LECTURE NOTES: ACCOUNTING FOR RECEIVABLES

Study Objectives: 1. Identify the different types of receivables. 2. Explain how accounts receivable are recognized in the accounts. 3. Distinguish between the methods and bases used to value accounts receivable. 4. Describe the entries to record the disposition of accounts receivable. 5. Compute the maturity date of and interest on notes receivable. 6. Explain how notes receivable are recognized in the accounts. 7. Describe how notes receivable are valued. 8. Describe the entries to record the disposition of notes receivable. 9. Explain the statement presentation and analysis of receivables.

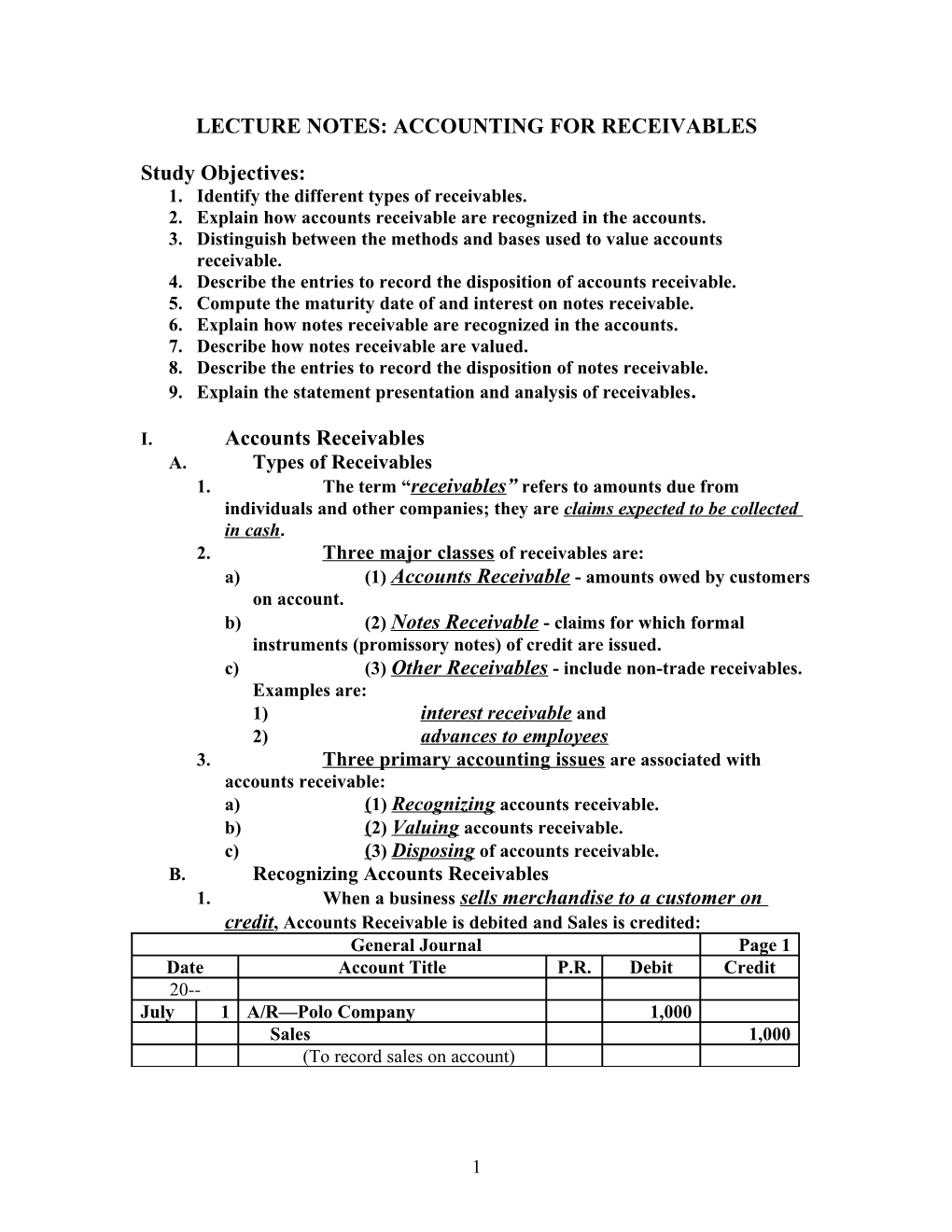

I. Accounts Receivables A. Types of Receivables 1. The term “receivables” refers to amounts due from individuals and other companies; they are claims expected to be collected in cash. 2. Three major classes of receivables are: a) (1) Accounts Receivable - amounts owed by customers on account. b) (2) Notes Receivable - claims for which formal instruments (promissory notes) of credit are issued. c) (3) Other Receivables - include non-trade receivables. Examples are: 1) interest receivable and 2) advances to employees 3. Three primary accounting issues are associated with accounts receivable: a) (1) Recognizing accounts receivable. b) (2) Valuing accounts receivable. c) (3) Disposing of accounts receivable. B. Recognizing Accounts Receivables 1. When a business sells merchandise to a customer on credit, Accounts Receivable is debited and Sales is credited: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- July 1 A/R—Polo Company 1,000 Sales 1,000 (To record sales on account)

1 2. When a business receives returned merchandise previously sold to a customer on credit, Sales Returns and Allowances is debited and Accounts Receivable is credited:

General Journal Page 1 Date Account Title P.R. Debit Credit 20-- July 1 Sales Returns and Allowances 100 A/R—Polo Company 100 (To record merchandise returned)

3. When a business collects cash from a customer for merchandise previously sold on credit during the discount period, Cash and Sales Discounts are debited and Accounts Receivable is credited: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- July 11 Cash ($900-$18) 882 Sales Discounts (2% x $900) 18 A/R—Polo Company 900 (To record collection of A/R)

4. When you use a retailer’s credit card, such as those issued by Sears, JCPenney Co., Target, Wal-Mart, Macy’s, etc., the retailer charges interest on the balance due if not paid with a specified period (usually 25- 30 days). For example if JCPenney Co. had sales of $300 and if the amount was not paid within the discount period, a common rate of 18% per year (1.5% per month) finance charge would be added as follows:

General Journal Page 1 Date Account Title P.R. Debit Credit 20-- July 1 Accounts Receivable—name of customer 300 Sales 300 (To record sale of merchandise)

Aug. 1 Accounts Receivable—name of customer 4.50 Interest Revenue (1.5% x$300) 4.50 (To record interest on amount due)

C. Valuing Accounts Receivable 1. To ensure that receivables are not overstated on the balance sheet, they are stated at their cash (net) realizable value.

2 2. Cash (net) realizable value is the net amount expected to be received in cash and excludes amounts that the company estimates it will not be able to collect. 3. Credit losses are debited to Bad Debts Expense and are considered a normal and necessary risk of doing business. a) Bad debt or uncollectible accounts: A business's accounts receivable that, for one reason or another, cannot be collected. There are several ways to determine whether an account has become uncollectible.

1) Receive notice of a customer's personal bankruptcy, disability, or death. 2) Unable to contact the customer as left the area, telephone disconnected, mail is returned with no forwarding address. 3) The cost of collecting a past due account does not justify the amount that may be received.

b) Bad debts expense: The expense that results from the inability to collect receivables—an ordinary and necessary expense when selling on account. With many companies, Bad debts expense is an operating expense classified as an administrative expense because decisions to grant credit are usually made by management, not salespeople. But this textbook indicates on page 380 that bad debts expense is reported as a selling expense Therefore it is not a part of the selling function of the business. Most all types of businesses that regularly sell goods and/or services on account will have bad debts. To avoid bad debts, some retail businesses only accept credit cards for credit sales. This practice shifts the risk of uncollectible accounts to banks and credit card companies. Other retail businesses, such as Sears, J.C. Penney, Mervyns, have created their own credit cards as well. 4. Two methods of accounting for uncollectible accounts: a) (1) Direct write-off method 1) Under the direct write-off method, bad debt losses are not anticipated and no allowance account is used. 2) No entries are made for bad debts until an account is determined to be uncollectible at which time the loss is charged to Bad Debts Expense. 3) No attempt is made to match bad debts to sales revenues or to show cash realizable value of accounts receivable on the balance sheet. 4) Consequently, unless bad debt losses are insignificant, this method is not acceptable for financial reporting purposes. b) (2) Allowance method

3 1) The allowance method is required when bad debts are deemed to be material in amount. 2) Uncollectible accounts are estimated and the expense for the uncollectible accounts is matched against sales in the same accounting period in which the sales occurred. 3) Recording Estimated Uncollectibles. The adjusting entry under the allowance method: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Dec. 31 Bad Debts Expense 12,000 Allowance for Doubtful Accounts 12,000 (To record estimate of uncollectible accounts) 4) Presentation of allowance for doubtful accounts: a. The Allowance for doubtful accounts shows the estimated amount of claims on customers that are expected to become uncollectible in the future. b. This contra account is used instead of direct credit to Accounts Receivable because we do not know which customers will not pay. c. The amount of the $188,000 represents the expected cash realizable value of the accounts receivable at the statement date. d. Allowance for Doubtful Accounts is not closed at the end of the fiscal year.

D. THE DIRECT WRITE-OFF METHOD: The method of accounting for bad debts in which the expense from a bad debt is recorded at the time of write-off; no advance estimate is made for bad debts. When the direct write-off method is used, no entry is made for the bad debt until the management of the business thinks that a customer’s account will be uncollectible. The direct write-off method is used mainly by professional service firms and small merchandising businesses that do not get a significant portion of their revenue from credit sales. The direct write-off method is the only method that can be used for tax purposes per the Tax Reform Act of 1986. The direct write-off method must be used for tax purposes.

1. To Write-Off Accounts under the Direct Write-off Method: Essentially, under the direct write-off method, you wait until you know the account has gone bad. At this point, the uncollectible amount is transferred from the Accounts Receivable account to the Bad Debts Expense

4 account. The basic entry is a debit to Bad Debt Expense and a credit to Accounts Receivable.

Owner's

Assets = Liabilities + Equity + Revenues - Expenses Accounts_Receivable Bad_Debts_Expense 600 600

Warden Co. writes off M. E. Doran’s $200 balance as uncollectible on December 12. When this method is used, Bad Debts Expense will show only actual losses from uncollectibles and is entered into the general journal as follows:

General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Dec. 12 Bad Debts Expense 200 Accounts Receivable—M.E. Doran 200 (To record write-off of account)

2. Recovery of Bad Debts: If recovery is made in the same period as the write-off, the expense account has not been closed, so the account can just be reinstated. If an account that has been written off is later collected, the account is said to be recovered and its balance is reinstated. Under the direct write-off method, the entry for reinstatement depends on whether the recovery occurs in the same period as the write-off or in a later period. Basically both methods have the same two-step process where the first step is to reinstate the account and the second step is to collect the cash.

a) Recovery in the same accounting period: 1) The first entry to reinstate the account means to reverse the write-off to bad debts, which cancels the expense. The reason the Accounts Receivable account is debited when a recovery is made is to reinstate the customer’s account. In other words, the customer’s account in the accounts receivable SUBSIDIARY ledger needs to show that the customer did make payment. If the customer’s account was not debited and updated for a reinstatement and payment, it would appear as if the customer had been written off and never paid. : Owner's Assets = Liabilities + Equity + Revenues - Expenses Accounts_Receivable Bad_Debts_Expense 600 600

5 2) The second entry is to record the cash collected from the customer:

Owner's Assets = Liabilities + Equity + Revenues - Expenses Cash Bad_Debts_Expense 600 600

Accounts_Receivable 600 600

b) Recovery in a later period: If recovery is made in a later period than the write-off, the expense account has been closed, so another account must be credited. It is not possible to use a current period expense account to correct an entry made in a previous period, because expenses are closed each year into the owner’s capital account as part of the net income figure. Thus, when a bad debt written off in one year is collected in another year, a special account, Recovery of Bad Debts, must be used. 1) The first entry to reinstate the account will use a different account than Bad Debts Expense so that the amount of bad debts expense for the later period will not be understated. The account, Recovery of Bad Debts, should be used as the credit entry which can be listed as a miscellaneous income item.

Owner's Assets = Liabilities + Equity + Revenues - Expenses Accounts_Receivable Recovery_of_Bad_Debts 600 600

2) The second entry is to record the cash collected from the customer:

Owner's Assets = Liabilities + Equity + Revenues - Expenses Cash Recovery_of_Bad_Debts 600 600

Accounts_Receivable 600 600

6 E. THE ALLOWANCE METHOD: For a business with a large amount of credit sales, the direct write-off could result in an improper matching of revenues and expenses in the same accounting period because the direct write- off method does not always conform to the matching principle.

1. Advantages of the Allowance Method: Since the matching principle of accounting requires that expenses incurred during an accounting period should be matched with (subtracted from) the revenue that was earned during the same period, most large business use the allowance method where an estimate of the total bad debts expected for the coming year is made at the end of the current year as an adjusting entry. 2. According to G.A.A.P. (Generally Accepted Accounting Principles), there are two methods that can be used under the allowance method. The choice is a management decision as it depends on the relative emphasis that management wishes to expenses and revenues on the one hand or the Cash (net) realizable value (the actual amount of receivables that is expected to be collected or the amount of cash expected to realize). At the end of the year, then, management must decide (management decision) which approach to use: income statement approach

vs. the balance sheet approach ??????

a) The income statement approach (since the estimate is based on an income statement amount) bases the estimate on a percentage of credit sales for the current year. 1) Percentage of Sales—Matching Sales to Bad Debts Expense: Percentage of Sales Matching

7 Sales ↔ Bad Debts Expense

2) The balance sheet approach (since the estimate is based on a balance sheet amount) bases the estimate on aging accounts receivable and applying a percent to various ranges according to how long the receivables within the range have been outstanding or sometimes a percentage of the total receivables is used. 3) Percentage of Receivables—Matching Accounts Receivable to Allowance for Doubtful Accounts (AFDA): Percentage of Receivables Matching to achieve Cash Realizable Value Accounts Receivable ↔ AFDA b) The Income Statement Approach (Percentage of Sales) to Estimating Bad Debts (also called the percentage of sales method) is an estimate of the amount of credit sales that will go to bad debts expense. c) The adjustment cannot directly reduce Accounts Receivable (see reason below); must use the Contra-Asset account. Any previous balance in the allowance account is ignored in this method. Based on past experience with the business, an estimated rate (a percent) is multiplied times the credit sales to make the journal entry. Since the entry is recorded as an adjusting entry at year end, the actual accounts that will be written off is not known at the time and since the accounts receivable account is a controlling account to the accounts receivable subsidiary ledger, the credit cannot be made to the accounts receivable or the controlling account would not balance to the subsidiary ledger. Therefore a contra asset (contra to accounts receivable) account is used called Allowance for Doubtful Accounts (AFDA) similar to the contra asset account, Accumulated Depreciation as follows:

1) They are similar as both are contra asset assets —AFDA is contra to accounts receivable and Accumulated Depreciation is contra to a fixed asset account.

8 2) They differ in the place on the Balance Sheet where they are reported—AFDA is reported in the current assets section as a reduction in the amount of accounts receivable. Accumulated depreciation is reported in the plant assets section as a reduction of the related plant asset balance. d) The adjusting entry under the allowance method serves two purposes: 1) It reduces the value of the receivable to the amount of cash expected to be collected in the future (called the cash (net) realizable value.) 2) It matches the bad debt expense of the current period with the related sales of the period. e) Under the income statement approach, where the emphasis is only on the income statement—ANY PRIOR BALANCE IN THE ALLOWANCE FOR DOUBTFUL ACCOUNTS IS "IGNORED." When completing problems dealing with the percentage of sales method, the current balance in the Allowance for Doubtful Accounts is always given as part of the information so you think that you should consider it as part of the calculation. But the manager who chooses the income statement method in estimating bad debts DOES NOT CARE how the entry affects the balance sheet so it DOES NOT MATTER what balance is in the Allowance for Doubtful Accounts. What matters to this manager is that the bad debts Expense amount is matched to the credit sales for the period. Refer to the accounting equation below where the green (shaded) area is the only place that the income statement approach manager will focus his or her attention when making the adjusting entry. f) What shows in the Allowance for Doubtful Accounts before or after the adjustment is of NO significance to this manager. The example to illustrate this method where the credit sales for the period are

9 $800,000 x 1% = $8,000 estimated to adjust to bad debts expense. The computation is made and the entry is recorded without looking at all to the balances in accounts on the balance sheet side. Owner's Assets = Liabilities + Equity + Revenues - Expenses Balance_Sheet_Emphasis Income_Statement_Emphasis Accounts_Receivable Sales Bad_Debts_Expense 800,000 8.000 x 1% Allowance_for_Doubtful_Accts. 8,000 Balance ??_or_Balance?? 8,000 Prior_Balance_does_not_matter!!! 3. The Balance Sheet Approach of Estimating Bad Debts (also called the percent of receivables method) is an estimate of the amount of receivables that will go to bad debts expense. The Balance Sheet approach will either take a single percent of receivables or will base the expense on the aging of accounts receivable where an increasing rate of receivables is used based on the length of time the receivables has been outstanding. Under the balance sheet approach, where the emphasis in on the net realizable value (Accounts Receivable - Allowance for Doubtful Accounts) or the estimate of cash to be realized from the receivables, ANY PRIOR BALANCE IN THE ALLOWANCE FOR DOUBTFUL ACCOUNTS MUST BE "CONSIDERED," as the goal of the manager who chooses the Balance Sheet method for estimating bad debts is to have the balance in the Allowance for Doubtful Accounts match the total estimated uncollectible accounts on the Aging Schedule "after" the adjusting entry so this manager DOES NOT CARE what affect the entry will have on the income statement. Refer to the accounting equation below where the blue (shaded) area is the only place that the balance sheet approach manager will focus his or her attention when making the adjusting entry. What shows as a balance in the Allowance for Doubtful Accounts before and after the adjustment is of GREAT significance to this manager as that determines what the adjusting entry will be. What shows

10 in the bad debts expense account after the adjustment is of NO significance to this manager who has a balance sheet emphasis. The following examples illustrate the situation when there is a prior credit balance of $528 and where there is a prior debit balance of $500.

a) Adjusting Entry When the Allowance for Doubtful Accounts has a prior CREDIT balance of $528:

Owner's Assets = Liabilities + Equity + Revenues - Expenses Balance_Sheet_Emphasis Income_Statement_Emphasis Accounts_Receivable Sales 39,600 800,000

Allowance_for_Doubtful_Accts. Bad_Debts_Expense $528 Balance_"before"_adjustment 1,700 1,700 Adjustment_REQUIRED_to_bring_balance_to_aging_schedule 2,228 Aging_schedule_indicates_balance_MUST_BE_this_amount!!!

b) Adjusting Entry When the Allowance for Doubtful Accounts has a prior DEBIT balance of $500: Owner's

Assets = Liabilities + Equity + Revenues - Expenses Balance_Sheet_Emphasis Income_Statement_Emphasis Accounts_Receivable Sales 39,600 800,000

Allowance_for_Doubtful_Accts. Bad_Debts_Expense $500 Balance_"before"_adjustment 2,728 2,728 Adjustment_REQUIRED_to_bring_balance_to_aging_schedule 2,228 Aging_schedule_indicates_balance_MUST_BE_this_amount!!!

Partial Balance Sheet showing the allowance for doubtful accounts: HAMPSON FURNITURE Balance Sheet (partial) December 31, 20-- Assets Current assets: Cash $14,800.00 Accounts receivable $200,000.00 Less: Allowance for doubtful accounts 12,000.00 188,000.00 Merchandise inventory 310,000.00

11 Prepaid expense 25,000.00 Total current assets $537,800.00 F. RECORDING THE WRITE-OFF OF A CUSTOMER'S ACCOUNT USING THE ALLOWANCE METHOD: The allowance account is always debited regardless of the amount. When the actual accounts receivable that does need to be written off, under the Allowance Method (either income statement (Percent of Sales) or balance sheet (Percent of Receivables) approach) in the next year, you do NOT WANT TO DEBIT the Bad Debts Expense account as you have already allowed for the bad debt as an adjusting entry at the end of the prior year. You debit the Allowance for Doubtful Accounts and credit Accounts Receivable--customer's account as now you know which account has gone bad. The cash (net) realizable value of accounts receivable does not change. The Cash Realizable Value (CRV) before and after the entry is the same and that is still the dollar amount, you think you will realize from your receivables. The entry to write-off a customer's account: Owner's

Assets = Liabilities + Equity + Revenues - Expenses Allowance_Method Accounts_Receivable 200,000 500 Write_off_of_an_account

Allowance_for_Doubtful_Accts. CRV_=_$188,000 12,000 500 Write_off_of_an_account G. RECOVERY OF ACCOUNTS UNDER THE ALLOWANCE METHOD—time does not matter in this method: If an account that has been written off is later collected, the account is said to be recovered and its balance is reinstated. Under the allowance method (either the income statement or the balance sheet approach), the entry is the same no matter what period the reinstatement occurs. Basically the process is the same two- step process where the first step is to reinstate the account (reverse the original write-off of the account) and the second step is to collect the cash.

1. The first entry to reinstate the account means to reverse the write-off to Allowance for Doubtful Accounts as a credit to the account: Owner's

Assets = Liabilities + Equity + Revenues - Expenses Allowance_Method Accounts_Receivable 199,500 500 Reverse_write_off CRV_=_$37,300 Allowance_for_Doubtful_Accts. 11,500

12 500 Reverse_write_off_of_an_account 2. The second entry is to collect the cash from the customer:

Owner's Assets = Liabilities + Equity + Revenues - Expenses Cash 500

Accounts_Receivable 200,000 500

Allowance_for_Doubtful_Accts. 12,000 To recap the difference between the Percentage of Sales vs. Percentage of Receivables, a three-year illustration of the differences between the two methods:

Three-Year Illustration of Allowance Method: Income Statement Approach Year 1: 2014 Company has credit sales of $90,000. Bad Debts have been about 3% of credit sales. Owner's Assets = Liabilities + Equity + Revenues - Expenses Bad Debts Accts. Receivable Sales Expense

40,000 90,000 2,700 Adj. x 3% 12/31 2,700 Allow. For Dbt. Accts, 2,700 Adj. 12/31/08 Year 2: 2015 Company has credit sales of $110,000. Bad Debts estimated 3% of credit sales. Note: in AFDA account the write-offs of accounts during the year Owner's Assets = Liabilities + Equity + Revenues - Expenses Bad Debts Accts. Receivable Sales Expense

40,000 300 Jan. 110,000 3,300 Adj. 110,000 500 Apr x 3% 12/31 600 July 3,300 700 Aug 400 Oct

Allow. For Dbt. Accts, Jan 300 2,700 Bal. 1/1/09 Apr. 500 July 600 Aug. 700 Oct. 400

13 2,500 2,700 200 Bal Before Adj. 3,300 Adj. 12/31/09 3,500 Bal. 12/31/09 After Adj.

Year 3: 2016 Company has credit sales of $150,000. Bad Debts estimated 3% of credit sales. Note: in AFDA account the write-offs of accounts during the year Owner's Assets = Liabilities + Equity + Revenues - Expenses Bad Debts Accts. Receivable Sales Expense

45,000 700 Jan. 150,000 4,500 Adj. 150,000 1,500 Apr x 3% 12/31 1,100 July 4,500 400 Aug 1,300 Oct

Allow. For Dbt. Accts, Jan. 700 3,500 Bal. 1/1/09 Apr. 1,500 July 1,100 Aug. 400 Oct. 1,300 5,000 3,500 Bal Before 1,500 Adj. 4,500 Adj. 12/31/10 3,000 Bal. 12/31/10 After Adj.

Three-Year Illustration of Allowance Method: Balance Sheet Approach Year 1: 2014 Company's Aging Schedule shows total estimated uncollectible Accounts - $2,742. Owner's Assets = Liabilities + Equity + Revenues - Expenses Accts. Receivable Sales

Bal. 44,990 150,000 Bad Debts Expense Allow. For Dbt. Accts, 2,742 Adj. 2,742 Adj. 12/31/08 as no prior balance 12/31 Year 2: 2015 Company's Aging Schedule shows total estimated uncollectible Accounts - $3,245 Note: in AFDA account the write-offs of accounts during the year. Owner's Assets = Liabilities + Equity + Revenues - Expenses Accts. Receivable Sales 44,990 300 Jan. 165,000 165,000 500 Apr 600 July

14 700 Aug 400 Oct

xxxxx Bal. 54,083 Bad Debts Allow. For Dbt. Accts, Expense Jan. 300 2,742 Bal. 1/1/09 3,003 Adj. Apr. 500 12/31 July 600 Aug. 700 Oct. 400 2,500 2,742 Bal Before 242 Adj. Adj. 12/31/09 (amount needed for correct 3,003 balance) Bal. 12/31/09 After Adj (Agrees to Aging 3,245 Schedule)

Year 3: 2016 Company's Aging Schedule shows total estimated uncollectible Accounts - $3,888 Note: in AFDA account the write-offs of accounts during the year Owner's Assets = Liabilities + Equity + Revenues - Expenses Accts. Receivable Sales 54,083 700 Jan. 220,000 220,000 1,500 Apr 1,100 July 400 Aug 1,300 Oct xxxxx

Bal. 64,800 Bad Debts Allow. For Dbt. Accts. Expense Jan. 700 3,245 Bal. 1/1/09 5,643 Adj. Apr. 1,500 12/31 July 1,100 Aug. 400 Oct. 1,300 5,000 3,245 1,755 Bal Before Adj. 5,643 Adj. 12/31/10 (amount needed for correct balance) 3,888 Bal. 12/31/10 After Adj. (Agrees to Aging Schedule) H. Disposing of Accounts Receivable 1. Companies frequently dispose of accounts receivable in one of two ways: a) (1) Sell to a factor such as a finance company or a bank:

15 1) A factor buys receivables from businesses for a fee and collects the payments directly from customers. 2) Receivables are sold for two major reasons: a. (1) They are the only reasonable source of cash. b. (2) Billing and collection are often time consuming and costly. 3) Example: Hendrendon Furniture factors $600,000 of receivables to Federal Factors, Inc. Federal Factors assesses a service charge of 2%of the amount of receivables sold. The journal entry: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Mon. Day Cash ($600,000-$12,000) 588,000 Service Charge Expense (2% x $600,000) 12,000 A/R—Polo Company 600,000 (To record the sale of A/R)

b) (2) Make credit card sales 1) Credit cards are frequently used by retailers who wish to avoid the paperwork of issuing credit. 2) Retailers can receive cash more quickly from the credit card issuer. 3) A credit card sale occurs when a company accepts national credit cards, such as Visa, MasterCard, Discover, and American Express. 4) Three parties involved when credit cards are used in making retail sales are: a. (1) the credit card issuer, b. (2) the retailer, and c. (3) The customer. 5) The retailer pays the credit card issuer a fee of 2- 6% of the invoice price for its services. 6) From an accounting standpoint, sales from Visa, MasterCard, and Discover (bank cards) are treated differently than sales from American Express (non-bank cards). a. Sales resulting from the use of VISA, MasterCard, and Discover are considered cash sales by the retailer. 1. These cards are issued by banks. 2. Upon receipt of credit card sales slips from a retailer, the bank immediately adds the amount (cash) to the seller’s bank balance.

16 3. To illustrate: Anita Ferreri purchases a number of compact discs for her restaurant from Karen Kerr Music Co. for $1,000 using her VISA First Bank Card. The service fee that First Bank charges is 3%. The entry would be: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Mon. Day Cash ($1,000-$30) 970 Service Charge Expense (3% x $1,000) 30 Sales 1,000 (To record VISA credit card sales)

b. Sales using American Express cards are reported as credit sales, not cash sales. 1. Conversion into cash does not occur until the companies remit the net amount to the seller. 2. To illustrate: Four Seasons restaurant accepts an American Express card for a $300 bill. The service fee that American Express charges are 5%. American Express will subsequently (may be the next month) pay the restaurant $285. The entries the restaurant records are as follows: General Journal Page 1 Date Account Title P.R Debit Credit 20-- Mon. Day A/R—American Express ($300-$15) 285 Service Charge Expense (5% x $300) 15 Sales 300 (To record Am. Express credit card sales)

Mon. Day Cash 285 A/R—American Express 285 (To record redemption of credit card billings)

II. Notes Receivable A. Introduction 1. A promissory note is a written promise to pay a specified amount of money on demand or at a definite time. 2. A promissory note may be used: a) (1) When individuals and companies lend or borrow money. b) (2) When the amount of the transaction and the credit period exceed normal limits. c) (3) In settlement of accounts receivable.

17 3. Parties involved in promissory notes: a) The party making the promise is the maker. b) The party to whom payment is made is called the payee.

B. Determining the Maturity Date: 1. When the life of the note is expressed in terms of months, the due date is found by counting the months from the date of issue a) Example: The maturity date of a 3-month note dated May 31 is August 31. b) A note drawn on the last day of the month matures on the last day of a subsequent month. Two months from July 31 is September 30. 2. When the life of the note is expressed in terms of days, you need to count the days. a) In counting, the date of issue is omitted but the due date is included. b) If the note is in days, you must know the days in each month to calculate the exact number of days. Count days after the date of the note up to and including the date of maturity. The poem helps: Thirty days has September, April, June, and November. All the rest has 31 except for February (where for purposes of this course, we will consider it to be 28). There is also the knuckle method where you make a fist out of both hands and beginning with your left hand, the knuckles have 31 days and the valley between the knuckles has 30 days or in the case of February 28 days. So with the left hand, it begins with a knuckle which is January (31 days), February (28 days), then March (31), April (30), May (31), June (30) July (31 which ends the left hand). Then your right hand begins with a knuckle which is August (31), September (30), October (31), November (30), December (31). c) TO CALCULATE THE DUE DATE OF A NOTE, USE THE METHOD BELOW (Example used: 90 days after June 20):

Last day of month that note is dated = June 30 June has 30 days - Date of the note = June -20 Note is dated June 20 = Days in the first month = June 10 Subtract for days in 1st month + Days in the following month = July 31 Number of days in July + Days in the next month = August 31 Number of days in August + Days needed in the next month = Sept. 18 DUE DATE OF NOTE Total of all the days in the months to length of note 90 Number of days of the note

Example of 90 days after March 11: March 31 Number of days in March (the month the note was dated)

18 March -11 Subtract the date of the note March 20 Number of days to count for March April 30 Number of days in April May 31 Number of days in May Number of days needed in June to reach 90 days=DUE DATE June 9 OF NOTE Total 90 Total "exact" days of the note d) Example: The maturity date of a 60-day note dated July 17 is: Term of note 60 days July (31 – 17) 14 August 31 45 Maturity date: September 15 C. Computing Interest (PRT) 1. The basic formula for computing interest: Face Value of Note x Annual Interest Rate x Time in Terms of 1 Yr. = Interest 2. The interest rate specified on the note is an annual rate of interest. 3. Computation of interest for various time periods: Terms of Note Interest Computation Face x Rate x Time = Interest $730, 18%, 120 days $730 x 18% x 120/360 = $43.80 $1,000, 12%, 6 months $1,000 x 15% x 6/12 = $75.00 $2,000, 12%, 1 year $2,000 x 12% x 1/1 = $240.00 D. Recognizing Notes Receivable 1. To illustrate: Wilma Company receives a $1,000, 2-month, 12% promissory note from Brent Company to settle an open account. The entry to record: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- May 1 Notes Receivable 1,000 Accounts Receivable—Brent Company 1,000 (To record acceptance of note) 2. A note is recorded at its face value, the value shown on the face of the note.

E. Valuing Notes Receivable 1. Like accounts receivable, short-term notes receivable are reported at their cash (net) realizable value. 2. The notes receivable allowance account is Allowance for Doubtful Accounts.

19 F. Disposing of Notes Receivable: 1. Honor on Notes Receivable a) A note is honored when it is paid in full at its maturity date. b) For an interest-bearing note, the amount due at maturity is the face value of the note plus interest for the length of time specified on the note. c) To illustrate: Betty Co. lends Wayne Higley Inc. $10,000 on June 1, accepting a 5-month, 9% interest-bearing note ($10,000 x 9% x 5/12= $375 interest. Betty collects the maturity value of the note from Higley on November 1. The entry to record the honoring of the note: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Nov. 1 Cash 10,375 Notes Receivable 10,000 Interest Revenue 375 (To record collection of Higley, Inc. note)

d) If Betty Co. prepares financial statements as of September 30, interest for 4 months, or $300, would be accrued as follows: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Sept. 30 Interest Receivable ($10,000 x 9% x 4/12) 300 Interest Revenue 300 (To accrue 4 months interest) e) When interest has been accrued, it is necessary to credit Interest Receivable at maturity. The entry to record the honoring of the note: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Nov. 1 Cash 10,375 Notes Receivable 10,000 Interest Receivable 300 Interest Revenue ($10,000 x 9% x 1/12) 75 (To record collection of Higley, Inc. note)

2. Dishonor of Notes Receivable a) A dishonored note is a note that is not paid in full at maturity. b) A dishonored note receivable is no longer negotiable.

20 c) Since the payee still has a claim against the maker of the note, the balance in Notes Receivable is usually transferred to Accounts Receivable. d) To illustrate, assume that Wayne Higley, Inc. on November 1 indicates that it cannot pay at the present time. The entry to record the dishonor of the note if Betty Co. expects eventual collection: General Journal Page 1 Date Account Title P.R. Debit Credit 20-- Nov. 1 Accounts Receivable—Wayne Higley, Inc. 10,375 Notes Receivable 10,000 Interest Revenue 375 (To record dishonor of Higley, Inc. note)

III. Statement Presentation and Analysis A. Presentation 1. In the balance sheet, short-term receivables are reported in the current assets section below short-term investments. 2. Report both the gross amount of receivables and the allowance for doubtful accounts. See illustrations in textbook. 3. In a multiple-step income statement, bad debts expense and service charge expense are reported as selling expenses in the operating expenses section. 4. Interest revenue is shown under “Other revenues and gains” in the nonoperating activities section of the income statement. B. Analysis 1. Financial ratios dealing with receivables are computed to evaluate the company’s ability to pay debt and the liquidity of a company’s accounts receivable. 2. The acid-test ratio is the sum of cash, cash equivalents, short-term investments, and net current receivables to total current liabilities. The ratio tells whether the entity could pay all its current liabilities if they came due immediately. What is an acceptable acid-test ratio depends on the industry but generally a ratio of 1.00 or 1:1 or better is considered safe. 3. The accounts receivables turnover ratio is used to assess the liquidity of the receivables.

4. If Cisco Systems had net sales of $24,801 million for the year and beginning net accounts receivable (accounts receivable less AFDA) balance of $1,825 million and an ending accounts receivable (net)

21 (accounts receivable less AFDA) of $2,216 million, its turnover ratio is computed as follows: Net Credit Sales ÷ Average “NET” Receivables = Receivables Turnover $1,825 + $2,216 $24,801 ÷ = 12.3 Times 2 5. The average collection period in days is a variant of the turnover ratio that makes liquidity even more evident. 6. This is done by dividing the turnover ratio into 365 days. The general rule is that the collection period should not exceed the credit term period (the time allowed for payment). 7. Cisco’s turnover ratio is computed as follows: Days in year. ÷ Receivables Turnover = Average Collection Period 365 ÷ 12.3 = 29.7 days or 30 days

22