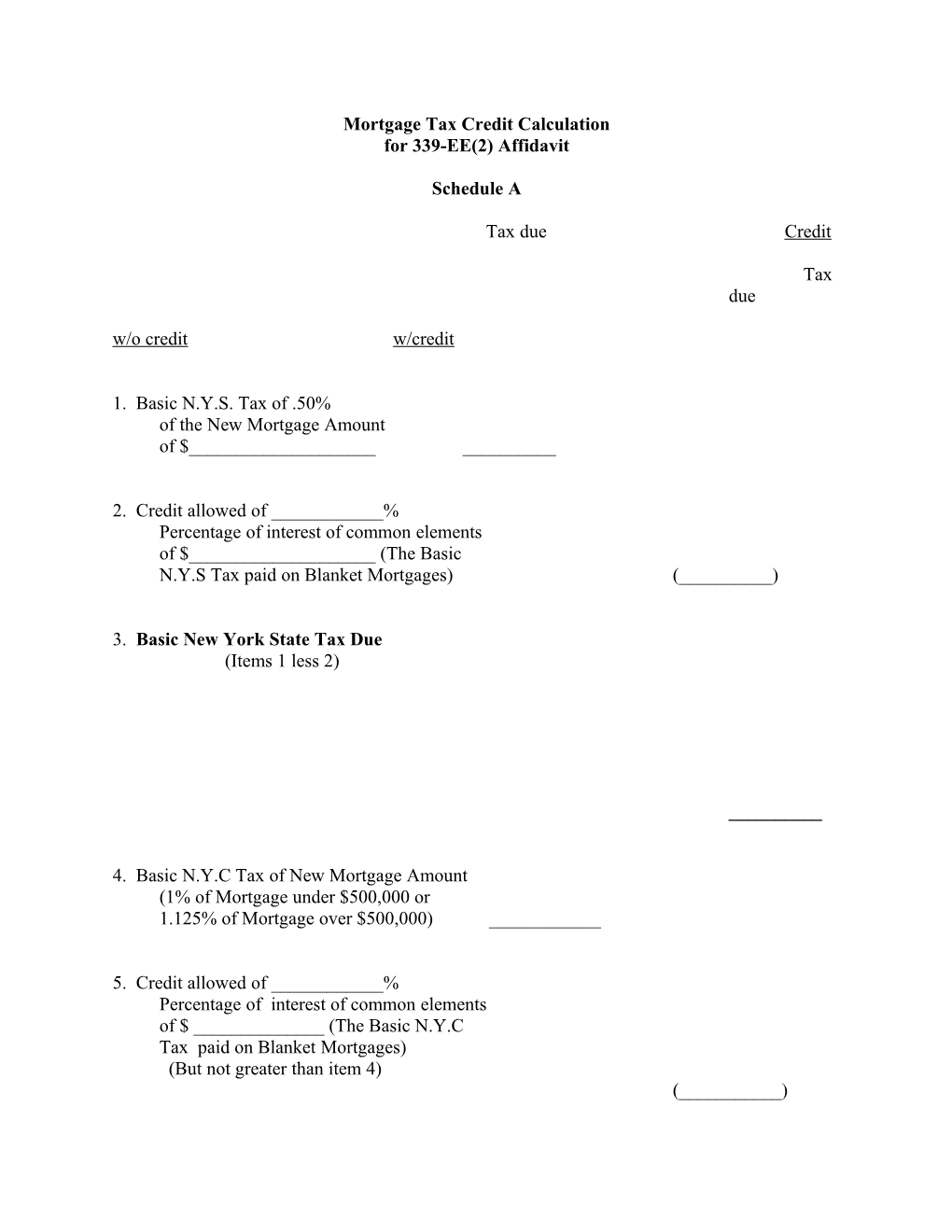

Mortgage Tax Credit Calculation for 339-EE(2) Affidavit

Schedule A

Tax due Credit

Tax due w/o credit w/credit

1. Basic N.Y.S. Tax of .50% of the New Mortgage Amount of $______

2. Credit allowed of ______% Percentage of interest of common elements of $______(The Basic N.Y.S Tax paid on Blanket Mortgages) (______)

3. Basic New York State Tax Due (Items 1 less 2)

______

4. Basic N.Y.C Tax of New Mortgage Amount (1% of Mortgage under $500,000 or 1.125% of Mortgage over $500,000) ______

5. Credit allowed of ______% Percentage of interest of common elements of $ ______(The Basic N.Y.C Tax paid on Blanket Mortgages) (But not greater than item 4) (______) 6. Basic New York City Tax Due (Items 4 less 5)

______

7. Additional Tax of .30% of new mortgage debt of $______

8. Exemption of first $10,000 of new debt (1-2 family residence)

( $30 ) 9. Credit allowed of ______% Percentage of interest of common elements of $______(Additional Tax paid on Blanket Mortgages) (But not greater than item 7 less item 8) (______)

10. Additional New York State Tax Due (Items 7 less 8 and 9) ______

11. NYC Additional Tax of .625% of New Mortgage Amount of $______

______

12. Mortgagor’s portion of tax due (sum of items 3, 6,10 and 11 if applicable)

______

13. Mortgagee’s Portion of New York Tax of .25% of New Mortgage Debt of $______(Pursuant to Section 253 of tax Law) ______

14. Total Mortgage Tax Due and Tendered Herewith. (sum of items 12 and 13)

______

15. Total Mortgage Tax Credit Pursuant to Section 339ee(2) and Section 253 of the Real Property Law (sum of items 2, 5, 8, and 9) ______