The Ohio State University Proposed Composite Benefit Rates for Salary Year Ending August 31, 2013 April 16, 2012

General Notes on Methodology:

Cost projections are based on the actual costs of the last full fiscal year, incremented for known and/or anticipated changes in costs.

A primary cost driver is identified for each component of the rate and is used consistently for allocation of actual and projected cost to benefit rate groups. There are two primary cost drivers – salary dollars and benefit-eligible headcounts. OPERS, STRS and most of the smaller benefit components are allocated to benefit-eligible rate groups based on salary dollars; health care costs and employee/dependent tuition are allocated based on benefit-eligible headcounts.

To ensure consistency in the calculation of composite rates, we use FY11 actual headcounts and FY11 actual salaries, incremented across all rate groups for guideline wage increases. The costs to be recovered are variable costs (as covered salary dollars and benefit-eligible headcounts go up or down, the benefit costs and associated composite rate charges to the departments go up or down accordingly).

Employee contribution rates for health coverage will not be set until Autumn Semester and are effective January 1, 2013. The current composite-rate calculations assume that the employee’s share of projected costs will equal employee contributions. To the extent that employee contributions are set below their projected share of health care costs, the additional costs would need to be recovered via the composite rates charged to the departments.

A complicating factor in the rate-setting process is the multiple “years” associated with employee benefits. University budgets and Office of Sponsored Programs (formerly OSURF) rates are on a July-June fiscal year, salary increases and University/Health System composite benefit rates are on a September-August year, and medical benefit plan designs and employee contribution levels are on a calendar (January-December) year. We need to predict, by February 2012, what rates will be required to cover costs and provide sufficient benefit cash balances for the benefit “year” ending August 31, 2013.

University/Health System Rates vs. OSP Sponsored Program Rates:

University/Health System rates are determined by OSU; OSP rates are proposed by OSU and are subject to negotiation with the federal government (DHHS).

For University/Health System rates, OSU has discretion to pursue rate stability, particularly related to maintaining targeted cash balances and amortizing

1 The Ohio State University Proposed Composite Benefit Rates for Salary Year Ending August 31, 2013 April 16, 2012

over/under-recoveries over multiple periods. For OSP rates, the federal government requires full amortization of over/under-recovery in next even/odd year (for example, all over/under-recoveries for FY11 must be incorporated in the FY13 rate calculation).

The lock-step amortization of under/over-recoveries under the federal rate-setting rules increases the likelihood of abrupt increases or decreases in OSP benefit rates, hindering long-range planning.

Targets for Benefit Cash Balances:

Benefit rate calculations are tied into an analysis of benefit cash balances.

The absolute minimum/floor for benefit cash balances is an amount equal to the full-accrual liabilities for each component of the benefit rate.

For the 12-13 benefit rate calculation, the target for benefit cash balances is an amount that includes both the full-accrual liabilities and the $13 million Medical Plan Reserve.

The University’s benefit plans finished the 10-11 salary year with cash balances of $67.2 million, which is approximately $8.2 million lower than our target cash balances. This is primarily due to under-recovery of medical costs. Additional information on the decrease in cash balances is provided on page 5.

OSU Physicians (Faculty Practice Group) Benefit Rates:

Salaries and benefits for OSU Physicians are now paid through the University for most physician-faculty members.

OSUP benefit rates will be similar to existing rates for Specials and will include a retirement component, plus smaller components such as Medicare, unemployment and workers compensation, which apply to all appointment types.

Physician income for faculty members hired prior to January 1, 2011 are not eligible for STRS. Retirement Continuation Plan contribution amounts will be agreed upon by each medical practice group. Physician income for faculty members hired after January 1, 2011 are eligible for STRS (subject to STRS income limitations).

2 The Ohio State University Proposed Composite Benefit Rates for Salary Year Ending August 31, 2013 April 16, 2012

Proposed Composite Rates for the 2012-2013 Salary Year

General University

Current Rates Proposed Rates (11-12) (12-13) % Change

Faculty 28.8% 29.5% 2.4%

Unclassified 33.8% 34.9% 3.3%

Classified Civil Service 42.8% 45.0% 5.2%

Specials 16.3% 15.9% -2.5%

Students 0.9% 0.6% -33.3% Post-Doctoral Fellows 4.2% 3.3% -20.8%

Graduate Associates 8.9% 11.3% 26.5%

OSU Health System

Current Rates Proposed Rates (11-12) (12-13) % Change

Faculty 35.3% 36.8% 4.1%

Unclassified 29.6% 30.6% 3.5%

Classified Civil Service 43.5% 45.6% 4.8%

Specials 16.3% 16.4% 0.3%

Students 0.9% 1.1% 22.2%

Post-Doctoral Fellows 4.2% 3.3% -20.8%

Graduate Associates 8.6% 11.2% 30.4%

Office of Sponsored Programs (formerly OSURF) Negotiated and Proposed Benefit Rates for Sponsored Research Programs Fiscal Years Ended June 30, 2012 and 2013

Negotiated-FY12 Proposed-FY13

Faculty 28.0% 30.4% Unclassified 36.7% 36.1% Classified Civil Service 46.5% 45.3% Specials 14.6% 15.0% Student, Grad, Fellow Combined Rate 4.4% 10.0%

3 The Ohio State University Proposed Composite Benefit Rates for Salary Year Ending August 31, 2013 April 16, 2012

The Ohio State University Summary of Key Assumptions Used in Benefit Rate Calculations

Global Assumptions:

Headcount Assume stable benefit-eligible headcounts (FY11 actual)

Average Pay Increase Assume guideline increases of 2% in FY12 and 3% in FY13.

Structure of Benefit Rate Groups Assume no new rate groups or movement of employees between groups

Composition of Benefit Package Assume same components as prior year

Target for Benefit Cash Balances Cash equal to fully funded benefit liabilities, plus the $13 million Medical Plans Reserve

Summary of Actual and Projected Costs by Component: FY11 FY13 Primary FY11 Total Actual Rate/ FY13 Total Projected Rate/ Cost Driver Actual Cost Cost per Head Projected Cost Cost per Head Notes

STRS Salary $ 73,311,209 13.23% 81,505,073 14.00% (1) OPERS Salary $ 170,766,639 14.38% 174,683,352 14.00% (2) Medicare Salary $ 20,841,877 1.20% 21,713,464 1.19% (3) Group Life Salary $ 5,615,518 0.35% 5,561,394 0.33% Disability Salary $ 4,483,990 0.28% 4,880,015 0.29% Unemployment Comp Salary $ 1,652,883 0.09% 1,736,519 0.09% Workers Comp-UNIV/RF Salary $ 5,836,591 0.47% 6,274,639 0.48% Workers Comp-Health System Salary $ 6,177,634 0.93% 6,560,162 0.94% Other Benefit Admin Costs Salary $ 2,584,969 0.14% 2,719,583 0.14% Student Insurance Salary $ 9,978,800 9.70% 11,510,938 10.14% Medical Plans Headcount 210,321,964 7,414 240,797,617 8,488 (4) Vision Headcount 1,951,307 69 2,070,142 73 Dental Headcount 13,402,359 472 15,631,171 551 Employee Tuition Headcount 10,995,292 388 12,824,908 452 Dependent Tuition Headcount 8,702,302 307 10,150,365 358

Totals 546,623,333 598,619,342

NOTES:

(1) - STRS statutory rate to be applied to all Faculty and Specials salaries

(2) - OPERS statutory rate to be applied to all Unclassified and CCS salaries

(3) - Below 1.45% statutory rate due to exempt staff

(4) - Reflects projected cost increases of 7% per year

4 The Ohio State University Proposed Composite Benefit Rates for Salary Year Ending August 31, 2013 April 16, 2012

The Ohio State University Analysis of Cash Balances in Benefits Funds (Employer Share of Costs) 30-Sep-11

Minimum Cash (full accrual liability, plus Med Reserve Actual Cash Description FY11 Actual Cost FY13 Projected Cost at 9/30/11) at 9/30/11 Comments

STRS 73,311,209 80,713,761 6,110,000 8,598,055 Based on HR target at 6/30/11 PERS 170,766,639 172,987,397 14,160,000 17,545,706 Based on HR target at 6/30/11 Medicare 20,841,877 21,683,889 1,217,000 777,897 Based on HR target at 6/30/11 Group Life 5,615,518 5,674,892 923,161 1,495,786 Based on HR target at 6/30/11 Disability 4,483,990 4,832,636 380,000 171,584 Based on HR target at 6/30/11 Unemployment Comp 1,652,883 1,719,660 138,000 227,996 Based on HR target at 6/30/11 Workers Comp-UNIV/RF 5,836,591 6,341,902 3,000,000 3,954,596 Based on HR target at 6/30/11 Workers Comp-Health System 6,177,634 6,565,733 Other Benefit Admin Costs 2,584,969 2,693,179 2,584,969 (1,710,268) add one year worth of misc expense as cushion Student Insurance 9,978,800 11,399,181 3,000,000 431,189 Premiums paid quarterly

Medical Plans 210,321,964 240,797,617 36,900,000 28,598,257 IBNR at 6/30/11, plus $13 million Med Reserve. Vision 1,951,307 2,070,142 347,000 331,224 Based on HR target at 6/30/11 Dental 13,402,359 15,631,171 1,442,000 1,637,325 Based on HR target at 6/30/11 Employee Tuition 10,995,292 12,824,908 3,000,000 3,934,408 Based on HR target at 6/30/11 Dependent Tuition 8,702,302 10,150,365 2,200,000 1,182,508 Based on HR target at 6/30/11

Totals 546,623,333 596,086,434 75,402,130 67,176,264 (8,225,866) Surplus (Deficit)

Prior Year Total Cash (9/30/2010) 98,244,252

Increase (Decrease) in Cash (31,067,988)

Note on Cash Balances:

The overall decrease in cash balances is primarily due to the following: Over the past three years, OPERS payments have shifted from a 3-4 month lag to a one month lag. The final “catch up” payment in December 2010 reduced cash by approximately $9.5 million. The 2010-2011 rates were reduced to return approximately $8 million in surplus in the medical funds to the departments. The 2010-2011 rates also included a reduction in the medical trend rate, from 7% to 5.5%. The medical trend rate was returned to 7% for the 2011-2012 rates and the (proposed) 2012-2013 rates. The portion of Student Health Insurance costs funded by the benefit rates was under- estimated by approximately $2 million in 2010-2011. To avoid this error in the future, we are now comparing costs per analysis of the benefit funds with separate analyses prepared by the Office of Student Life.

5 The Ohio State University Proposed Composite Benefit Rates for Salary Year Ending August 31, 2013 April 16, 2012

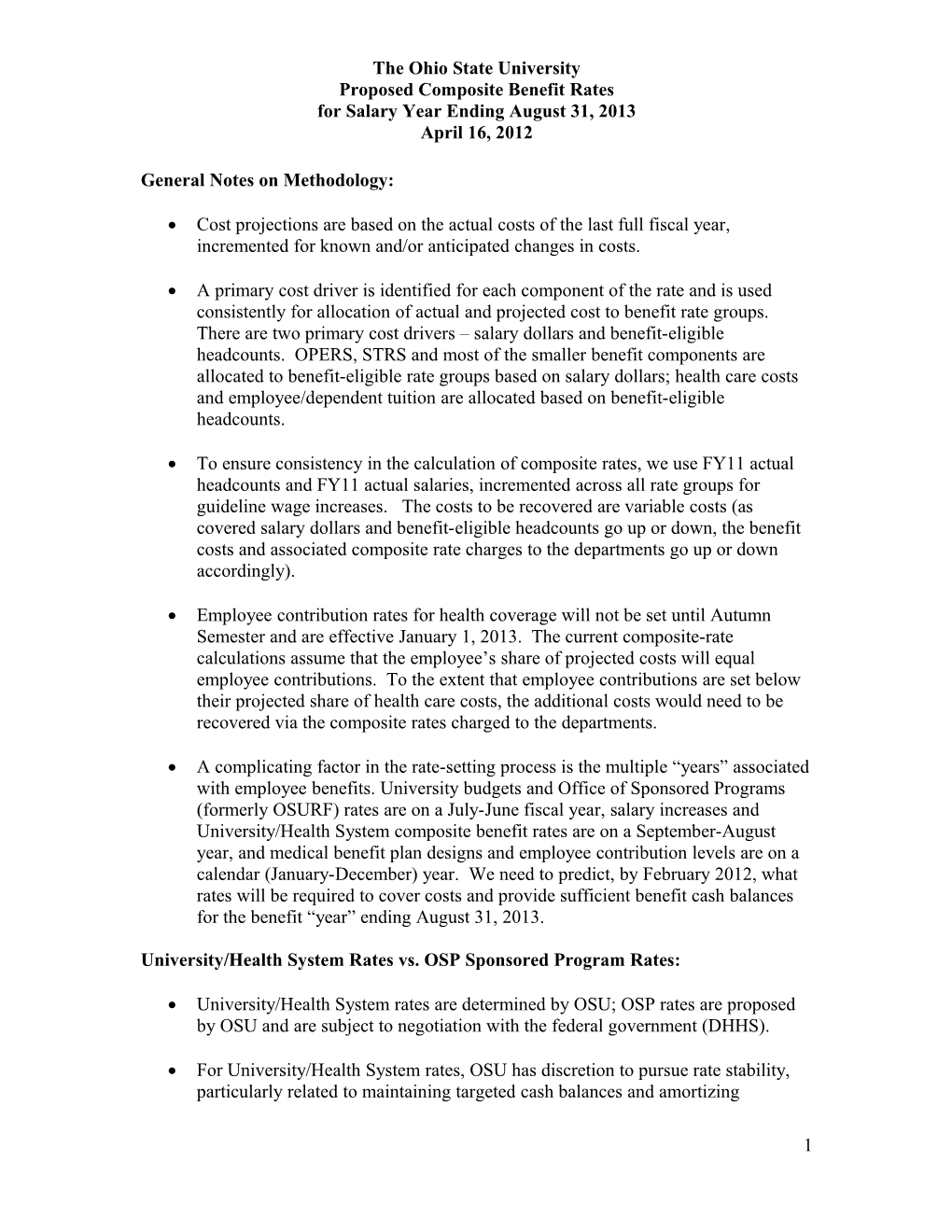

The Ohio State University Trends in General University Composite Benefit Rates 45.0%

% of Salary 40.0%

35.0%

30.0% Faculty 25.0% Unclassifed (A&P) Classified Civil Service 20.0% Non-Student Specials Student 15.0% Post Doc Fellows Graduate Associates 10.0%

5.0%

0.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Year

6