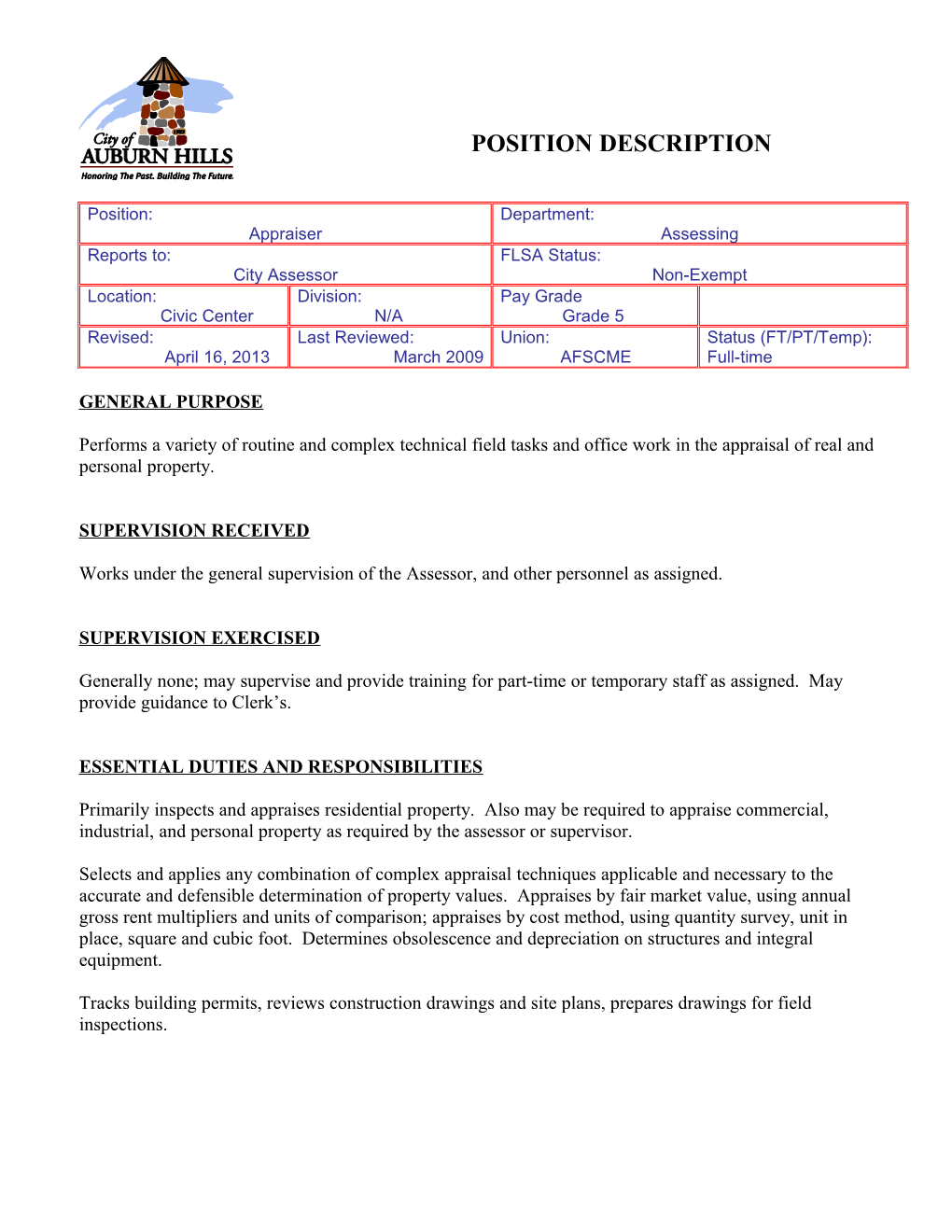

POSITION DESCRIPTION

Position: Department: Appraiser Assessing Reports to: FLSA Status: City Assessor Non-Exempt Location: Division: Pay Grade Civic Center N/A Grade 5 Revised: Last Reviewed: Union: Status (FT/PT/Temp): April 16, 2013 March 2009 AFSCME Full-time

GENERAL PURPOSE

Performs a variety of routine and complex technical field tasks and office work in the appraisal of real and personal property.

SUPERVISION RECEIVED

Works under the general supervision of the Assessor, and other personnel as assigned.

SUPERVISION EXERCISED

Generally none; may supervise and provide training for part-time or temporary staff as assigned. May provide guidance to Clerk’s.

ESSENTIAL DUTIES AND RESPONSIBILITIES

Primarily inspects and appraises residential property. Also may be required to appraise commercial, industrial, and personal property as required by the assessor or supervisor.

Selects and applies any combination of complex appraisal techniques applicable and necessary to the accurate and defensible determination of property values. Appraises by fair market value, using annual gross rent multipliers and units of comparison; appraises by cost method, using quantity survey, unit in place, square and cubic foot. Determines obsolescence and depreciation on structures and integral equipment.

Tracks building permits, reviews construction drawings and site plans, prepares drawings for field inspections. Performs accounting and auditing procedures relating to assessments; performs on-site inspections of property, including measuring buildings and taking photographs; check accuracy of existing property record cards, assesses appropriateness of depreciation schedule used for tax assessment purposes.

Correlates data and completes report of final appraisal judgments; prepares activity and progress reports relative to the work assignment; maintains and updates real property record cards.

Inputs appraisal data to computer assisted mass appraisal system.

List, analyze, and prepare studies of real property sale transactions.

Review and edit Oakland County Equalization division sales reports.

Process land divisions including updating ownership and tax file information, assessment, state equalized, and taxable values, property numbering log, assessment data and property record cards.

Responds to inquiries from the public regarding appraisal procedures and assessments. Attempts to resolve assessment complaints with taxpayers.

Also answers telephone/in-person inquiries from mortgage companies, real estate brokers and salespeople, and other real estate appraisers for routine information on property, including assessment information, estimated taxes, land divisions, tax abatements, deeds, property ownership, zoning, flood plain areas, location of property, explanation of property tax laws and department procedures.

Assists the public in filling out department forms, questionnaires, and applications.

Coordinates appraisal reviews and appeals before the Board of Review and the Michigan Tax Tribunal.

Testifies at hearing to present data documenting and substantiating assessments.

Operates listed office machines and field survey tools as required.

Other duties as assigned.

PERIPHERAL DUTIES

Explains appraisal methods and techniques and trains other personnel in their use, as well as assists with questions and problems relating to various appraisal methods and techniques.

May serve as a member of various employee committees.

Attends meetings and training to keep abreast of trends related to the position. REQUIRED MINIMUM QUALIFICATIONS

Education and Experience:

(A) Associate Degree (60 credit hours minimum) from an accredited college or university in business or public administration or closely related field of study, and

(B) State Certification Level II Assessment Administration (Michigan Certified Assessing Officer (MCAO))

(C) Two years of appraisal experience.

Necessary Knowledge, Skills and Abilities:

(A) Thorough knowledge of real estate appraisal principles, techniques, procedures, laws and regulations. Considerable knowledge of building, zoning and construction codes; working knowledge of accounting and auditing practices relative to property appraisal.

(B) Working knowledge of general property tax laws of the State of Michigan and manuals and procedures established by the State Tax Commission.

(C) Skill in operation of the listed tools and equipment.

(D) Ability to read, understand and apply appraisal techniques. Ability to read and understand legal descriptions and appraisal manuals. Ability to accurately appraise real and personal property. Ability to input and control data processing. Ability to communicate effectively verbally and in writing. Ability to work in inclement weather. Ability to establish successful working relationships.

(E) Working knowledge of computers and electronic data processing equipment including word processing, spreadsheet, database, and other appraisal software; working knowledge of modern office practices and procedures; some knowledge of accounting principles and practices.

SPECIAL REQUIREMENTS

(A) Valid state driver's license.

(B) Must maintain minimum of Level II assessment certification (MCAO) with State Tax Commission, including successful completion of annual continuing education requirement.

(C) Demonstrated ability to meet the above mentioned qualifications. An eight (8) week trial period is provided for existing AFSCME employees and a six (6) month period for new hires as provided by contract. TOOLS AND EQUIPMENT USED

Tape measure, measuring rod or wheel, pencil or micro-computing device, calculator, portable or mobile radio, phone, copy machine, fax machine, networked computer terminal, personal computer, computerized property appraisal system, and other tools and equipment as assigned.

PHYSICAL DEMANDS

The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

While performing the duties of this job, the employee is occasionally required to reach with hands and arms, stand, walk, and use hands to finger, handle, feel or operate objects, tools, or controls. The employee is occasionally required to sit, climb or balance, stoop, kneel, crouch or crawl and talk or hear.

The employee must occasionally lift and/or move up to 25 pounds. Specific vision abilities required by this job include close vision, distance vision, peripheral vision, and the ability to adjust focus.

WORK ENVIRONMENT

The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

While performing the duties of this job, the employee occasionally works in outside weather conditions. The employee is occasionally exposed to wet, cold and/or humid conditions.

The noise level in the work environment is usually moderately quiet in the office and moderate to loud in the field.

SELECTION GUIDELINES

Formal application, rating of education and experience, oral interview and background check; conditional offer of employment, post offer physical examination, drug screen and psychological evaluation; other job related tests may be required.

The duties listed above are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to the position.

The job description does not constitute an employment agreement between the employer and employee and is subject to change by the employer as the needs of the employer and requirements of the job change. Approval: ______Approval: ______Assessor City Manager Approval: ______Employee