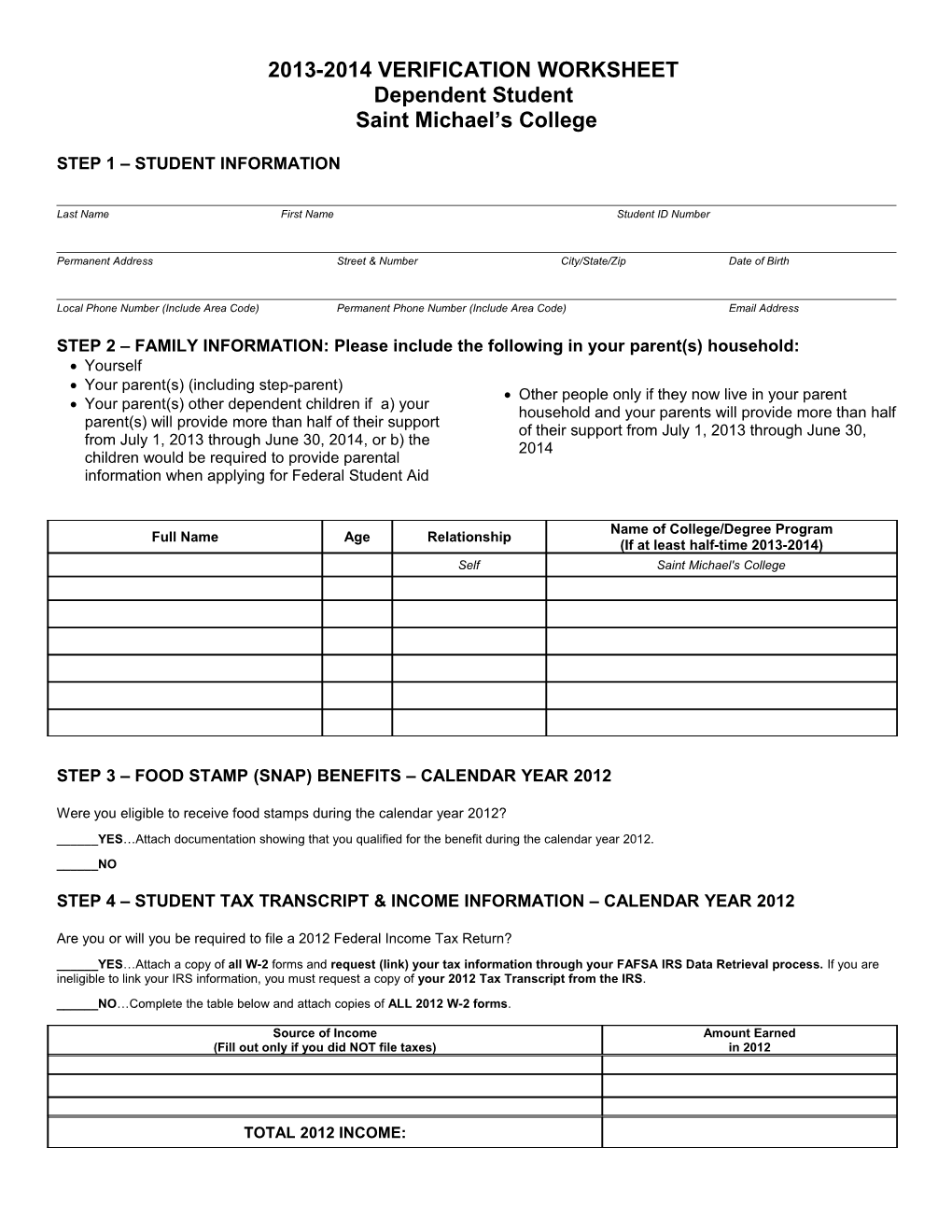

2013-2014 VERIFICATION WORKSHEET Dependent Student Saint Michael’s College

STEP 1 – STUDENT INFORMATION

Last Name First Name Student ID Number

Permanent Address Street & Number City/State/Zip Date of Birth

Local Phone Number (Include Area Code) Permanent Phone Number (Include Area Code) Email Address

STEP 2 – FAMILY INFORMATION: Please include the following in your parent(s) household: Yourself Your parent(s) (including step-parent) Other people only if they now live in your parent Your parent(s) other dependent children if a) your household and your parents will provide more than half parent(s) will provide more than half of their support of their support from July 1, 2013 through June 30, from July 1, 2013 through June 30, 2014, or b) the 2014 children would be required to provide parental information when applying for Federal Student Aid

Name of College/Degree Program Full Name Age Relationship (If at least half-time 2013-2014) Self Saint Michael's College

STEP 3 – FOOD STAMP (SNAP) BENEFITS – CALENDAR YEAR 2012

Were you eligible to receive food stamps during the calendar year 2012?

______YES…Attach documentation showing that you qualified for the benefit during the calendar year 2012.

______NO

STEP 4 – STUDENT TAX TRANSCRIPT & INCOME INFORMATION – CALENDAR YEAR 2012

Are you or will you be required to file a 2012 Federal Income Tax Return?

______YES…Attach a copy of all W-2 forms and request (link) your tax information through your FAFSA IRS Data Retrieval process. If you are ineligible to link your IRS information, you must request a copy of your 2012 Tax Transcript from the IRS.

______NO…Complete the table below and attach copies of ALL 2012 W-2 forms.

Source of Income Amount Earned (Fill out only if you did NOT file taxes) in 2012

TOTAL 2012 INCOME: PLEASE NOTE: We cannot accept a signed copy of the tax return. To request a Tax Return Transcript or a “W-2 Wage Summary” (if you did not keep a copy of your W-2 form) call the IRS at 800.829.1040. Please be advised that it may take a minimum of three weeks for the IRS to mail these documents to you.

STEP 5 – PARENT TAX TRANSCRIPTS & INCOME INFORMATION –CALENDAR YEAR 2012

Are you or will you be required to file a 2012 Federal Income Tax Return?

______YES…Attach a copy of all W-2 forms and request (link) your tax information through your FAFSA IRS Data Retrieval process. If you are ineligible to link your IRS information, you must request a copy of your 2012 Tax Transcript from the IRS.

______NO…Complete the table below and attach copies of ALL 2011 W-2 forms.

Source of Income Amount Earned (Fill out only if you did NOT file taxes) in 2012

TOTAL

PLEASE NOTE: We cannot accept a signed copy of the tax return. To request a Tax Return Transcript or a “W-2 Wage Summary” (if you did not keep a copy of your W-2 form) call the IRS at 800.829.1040. Please be advised that it may take a minimum of three weeks for the IRS to mail these documents to you.

STEP 6 – CHILD SUPPPORT PAID – CALENDAR YEAR 2012

Did you (parent or student) pay child support because of divorce or separation during the calendar year 2012? (Do not include support paid for children included in household size in STEP 2)

______YES…Complete the table below.

______NO

Amount of Child Support Paid for all children Name(s) of Children that you paid support for in 2012.

TOTAL:

STEP 7 – CERTIFICATION: By signing this worksheet, I certify all the information reported is complete and correct:

Student Signature Date Student Name (Please Print) Student ID Number

Parent Signature Date Parent Name (Please Print)

Please return this form to: Saint Michael's College 1 Winooski Park Box 4 Colchester, Vermont 05439 Or fax to: 802-654-2591