General Notes on revised EUR Fair Value and Accrual Index Swap Annexes

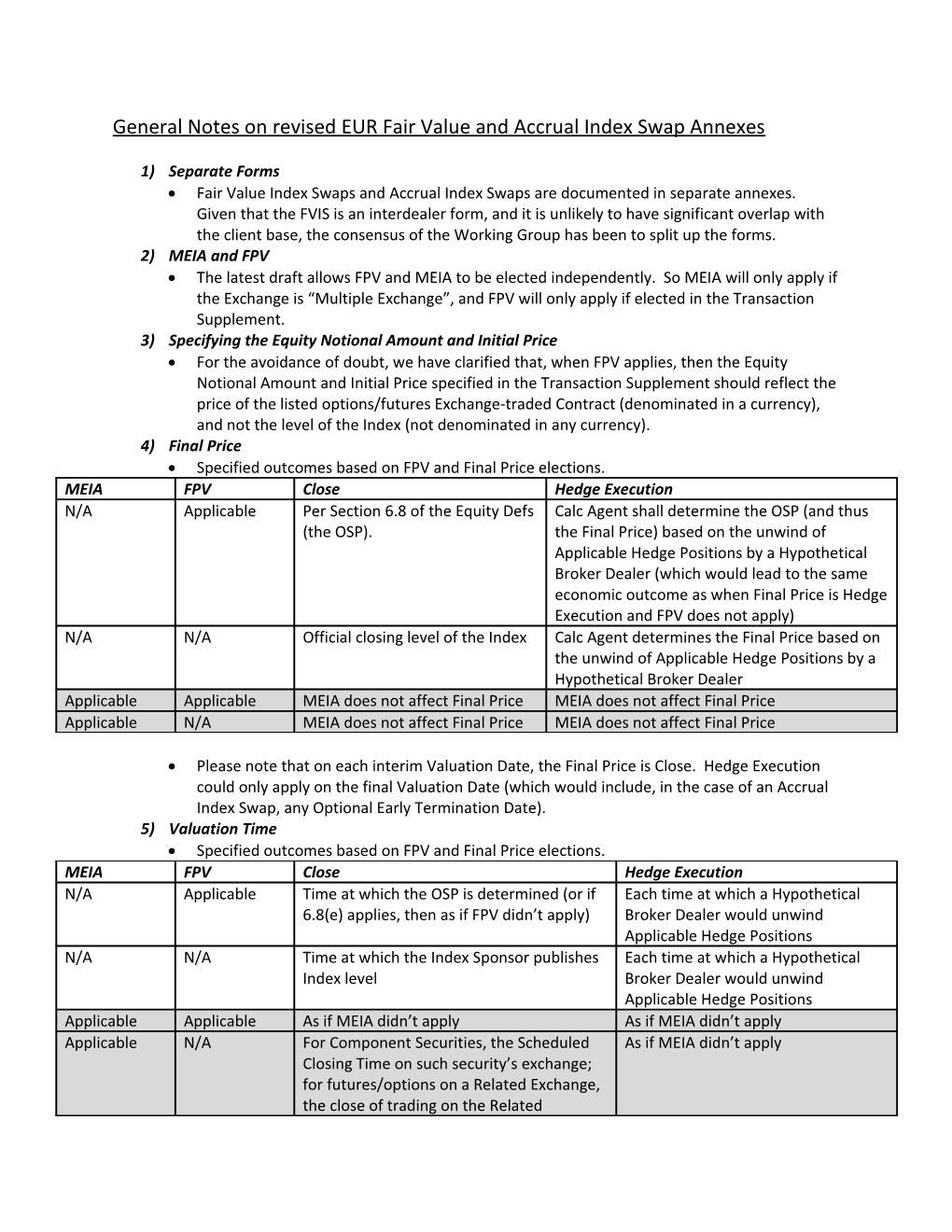

1) Separate Forms Fair Value Index Swaps and Accrual Index Swaps are documented in separate annexes. Given that the FVIS is an interdealer form, and it is unlikely to have significant overlap with the client base, the consensus of the Working Group has been to split up the forms. 2) MEIA and FPV The latest draft allows FPV and MEIA to be elected independently. So MEIA will only apply if the Exchange is “Multiple Exchange”, and FPV will only apply if elected in the Transaction Supplement. 3) Specifying the Equity Notional Amount and Initial Price For the avoidance of doubt, we have clarified that, when FPV applies, then the Equity Notional Amount and Initial Price specified in the Transaction Supplement should reflect the price of the listed options/futures Exchange-traded Contract (denominated in a currency), and not the level of the Index (not denominated in any currency). 4) Final Price Specified outcomes based on FPV and Final Price elections. MEIA FPV Close Hedge Execution N/A Applicable Per Section 6.8 of the Equity Defs Calc Agent shall determine the OSP (and thus (the OSP). the Final Price) based on the unwind of Applicable Hedge Positions by a Hypothetical Broker Dealer (which would lead to the same economic outcome as when Final Price is Hedge Execution and FPV does not apply) N/A N/A Official closing level of the Index Calc Agent determines the Final Price based on the unwind of Applicable Hedge Positions by a Hypothetical Broker Dealer Applicable Applicable MEIA does not affect Final Price MEIA does not affect Final Price Applicable N/A MEIA does not affect Final Price MEIA does not affect Final Price

Please note that on each interim Valuation Date, the Final Price is Close. Hedge Execution could only apply on the final Valuation Date (which would include, in the case of an Accrual Index Swap, any Optional Early Termination Date). 5) Valuation Time Specified outcomes based on FPV and Final Price elections. MEIA FPV Close Hedge Execution N/A Applicable Time at which the OSP is determined (or if Each time at which a Hypothetical 6.8(e) applies, then as if FPV didn’t apply) Broker Dealer would unwind Applicable Hedge Positions N/A N/A Time at which the Index Sponsor publishes Each time at which a Hypothetical Index level Broker Dealer would unwind Applicable Hedge Positions Applicable Applicable As if MEIA didn’t apply As if MEIA didn’t apply Applicable N/A For Component Securities, the Scheduled As if MEIA didn’t apply Closing Time on such security’s exchange; for futures/options on a Related Exchange, the close of trading on the Related Exchange; and otherwise, the time at which the Index Sponsor published the Index level

The Valuation Time in the GTC overrides the Valuation Time in the MEIA, for Close (if FPV applies) and Hedge Execution (regardless of whether FPV applies). In other words, the Valuation Time in the MEIA only applies for Close (if FPV doesn’t apply). o GTC overrides MEIA for FPV and Close because the key pricing determinant is the Exchange-traded Contract. Note that this leads to the same outcome for GTC and MEIA when the OSP is determined using “the close of trading on the Related Exchange” [from MEIA]. o GTC overrides MEIA for Hedge Execution because the Valuation Time should reflect the time at which a Hypothetical Broker Dealer unwinds Applicable Hedge Positions. 6) Number of Index Units Locked in on Trade Date, and does not adjust in conjunction with Equity Notional Reset (however, note that in Accrual Index Swaps, the Number of Index Swaps may decrease due to optional early termination). 7) Linear Interpolation Revised so that an election must be made in the Transaction Supplement, instead of including a default election. 8) Futures Price Valuation Cleaned up previous draft. Hedge Execution no longer prevents FPV from being Applicable; however, the pricing outcome is generally the same. 9) Nearest Index Contract Deleted this term. The Exchange-traded Contract must now be specified in the Transaction Supplement, to reduce the potential for ambiguity on this critical pricing reference. 10) Interpretation of ‘Official Settlement Price’ Deleted. If Section 6.8(e) applies, then the level of the Index would be used as an input to determine the OSP, instead of using the level itself as the OSP (so we’re not comparing index levels to settlement prices, and otherwise attempting to directly substitute the price of an options/futures contract for the Index level). To be clear, the OSP is the price of the options/futures contract, and not the level of the Index. o Example: The DJ EURO STOXX 50 is at 2015. A call option on the DJ EURO STOXX 50 trading on Eurex, expiring in April with a strike of 2000 trades at €80. Thus, the OSP is €80, and the level of the Index is 2015. 11) FPV Adjustments Includes technical fixes to the Equity Definitions, to determine the relevant price on a final Valuation Date where no OSP is published. A similar approach was used in ISDA’s AEJ Protocol, published March 9, 2009. 12) Dividends Please provide feedback if you believe it would be necessary to adjust these terms for FPV, as a listed contract may or may not already take dividends into account. 13) Index Disruption Where MEIA applies, an Index Disruption is treated as though it were a Disrupted Day. To account for varying Dealer preferences, we include footnoted language that can be added should the parties wish to follow this procedure when MEIA doesn’t apply. 14) FVIS: Change in Law References ‘Hedge Positions’, not ‘Shares’. 15) AIS: HD/ICOH/Consequences/Cancellation Amount The sell side has agreed to use the terms from the EUR EFS Annex, and the buy side has agreed to give up the option to provide replacement hedge positions upon the occurrence of a HD/ICOH. 16) Applicable Hedge Positions, and Hypothetical Broker Dealer Both terms have been reintroduced, because they are referenced in the Annex. 17) Hedging Party For client-facing Accrual Index Swaps, Party A is the Hedging Party. For interdealer Fair Value Index Swaps, parties may elect one or both as the Hedging Party. 18) AIS: Determining Party Per the EUR EFS Annex, the consequences of ADEs have been amended such that the Calculation Agent determines any Cancellation Amount. Thus, an election for Determining Party would be unnecessary. 19) AIS: Optional Early Termination We have based OET on the EUR EFS terms. We would like to know if there is a preference as to whether partial terminations should be denominated in terms of Number of Index Units, or as a proportion of the Equity Notional Amount (as we have done elsewhere in the AIS Annex). 20) Transaction Supplement Miscellaneous changes, in line with revisions to the GTC.

Definitions FPV: Futures Price Valuation GTC: General Terms Confirmation HD: Hedging Disruption ICOH: Increased Cost of Hedging MEIA: Multiple Exchange Index Annex OET: Optional Early Termination OSP: Official Settlement Price