Name: ______Pd ___ Date ___ / ___ / ___ Mr. Henry Honors Econ

Final Exam Study Guide – 100 pts. total Chapters 1 through 15 Thursday = 74 Points – Multiple Choice – Scantron Wednesday = 20 points Essay (two 10 pt. essays) + 3 Subjective Questions Unit 1 Bond Economic Model Paradox of Value Capitalism Factors of Production Partnerships Cash Flow Fixed Income Preferred Stock Chamber of Commerce Free Enterprise Economy Principal Command Economy General Partnership Profit Motive Communism Gross Domestic Product Public Utility Common Stock Horizontal Merger Scarcity Conglomerate Human Capital Social Security Consumer Good Interest Socialism Corporations Limited Life Sole Proprietorships Cost-Benefit Analysis Limited Partnership Specialization Depreciation Market Trade-off Dividend Market Economy Traditional Economy Double Taxation Minimum Wage Unlimited Liability Economics Mixed Economy Vertical Merger Economic Multinational Voluntary Exchange Inflation Nonprofit Organizations Interdependence Opportunity Cost 1 What are the major differences between factor markets and product markets?

2 What effect do limited resources and unlimited wants have on the economy?

3 What was Adam Smith’s view of the relationship between a country’s wealth, its material possessions, and its people?

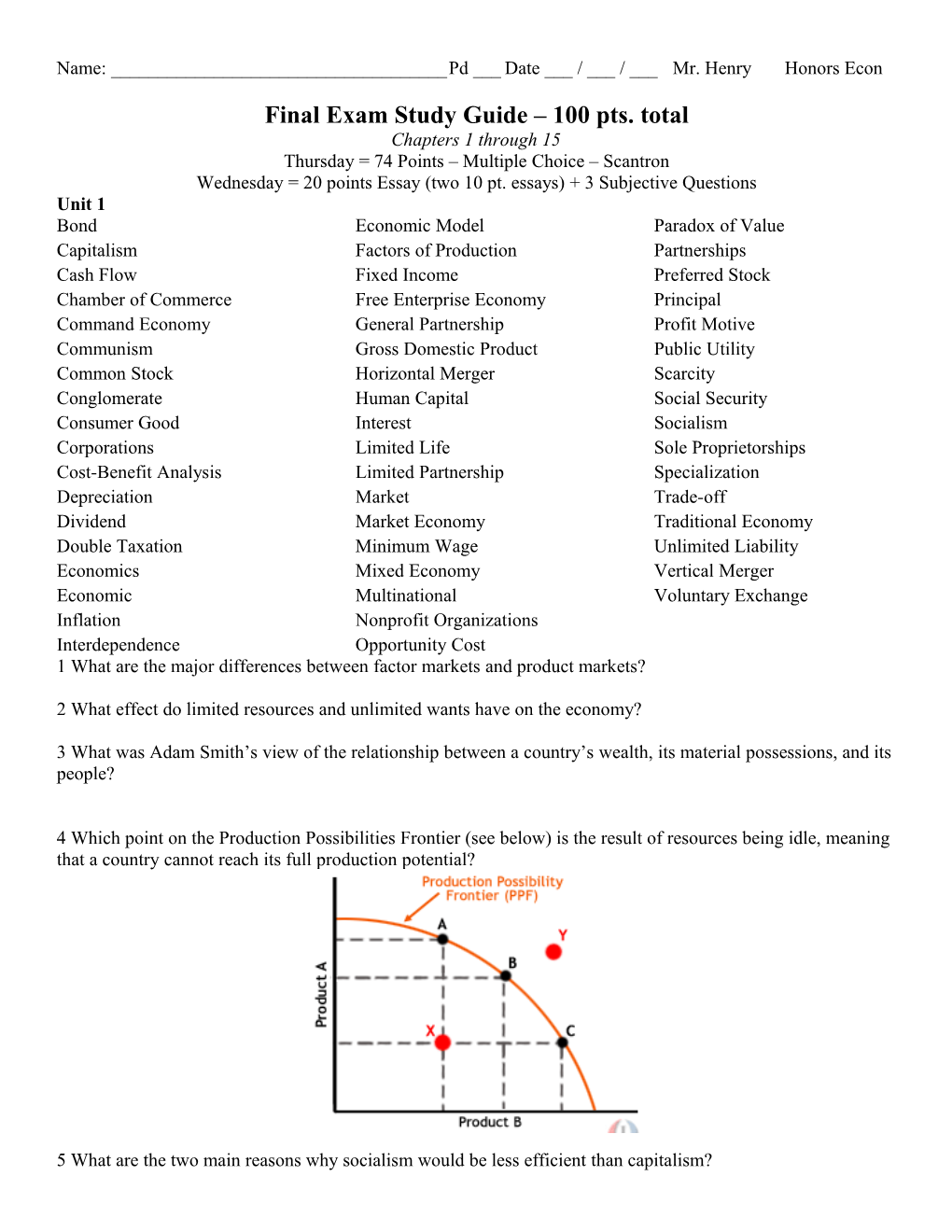

4 Which point on the Production Possibilities Frontier (see below) is the result of resources being idle, meaning that a country cannot reach its full production potential?

5 What are the two main reasons why socialism would be less efficient than capitalism? 6 Why might a business not want to have a large inventory of parts and supplies on hand?

7 What are the three basic questions that scarcity forces every society to answer?

8 What effect does economic efficiency have on the number of goods available?

9 What are some personal qualities that a sole proprietor might need to form a successful proprietorship?

10 What is TINSTAAFL, where did TINSTAAFL originate, and cite one example of TINSTAAFL?

11 Describe each of the 4 factors of production

12 Developed product known as Under Armor at the University of Maryland

13 Provides an ethical marketplace where buyers & sellers can trust each other

14 Provides a benefit to its members; like a credit union or Ocean Spray

15 Developed the perfect fitting jeans at a reasonable price; known as the Gap

16 Risk-taking individual in search of profits

17 What are the 5 Characteristics of Free Enterprise Capitalism

18 What are the 5 Roles of Government in Free Enterprise Capitalism

19 What are the 5 reasons for a merger

20 What are the 7 Economic and Social Goals that we have here in the United States?

Unit 2 Break Even Point Law of Supply Price Ceiling Cease and Desist Order Long Run Price Discrimination Change in Demand Marginal Analysis Price-Fixing Change in Quantity Demanded Marginal Cost Price Floor Collusion Marginal Product Product Differentiation Deficiency Payment Marginal Revenue Public Disclosure Demand Marginal Utility Public Goods Demand Curve Market Demand Curve Rationing Demand Elasticity Market Failure Ration Coupon Demand Schedule Market Structure Rebate Diminishing Marginal Utility Market Supply Curve Short Run Diminishing Returns Microeconomics Shortage Economic Model Minimum Wage Subsidy Economies of Scale Monopolistic Competition Substitution Effect Elastic Monopoly Supply Equilibrium Price Natural Monopoly Supply Elasticity Externality Negative Externality Surplus Geographic Monopoly Nonprice Competition Target Price Government Monopoly Nonrecourse Loan Technological Monopoly Imperfect Competition Oligopoly Total Revenue Income Effect Overhead Trust Inelastic Perfect Competition Variable Costs Laissez-Faire Positive Externality Law of Demand Price 1 What causes a change in demand?

2 What problem might economists have in trying to measure marginal utility?

3 How does the supply curve compare to the demand curve you read about in Chapter 4?

4 How does the cost of resources affect the quantity offered for sale?

5 Why is the use of the production function important in business?

6 What steps can a company take if marginal cost is less than marginal revenue?

7 What would happen if consumers did not have easy access to information about products and services?

8 Enforces laws to ensure purity, effectiveness, and truthful labeling of food, drugs, and cosmetics; inspects production and shipment of these products

9 Administers antitrust laws forbidding unfair competition, price fixing, and other deceptive practices

10 Licenses and regulates radio and television stations and regulates interstate telephone and telegraph rates and services

11 Regulates and supervises the sale of listed and unlisted securities and the brokers, dealers, and bankers who sell them 12 Administers federal labor-management relations laws; settles labor disputes; prevents unfair labor practices

13 Oversees the airline industry

14 Investigates and rules on charges of discrimination by employers and labor unions

15 Protects and enhances the environment

16 Investigates accidents in the workplace; enforces regulations to protect employees at work

17 Develops standards of safety for consumer goods

18 Regulates civilian use of nuclear materials and facilities

19 Supervises transmission of various forms of energy

20 Write the equation for PEoD

21 What are the 5 Changes in the Determinants of Demand

22 What are the 5 main causes of market failures

23 What are the factors that could disturb an equilibrium market

24 What are the 4 types of costs that businesses must keep their eye on in order to produce efficiently

25 What are the 3 determinants of elasticity

26 What are the 5 necessary conditions that must be met for perfect competition Unit 3 Chapter 8 picket skilled labor mediation two tier wage system boycott seniority binding arbitration glass ceiling lockout signaling theory fact finding set aside contract right to work law collective bargaining injunction closed shop grievance procedure giveback Chapter 9 Sin tax Progressive tax Excise tax Investment tax credit Tax loophole Regressive tax Estate tax Capital gains Benefit principle taxation FICA Gift tax Flat tax Medicare Payroll tax Tax assessor Value-added tax Chapter 10 Pork Fiscal year Medicaid Line-item veto Public sector Appropriations bill Deficit spending Entitlement Private sector Budget deficit Trust fund Transfer payment Mandatory spending Per capita Grant-in-aid Discretionary spending Crowding-out effect Chapter 11 Certificate of deposit Maturity Treasury Bond Treasury Bill Premium Junk Bond Tax-exempt IRA Pension Municipal Bond Savings Bond Mutual Fund Risk Beneficiary 403B Bond Treasury Note 401K 1 Trade unions and industrial unions developed in the U.S. in response to increased industrial activity after this event?

2 This type of union arrangement is one in which nonunion workers must pay union dues or “fair-share”?

3 This is the process of negotiation which includes pay, benefits, and job-related items?

4 The economic impact of taxes in which the factors of production are affected when a tax is levied is called?

5 The Constitutional Amendment that enacted our current individual income tax system was?

6 What is the amount of Social Security that is taken out of someone’s paycheck?

7 This U.S. President in 1960 had a balanced budget?

8 This is a bond that carries an exceptionally high risk of nonpayment and a low rating?

9 This created Interstate Commerce and the minimum wage laws, which established a 40 hour work week?

10 This is the explanation of wages rates relying on supply and demand? 11 Wage, fringe benefit, or work rule given up when renegotiating a contract?

12 A criteria for effective taxes that avoids tax loopholes, exceptions, or oversights in the tax law is called? 13 FICA stands for

14 What are the Pennsylvania state owned universities

15 Ronald Reagan’s program in 1981 that lowered tax brackets from 16 to 13 and decreased the highest marginal tax rate from 70% to 50% was

16 The advantage of the Value Added Tax is

17 This created spending caps on discretionary spending but was abandoned by Congress

18 What are the 4 basic investment considerations

Unit 4 Chapter 12 Macroeconomics Gross National Product Demographer Lorenz Curve Gross Domestic Product Census Net Immigration Earned Income Tax Credit Real GDP Center of Population Poverty Threshold Workfare Current GDP Dependency Ratio Poverty Guidelines Food Stamps Chapter 13 Trend Line Economic Model Hyperinflation Unemployment Rate Recession Price Index Demand-Pull Inflation Cyclical Unemployment Trough Consumer Price Index Cost-Push Inflation Seasonal Unemployment Depression Scrip Stagflation Outsourcing Structural Unemployment Chapter 14 Federal Reserve System Store of Value Bank Run Quantity Theoryof Money Commodity Money M1 Bank Holiday Bank Holding Company Fiat Money M2 Fractional Reserve System Regulation Z Specie State Bank Easy Money Policy Measure of Value Silver Certificate Prime Rate Chapter 15 Aggregate Supply Fiscal Policy Unemployment Monetarism Aggregate Demand Keynesian Economics Insurance Equilibrium Price Automatic Stabilizers Supply-Side Policies Accelerator Entitlements Deregulation 1 The number of district or reserve banks that have a vote in the FOMC are

2 How many district or reserve banks are there

3 Which district bank is guaranteed a vote in the FOMC 4 Who appoints the Board of Governors for the Fed

5 How many Board of Governors are there for the Fed

6 Who approves the Board of Governors for the Fed

7 This U.S. President announced a bank holiday on March 5, 1933, requiring every bank in the U.S. to close

8 The components of the output-expenditure model for GDP are 9 The Census Bureau uses this equation to calculate the unemployment rate

10 Our U.S. dollar name grew from this (country & currency name)

11 This type of fiscal policy is one in which fiscal policies are policies designed to strengthen the economy over a longer period of time

12 This type of stabilization policy is designed to stimulate output and lower unemployment by increasing production rather than by stimulating demand

13 What are the 12 district or reserve banks for the Fed

14 The Fed monetary Policy Tool in which the Fed can change the backing of existing deposits in the banking system

15 The Fed Advisory Committee that advises on matters pertaining to the Savings and Loan industry

16 The Anti-Poverty Program that gives cash payments for the death, absence, or disability of a parent

17 The Anti-Poverty Program that gives cash payments to the blind or disabled over age 65

18 What are the consequences of unemployment

19 What are the 4 main categories of items that are excluded from the GDP

20 The 3 functions of money are

21 The 4 consequences of inflation are

22 The 4 components of the National Income are

23 The 4 characteristics of money are

24 The 3 factors of population growth are

Review your Reference Section (Budgeting, Rent, Credit, and Checking)

Essays: A member of your class will roll a die to determine which 2 essays you will have to answer for your Exam.

Below are the essays. In addition to the textbook/CD and class notes, you may utilize outside research for your essay preparation. You will not be permitted to have any notes with you the day of the exam.

2 Essays x 10 pts. each

1 Explain the problems the economy might face in recovering from a period of recession?

2 Cite examples in U.S. Economic history of how economic and legal institutions have developed policies to help sustain economic activity and growth in our country.

3 When analyzing the “Material Wealth” posters, describe 2 families that would be the “haves” and 2 families that would be the “have nots” and why. For the final point, describe what the typical American family would look like.

4 Explain the differences between elastic and inelastic goods in Economics and cite examples of goods for each and describe why they are elastic or inelastic goods.

5 What are reasons why imperfect competition exists in the United States and demonstrate your understanding of examples of imperfect competition.

6 What are the views and differences in views between John Maynard Keynes (Ch 15) and Adam Smith (Ch 1)?

Subjective:

1 I feel that the government has / has not overstepped its role in the economy because…

2 An item from the course that I can now apply to my own life…

3 I feel that the best examples of wasted taxpayer money are…

4 Sequesters, government shut-downs, or budget disputes (at any level) can impact our economy by…

5 Describe one of the anti-poverty programs that you favor and why

6 Economics is an important course to study in high school because….