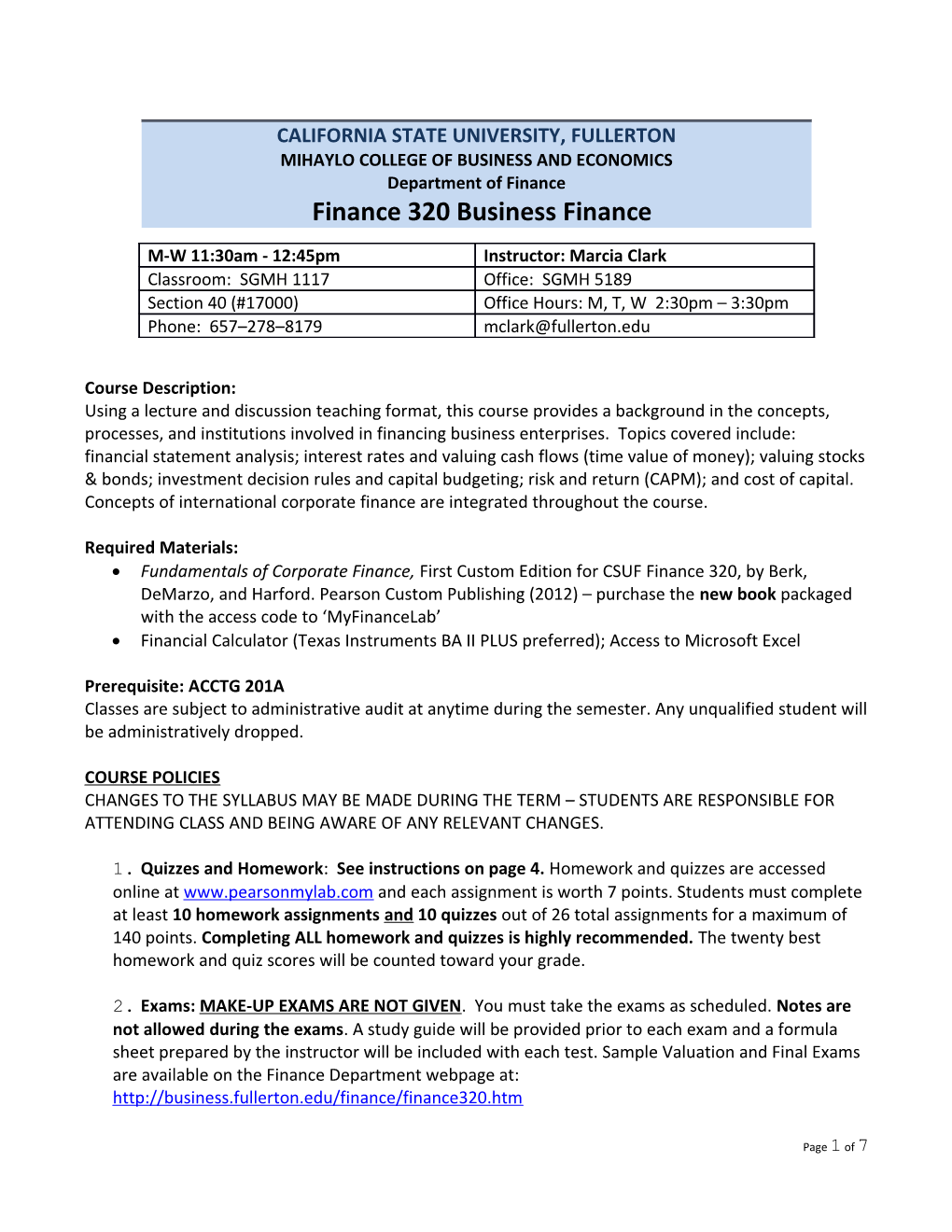

CALIFORNIA STATE UNIVERSITY, FULLERTON MIHAYLO COLLEGE OF BUSINESS AND ECONOMICS Department of Finance Finance 320 Business Finance

M-W 11:30am - 12:45pm Instructor: Marcia Clark Classroom: SGMH 1117 Office: SGMH 5189 Section 40 (#17000) Office Hours: M, T, W 2:30pm – 3:30pm Phone: 657–278–8179 [email protected]

Course Description: Using a lecture and discussion teaching format, this course provides a background in the concepts, processes, and institutions involved in financing business enterprises. Topics covered include: financial statement analysis; interest rates and valuing cash flows (time value of money); valuing stocks & bonds; investment decision rules and capital budgeting; risk and return (CAPM); and cost of capital. Concepts of international corporate finance are integrated throughout the course.

Required Materials: Fundamentals of Corporate Finance, First Custom Edition for CSUF Finance 320, by Berk, DeMarzo, and Harford. Pearson Custom Publishing (2012) – purchase the new book packaged with the access code to ‘MyFinanceLab’ Financial Calculator (Texas Instruments BA II PLUS preferred); Access to Microsoft Excel

Prerequisite: ACCTG 201A Classes are subject to administrative audit at anytime during the semester. Any unqualified student will be administratively dropped.

COURSE POLICIES CHANGES TO THE SYLLABUS MAY BE MADE DURING THE TERM – STUDENTS ARE RESPONSIBLE FOR ATTENDING CLASS AND BEING AWARE OF ANY RELEVANT CHANGES.

1. Quizzes and Homework: See instructions on page 4. Homework and quizzes are accessed online at www.pearsonmylab.com and each assignment is worth 7 points. Students must complete at least 10 homework assignments and 10 quizzes out of 26 total assignments for a maximum of 140 points. Completing ALL homework and quizzes is highly recommended. The twenty best homework and quiz scores will be counted toward your grade.

2. Exams: MAKE-UP EXAMS ARE NOT GIVEN. You must take the exams as scheduled. Notes are not allowed during the exams. A study guide will be provided prior to each exam and a formula sheet prepared by the instructor will be included with each test. Sample Valuation and Final Exams are available on the Finance Department webpage at: http://business.fullerton.edu/finance/finance320.htm

Page 1 of 7 3. Investment Project and Oral Report: Each student must complete a comprehensive term project over the semester. Projects may be completed individually or as a team. Each team will present an oral report on their project once per semester, selected by lottery on designated class dates.

4. Points will be allocated across assignments as detailed below:

Points Percentage ‘MyFinanceLab’ Homework & Quizzes 140 19% Midterm Exams (2 @ 100 pts. each) 200 27% Valuation Exam (online via MyFinanceLab) 80 10% Semester Project (3 parts @ 50 pts) 150 20% Oral Report 30 4% Final Exam (cumulative) 150 20% Total 750 100%

5. Plus /minus grading will be used in this course. You are guaranteed at least the following grade if your weighted average course score falls within the following percentiles. A curve may be applied to these scores.

Letter GPA % Range Letter GPA % Range Letter GPA % Range Grade Grade Grade A+ 4.0 98 – 100% A 4.0 94 – 97.9% A- 3.7 90 – 93.9% B+ 3.3 88 – 89.9% B 3.0 84 – 87.9% B- 2.7 80 – 83.9% C+ 2.3 78 – 79.9% C 2.0 74 – 77.9% C- 1.7 70 – 73.9% D+ 1.3 68 – 69.9% D 1.0 64 – 67.9% D- 0.7 60 – 63.9% F 0.0 < 60%

6. CSUF Policy on Academic Dishonesty: Academic dishonesty will not be tolerated. The University Catalog and the Class Schedule provide a detailed description of Academic Dishonesty under `University Regulations.’ (Or read this link on CSUF’s policy on Academic Dishonesty.)

7. The main purpose of the degree program at Mihaylo College of Business and Economics (MCBE) at CSU Fullerton is to provide you with the knowledge and skills that prepare you for a successful career in business. In order to assist us in achieving this goal, we will use a number of assessment tools to track your progress throughout the MCBE curriculum. Please expect to participate in MCBE assessment activities in several of your courses while at MCBE. As you do so, you will assist us in identifying our program’s strengths and weaknesses as well as areas for improvement. In other words, you are making an important investment in the value of your degree.

8. CSUF Policy on Disabled Students: The University requires students with disabilities to register within the first week of classes with the Office of Disabled Student Services (DSS), located in UH- 101 and at (657) 278 – 3112 in order to receive prescribed accommodations and support services

2 appropriate to their disability. Students requesting accommodations should inform their instructors during the first week of classes about any disability or special needs that may require specific arrangements/accommodations related to attending class sessions, completing course assignments, writing papers, or quizzes, tests or examinations. Click on the links for information about the services provided by DSS to students and the obligations of faculty to make accommodations for students registered with the DSS office.

9. Emergency Policies: All students should be aware of what needs to be done in the case of an emergency, such as an earthquake, a fire, or other disasters, natural or otherwise. Be sure to look at the CSUF Emergency Preparedness website for critical information about your safety.

COURSE OUTLINE

Day Chapter Topic/Assignment Aug. 27, 29 1 Corporate Finance and the Financial Manager Sep. 3 LABOR DAY – NO CLASS Sep. 5, 10 2 Introduction to Financial Statement Analysis Sep. 12, 17 3 Time Value of Money: An Introduction Sep. 19, 24 4 Time Value of Money: Valuing Cash Flow Streams; Project Part 1 Due Sunday Oral Reports: Financial Statements & Business Performance Sep. 26 3 - 4 Time Value of Money – Focus on Timelines/Formulas & Excel Oct. 1 Chp. 1 - 4 Midterm Exam 1 (Scantron form 288: wide, red version) Oct. 3, 8 5 Interest Rates Oct. 10, 15 6 Bonds Oct. 17, 22 7 Stocks (Int’l Corp Fin) Oct. 24 3, 4, 6, 7 Valuation Exam (Administered through MyFinanceLab) Oct. 29, 31 8 Investment Decision Rules; Project Part 2 Due Sunday Oral Reports: Stock and Bond Valuation Nov. 5, 7 9 Fundamentals of Capital Budgeting Nov. 12 VETERAN’S DAY – NO CLASS Nov. 14 Chp. 5 - 9 Midterm Exam 2 (Scantron form 289: narrow, red version) Nov. 19-25 FALL RECESS Nov. 26 10 Stock Valuation: A Second Look (11/26 student evaluations) Nov28, 11 Risk and Return in Capital Markets Dec3 Dec. 5, 10 12 Systematic Risk and the Equity Risk Premium Project Part 3 Due Sunday Oral Reports: Capital Budgeting Techniques Dec. 12 13 The Cost of Capital

Page 3 of 7 Dec. 21 12:00 – 1:50pm FINAL EXAM (Scantron form 289: narrow, red version) MyLab / Mastering Student Registration Instructions

To register for Fin320 Fall 2012 MClark:

1. Go to pearsonmylab.com

2. Under Register, click Student.

3. Enter your instructor’s course ID: clark85135, and click Continue.

4. Sign in with an existing Pearson account or create an account: · If you have used a Pearson website (for example, MyITLab, Mastering, MyMathLab, or MyPsychLab), enter your Pearson username and password. · Click Sign In. · If you do not have a Pearson account, click Create. Set up a username similar to your official name with the university so the instructor can easily identify you. · Make a note of your new Pearson username and password.

5. Select an option to access your instructor’s online course: · Use the access code that came with your textbook or that you purchased separately from the bookstore. · Buy access using a credit card or PayPal. · If available, get 17 days of temporary access. (Look for a link near the bottom of the page.)

6. Click Go To Your Course on the Confirmation page. Under MyLab / Mastering New Design on the left, click Fin320 Fall 2012 MClark to start your work.

Retaking or continuing a course? If you are retaking this course or enrolling in another course with the same book, be sure to use your existing Pearson username and password. You will not need to pay again.

To sign in later: 1. Go to pearsonmylab.com and click Sign In. 3. Enter your Pearson account username and password. Click Sign In. 4. Under MyLab / Mastering New Design on the left, click Fin320 Fall 2012 MClark to start your work.

Additional Information See Students > Get Started on the website for detailed instructions on

4 registering with an access code, credit card, PayPal, or temporary access. Verbal Communication Rubric

Presenting Person / Group:______Evaluator:______

Criteria: Very Poor (0) Poor (1) Average (2) Good (3) Excellent (4) Score C Misses two or Misses one major Handles case Handles all Handles all CONTENT/ CASE: more elements of element of the material elements of the elements of the Clarity, the case; major case; leaves out competently; case with skill; case professionally; completeness factual errors essential includes develops and develops and misinterprets case information; essential supports ideas in a supports ideas assignments. some minor information; better- than- using well- chosen factual errors. factually correct. average way. examples and creative details. L* Makes repeated Makes disruptive Writes generally Proofreads well Makes virtually no LITERACY: grammatical or grammatical/ correct prose; enough to grammatical or Grammar, spelling, syntactical errors. syntactical errors occasionally fails eliminate most syntactical errors. punctuation Frequently such as run-ons, to catch minor grammatical Establishes misspells fragments, grammatical errors; may have credibility with the homonyms. unintelligible errors. minor problems audience. sentences. with punctuation or usage. A Lacks audience Writer- focused; Is polite; does Is courteous; Reader-focused; AUDIENCE: awareness. Is rude, lacks you attitude, not slight the addresses readers’ addresses readers’ “you” attitude; hostile, positive emphasis, reader. Uses needs and/or questions and/or awareness of discourteous, or audience positive concerns; makes objections; creates reader’s needs insulting to the awareness. emphasis. no unreasonable goodwill. reader. demands. S Presents a Is unclear about Is clear; Employs good Adopts strategy to STRATEGY: disorganized, purpose; unclear correctly uses strategy; finds a achieve desired Purpose, unprofessional topic sentences, the “checklist” fresh way of outcome; clearly effectiveness of document. Projects arrangement of approach; solving the defines purpose approach, a negative image ideas, and makes no problem; effective and uses logical professionalism of the writer and transitions. serious false sequencing of and/or emotional means used. of the step; gets the ideas. appeal effectively. organization. job done. S a) Uses garbled a) Writes in a a) Writes a) Writes clearly, a) Demonstrates a STYLE: style. Plagiarizes. notably awkward serviceable concisely, and sophisticated grasp a) tone, word manner: misuses prose; uses coherently; of the language; choice words and idioms; active voice, employs writes in a fluid uses slang; wordy; strong, action syntactical variety manner; varies uses some verbs; rarely with general syntax and borrowed uses jargon or success. Creates a vocabulary; uses language. clichés. friendly, business- original language. like, positive style. ______b) document b) Format b) Design helps b) Design helps design interferes with b) Imbalanced or b) Readable readers find the readers readability cluttered design. format. information they understand and need. remember information. This is what your Your position has The boss is The boss judges Your job Your job promotion grade would mean been posted on scrutinizing your this document promotion is is ensured. at work. the Internet. work; you’re on acceptable probable. probation. subject to minor revisions.

Page 5 of 7 6 Oral Communication Rubric

Presenting Person / Group:______Evaluator:______

Criteria Very Poor* Poor* Acceptable* Good* Excellent* Score Introduction No introduction Underdeveloped and / or Minimal audience Audience engagement; positive High audience involvement; used irrelevant opening statement engagement evident response to opening statement / original, appropriate, and relevant joke intelligent introduction Main Point No main point Main idea unclear throughout Generally clear idea; further Clear topical focus and central Fully developed and organized; evident presentation development needed issues well placed within the presentation Supporting No supporting Generalized or inappropriate Relevant and essential Logical, relevant, and credible; Superior display of supporting Material material used with no topic relevance information complete with examples material well integrated into the presentation Transition No transition Incoherent transitions from Several subtopics vaguely Prepared subtopics in a logical Smooth and natural transitions Points points used one point to another connected order from one topic to another

Vocal Unintelligible Inappropriate and / or Generally clear delivery; minor Effective articulation and volume Fluid, well-articulated, and Delivery speaking style; ineffective articulation or articulation problems, such as, level volume-appropriate delivery very difficult to volume but not limited to, slurring or throughout understand running words together Effective Words or Muddled meaning; distracting Generally correct language; an Clear word choices and Clear and distinctive words, Language sentences are not in sentence structure or word occasional sentence structure expressions; no grammatical expressions, and sentence understandable or usage or grammatical error errors structures; rapt audience are offensive attention Overall No organization Ideas not focused or Main idea evident; however, Main idea clear with relevant Clear purpose; exceptionally Organization evident developed; unclear purpose weak organizational structure examples and smooth flow well organized, developed and supported ideas

Conclusion No conclusion Abrupt, ending without Acceptable work; additional Satisfying review of highlights Outstanding topic review; connection to subject development needed strong sense of closure

* Very Poor: Does not meet any of the necessary criteria * Poor: Effort apparent but does not achieve acceptable standards * Acceptable: Meets basic requirements * Good: Well-prepared; does very well in a structured presentation * Excellent: Natural communicator; can talk about the topic with ease

7