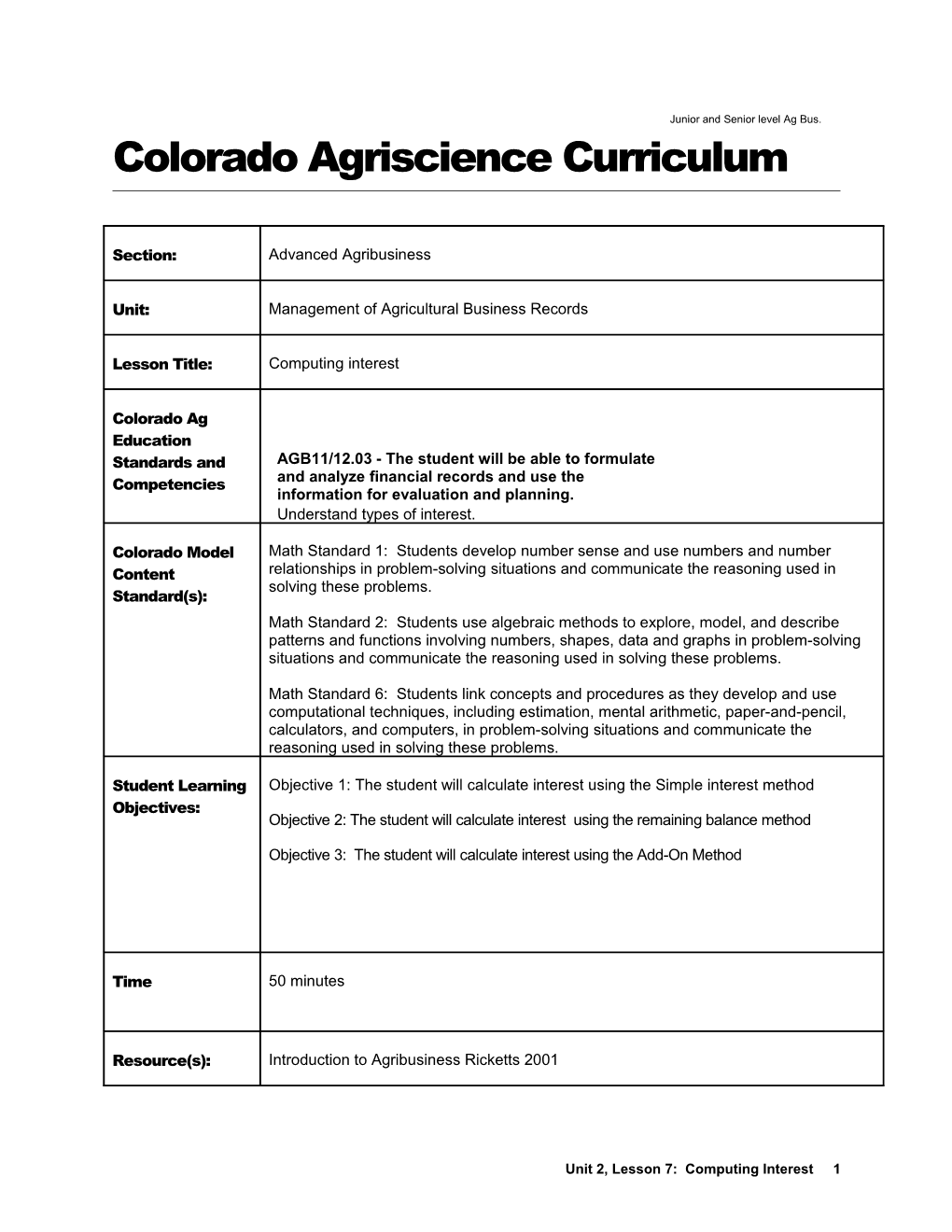

Junior and Senior level Ag Bus. Colorado Agriscience Curriculum

Section: Advanced Agribusiness

Unit: Management of Agricultural Business Records

Lesson Title: Computing interest

Colorado Ag Education Standards and AGB11/12.03 - The student will be able to formulate and analyze financial records and use the Competencies information for evaluation and planning. Understand types of interest.

Colorado Model Math Standard 1: Students develop number sense and use numbers and number Content relationships in problem-solving situations and communicate the reasoning used in solving these problems. Standard(s): Math Standard 2: Students use algebraic methods to explore, model, and describe patterns and functions involving numbers, shapes, data and graphs in problem-solving situations and communicate the reasoning used in solving these problems.

Math Standard 6: Students link concepts and procedures as they develop and use computational techniques, including estimation, mental arithmetic, paper-and-pencil, calculators, and computers, in problem-solving situations and communicate the reasoning used in solving these problems.

Student Learning Objective 1: The student will calculate interest using the Simple interest method Objectives: Objective 2: The student will calculate interest using the remaining balance method

Objective 3: The student will calculate interest using the Add-On Method

Time 50 minutes

Resource(s): Introduction to Agribusiness Ricketts 2001

Unit 2, Lesson 7: Computing Interest 1 Instructional Material Services ,Texas A&M[ Click here and enter information. ]

Instructions, Italicized words are instructions to the teacher, normal style text is suggested script. Tools, Create a “Knowbook” for each student prior to the start of the class period. Knowbooks can Equipment, and be made by taking 2 pieces of blank white paper and folding them together ‘hamburger’ style Supplies: – effectively creating an 8-page booklet (if you count the cover and the back pages)

Make Knowbooks available to each student prior to the beginning of the class period.

Make colored pencils / markers / crayons available to the students – perhaps place them on a table at the front of the room

Each student needs one version of the Student Handout Scenario (sheet is available at the end of the lesson plan).

14 different scenarios are provided – if you have more than 14 students, make additional copies so that each student has a scenario.

Before students enter the room put the following information on the chalkboard or overhead projector or Smart board – (a copy of this information is provided at the end of the lesson.

The Agricultural Bank of America

Today loans are due on the John Deere Tractors that you purchased one year ago.

Based on your credit rating, each of you was given a different interest rate at which we loaned you the money to purchase your tractor.

Listed below are the interest rates at which 14 different tractor loans were given.

Please look at your loan paperwork (given to you by your instructor). Come up to the board and write in the total interest you owe us, as well as the total amount you owe us.

Interest Rate Total Interest Paid Total Amount Due

4.5%

5.0%

5.5%

6.0%

6.5%

7.0%

Unit 2, Lesson 7: Computing Interest 2 7.5%

8.0%

8.5%

9.0%

9.5%

10.0%

15%

20%

Good morning everyone! Each of you has a piece of paper you received upon entering the Interest classroom this morning. The CEO of the Agricultural Bank of America has left a message for Approach: us on the board/overhead. When I say GET TO IT, please take a few minutes to read your scenarios as well as the message from the CEO. After you have read the information, please come up to the board and fill in your information. Do you have any questions? If so, please ask them now. If not, let’s GET TO IT!

Assist the students in filling in the chart on the board / overhead. They will certainly have a few questions and comments – especially when they realize that the original loan was for $300,000 and some of them are paying $360,000 ($60,000 in interest while others are only paying $13,500 in interest).

After the students have returned to their seats, start the discussion:

What do we notice about the information we’ve created on the board? Elicit responses

Why are some borrowers only paying $13,500 in interest, while others are paying $46,500 more? Elicit Reponses

How are interest rates determined? Elicit Reponses

As you can see, interest cost can be a major expense to agricultural businesses and to those in production agriculture.

Show PowerPoint #2:

Does anyone know how interest costs are calculated?

Elicit Responses

Today we are going to delve into how interest rates are calculated and how a borrower can take out a loan on the same amount – let’s say $1000 – but depending on the loan type and the way interest is calculated the total amount due may vary.

Unit 2, Lesson 7: Computing Interest 3 Cue up PowerPoint Slide #3 “Methods of Calculating Interest”

These loan types include: Simple Interest, Remaining Balance, Add-On Method

To get our brains jumpstarted, when I say COLOR, I’d like each of you to come up to the front of the room and get a Knowbook and some colored pencils / markers / crayons etc. Any questions? Great! COLOR!

Now that everyone has a knowbook, I’d like you to take a few minutes and create a title on the cover page that corresponds with the title of the PowerPoint Slide you see on the screen right now (Cue up PowerPoint slide #4 – “Computing Interest”)

After you’ve created your title – draw a quick picture of that title that’s meaningful for you. Make sure that the picture adequately represents the title to you. Your picture may be different from your neighbors; that’s OK – what’s important is that YOU know what your picture represents.

Great work everyone! Make sure to list yourself as the ‘author’ of this Knowbook – you’ve got to get credit for the amazing work you’re going to create today!

Fantastic – now that everyone’s finished their cover page – please open your books to the first two pages and prepare to be ‘amazed’ by the information we’re about to go over!

Objective 1: Objective 1: The student will calculate interest using the Simple Interest Method

Cue up Slide #5

As we review this information in class, take a few minutes to capture the information presented through lecture and the PowerPoint presentation in your Knowbook. Make sure to write the information down in a way that you can accurately remember it – draw pictures to accompany the information (if it helps you).

The annual percentage rate (APR) of a loan can be calculated using several different methods.

The method used will determine how much interest cost is paid by the business.

Cue up Slide #6

The First method we will use is the Simple interest method. EXAMPLE

$1000 borrowed for 1 year at 5% interest

1000 x .05 = $50 interest charge

SO $1050 would be paid back at the end of the one year loan - Period.

Objective 2: Objective 2: The student will calculate interest using the Remaining Balance Method

Cue up Slide #7 – Check to make sure the students are still keeping pace with their

Unit 2, Lesson 7: Computing Interest 4 Knowbooks. Encourage them where appropriate.

The second method of computing interest we will look at is the Remaining Balance Method.

This method is used when several payments will be made to pay off the loan

Interest is charged only on the remaining principal balance.

Cue up Slide #8

Example: $1000 borrowed for 4 years at 8% interest. The $1000 will be paid back in yearly principal installments of $250.

Slide #9

YEAR 1: $1000 X .08 (interest rate) = $80 in interest cost

+

$250 Principal Payment

$330 Annual Payment

Slide #10

YEAR 2: $750 X .08 (interest rate) = $60 in interest cost

+

$250 Principal Payment

$310 Annual Payment

Slide #11

YEAR 3: $500 X .08 (interest rate) = $40 in interest cost

+

$250 Principal Payment

$290 Annual Payment

Unit 2, Lesson 7: Computing Interest 5 Slide #12

YEAR 4: $250 X .08 (interest rate) = $20 in interest cost

+

$250 Principal Payment

$270 Annual Payment

Slide #13

TOTAL INTEREST Paid over a 4 year Period = $200

Objective 3: The student will calculate interest using the Add-On Method Objective 3: Cue up Slide #14

The third method of computing interest is the Add-On method.

In this method, interest is charged on the full principal amount for the entire life of the loan. This amount is then added to the principal and divided into even payments.

Cue up Slide #15

EXAMPLE $1000 BORROWED FOR 4 YEARS AT 8% INTEREST

Cue up Slide #16

Step 1: Calculate the total interest paid over the lifespan of the loan

$1000 (principal amount) X .08 (interest rate) x 4 (years) = $320

This $320 is the Interest Charge (or the total amount of interest paid over the lifespan of the loan)

Cue up Slide #17

Step 2: Add the interest charge to the principal amount

$1000 (principal amount) + $320 (Interest Charge) = $1320 (Total amount paid)

Cue up Slide #18

Step 3: Divide total amount paid by the total number of

Unit 2, Lesson 7: Computing Interest 6 payments

$1320 (total amount paid) / 4 (years)= $330 Yearly Payment

Notice that the total Interest Charge is $120 higher using the Add- On method than with the Simple Interest Method.

Why is that the case?

Why are we paying more in interest charges – even though we have the ‘same’ interest rate, and the loan lasts for the same number of years?

The answer is this: Add-On interest formulas calculate the interest rate for the entire life-span of the loan X the original amount of the loan to determine an Annual Percentage Rate.

The question now is, how are Annual Percentage Rages calculated?

Cue up Slide #19

Step 4: Calculating APR using the Add-On Interest Formula

The ‘secret’ formula is:

R = 2C X 100 L (P + A)

Formula Key:

R = Annual Percentage Rate

C = Total Interest Cost

L = Length of Loan in Years

P = Principal Amount Borrowed

A = Payment Amount Each Period

Cue up Slides #20 & #21

Unit 2, Lesson 7: Computing Interest 7 SOOOOO

For our previous add on interest example 2 X $320 divided by 4 ( 1000 + 330) X 100

EQUALS 12.03% APR MUCH HIGHER THAN THE 8% INTEREST CHARGED!!

Review/Summary Cue up Slide #22 - Use the Jeopardy moment to review content of the lesson. : Divide students into small groups. Identify the categories of Questions for students to write. Have students develop clue cards for facts presented in the lesson. On a separate sheet have students write the appropriate question for each fact card! Collect the cards. Explain the game and begin reviewing.

Application-- Invite guest speaker {Banker) to class to visit with STUDENTS about interest Extended Classroom Activity:

Application--FFA Participate in the Farm Business Management Contest Activity:

Application--SAE Have students look at any loans they might have secured for their SAE (or personal Activity: purposes). Ask them to determine the type of interest rates that were used on these loans. Were they simple, remaining balance, or add-on?

Evaluation: Have students write a page where they compare and contrast the different types of interest computation methods.

Make sure students use proper grammer, punctuation, spelling and sentence structure.

This one page synopsis should include positive and negative aspects of each method as well as applications for each method

Evaluation Answers will vary with student Answer Key:

Unit 2, Lesson 7: Computing Interest 8 Interest Approach Handouts Make additional copies as necessary so that each student in the class is presented with a mini-scenario upon entering the class for the day.

Student #1: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 4.5%.

Original Loan Amount: $300,000 Fixed Interest Rate: 4.5% Duration of Loan: 1 year Annual Payment: $313,500

Student #2: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 5.0%.

Original Loan Amount: $300,000 Fixed Interest Rate: 5.0% Duration of Loan: 1 year Annual Payment: $315,000

Student #3: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 5.5%.

Original Loan Amount: $300,000 Fixed Interest Rate: 5.5% Duration of Loan: 1 year Annual Payment: $316,500

Student #4: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 6.0%.

Original Loan Amount: $300,000 Fixed Interest Rate: 6.0% Duration of Loan: 1 year Annual Payment: $318,500

Unit 2, Lesson 7: Computing Interest 9 Student #5: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 6.5%.

Original Loan Amount: $300,000 Fixed Interest Rate: 6.5% Duration of Loan: 1 year Annual Payment: $319,500

Student #6: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 7.0%.

Original Loan Amount: $300,000 Fixed Interest Rate: 7.0% Duration of Loan: 1 year Annual Payment: $321,000

Student #7: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 7.5%.

Original Loan Amount: $300,000 Fixed Interest Rate: 7.5% Duration of Loan: 1 year Annual Payment: $322,000

Student #8: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 8.0%.

Original Loan Amount: $300,000 Fixed Interest Rate: 8.0% Duration of Loan: 1 year Annual Payment: $324,000

Student #9: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 8.5%.

Original Loan Amount: $300,000 Fixed Interest Rate: 8.5% Duration of Loan: 1 year Annual Payment: $325,500

Unit 2, Lesson 7: Computing Interest 10 Student #10: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 9.0%.

Original Loan Amount: $300,000 Fixed Interest Rate: 9.0% Duration of Loan: 1 year Annual Payment: $327,000

Student #11: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 9.5%.

Original Loan Amount: $300,000 Fixed Interest Rate: 9.5% Duration of Loan: 1 year Annual Payment: $328,500

Student #12: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 10%.

Original Loan Amount: $300,000 Fixed Interest Rate: 10.0% Duration of Loan: 1 year Annual Payment: $330,000

Student #13: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 15%.

Original Loan Amount: $300,000 Fixed Interest Rate: 15.0% Duration of Loan: 1 year Annual Payment: $345,000

Student #14: You are about to purchase a brand new John Deere Tractor with all the bells and whistles. This tractor has a sticker price of $300,000. Because you have an outstanding credit rating, your lending institution (The Agricultural Bank of America) has agreed to give you a 1 year loan, with a fixed interest rate of 20%.

Original Loan Amount: $300,000 Fixed Interest Rate: 20% Duration of Loan: 1 year Annual Payment: $360,000

Unit 2, Lesson 7: Computing Interest 11 The Agricultural Bank of America – Interest Approach Overhead Master

The Agricultural Bank of America

Today the loans are due on the John Deere Tractors that you purchased one year ago.

Based on your credit rating, each of you was given a different interest rate at which we loaned you the money to purchase your tractor.

Listed below are the interest rates at which 14 different tractor loans were given.

Please look at your loan paperwork (given to you by your instructor). Come up to the board and write in the total interest you owe us, as well as the total amount you owe us.

Interest Rate Total Interest Paid Total Amount Due

4.5%

5.0%

5.5%

6.0%

6.5%

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

10.0%

15%

20%

Unit 2, Lesson 7: Computing Interest 12