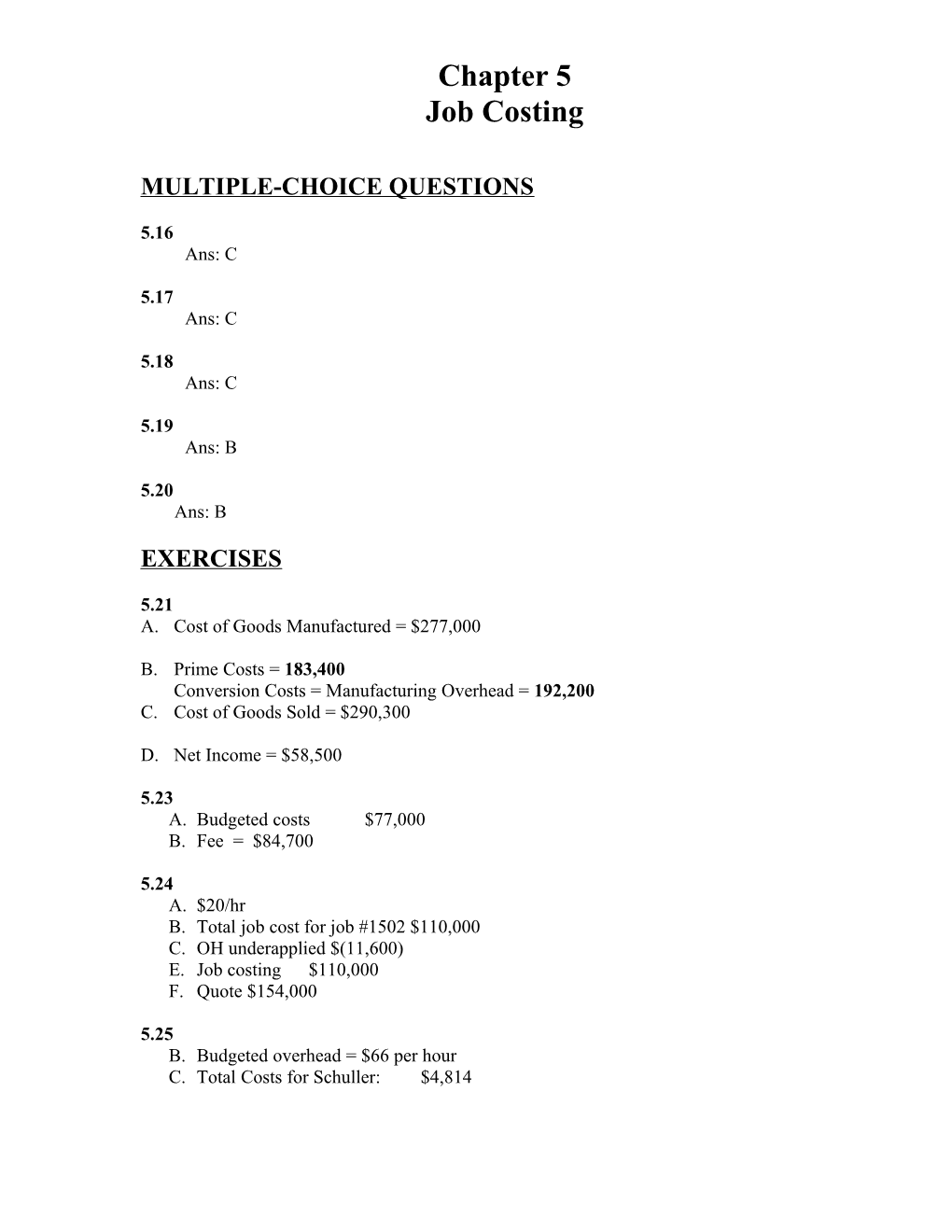

Chapter 5 Job Costing

MULTIPLE-CHOICE QUESTIONS

5.16 Ans: C

5.17 Ans: C

5.18 Ans: C

5.19 Ans: B

5.20 Ans: B

EXERCISES

5.21 A. Cost of Goods Manufactured = $277,000

B. Prime Costs = 183,400 Conversion Costs = Manufacturing Overhead = 192,200 C. Cost of Goods Sold = $290,300

D. Net Income = $58,500

5.23 A. Budgeted costs $77,000 B. Fee = $84,700

5.24 A. $20/hr B. Total job cost for job #1502 $110,000 C. OH underapplied $(11,600) E. Job costing $110,000 F. Quote $154,000

5.25 B. Budgeted overhead = $66 per hour C. Total Costs for Schuller: $4,814 5-2 Cost Management

5.26 A. Total Actual Costs Incurred $535,000 B. Overhead was underapplied by $55,000.

5.27 A. $1,000,000 B. $788,000 C. $985,000

5.28 C. Ending WIP $203

5.29 A. Total cost – Job 717 $111,500 C. Underapplied OH $24,000

5.30 A. 197.5% of DL costs B. Revenue - $14,875

5.31 A. 139% of direct costs B. Price Quote $133,840 C. Underapplied OH $1,122,000

5.33 A. Labour = $800 B. Overhead = $900

5.34 A. Ending WIP Balance = $36,000 B. Direct labour = $7,500 C. Direct materials = $19,500

5.35 A. Cost of goods manufactured $64,750 Cost of goods sold $61,450

5.36 Cost of goods manufactured = $ 55,260

5.39 A. Overhead estimated allocation rate = $1.60 per machine hour B. Overhead allocated to Job No. 21 = $25,600 C. Overapplied overhead = $16,000 Chapter 5: Job Costing 5-3

5.40 B. $143,000 C. Total overhead overapplied $2,000

PROBLEMS

5.46 A. Overhead estimated allocation rates: Machining: = $20 per machine hour Finishing: = 125% of direct labour cost B. Overhead costs for Job 602: $9,138 C. Total cost for Job 602: $25,188 Per unit total cost $125.94

5.47 A. Overhead rate method 1: 140% of direct professional labour cost B. Overhead rate method 2: 67% of direct professional labour cost C. Overhead rate method 3: 38.5% of total direct costs D.

5.48 A. Allocated overhead cost for Job 75 using plant-wide rate: $105.00 B. Allocated overhead cost for Job 75 using production cost pools: $169.50

5.50 A. OH rate $75/hour B. Job 141 $30,000; Job 142 $17,500 D. Underapplied overhead $10,500 E. $96/hour

5.51 A. Set-up overhead estimated allocation rates Variable rate = 200% of direct labour costs Fixed rate = €40 per direct labour hour B. Overhead allocated to Job 20 during October: €900 C. Total cost of Job 20: €5,650 D. Amount of fixed overhead allocated to jobs in October: €9,160 Amount of variable overhead allocated to jobs in October: €11,450

MINI-CASES

5.52 B. $59.20 per machine hour