Math 11 Foundations – Review

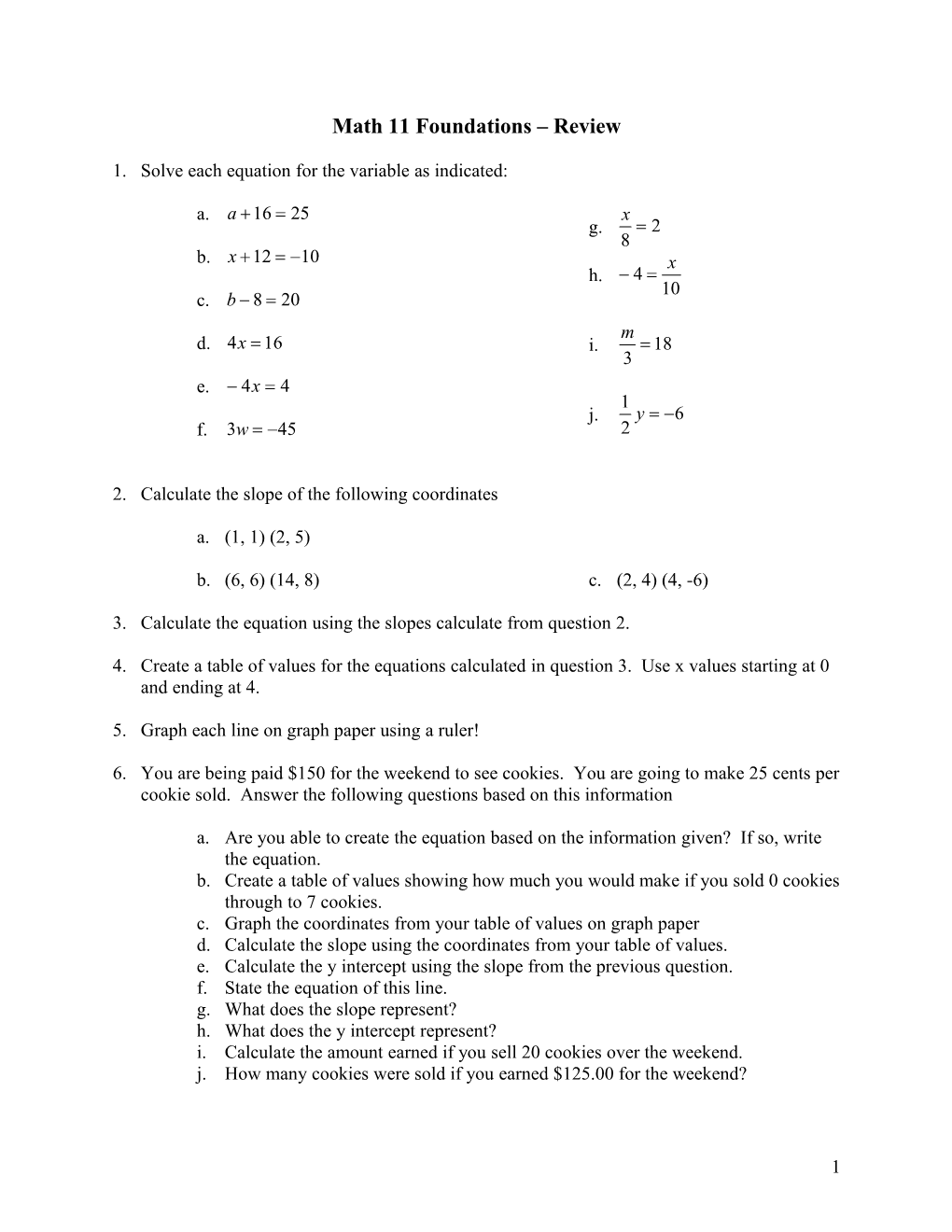

1. Solve each equation for the variable as indicated:

a. a 16 25 x g. 2 8 b. x 12 10 x h. 4 10 c. b 8 20 m d. 4x 16 i. 18 3 e. 4x 4 1 j. y 6 f. 3w 45 2

2. Calculate the slope of the following coordinates

a. (1, 1) (2, 5)

b. (6, 6) (14, 8) c. (2, 4) (4, -6)

3. Calculate the equation using the slopes calculate from question 2.

4. Create a table of values for the equations calculated in question 3. Use x values starting at 0 and ending at 4.

5. Graph each line on graph paper using a ruler!

6. You are being paid $150 for the weekend to see cookies. You are going to make 25 cents per cookie sold. Answer the following questions based on this information

a. Are you able to create the equation based on the information given? If so, write the equation. b. Create a table of values showing how much you would make if you sold 0 cookies through to 7 cookies. c. Graph the coordinates from your table of values on graph paper d. Calculate the slope using the coordinates from your table of values. e. Calculate the y intercept using the slope from the previous question. f. State the equation of this line. g. What does the slope represent? h. What does the y intercept represent? i. Calculate the amount earned if you sell 20 cookies over the weekend. j. How many cookies were sold if you earned $125.00 for the weekend?

1 1. The table below represents the amount of money spent per week on basketball games for basketball fans

12 13 13 14 14 15 15 16 16 17 18 18 22 24 25 30 32 35 37 42 45

The table below represents the amount of money spent per week on basketball games for non- basketball fans (they were dragged to games by their friends/parents, etc)

5 6 7 7 8 8 10 12 13 15 19 19 20 25 27 28 29 35 42 46

a. Find the mean amount of money spent per week on basketball games for each set of data b. State the median for each set of data c. State the mode for each set of data d. Create one stem and leaf chart for both tables e. Create a separate tally and frequency for each set of data a. Which class had the highest frequency? (for each chart) b. Which class had the lowest frequency? (for each chart) c. How many people fell in the 3rd class? The 5th class? f. Create 1 box & whisker plot for each set of data (include the mean for each box & whisker plot) g. Draw a separate histogram to display each set of data. Do not forget to label each axis and to title your histogram

2. The following tally & frequency chart describes the favorite types of beverages

Search Engine Tally Frequency Pepsi 20 Diet Pepsi 17 Coke 18 Diet Coke 20 7 Up 10 Diet Sprite 8

a. Fill in the tally section of the chart b. Create a bar graph displaying the information above (don’t forget to label & title) c. Which beverage had the largest preference for this survey? d. Which beverage had the least preference for this survey? e. How many more people preferred Pepsi to Coke? f. How many people were asked in total? g. How many people don’t like 7 Up?

2 1. Write each percent as a decimal.

a. 5.87% = c. 0.54% = b. 21.6% = d. 0.0081% =

2. Write each decimal as a percent. (Remember to express as a %)

a. 15.8 c. 0.54 b. 21.6 d. 0.0081

3. Find the percent of each number.

a. 16% of 317= c. 99.5% of 395=

b. 19% of 226= d. 24.75% of 12=

4. Calculate the tax for the following purchases (tax is 15%)

a. $2.87= c. $89.99=

b. $6.85= d. $209.80=

5. Calculate the total amount (incl. tax) for the following purchases (tax is 15%)

a. $3.49= c. $75.00=

b. $29.99= d. $109.50=

6. The Principal amount represents the amount borrowed from different banks. Calculate the amount of interest owing as well as the balance.

Principal Rate time Interest Balance Borrowed $425 7% 1 year $740 8.2% 1 year $320 4% 1 year $890 6.5% 1 year

3 7. Calculate the interest owing for the amounts borrowed as well as the total amount owing after the given time period.

Name Principal Rate of Time to Interest Amount Borrowed Interest per Borrow Owing Year Mr. Henry $1 675 18% 8 months Mrs. Caller $1 450 12.5% 10 months Ms. Finch $1 075 10% 18 months Mr. Bourgeois $15 150 9% 3 months

8. The chart below states the number our hours each person worked per day as well as their hourly rate. Calculate the amount they bring home for the week before taxes. Name M T W Th F Total Hourly Rate Gross Income Grace 6 7 8 4 6 $8.50 Kelly 7 9 10 5 8 $8.95 Naomi 3 8.5 8 6 8 $21.75 Norman 4 6 10 7.5 8 $14.86

9. The chart below states the number of lids each person put on cap per day as well as the amount they receive for each lid sealed. Calculate the amount they receive for the week of sealing lids. Name M T W Th F Total Piece Rate Gross Income Beth 120 80 60 110 90 $0.85 Nadia 90 140 80 75 85 $1.55 Tom 150 125 125 115 82 $2.25 June 40 60 90 52 85 $2.75

10. The chart states the number of cars sold in a week and the amount of commission each person earns. Calculate the amount of commission earned in a week as well as their take home pay. Sales Cars Total Sales Commission Commission Take home Person Sold for week Rate Earned (1week) Pay (25% tax)

Jim 4 $525 000 4.00% Teresa 3 $175 000 4.25% Al 3 $250 000 3.75%

4 John 8 $600 000 3.50%

5 11. The chart below shows the weekly salary of each employee. Employees earn their weekly salary and commission on their sale. Complete the chart as indicated. Sales Weekly Total Sales Commission Commission Total Take Person Salary ($) Rate Earnings Weekly home Pay ($) Earnings (24%) Trey 275.00 1 598.85 3.75% Yannick 225.00 4 165.50 4.25% Sheila 209.00 3 142.30 4.00% Rae 340.00 2 145.88 4.75%

12. The chart below shows the weekly salary of each employee. Employees earn their weekly salary and commission on their sales over $350. Complete the chart as indicated. Sales Weekly Total Sales Amount over Commission Commission Total Weekly Take Home Person Salary $350 Rate Earned Earnings Pay (22% tax) Roland $200.00 $425.00 4% Teresa $200.00 $590.00 5% Rhonda $200.00 $260.00 3% Rohan $200.00 $675.00 4% Theo $200.00 $525.00 2% 13. You own a store and bought some supplies at a cost of Prime. Because you want to make a profit, you markup your price. Calculate the amount of markup and the selling price. Prime ($) Markup Amount of markup Selling Price ($) 225.00 4% 55.00 15% 125.00 9% 225.00 35%

14. Find the percentage markup given a selling the price and prime. Prime ($) Selling Price ($) Markup 120.00 130.00 150.00 185.00 270.00 195.00 137.00 136.00 15. Complete the chart. The overtime rate is 1.5 times the hourly rate. Hourly Rate Reg. Hrs. Reg. Income OT Hrs. Total OT Total Income worked Worked Income $6.70 25 12 $15.00 35 8

6 $12.50 32.50 5.50 8 22.75 6.75 Place the correct symbol in the space provided

1. 5 _____ 8 6. 18 _____ 4

2. 10 _____4 7. 21 _____ 5

3. -2 _____ 5 8. 49 _____ 50

4. 6 _____ -3 9. 64 _____ 27

5. -2 _____ -4 10. -5 _____ -15

Graph each of the following equations on a separate graph and shade where appropriate:

1. x 0 4. x 6 7. y 3

2. x 4 5. x 10 8. y 5

3. x 2 6. y 0 9. y 4

Graph each of the following equations on a separate graph and shade where appropriate:

1. y 2x 1 6. y 2x 5 4. y 3x 1 2. y 3x 4 7. y x 5 5. y 3x 4 3. y x 6 8. y 2x 3

Draw each set of equations on one graph. Make sure to shade in the common area with a colored pencil:

1. x 2 and y 3 5. x 3 and y 2 6. y x 3 and y x 4 2. y 2 and y 1 7. y 2x 1 and y 3 2x 3. x 3 and y 2 8. y 3x 2 and y 2 2x 4. y 4 and y 2

7 1 9. y x 3 and y x 5 2 10. y 2x and y 3x Store Discounts and Taxes Using the table below, answer the questions that follow.

DVD Player $140 VCR $148 13 inch TV $5 Laptop $2026 2-Way Radio $75 Answering Machine $192 Digital Camera $344 CD Disc Changer $112 50 inch TV $1125 Discman $194 Cordless Phone $45 Wireless Phone $78

1. 6% sales tax is on one 13 inch television. What amount of sales tax did you pay?

2. 6.4% sales tax is on one answering machine. What amount of sales tax did you pay?

3. 6% sales tax is on one DVD player. What amount of sales tax did you pay?

4. You want to buy the CD Disc Changer and the Digital Camera. If the sales tax is 6.5%, what is your after – tax total?

5. There is a 20% discount on one VCR. What is the amount of the discount?

6. There is a 50% discount on a 2-way radio. What is the discount?

7. 27% discount on one 50 inch television and the sales tax is 4%. How much is the after tax total?

8. You ordered 2 digital cameras online. Edhelper offers a 15% discount off the price of the digital camera. You pay no tax, but the total shipping charge for the order is $9.97. What is the total you pay?

9. You ordered 3 laptops online. Edhelper offers a 15% discount off the price of the digital camera. You pay no tax, but the total shipping charge for the order is $7.12. What is the total you pay?

10. You want to buy the 2 way radio and the discman. The sales tax for the radio is 6.2% and for the discman it is 7.5%.

8 Create a yearly and monthly budget based on the following information. Assume you are 25 years of age and living in Halifax.

Car $450.00 per Income $20 000 Insurance year 25% of gross $20.00 per Deductions pay Gas week $375.00 per $40.00 per Rent month Groceries week $75.00 per $25.00 per Utilities month Phone month $300.00 per Car Payment month Savings 10% of net pay

Month Year Gross Pay

Deductions

Rent

Utilities

Car Payment

Car Insurance

Gas

Groceries

Phone

Savings

Disposable Income

a. Disposable Income is money left over for you to spend. Do you have any left over? What could you do with it? b. Are there costs that you have that are not on this sheet? Can you still afford them? c. Will you have enough to buy gifts for people? Reading and interpreting pay stubs

9 Record all of your answers on a separate piece of paper

1. What are the names of the employers?

2. How much did each person earn before deductions? (gross income)

3. What is each person’ hourly wage?

4. List everyone’s deductions.

5. How much Income tax was taken off for each person for this pay?

6. How much Income tax was taken off for the year?

7. What is the pay period for each person?

8. How many hours did each person work?

9. How much overtime did each person work?

10. How much did each person contribute to their RRSP?

11. How much is each person’s take home pay? (Net Income)

12. How much is each person’s monthly pay?

13. How much is each person’s yearly pay?

14. How much did each person pay in Employment Insurance for this pay??

15. How much did each person pay in EI for the year?

16. What percentage of their gross income did they pay to EI?

17. How much did each person pay in Canada Pension Plan for this pay?

18. How much did each person pay in CPP for the year?

19. What percentage of their gross income did they pay to CPP?

20. How much did each person pay towards their medical plan?

21. How much did each person pay towards their staff fund?

10 Employer: Tires R US Employee: C Brown SIN: 123-456-789 Payroll Account Pay Period 3/1/_____ to 3/15/ _____ Net Pay 524.28

Gross Earnings Deductions Other Deductions Description Hours Amount Tax Current YTD Description Amount

Regular 80 640.00 Income Tax 104.55 293.4 RRSP 35.00 Overtime 5 60.00 EI 20.65 160.65

CPP 15.52 64.08 Current 700.00 YTD 2100.00

Employer: Hamburger Palace Employee: Zina Picard Enterprise SIN: 123-456-789 Payroll Account Pay Period 2/28/_____ to 3/14/ _____ Net Pay 234.33

Gross Earnings Deductions Other Deductions Description Hours Amount Tax Current YTD Description Amount

Regular 40 240.00 Income Tax 42.65 128.7 Staff Fund 2.00 Overtime 6 54.00 EI 8.67 126.23

CPP 6.35 25.41 Current 294.00 YTD 3582.00

Employer: The Banana BreadboxEmployee: Peter Devries SIN: 123-456-789 Payroll Account Pay Period 8/6/_____ to 8/12/_____ Net Pay 186.26

Gross Earnings Deductions Other Deductions Description Hours Amount Tax Current YTD Description Amount

Regular 40 240.00 Income Tax 30.75 372.01 RRSP 30.00 Overtime 6 54.00 EI 22.49 272.13 Medical 15.00

CPP 9.50 114.95 Current 294.00 YTD 3582.00

11