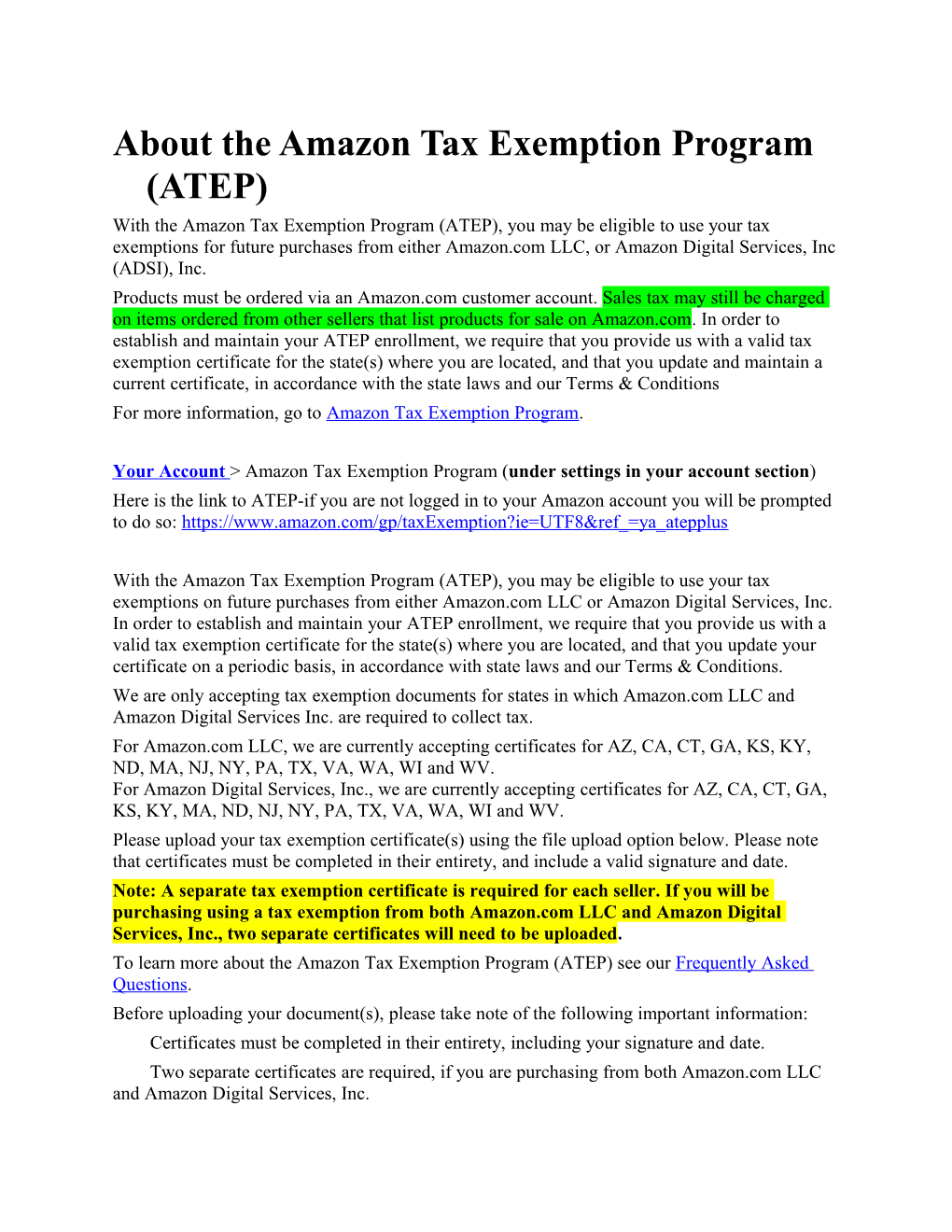

About the Amazon Tax Exemption Program (ATEP) With the Amazon Tax Exemption Program (ATEP), you may be eligible to use your tax exemptions for future purchases from either Amazon.com LLC, or Amazon Digital Services, Inc (ADSI), Inc. Products must be ordered via an Amazon.com customer account. Sales tax may still be charged on items ordered from other sellers that list products for sale on Amazon.com. In order to establish and maintain your ATEP enrollment, we require that you provide us with a valid tax exemption certificate for the state(s) where you are located, and that you update and maintain a current certificate, in accordance with the state laws and our Terms & Conditions For more information, go to Amazon Tax Exemption Program.

Your Account > Amazon Tax Exemption Program (under settings in your account section) Here is the link to ATEP-if you are not logged in to your Amazon account you will be prompted to do so: https://www.amazon.com/gp/taxExemption?ie=UTF8&ref_=ya_atepplus

With the Amazon Tax Exemption Program (ATEP), you may be eligible to use your tax exemptions on future purchases from either Amazon.com LLC or Amazon Digital Services, Inc. In order to establish and maintain your ATEP enrollment, we require that you provide us with a valid tax exemption certificate for the state(s) where you are located, and that you update your certificate on a periodic basis, in accordance with state laws and our Terms & Conditions. We are only accepting tax exemption documents for states in which Amazon.com LLC and Amazon Digital Services Inc. are required to collect tax. For Amazon.com LLC, we are currently accepting certificates for AZ, CA, CT, GA, KS, KY, ND, MA, NJ, NY, PA, TX, VA, WA, WI and WV. For Amazon Digital Services, Inc., we are currently accepting certificates for AZ, CA, CT, GA, KS, KY, MA, ND, NJ, NY, PA, TX, VA, WA, WI and WV. Please upload your tax exemption certificate(s) using the file upload option below. Please note that certificates must be completed in their entirety, and include a valid signature and date. Note: A separate tax exemption certificate is required for each seller. If you will be purchasing using a tax exemption from both Amazon.com LLC and Amazon Digital Services, Inc., two separate certificates will need to be uploaded. To learn more about the Amazon Tax Exemption Program (ATEP) see our Frequently Asked Questions. Before uploading your document(s), please take note of the following important information: Certificates must be completed in their entirety, including your signature and date. Two separate certificates are required, if you are purchasing from both Amazon.com LLC and Amazon Digital Services, Inc. Failure to include the appropriate "LLC" or "Inc." distinction in the seller names may prevent us from being able to accept your certificate(s). Select a file from your computer. Files must be less than 4 MB in size. We accept pdf, jpg, gif, png, doc, and docx file formats.

I have read and accept the Terms & Conditions

For additional information about tax exemptions and appropriate types of exemption documentation, please visit the Tax section of our Help page.