A standardised approach to the reporting and investigation of insurance fraud

The ‘package’

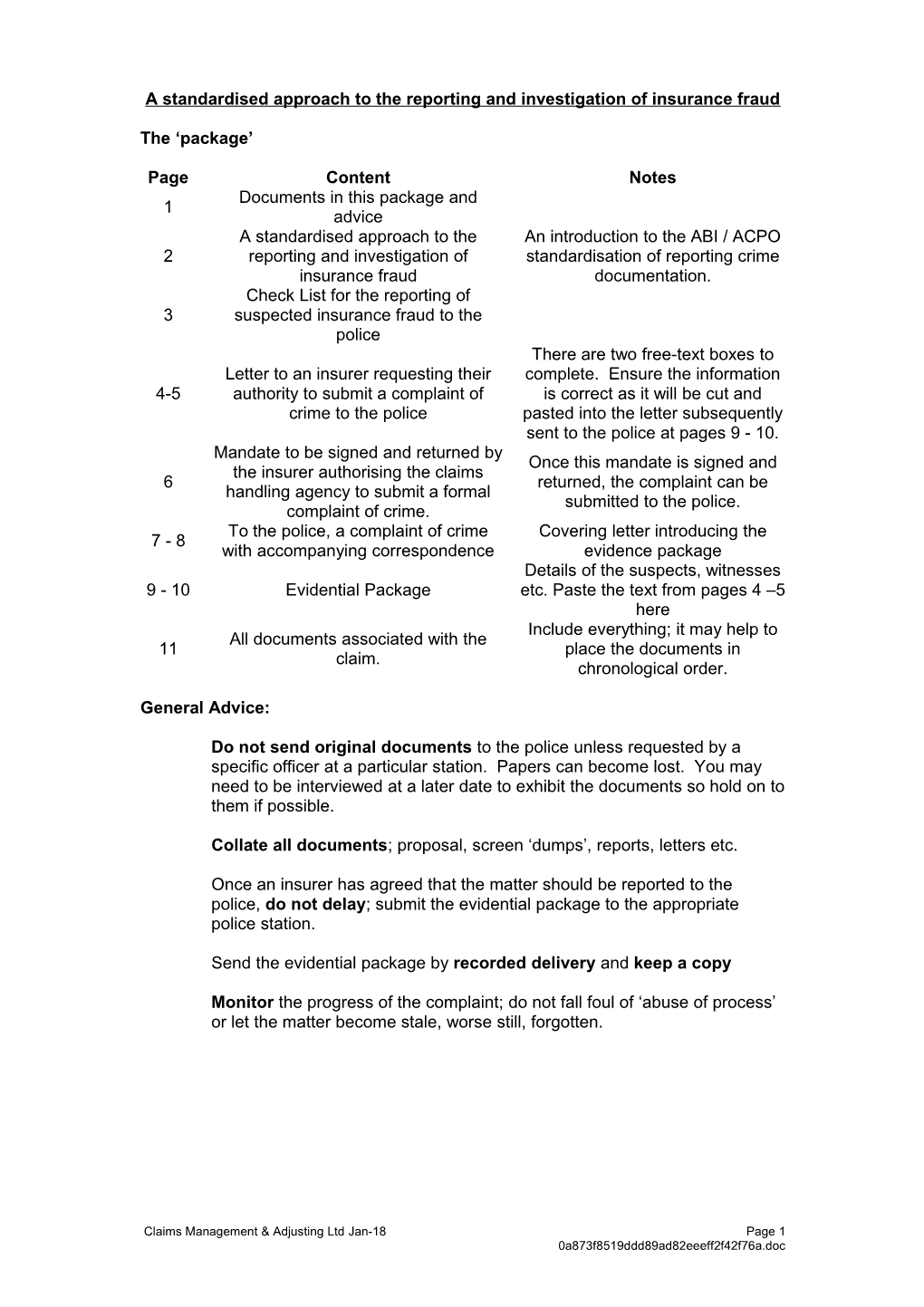

Page Content Notes Documents in this package and 1 advice A standardised approach to the An introduction to the ABI / ACPO 2 reporting and investigation of standardisation of reporting crime insurance fraud documentation. Check List for the reporting of 3 suspected insurance fraud to the police There are two free-text boxes to Letter to an insurer requesting their complete. Ensure the information 4-5 authority to submit a complaint of is correct as it will be cut and crime to the police pasted into the letter subsequently sent to the police at pages 9 - 10. Mandate to be signed and returned by Once this mandate is signed and the insurer authorising the claims 6 returned, the complaint can be handling agency to submit a formal submitted to the police. complaint of crime. To the police, a complaint of crime Covering letter introducing the 7 - 8 with accompanying correspondence evidence package Details of the suspects, witnesses 9 - 10 Evidential Package etc. Paste the text from pages 4 –5 here Include everything; it may help to All documents associated with the 11 place the documents in claim. chronological order.

General Advice:

Do not send original documents to the police unless requested by a specific officer at a particular station. Papers can become lost. You may need to be interviewed at a later date to exhibit the documents so hold on to them if possible.

Collate all documents; proposal, screen ‘dumps’, reports, letters etc.

Once an insurer has agreed that the matter should be reported to the police, do not delay; submit the evidential package to the appropriate police station.

Send the evidential package by recorded delivery and keep a copy

Monitor the progress of the complaint; do not fall foul of ‘abuse of process’ or let the matter become stale, worse still, forgotten.

Claims Management & Adjusting Ltd Jan-18 Page 1 0a873f8519ddd89ad82eeeff2f42f76a.doc C.M. A comment

The following pages, whilst directly taken from the ABI / ACPO Acceptance Criteria and Guidelines, present the information in a different format; one intended to simply the reporting of suspected fraudulent insurance claims to the police.

Please copy or use this document as required

Introduction

This document, produced in August 1999, comprises an evidential package developed directly from the Association of British Insurer’s booklet, which was a joint initiative with the Association of Chief Police Officers’ (National Working Group on Fraud).

A copy of the booklet can be obtained from the Crime and Fraud Prevention Bureau, Association of British Insurers, 51 Gresham Street, London EC2V 7HQ.

Insurers have often experienced difficulty in getting cases accepted for investigation by the police. Fraud cases are complex, involving a number of different factors and insurers have often presented cases to the police in a manner that is difficult to understand. Police constabularies have occasionally experienced difficulties deciding whether the case is strong enough to merit further investigation.

The acceptance criteria and guidelines aim to standardise agreements on the reporting of suspicious fraudulent claims.

The Agreement

When reporting an alleged insurance fraud to the police, we must satisfy the entire acceptance criteria, set out in page 3.

We must establish that there is a prima facie criminal case to investigate.

Allegations reported to the police should be made in writing and in the form of an evidential package.

As soon as possible we must locate and preserve all original documents relating to the alleged offences. These should be made available to the police on request.

Any decision to proceed with the investigation will rest with the police service to which the allegations have been made, or with the service in whose area the alleged offences took place.

The police will inform the complainant company (usually an insurer – we should ask that it be us also) in writing of their decision to proceed with the investigation. Where it is decided not to proceed with a case the reasons for the decision will be included.

Should an investigation be commenced, the officer in charge of that investigation will be identified to the complainant insurance company.

The Crown Prosecution Service will make the final decision as to whether or not a criminal prosecution will be undertaken.

Claims Management & Adjusting Ltd Jan-18 Page 2 0a873f8519ddd89ad82eeeff2f42f76a.doc Check List for the reporting of suspected insurance fraud to the police

Before submitting a complaint of crime to the police, the following must to be addressed:

Has it been established that there are 1 reasonable grounds to believe that a Yes No criminal offence has been committed? Does the report of an allegation relate to an insurance claim which is (allegedly): a. substantially exaggerated, 2 Yes No b. fraudulent throughout or c. relates to wholly contrived or fabricated incidents? Have we clearly defined the criminal 3 intent (this must be more than an error or Yes No omission)? Does the allegation concern recent events (incidents over two years old before discovery, need to be judged 4 Yes No individually on their merits, including availability of documentary evidence and the reliability of witnesses’ memories)? Are we satisfied there is no evidence of negligence by the insurer i.e. that the 5 Yes No Insurer did not bring about the circumstance surrounding the allegation? Are we satisfied: To comply with the rules of disclosure, the insurance company will identify and A Yes No preserve all original documents relating to any intended complaint The insurer is be prepared to supply all original relevant documents to the police B Yes No if they undertake to investigate the allegations made. The insurance company will not attempt to use the police merely as a means to C Yes No recover monies paid out instead of using civil means. Has any other police service made a D decision to refuse to investigate the case Yes No for other than geographical reasons?

If the answer to any of the above questions is ‘No’ the matter must not be submitted to the police, the advice of a claims manager / director must be sought.

The original of this document is to stay on file, a copy attached to the police package.

Claims Management & Adjusting Ltd Jan-18 Page 3 0a873f8519ddd89ad82eeeff2f42f76a.doc To an insurer requesting authority to submit a complaint of crime

Insurance Company Address Address Address Address

Date

Dear Sirs

Your Ref: Insured: Loss date: Re: Our Ref:

We write to advise that we believe there are sufficient grounds for placing this matter before the police. We are seeking your confirmation that you wish the matter reported in accordance with the Acceptance Criteria and Guidelines for the reporting of Suspected Fraudulent Insurance Claims to the Police (ACPO & ABI joint agreement, 1999). The following information is designed to ensure the police constabulary to whom we report the matter will accept the complaint of crime.

It has it been established that there are reasonable grounds to believe a criminal offence has been committed in relation to the above claim in that it is:

substantially exaggerated, fraudulent in part or throughout or relates to wholly contrived or fabricated incidents.

We believe the criminal intent is more than an error or omission and is as follows:

Offences:

FREE TEXT 1 Examples:

1. Insured

Obtaining a pecuniary advantage Attempted deception

Note: consider associates / witnesses and the possibility of a conspiracy

Claims Management & Adjusting Ltd Jan-18 Page 4 0a873f8519ddd89ad82eeeff2f42f76a.doc Brief Facts:

FREE TEXT 2 A summary of the events. Try to describe the relevant facts in chronological order, for example:

On (day, date, the Insured, Mr ***** ****** obtained a policy of insurance with ******** insurance company, in respect of motor vehicle registration number ********. The policy provide use for social, domestic, pleasure and commuting purposes.

The policy provided third party, fire and theft cover, insured only to drive the vehicle

On (day, date), the insured reported the theft of the vehicle to ******** police station (ref # telephone #).

On (day, date), the insured was interviewed and made a statement confirming the loss, stating that they had paid £3,000 for the vehicle from the last registered keeper.

Enquiries confirmed that the Insured is a motor trader who purchased the vehicle from an auction in the sum of £800.

The allegation concerns recent events; the incidents are not over two years old before discovery. The allegation therefore does not need to be judged individually on its merits (including availability of documentary evidence and the reliability of witnesses’ memories) to comply with the reporting of suspected insurance fraud to the police

We are satisfied that neither you, nor we, have been negligent resulting in the circumstance surrounding the allegation.

Please can you confirm, by returning the attached ‘INSURER AUTHORITY TO SUBMIT A FORMAL COMPALINT OF CRIME’ mandate, that:

1. to comply with the rules of disclosure, the insurance company will identify and preserve all original documents relating to any intended complaint

2. you are prepared to supply all original relevant documents to the police if they undertake to investigate the allegations made.

3. you will not attempt to use the police merely as a means to recover monies paid out instead of using civil means.

4. a decision to refuse to investigate the case has not been made by any other police service other than for geographical reasons.

Initial reports to the police can be made orally but will be submitted by us in writing. Whilst we will present the facts to the applicable police service, the decision to accept a case for investigation will be with the police.

Where a complaint is made to the police, the police will after consideration of the facts, inform us, or yourselves in writing of their decision as to whether or not they will take further action on the case.

Please complete and return the enclosed report of crime for the attention of the writer

Yours faithfully,

Claims Management & Adjusting Ltd Jan-18 Page 5 0a873f8519ddd89ad82eeeff2f42f76a.doc INSURER AUTHORITY TO SUBMIT A FORMAL COMPLAINT OF CRIME

To Claims Handling Company Address Address Address Tel: Fax:

Dear Sirs,

Our Ref: Insured: Loss date: Re: C.M.A. Ref:

In accordance with the Acceptance Criteria and Guidelines for the reporting of Suspected Fraudulent Insurance Claims to the Police (ACPO & ABI joint agreement, 1999) we ask that you make a formal complaint of crime in respect of the claim submitted by our policyholder.

We can confirm:

A. to comply with the rules of disclosure, we will identify and preserve all original documents relating to the complaint

B. we are prepared to supply all original relevant documents to the police if they undertake to investigate the allegations made.

C. we will not attempt to use the police merely as a means to recover monies paid out instead of using civil means.

D. To our knowledge, a decision to refuse to investigate the case has not been made by any other police service (other than for geographical reasons).

Yours faithfully

Signed: ______

Print Name: ______

Date: ______

Insurer name : Insurer address:

Insurer Reference:

Direct Dial Tel #: e-mail:

Claims Management & Adjusting Ltd Jan-18 Page 6 0a873f8519ddd89ad82eeeff2f42f76a.doc Police Station Address Address Address

Date

Recorded Delivery

Dear Sirs

Reporting of a Suspected Fraudulent Insurance Claim Insured: Re: Our Ref:

We confirm that we act as the representative of insurers, the complainant insurance company and enclose a written authority in support of this.

In accordance with the Acceptance Criteria and Guidelines for the reporting of Suspected Fraudulent Insurance Claims to the Police (ACPO & ABI joint agreement, 1999) we submit the attached as a formal complaint of alleged fraud.

We ask to be informed in writing of your decision as to whether you will take further action on the case. Specifically, we ask to be advised of:

1. Your assessment of the package and acceptance of the papers for investigation

2. The relevant division or department assigned to deal with the package. We ask that the package be forwarded to the department for enquiries to commence.

3. The appropriate location for the investigation to be based.

4. The station and officer assigned to pursue the investigation. If the case is forwarded to another Service, we ask to be advised, in writing, of the constabulary appointed to receive the file and the station / officer assigned to undertake the investigation.

5. The crime reference number allocated to the allegation

If the case is not accepted for investigation, we ask to be notified, in writing, of the reasons.

If the case is accepted, we ask that the police officer in charge of the investigation maintains contact with us, if necessary supplying periodic updates on the progress of the investigation.

Claims Management & Adjusting Ltd Jan-18 Page 7 0a873f8519ddd89ad82eeeff2f42f76a.doc If the Crown Prosecution Service makes a decision not to prosecute we ask to be notified of the decision and the reasons given.

We do not as a general rule expect you to routinely provide us with a list of property, witness statements and copies of crime reports. However, where there is a strong suspicion of a substantial fraud being perpetrated and ask that consideration is given to supplying the relevant information.

We are not seeking details of criminal records, previous convictions or information from the Police National Computer.

Yours faithfully,

Claims Management & Adjusting Ltd Jan-18 Page 8 0a873f8519ddd89ad82eeeff2f42f76a.doc This document contains personal data and must be treated as confidential. The document may not be copied in part or in whole to a third party without written authorisation from (name or person / company reporting the crime.

Evidential Package

The following is considered to be all relevant information surrounding the allegations made:

Suspect / Insured

Insured: Address: Date of Birth: Occupation: Allegation:

Suspect(s) if other than Insured / not applicable

1 Name of Suspect 2 Address of Suspect 3 Date of Birth of Suspect 4 Allegation: 5 Reasons for suspicion See ‘Evidential Package – Brief Summary’

Other Parties suspected of involvement / none:

1 Name of 2nd Suspect 2 Address of 2nd Suspect 3 Date of Birth of 2nd Suspect 4 Allegation: 5 reasons for the suspicions See ‘Evidential Package – Brief Summary’

1 Name of 3rd Suspect 2 Address of 3rd Suspect 3 Date of Birth of 3rd Suspect 4 Allegation: 5 reasons for the suspicions See ‘Evidential Package – Brief Summary’

1 Name of 4th Suspect 2 Address of 4th Suspect 3 Date of Birth of 4th Suspect 4 Allegation: 5 reasons for the suspicions See ‘Evidential Package – Brief Summary’

The allegations is as follows:

Value of claim: Relevant dates:

Claims Management & Adjusting Ltd Jan-18 Page 9 0a873f8519ddd89ad82eeeff2f42f76a.doc Copy and insert FREE TEXT 1 here. See page 4 (above).

Brief summary:

Copy and insert FREE TEXT 2 here. See page 5 (above).

Add the nature, circumstances and investigations undertaken:

Previous claims are associated with the suspect(s) as follows:

None (other, as applicable)

Claims Management & Adjusting Ltd Jan-18 Page 10 0a873f8519ddd89ad82eeeff2f42f76a.doc Documents:

Copies of relevant documents, to include statements taken from suspects, are as follows:

Document # of # Document Name Produced by date pages 1 2 3 4 5 6 7 8 9 10 11 12

Witnesses:

Statement Name Address Telephone recorded? 1 Yes / No 2 Yes / No 3 Yes / No

Copies of statements are attached (see ‘Documents’, above).

Police:

To our knowledge, no police reference numbers have previously been applied to any part of the case.

We are unaware of the crime number associated with the original crime relating to the offence

The crime reference associated with the loss allegedly suffered by the subject(s) is: ______

Complainant Contacts:

Name Company Address Telephone # Claims 20, Churchill Square Management & West Malling, 01732 877700 Adjusting Ltd Kent ME19 4YU Insurance Company

Claims Management & Adjusting Ltd Jan-18 Page 11 0a873f8519ddd89ad82eeeff2f42f76a.doc