discovery requests for disclosure of National Energy Task Force use of oil companies as advisors especially since in civil case H. Executive and Legislative Immunity 1. C Text: only mentions immunity for Congressmen & limits it to only when they’re on the floor (argument for prez immunity: absolute cuz not qualified by C; argument against prez immunity: not even mentioned in C) 2. Nixon v. Fitzgerald (1982): air force analyst allegedly fired for retaliation against damning congressional testimony (cost overruns) sued prez, but court held prez immune from official actions to prevent distraction from public duties 3. Harlow v. Fitzgerald (1982): lower exec officials (White House aides) have qualified immunity if at time actions were taken, they had reasonable grounds for believing that what they did didn’t violate any C or statutory provisions 4. Clinton v. Jones (1997): allowing prez to be sued for alleged improper sexual advances prior to coming to office cuz immunity from suits for official acts inapplicable to unofficial conduct (though need to be sensitive to needs of prez)