International Master of Science in Business Economics Economics of Business and Markets Final Exam

Professor Fátima Barros January 5th, 2012

Exercise 1 (3.5 points)

Consider a market where two firms, A and B, compete in prices à la Bertrand and sell a homogenous product. Both firms know that if they practice a price larger than 9€ no consumer will buy the product; if the price is equal or smaller than 9€, each consumer will buy one unit. Currently, each firm has a constant marginal cost equal to 3€. Suppose there are 10.000 potential consumers in this market. If both firms practice the same price, each one will cover half of the market. Both firms have enough production capacity to serve the entire market on their own. a) What is the market equilibrium in terms of price and quantities? Compute the profits. b) Suppose firm A may adopt a new technology that reduces its marginal cost to 2€. How much is A willing to pay for that new technology? c) Assume that both firms adopted the new technology mentioned in question b). Since their profit margins have been squeezed through price competition, firms decided to collude. (i) Define trigger strategies that will allow firms to sustain a collusion agreement. (ii) For what values of the discount rate will the collusive solution be the equilibrium of the infinitely repeated game?

Exercise 2 ( 1.5 points)

The following are the approximate market shares of different brands of soft drinks during the 1980’s: Coke: 40%, Pepsi: 30%; 7-Up: 10%; Dr. Pepper: 10%; all other brands: 10%. a. Compute the Herfindahl for the soft drink market. Suppose that Pepsi acquired 7-Up. Compute the post-merger Herfindahl. What assumptions did you make? b. Federal antitrust agencies would be concerned to see a Herfindahl of the magnitude you computed in a), and might challenge the merger. Pepsi could respond by offering a different market definition. What market definition might they propose? Why would this change the Herfindahl? Exercise 3 (5 points) Suppose consumers’ preferences for movies are uniformly distributed along a [0,2] segment, where 0 represents movies for children and 2 represents the most violent movies. Consider that there exist only two cinemas. Each cinema exhibits a certain variety of movies, corresponding to the preference points {0 and 2}: the two cinemas are 21st Century Child (location 0) and Horror Pictures (location 2). The cinemas in this market have negligible marginal costs. If a consumer watches a movie that does not exactly correspond to his preference, he incurs in a disutility 2*(v-x)2, measured in Euros, which can be interpreted as a ‘transportation cost’ to consume a different variety. Assume that the market must always be covered, that each consumer will watch one movie and that the reservation price for each one is very high. There are N consumers in this market.

a) Derive the reaction functions in terms of prices for each cinema. Compute the equilibrium prices and profits. Concerned with the content of the latest movies for children, the Government nationalized 21st Century Child. Since the Ministry of Education considers that movies for children should be a public good, 21st Century Child would exhibit its movies free of charge.

b) Compute the equilibrium in terms of prices and profits for the two cinemas under these circumstances. Explain why Horror Pictures would still be able to make profits despite the existence of movies that are offered for free.

c) Imagine that the ‘transportation cost’ decreases by a certain percentage k, such that it is given by 2α*(v-x)2 where 0<α<1. What would be the effect on Horror Pictures’ market share and profits? After some time, the Government realized that it had more important tasks to perform than entering into the cinema business, and decided to privatize again 21st Century Child. This move ended up pushing the price for cinema tickets to 8€, both at 21st Century Child and at Horror Pictures.

d) Determine the Herfindahl index for this market, and compare it with the case presented in question b). Would you say that it reflects here appropriately the level of price competition? Justify.

Exercise 4 (5 points) Firm Sirius is the only firm producing calculators capable of speaking directly with the user. The firm’s expert in marketing says that the market demand, mainly given by university students, is equal to Q 1000 10 P , where Q is the number of calculators demanded and P is the unit price in Euros. The average cost of production is constant and equal to 10 €. a) Which price should it charge and what is its profit level? The operations manager just informed the CEO that the firm was not yet prepared to produce such large quantities. It is only able to produce 400 units at a marginal cost of 10€. Every additional unit would have a marginal cost of 40€. b) Compute again the equilibrium in terms of price and profits. Represent the equilibrium graphically (including the marginal revenue). A consultancy firm informed Sirius that the market demand was the result of 10 identical students, each one with an individual demand given by q 100 P . In order to increase its profits, Sirius decided to practice a two-part tariff scheme. c) Determine the optimal two-part tariff and compute the resulting profit.

Exercise 5 (5 points)

A. Consider the following case. Can you find evidence of entry barriers in this industry? How do you characterize the behavior of each firm?

The ReaLemon brand, made by Borden, Inc., dominated the market for many years. When a rival firm, Golden Crown, entered the market with its own lemon juice product it found itself at a real disadvantage relative to ReaLemon, which had advertised heavily during the previous ten years. Even though Golden Crown’s product was chemically identical, Golden Crown had to sell at a 15 to 25 percent discount relative to ReaLemon’s price. When it did this, substantial price competition broke out between the two firms. As a result, ReaLemon lowered its price. In turn, this forced Golden Crown to reduce its price even further in order to maintain the relative discount necessary for Golden Crown to win any significant market share. After a few further rounds of such price cuts, Golden Crown found that it could barely break even. Were it not for the decision of the courts, Golden Crown would have been forced out altogether. Yet even with Golden Crown in the market, the degree of concentration remained quite high.

B. Discuss the following text taking into account the Sutton’s Endogenous Sunk Cost Model.

Two lines of explanation have been offered for the increase in concentration experienced by the U.S. beer industry over the past forty years. The first of these emphasizes the role of escalating advertising outlays by major brewers. The alternative view is that the increase in concentration is attributable to the change in the minimum efficiency scale (m.e.s.) that has occurred over time: as the plants become obsolete, they are replaced with new plants corresponding to the new and higher level of m.e.s.. Yet, a newer explanation defends that these two influences are not independent, they emerge as part of a single integrated mechanism.

In John Sutton, “Sunk Costs and Market Structure”

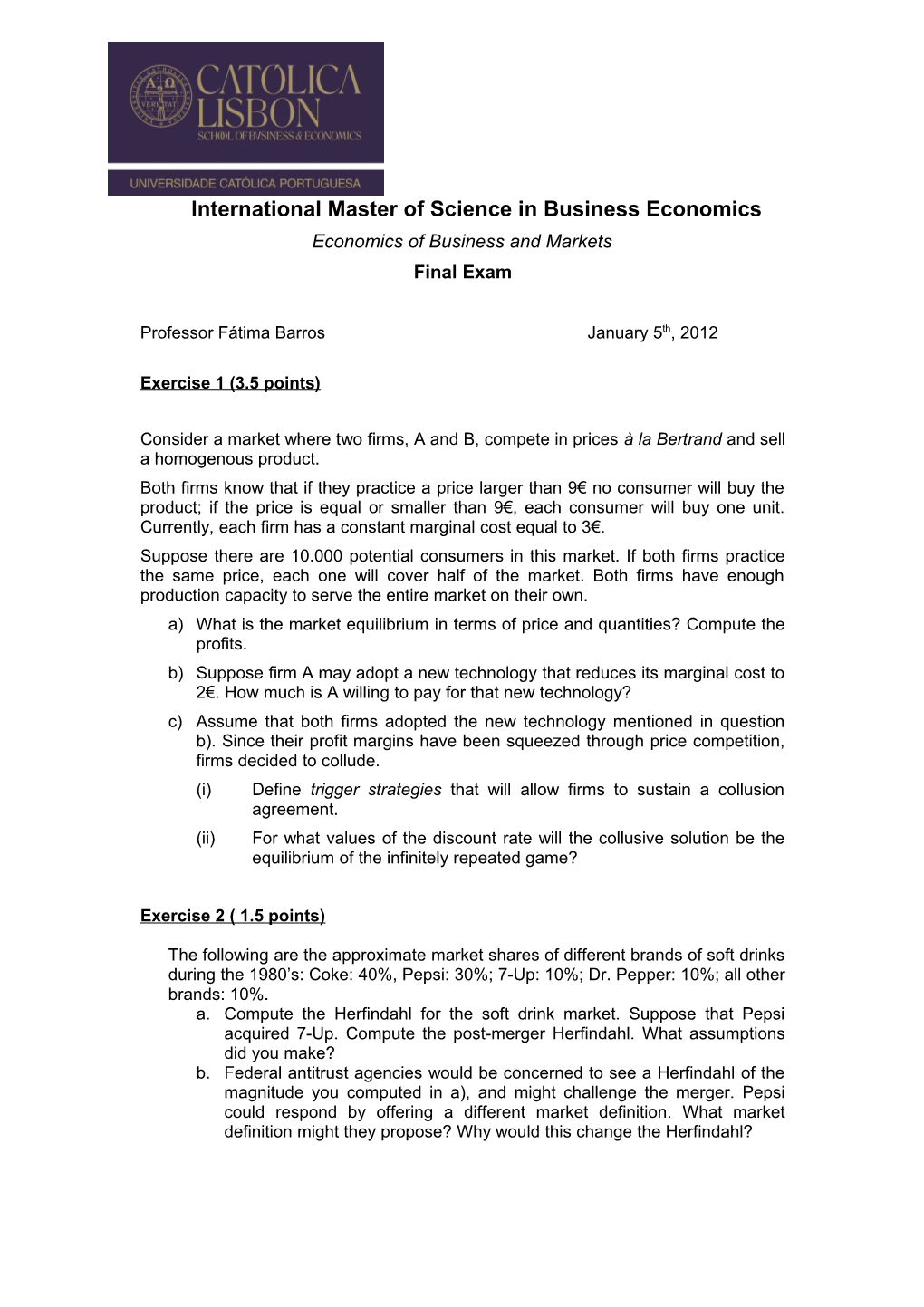

C. Consider the Sutton’s Endogenous Sunk Cost Model and explain the figure below. What does point X represent?

1 N

1

N

X

S