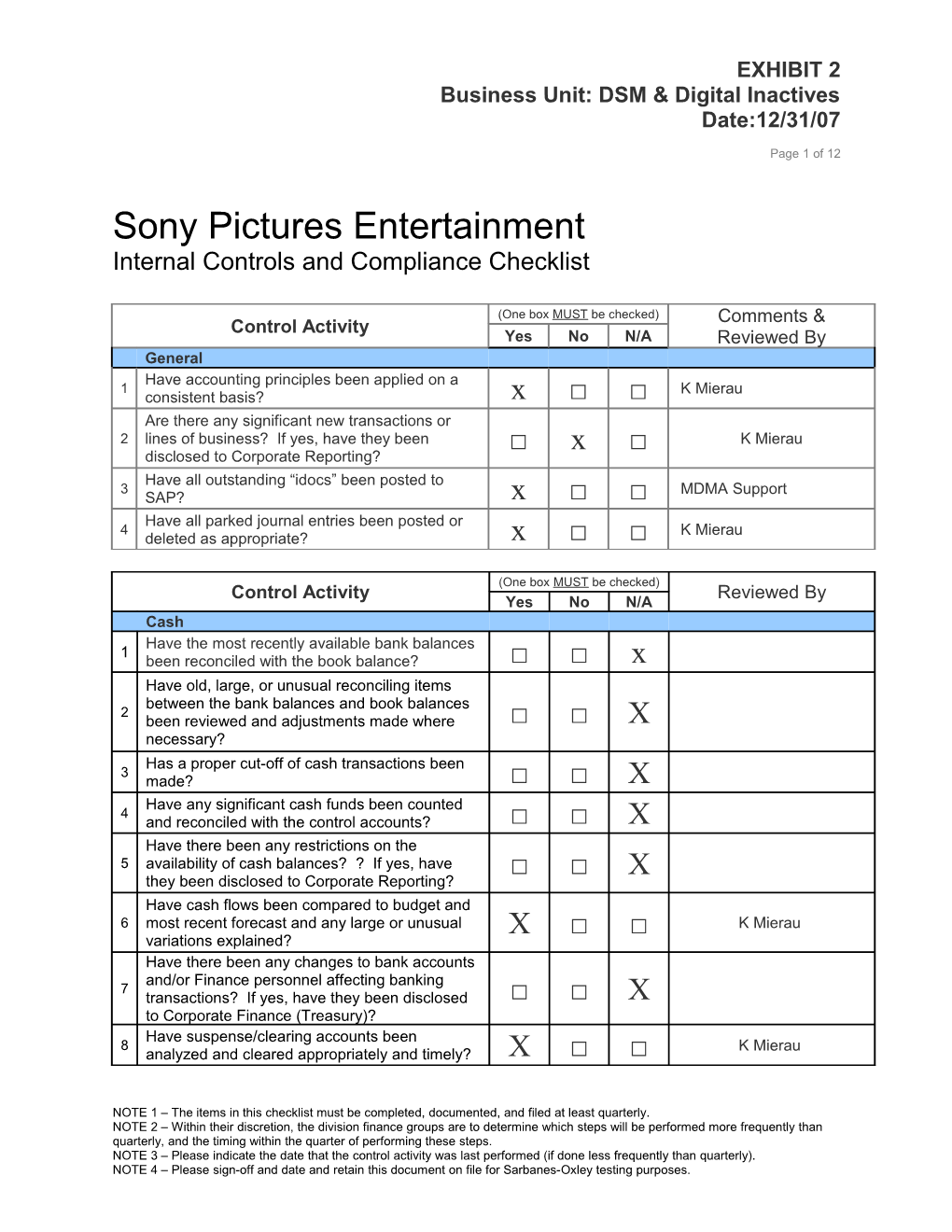

EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 1 of 12

Sony Pictures Entertainment Internal Controls and Compliance Checklist

(One box MUST be checked) Comments & Control Activity Yes No N/A Reviewed By General Have accounting principles been applied on a 1 K Mierau consistent basis? x □ □ Are there any significant new transactions or 2 lines of business? If yes, have they been □ x □ K Mierau disclosed to Corporate Reporting? Have all outstanding “idocs” been posted to 3 MDMA Support SAP? x □ □ Have all parked journal entries been posted or 4 K Mierau deleted as appropriate? x □ □

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Cash Have the most recently available bank balances 1 been reconciled with the book balance? □ □ x Have old, large, or unusual reconciling items between the bank balances and book balances 2 been reviewed and adjustments made where □ □ X necessary? Has a proper cut-off of cash transactions been 3 made? □ □ X Have any significant cash funds been counted 4 and reconciled with the control accounts? □ □ X Have there been any restrictions on the 5 availability of cash balances? ? If yes, have □ □ X they been disclosed to Corporate Reporting? Have cash flows been compared to budget and 6 most recent forecast and any large or unusual X □ □ K Mierau variations explained? Have there been any changes to bank accounts and/or Finance personnel affecting banking 7 transactions? If yes, have they been disclosed □ □ X to Corporate Finance (Treasury)? Have suspense/clearing accounts been 8 K Mierau analyzed and cleared appropriately and timely? X □ □

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 2 of 12

(One box MUST be Control Activity checked) Reviewed By Yes No N/A Accounts Receivable Has a proper cut-off of sales transactions been 1 K Mierau made? X □

Has the detailed trial balance of accounts 2 receivable been reconciled to the general □ □ X ledger (i.e. SPIRIT, C2C, etc. to SAP)? Have sufficient procedures been performed to 3 ensure that receivables have been properly X □ □ K Mierau classified between current and noncurrent? Has a review of the collectibility of receivables 4 been made and an adequate allowance X □ □ K Mierau provided for doubtful accounts? Have accounts considered uncollectible been 5 written off and properly approved in accordance X □ □ K Mierau with COFA? Has the accounts receivable G/L accounts been 6 K Mierau reviewed for large or unusual postings? X □ □ Have the accounts receivable Aging Reports been updated and reviewed and any significant 7 K Mierau changes in aging, past due accounts and credit X □ □ balances been investigated? Have credit memoranda been issued on a 8 timely basis with no significant backlog? □ □ X Have suspense/clearing accounts been 9 K Mierau analyzed and cleared appropriately and timely? X □ □ Has the allowance for returns and other 10 allowances been assessed for adequacy and X □ □ K Mierau adjustments properly approved? Have the unapplied cash balances been reviewed, investigated, and applied so that no 11 K Mierau unapplied balances are outstanding more than X □ □ three months? If appropriate, has interest been accrued or 12 discounts amortized on the receivable □ □ X balances? Are receivables from employees or related 13 K Mierau parties properly classified? X □ □ Have any receivables been pledged, 14 discounted, or factored? If yes, have they been □ x K Mierau disclosed to Corporate Reporting?

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 3 of 12

(One box MUST be Control Activity checked) Reviewed By Yes No N/A Inventory Have inventories been physically counted 1 internally or by third parties? If not, how have □ □ X inventory quantities been determined? If applicable, was there a review of inventory 2 procedures performed by third parties? □ □ X

Have the general ledger control accounts been 3 adjusted to agree with the physical inventories □ □ X (including inventory held by third parties)? If the physical inventory was taken at an interim 4 date, were proper procedures used to roll □ □ X forward the balance to the end of the period? Does the cost of manufactured inventory (and purchased inventory, if applicable) include 5 material, labor, and overhead where □ □ X applicable? Has the inventory been aged and reviewed for 6 obsolescence? □ □ X

Have write-downs for obsolescence or cost in 7 excess of net realizable value been made? □ □ X

Have proper cut-offs of purchases, goods in transit, and returned goods been made as of 8 the date of the physical inventory and at the end □ □ X of the period, if different? Have the inventory G/L accounts been reviewed 9 for large or unusual postings? □ □ X Has an analysis been performed comparing unit 10 value of inventory to current market value? □ □ X Have suspense/clearing accounts been 11 analyzed and cleared appropriately and timely? □ □ X 12 Are there any encumbrances on the inventory? □ □ x

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 4 of 12

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Intercompany

Have all intercompany/inter-profit center 1 balances been confirmed with the other party X □ □ K Mierau and any differences resolved?

Have all intercompany transactions including other SPE and other Sony related entities been identified and reported to Corporate Reporting to 2 K Mierau determine the need for any elimination of X □ intercompany, profit & loss, sales, and balances?

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Investments and Financial Instruments 1. Have gains or losses on disposal been

reflected properly? □ □ X 2. Has investment income been recorded

properly? □ □ X 3. Has appropriate consideration been given to the classification of investments between current

and noncurrent, and to the difference between □ □ X the cost and market value of investments? 4. Have significant movements and any unexpected or unusual relationships between

current month and prior month and □ □ X budget/forecast been reviewed and investigated? 5. Have entries to the investment G/L accounts

been reviewed for significant or unusual items? □ □ X 6. Have investment schedules/statements provided by third parties been reconciled to the □ □ X G/L? 7. Has an impairment analysis been performed

for significant investments? □ □ X 8. Have suspense/clearing accounts been

analyzed and cleared appropriately and timely? □ □ X 9. Are investments encumbered? If yes, have

they been disclosed to Corporate Reporting? □ □ X

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 5 of 12

(One box MUST be Control Activity checked) Reviewed By Yes No N/A Property, Plant, and Equipment Has SPE policy for the capitalization of 1 property, plant, and equipment been applied X □ □ K Mierau properly in the current period? Have all additions, retirements, abandonments, 2 and trade-ins been recorded properly in the X □ □ K Mierau current period?

Have gains or losses on the disposal of 3 K Mierau property been recorded properly? X □ □

Do repairs and maintenance include only items 4 K Mierau of an expense nature? X □ □

Has depreciation been calculated (or estimated 5 if an interim period) for the current period using X □ □ K Mierau appropriate, established methods and lives? If the entity has any material lease agreements, 6 have they been accounted for properly? □ □ X Were significant fixed assets held by third 7 parties reconciled to the fixed asset system, □ □ X fixed asset roll forward schedule and G/L? Has fixed assets been reviewed for any 8 K Mierau indications of impairment? X □ □ Has a fixed asset roll forward schedule been 9 K Mierau prepared and updated? X □ □ Have the fixed assets G/L accounts been 10 K Mierau reviewed for significant or unusual items? X □ □ Were significant capital expenditures compared 11 to budget/forecast and significant variances X □ □ K Mierau investigated? Have suspense/clearing accounts been 12 K Mierau analyzed and cleared appropriately and timely? X □ □ Is there any property or equipment that has been mortgaged or otherwise encumbered? If 13 K Mierau yes, have they been disclosed to Corporate □ X Reporting?

Have leased asset agreements been reviewed 14 for determination of proper accounting □ □ X treatment as operating or capitalized lease?

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 6 of 12

Have capitalized leased assets and the 15 corresponding liabilities been properly classified X □ □ K Mierau between current and non-current?

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 7 of 12

(One box MUST be Control Activity checked) Reviewed By Yes No N/A Film Costs Have subledger/local accounting systems been 1 reconciled to the G/L? □ □ X Was an aging of development costs prepared 2 and reviewed with operating management to □ □ X assess the need for a reserve/write-off? Has a Net Realizable Value (NRV) testing been 3 performed for all significant titles? □ □ X Has amortization expense been reconciled from 4 the sub ledger/schedule to the G/L? □ □ X Have “Catalog” balances been reviewed to 5 determine whether all exploitation costs have □ □ X been expensed as incurred? Has capitalizable overhead been properly 6 allocated on a by-title basis? □ □ X Have the film costs G/L accounts including 7 amortization expense been reviewed for large □ □ X or unusual postings? Have suspense/clearing accounts been 8 analyzed and cleared appropriately and timely? □ □ X Have significant changes in current ultimates in comparison to prior month, budget/forecast and 9 greenlight been investigated and corrected as □ □ X necessary? Have unusual “to-go” amounts (e.g. negative to- go amounts, large to-go amounts in markets 10 that have been exploited, etc.) been □ □ X investigated and corrected as necessary? Has actual performance been compared to 11 ultimates to ensure reasonableness of □ □ X ultimates?

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Other Assets (Prepaid Expense & Security

Deposits) Have the items classified as other assets been 1 reviewed to determine that the classification is X □ □ K Mierau proper? Have significant variances between the current 2 and prior month been identified and X □ □ K Mierau investigated? Have entries for the other assets G/L accounts 3 K Mierau been reviewed for significant or unusual items? X □ □

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 8 of 12 Have the other assets been properly classified 4 K Mierau between current and noncurrent? X □ □

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Other Assets (Prepaid Expense & Security

Deposits - cont.)

Have suspense/clearing accounts been 5 K Mierau analyzed and cleared appropriately and timely? X □ □

Are prepaid expenses being amortized on a 6 K Mierau reasonable basis? X □ □

Are any of these assets mortgaged or otherwise 7 encumbered? If yes, have they been disclosed □ X □ K Mierau to Corporate Reporting?

(One box MUST be Control Activity checked) Reviewed By Yes No N/A Accounts Payable, Notes Payable, and

Accrued Liabilities Has the Trade A/P subledger been reconciled to 1 K Mierau the G/L account? X □ Have all significant accruals, such as payroll and related taxes, legal, accounting, consulting fees, sales taxes, vacations, retirement benefits, 2 K Mierau interest, property taxes, and provisions for X □ □ pension and profit sharing plans been recorded properly? Are there any significant accounts that are being 3 disputed with vendors? If yes, have proper □ x □ K Mierau adjustments/accruals been made? Has the Goods Receipt/Invoice Receipt account been reconciled, including aged items >90 days 4 old, for any unmatched receiving reports and/or X □ □ K Mierau vendor invoices and have adjustments been recorded as appropriate? Is there a list that includes all short-term notes 5 payable, their due dates, and interest accrued □ □ X and paid during the period? Have the accounts payable and accrued liability 6 accounts been reviewed for significant or X □ □ K Mierau unusual postings? 7 Have significant purchase commitments been reviewed to determine if any such commitments □ □ X have become adverse? If adverse purchase commitments exist, have they been disclosed to

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 9 of 12

Corporate Reporting?

Have cash disbursements subsequent to “cost cut-off” (including corporate postings to divisions 8 K Mierau per SPE policy) been reviewed for potential X □ □ accrual adjustments?

(One box MUST be Control Activity checked) Reviewed By Yes No N/A Accounts Payable, Notes Payable, and

Accrued Liabilities (cont.) Have prior period accruals been reviewed to 9 K Mierau determine if adjustments/reversals are needed? X □ □ Have suspense/clearing accounts been 10 K Mierau analyzed and cleared appropriately and timely? X □ □ Are there are any collateralized liabilities? If 11 yes, have they been disclosed to Corporate □ X K Mierau Reporting? Are there any payables to employees or related 12 parties? If yes, have they been disclosed to □ X K Mierau Corporate Reporting

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Deferred Revenue Have the deferred revenue accounts in the G/L 1 K Mierau been reviewed for significant or unusual items? X □ □ Has the deferred revenue sub-system/schedule (i.e. C2C, TIGRES, Consumer Products, etc.) 2 K Mierau been reconciled to the G/L by contract/customer X □ □ and reviewed for unusual items? Have suspense/clearing accounts been 3 K Mierau analyzed and cleared appropriately and timely? X □ □

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Long-Term Liabilities Do you have any new transactions with “financial 1 institutions”? If yes, have they been disclosed to □ X K Mierau SPE Treasury? Have current maturities of long-term debt been 2 computed properly? □ □ X 3 Has interest expense, including any necessary K Mierau accruals, been computed properly and X □ □

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 10 of 12 recorded?

Have the appropriate calculations under 4 restrictive loan covenants been made? □ □ X Have any violations of restrictive loan covenants 5 been waived by lenders? (Explain a “Yes” or □ □ X “No” answer in an attached memorandum.) Have statements from the lending institution and 6 other partners been reconciled to the G/L? □ □ X Has a detailed review of restrictive loan 7 covenants been performed? □ □ X

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Long-Term Liabilities (cont.) Have suspense/clearing accounts been 8 analyzed and cleared appropriately and timely? □ □ X Are any long-term liabilities collateralized or 9 subordinated? If yes, have they been reported □ X □ K Mierau to Corporate Reporting?

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Other Liabilities, Contingencies, and

Commitments Have other liabilities been classified properly 1 K Mierau between current and non-current? X □ □ Are any significant contingent liabilities, such as discounted notes, drafts, endorsements, 2 K Mierau warranties, litigation, and unsettled asserted □ X claims reported to Corporate Reporting? Are significant unasserted potential claims 3 K Mierau reported to Corporate Reporting? X □ □ Are any material contractual obligations for the construction or purchase of real property and equipment or any commitments including 4 K Mierau operating leases or options to purchase or sell X □ □ the company’s securities reported to Corporate Reporting?

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Revenue and Expenses

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 11 of 12 Are revenues from sales of products and 1 services recognized in the appropriate period X □ □ K Mierau including “lag” and system cut-off issues? Are purchases and expenses recognized in the 2 appropriate period and properly classified X □ □ K Mierau including “lag” and system cut-off issues? Have significant, unexpected, or unusual variances between the current month and prior 3 K Mierau month, budget/forecast, flash, been investigated X □ □ and explained? Have the G/L accounts for revenue, COGS, selling and other expense accounts including 4 K Mierau overhead been reviewed for significant or X □ □ unusual items? Have suspense/clearing accounts been 5 K Mierau analyzed and cleared appropriately and timely? X □ □

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Other Have any events occurred after the end of the fiscal period that have a significant effect on the 1 K Mierau financial statements been reported to Corporate □ X Reporting? Are there any material uncertainties? If yes, 2 have they been disclosed to Corporate □ X K Mierau Reporting?

(One box MUST be checked) Control Activity Reviewed By Yes No N/A Consolidation and Financial Reporting Has the Hyperion/consolidation template been 1 K Mierau properly reviewed other than by the preparer? X □ □ Have Hyperion supporting and supplemental 2 schedules/reports including cash flows been X □ □ K Mierau provided? Have all NON-Hyperion supporting and 3 supplemental schedules been reviewed and X □ □ K Mierau reconciled to Hyperion? Have all foreign denominated transactions been 4 identified as such in the G/L and properly X □ □ K Mierau translated or re-valued? For International Home Office: Have territory results including overhead been 5 compared to budget/forecast and significant □ X variances identified and investigated?

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes. EXHIBIT 2 Business Unit: DSM & Digital Inactives Date:12/31/07

Page 12 of 12 Have producers share revenue and expenses 6 and related intercompany accounts been □ □ X reconciled and eliminated? Have territory submissions been reviewed and 7 reconciled to the amounts reported to Corporate X □ K Mierau Reporting?

NOTE 1 – The items in this checklist must be completed, documented, and filed at least quarterly. NOTE 2 – Within their discretion, the division finance groups are to determine which steps will be performed more frequently than quarterly, and the timing within the quarter of performing these steps. NOTE 3 – Please indicate the date that the control activity was last performed (if done less frequently than quarterly). NOTE 4 – Please sign-off and date and retain this document on file for Sarbanes-Oxley testing purposes.