Business Technology – Financial Management Assignment

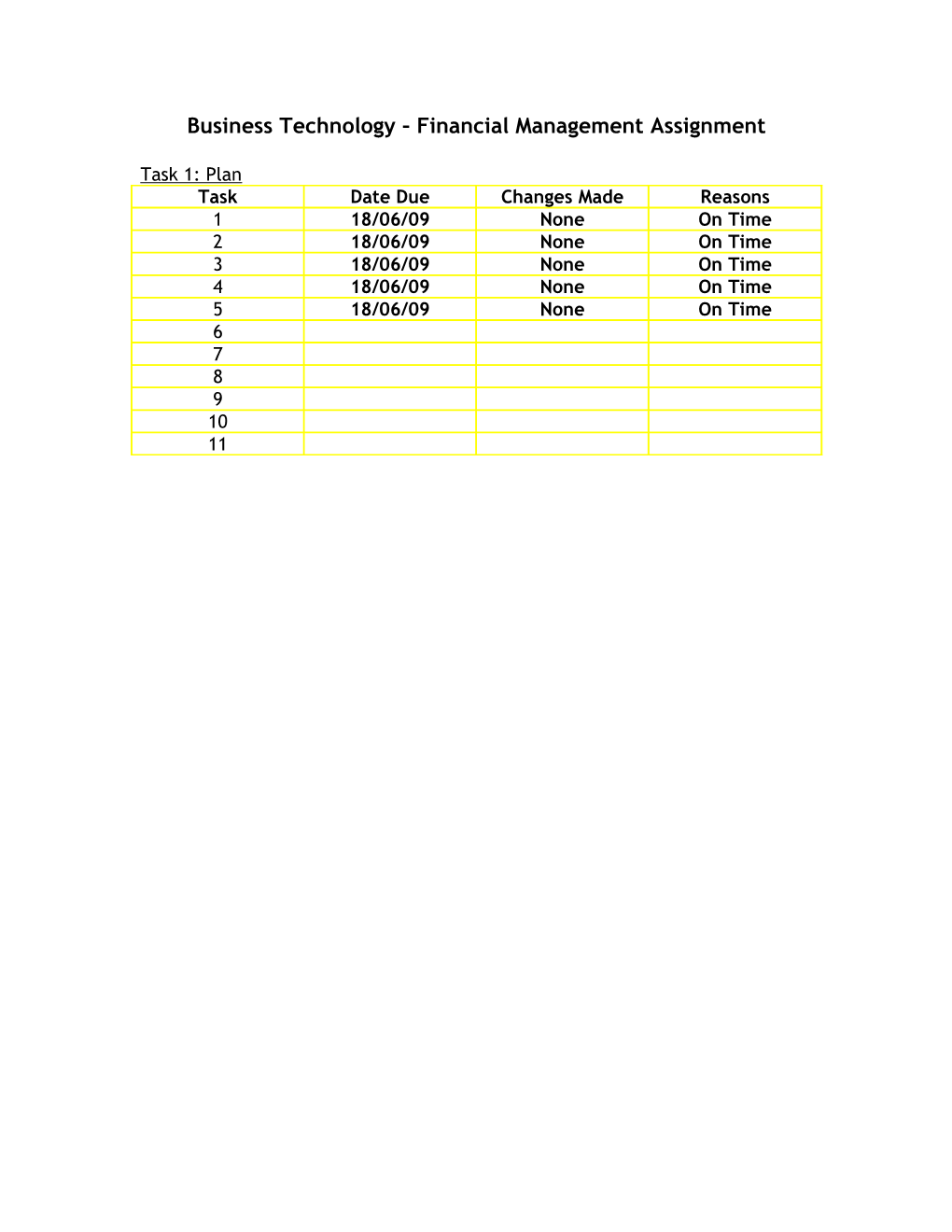

Task 1: Plan Task Date Due Changes Made Reasons 1 18/06/09 None On Time 2 18/06/09 None On Time 3 18/06/09 None On Time 4 18/06/09 None On Time 5 18/06/09 None On Time 6 7 8 9 10 11 Task 2: Concept Map

How can a new electronic accounting package assist an employee?

It is important that fuzzy finance Fuzzy Finance: This package must is able to use this package As the books are purchased, the A company that allow employees who because it allows employees to receipts are file automatically. file receipts etc faster. Also, it The revenue is also calculated provides training for have absolutely no allows them to do all the automatically. At the end of the employees of large knowledge of transactions with fewer errors. week, they are able to clearly see Therefore, it is efficient. At the whether they are making profit or organizations. QuickBooks, to use the end of the month, they could not. If the business fails, hopefully We Offer Quick Books. tutorial and under create tax statements by simply they could shut down with the stand it. clicking a button on this program. least amount of loss possible.

This package must Problem? Mr. Moore is include: Both asset and expenses It must also include a worked unsure about whether At least 20 credit payments solution to: Transactions Sales Receipts a complete list of the Quick Book Payment by instalments transactions Tutorials we offer Cash,Credit and Cheque Transactions Collection from debtors and a profit adnm loss state ment actually works. payments to creditors. a balance sheet. Captial contribution

It is important to have efficient employees because it determines the success or failure of a business. So they must be trained well. Fuzzy Finance is distributing tutorials programs to enable businesses to better manage their finance using Quickbooks. Currently, Mr Eroom is our new customer, however his is unsure about spending $10,000 to purchase a tutorial without a demonstration lesson that will show the quality of this program. Therefore, in order to solve this design challenge, I must create an example of a QuickBooks Tutorial that is interactive, fun and easy to manipulate, to convince Mr Eroom to invest in our excellent package. It is important to ensure this tutorial will allow employees, who are absolutely clueless about this program, to use it by the end of the month. So, to do this, I will conduct research using the Internet. I will also consult Mr Namo about this. In addition, I will have a look at the example tutorial provided.

Nowadays, there has been a rapid increase in the number of businesses using computerized accounting applications to record and organize financial data such as sales and expenses transactions. These applications categorize financial transactions and will automatically collate the data to produce financial reports necessary at the end of the financial year. Thus, it is ever more important that employees are able to use QuickBooks since it will enhance the business’ efficiency. As a result, it is likely to produce more profit. Since Fun Facts is one of the leading book stores in Australia, they would want to increase their profit and stay in competition with other major book stores. This could be done by efficiency and accuracy.

Task 3: Design Brief The problem we are facing in this design challenge is that our new customer, and possibly more customers in the future, is hesitant about purchasing a $10, 000 tutorial packages, that will enable their employees to learn more about QuickBooks, without at first a demonstration of the quality of it. So, to solve this challenge, we obviously have to create a QuickBooks Tutorial that will demonstrate how effective and excellent the tutorial is.

Our aim is to develop an innovative, fun and interactive program that will enable individuals to learn about this program – the fun way!! It is very important that the program is fun because scientific studies shows individuals learn more when they are focused and are enjoying what they are doing. Moreover, if it is fun and engaging, they would want to go back to it to practice using the program. If they practice constantly, they would be able to learn more effectively. So, it increases the likelihood for employees to grasp this program.

It is also important that new employees are able to learn about QuickBooks and use it efficiently because most businesses today require this skill to file receipt, calculate profits and loss, pay bills etc. So, if a business wants to be profitable (this factor involves efficiency and effectiveness of workers) they must ensure their staffs are able to use QuickBooks. If staffs are able to do transactions faster, the business would be able to make more profit. This is because fewer staff are needed if they are able to do transactions at the checkout desk faster. Thus, the owner could spend less money on wages. Moreover, they could spend this money somewhere else, i.e. advertising etc or they could have higher profits overall. Another importance of QuickBooks is that it does transactions with no errors because it automatically collates the data. This is great for providing profit and loss statements at the end of the financial year. Businesses would like interpret information effectively because it aids with decision making. At the end of the day, it determines whether the business can keep going or not.

In order to solve this challenge, I will use the internet and the example tutorial to help me develop this tutorial. However, while developing this tutorial, I must incorporate these necessary components in order to solve the design challenge. These requirements are a tutorial that: 1. has at least twenty different transactions 2. cash, credit and cheque transactions 3. capital contributions 4. Both asset an expense purchases 5. sales receipts 6. Payments by installments 7. Collections from debtors and payment to creditors 8. Worked solutions with a) A complete list of transactions b) A profit and loss statement c) A balance sheet.

Task 4: Identify research: a) Expenses: This term has been defined as the item that is used up. Therefore, if you don’t pay for it again you will not have the benefit of using it. This cost is used up in the short term and it is a variable cost. Examples are Staffs, Electricity and Advertising.

This factor is important to this business because it is the money that is spend, if it is calculated incorrectly the business may have more money that initially planned. So, the businesses may needed money for advertising but did not do it because they did not think they have it. Also, the company may have less money than they expected. As a result, they are losing profit. It is significant to calculates the expenses and revenues properly because, one, it ensure money is distributed evenly, two, the business is going to make profit, thirdly, there are enough money left over to pay taxes etc.

Anon. n.d. http://www.investorwords.com/1842/expense.html Anon. n.d. http://www.investopedia.com/terms/e/expense.asp Anon. n.d. http://en.wikipedia.org/wiki/Expense

b) Capital Purchases: Capital Purchases occurs when the owner puts money into the business then uses that money to buy an asset. For example, capital items may be machinery, cash registers, computers, car, plants, equipments and land and building. Certain capital purchases appreciate, while others depreciate. The term “appreciate” means the value increases over the years. In contrast, the term “depreciate” means the value declines over a certain number of years. This is relatively important to this assignment. For example, in this case, the owner of fuzzy finance may purchase new computers and the owner of Fun Facts may purchase new books for the book store. It is important that employees of Fun Facts know the things that fall under the category of capital purchases. This is because evidence shows that one change made QuickBooks will cause at least two other things to change. Hence, if a mistake was made, it may result in changes in other categories. This may, in turn, result in a wrong calculation of profits etc. This is detrimental because the business may be running at a loss without knowing it. Therefore, at the end of the month, they may not have produced enough profits to pay their staffs. This is both financially and legally problematic.

ATO. N.d. http://www.ato.gov.au/businesses/content.asp? doc=/content/42132.htm&page=48&H48

Anon. n.d. http://answers.yahoo.com/question/index? qid=20080318223133AALrv05

Finance Services. N.d. http://www.ucalgary.ca/financial/controller/asset_management/capital

c) Sales Revenue Sales Revenue is the money coming in from sales of goods and services. Things like returned or undeliverable merchandises are subtracted from this. This term is also referred to as “Sales”, “Turn over”, “Net Sales”, “Net Revenue”, and just plain Revenue. The relative important of Sales Revenue to a business is that it determines whether the business is able to continue or whether it is necessary for it to close down. In this case, it is significantly important that money is coming in to Fun Fact because they need it to pay for staffs, rents, and electricity (all of which fall under the category of Expenses) in order to sell their books. If they do not sell their books, they would not be able to make a profit. So, the business would need to close down. Moreover, where would they store the books? They may have to rent garages etc and this costs money.

Anon. n.d.http://www.moneychimp.com/glossary/sales_revenue.htm

Business Dictionary. N.d. http://www.businessdictionary.com/definition/sales-revenue.html Biz/ed. N.d. http://www.bized.co.uk/learn/business/accounting/busaccounts/notes/srev- ex.htm

d) Goods and Services Tax According to the Australian Government initiative, Goods and Services Tax, or GST is a broad based tax of 10% on the sale of most goods and services and other things in Australia. A business only needs to pay GST if they have an annual turn over or Sales Revenue of $75, 000 or more. In accordance to a business, it is important that this is paid when required because it is illegal not to pay your taxes. Moreover, where QuickBooks is concernen, this tax is deducted automatically. Therefore, the owners are able to calculate profit and loss easily, quickly and with few errors. If errors existed in the calculations (i.e. by other methods) the business may not have saved enough money to pay taxes, which is compulsory. AGI. 2009. http://www.business.gov.au/Business+Entry+Point/Business+Topics/Taxation/ Taxes+explained/Goods+and+Services+Tax.htm

ATO. 2009. http://www.ato.gov.au/businesses/pathway.asp?pc=001/003/022

Anon. 009. http://en.wikipedia.org/wiki/Goods_and_Services_Tax_(Australia)

e) Capital Contributions A capital contribution is a contribution or capital, in the form of money or property, to a business by an owner, partner, or shareholder. This contribution increases the owner’s equity interest in the business. So, it allows the owner to purchase more things for the business on a loan. However, if these borrowings are not repaid, the capital contribution is on the line. Thus, if Fun Fact’s owner, Mr Eroom decides to use his house as the capital contribution to purchase more books, computers or something that costs a lot of money for the business, and are unable to produce the sales expected as a result, he will lose his house. Generally, capital contributions are used in the short term to obtain money.

About.com. 2009. http://biztaxlaw.about.com/od/glossaryc/g/capitalcontrib.htm

Anon. 2006. http://www.investorwords.com/6437/capital_contribution.html

Power Water. 2004. http://www.nt.gov.au/ntt/utilicom/s_docs/pw_capcon_principles_statement_ 080604.pdf

f) Profits or loss Prior to starting a business, owners usually have some expectations of what kind of profit they want to make. They probably would like to make enough profit to pay oneself a livable wage and have some left over to grow the business. Factors, such as the volume of sales, pricing and expenses etc are all related to how much profit is produced. Also, expenses impact profits, i.e. cost of sold goods (freight), fixed expenses (rent), and Variable expenses (advertising). So it is important to calculate profits and losses. By using a profit or loss statement, one can easily calculate ones profit. This is a financial statement that summarizes the business’s income and expenses over a set period. If this is done regularly, it allows the owner to analyse income and costs. Hopefully, they are able to take action before small problems become big problems (e.g. increasing the cost of books to meet the increasing cost of expenses, such as advertising.

Investopedia, n.d. http://www.investopedia.com/terms/p/plstatement.asp

Centrelink. N.d. http://www.centrelink.gov.au/internet/internet.nsf/forms/su580.htm

Business Victoria. N.d. http://www.business.vic.gov.au/BUSVIC/STANDARD/PC_62562.html

g) Assets and Liabilities Assets are something that you own and liabilities are something that you owe in the long term (it is a fixed cost). Some examples of assets are: car; boat; watch and house etc. In contrast, examples of liabilities are: mortgage; car loan and overdraft etc. A business like Fun Facts must be able to easily distinguish the differences between assets and liability. This is because if they do not know the difference, they may enter the wrong data into QuickBooks. As aforementioned, every change that occurs on Quickbooks causes two other things to change. Therefore, a business may calculate how much money they have left over at the end of the month. This also has an affect on GST, which is a compulsory tax. A business must ensure there is enough money left over to pay for taxes.

All Businesses. 2009. http://www.allbusiness.com/accounting-reporting/assets/1257-1.html

Msn. 2009. http://encarta.msn.com/encyclopedia_761579934/assets_and_liabilities.html

Crown Group. 2009. http://crowngrp.net/Assets%20Liabilities.htm

h) Cash, credit and cheque transactions: Cash Transaction i) A cash transaction is a transaction that is settled with cash on the same day as the trade. However, a credit transaction means that the product is paid via a credit or a loan transaction. This transaction is often paid the next day. Sometimes, there are fees involved (a percentage of the transaction amount) to use a credit card –especially if you don’t pay the issuer back within the established terms, which is called interest and finance charges. A cheque transaction involves paying for a product with a cheque. This cheque can be taken to the bank and exchanged for money. However, one has to be very careful when one pays with a cheque. This is because sometimes the cheque can be considered non-negotiable. So, the business would not receive any money for the product traded if this happens.

This is extremely important to a business because Fun Facts trades books. So, if someone pays with a cheque and there is no money in that cheque, the business now has lost money for the product/ products. As books are not heavy and mutilple can be purchased at one time, a business would lose a lot of money if they are not careful. So normally, it is more appropriate Fun Facts limits transactions to cash and credit only.

Investopedia. 2009. http://www.investopedia.com/terms/c/cashtransaction.asp

Anon. n.d. http://wiki.answers.com/Q/What_is_the_difference_between_a_cash_transact ion_and_a_credit_transaction

Anon. n.d. http://www.mto.gov.on.ca/english/dandv/vehicle/nsfcheck.shtml j) Payments by installments, debtors and creditors:

Design Specification The design challenge states that Mr Eroom has requested to see an example of a QuickBooks Tutorial before deciding whether to invest $10, 000 or not. As revealed in the design challenge, this product must be attractive, innovative, easy to understand, engaging…….. Moreover, it must be meaningful to an employee of a bookstore.

However, it must also include several features, such as:- At least twenty different tranactions Cash, credit and cheque transactions Capital contributions Both asset and expense purchases Sales receipts Payments by instalments Collections from debtors and payment to creditors Worked solutions with a. A complete list of transactions b. A profit and loss statement c. A balance sheet

A list of needs for all stakeholders: Sales Agent Must: Ensure this product is marketable because if it is not then the business would not make any money. As a result, it may go bankrupt. Ensure there are no obscene languages or pictures present in this introductory package. This is because it may potentially ward off customers, which is detrimental to this business because it means we may not be able to make enough turnovers to pay for production costs etc. Ensure this program is not racist, i.e. the colour would not prove to be offensive in any way. This is important because Australia is a multicultural society. Therefore, we must be very careful not to offend others by being ignorant.

A way of Testing In order to test the effectiveness of the introductory program, I will conduct tests on at least 30 participants. The results will be collected, marked and comments will be considered.