UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN College of Commerce and Business Administration D E P A R T M E N T O F F I N A N C E

Finance 341 Assignment 6 Spring, 1999 Due: May 4, 1999 Maximum Number of Points: 10

(This assignment will be accepted for credit until the beginning of class on May 4, 1999.)

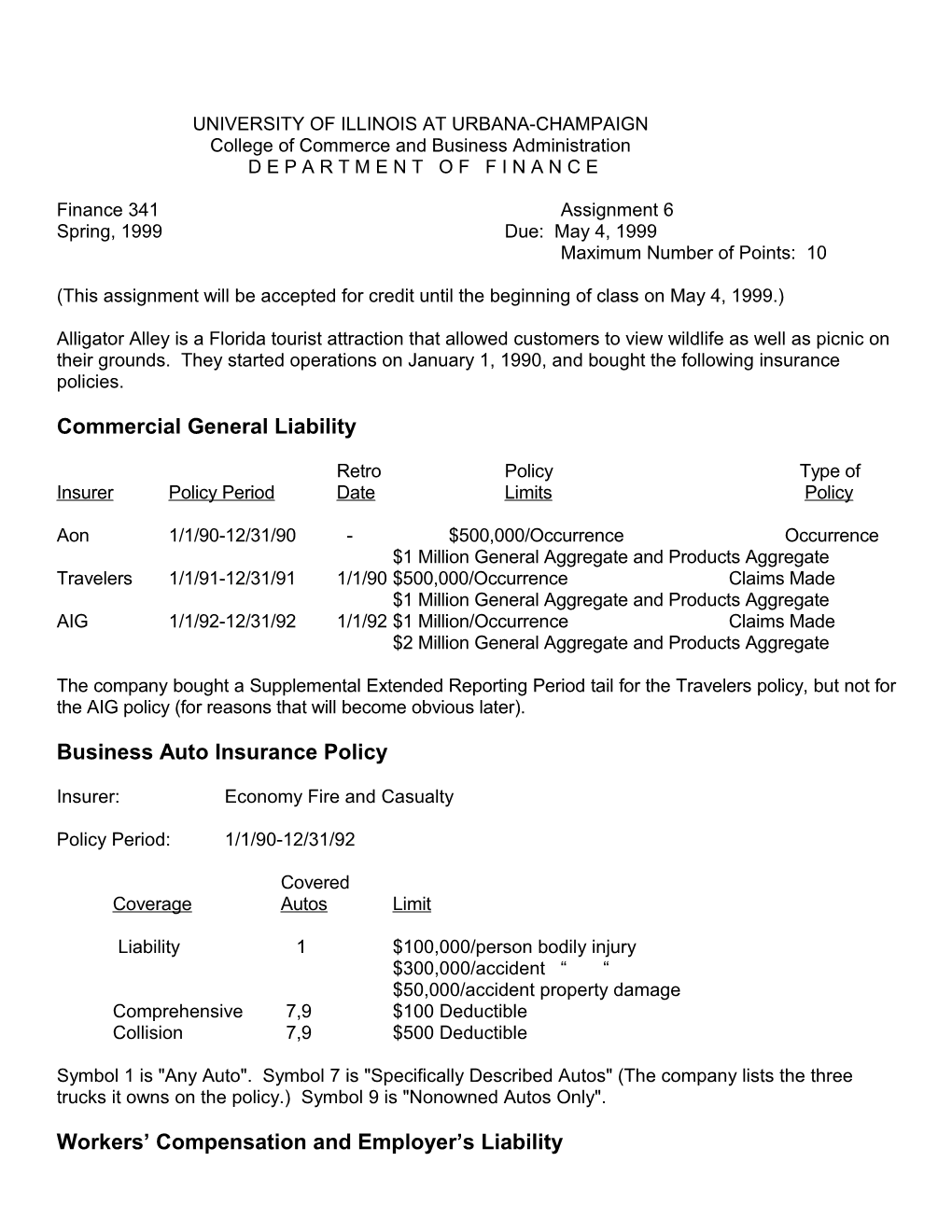

Alligator Alley is a Florida tourist attraction that allowed customers to view wildlife as well as picnic on their grounds. They started operations on January 1, 1990, and bought the following insurance policies.

Commercial General Liability

Retro Policy Type of Insurer Policy Period Date Limits Policy

Aon 1/1/90-12/31/90 - $500,000/Occurrence Occurrence $1 Million General Aggregate and Products Aggregate Travelers 1/1/91-12/31/91 1/1/90 $500,000/Occurrence Claims Made $1 Million General Aggregate and Products Aggregate AIG 1/1/92-12/31/92 1/1/92 $1 Million/Occurrence Claims Made $2 Million General Aggregate and Products Aggregate

The company bought a Supplemental Extended Reporting Period tail for the Travelers policy, but not for the AIG policy (for reasons that will become obvious later).

Business Auto Insurance Policy

Insurer: Economy Fire and Casualty

Policy Period: 1/1/90-12/31/92

Covered Coverage Autos Limit

Liability 1 $100,000/person bodily injury $300,000/accident “ “ $50,000/accident property damage Comprehensive 7,9 $100 Deductible Collision 7,9 $500 Deductible

Symbol 1 is "Any Auto". Symbol 7 is "Specifically Described Autos" (The company lists the three trucks it owns on the policy.) Symbol 9 is "Nonowned Autos Only".

Workers’ Compensation and Employer’s Liability Insurer: Liberty Mutual Policy Period: 1/1/90-12/31/92

Workers’ Compensation based on the laws of the state of: Florida (and any other applicable states) (assume Florida law covers 65% of wage losses)

Employer’s Liability Insurance:

Bodily Injury by Accident $100,000 each accident Bodily Injury by Disease $500,000 policy limit Bodily Injury by Disease $100,000 each employee

For each of the following incidents, indicate which, if any, of the above policies apply and how much each would pay. Assume the incidents all have occurred to this company, so, in some cases, the effect of prior claims has to be considered. In some cases, no policy applies; in others, more than one policy may apply.

1. On February 15, 1990, a child playing on a swing set in the picnic area fell off and broke her ankle. Her parents sued on her behalf and won an award of $50,000. The company provided notice about this loss on February 20, 1990. The court made its decision on July 8, 1993.

2. On March 20, 1990, one of the company’s employees was driving a company truck after picking up a new alligator that they had purchased. The alligator thrashed around in the back of the truck and startled the employee, who drove into a tree. The alligator then escaped from the truck. The accident caused $1800 in damage to the truck. The alligator made its way to a nearby farm and ate a prize cow, worth $150,000. The company is held liable for the loss of the cow. The company provided notice of this loss on March 21, 1990. The court award was determined on January 10, 1991.

3. On April 16, 1990, a drunk employee fell into an alligator pit while mowing the grass. The alligators chewed him up pretty badly. He incurred $250,000 in medical bills and missed three months of work. His salary was $2000 per month. The company provided notice about this loss on April 18, 1990.

4. On May 13, 1990, a customer was visiting Alligator Alley with her dog. She was having fun having her dog bark at the alligators to rile them up. While she was holding her dog over the fence, an employee lost his temper, grabbed the dog and flung him into the pit, where he was quickly disposed of by the alligators. The company fired the employee and apologized to the customer, but she still hired a lawyer and sued the company. She was awarded $5,000 for the loss of the dog, $200,000 for emotional distress and $1 million for punitive damages. The company provided notice about this loss on August 8, 1990. The court award was determined on October 19, 1995.

5. One of the company’s trucks had a loudspeaker system that was used to generate jungle sounds by playing CDs of animal noises. On September 15, 1990, someone broke into that truck and stole the company’s entire collection of jungle sound CDs, which had an actual cash value of $2000. It also cost $300 to repair the door lock that was broken. The company provided notice about this loss on October 18, 1990. 6. On January 12, 1991, one of the company’s employees developed a rare tropical illness that was diagnosed as being caused by contact with alligators. The employee had to be airlifted to a hospital in South America that specializes in treating this ailment. Fortunately, the employee made a complete recovery. The medical bills total $200,000 and the employee missed work for six months. Her salary was $2200 a month. The company provided notice about this loss on January 15, 1991.

7. On February 14, 1991, an employee driving his own car to work was involved in a serious accident with another car. The employee was injured and the driver of the other car was killed. Although it was hard to determine who was at fault, the jury decided to hold your employee liable and awarded the estate of the other driver $150,000. Your employee only carried $100,000 per accident per person bodily injury liability coverage. Your employee incurred $20,000 in medical bills and missed one month of work. His salary was $1500 per month. The company provided notice about this loss on April 18, 1991.

8. On April 29, 1991, a customer slipped and fell on a walkway near the alligator viewing area. The person seemed to be alright at the time, but on May 17, 1992, the company received notice that a suit had been filed for damages, alleging that the fall caused the customer permanent partial paralysis. The company promptly sent the notice to its insurer. On July 19, 1996, the court awarded the customer $150,000 to cover past and future medical expenses, $100,000 for loss of earnings, and $300,000 for pain and suffering.

9. On August 20, 1991, an employee was driving one of the company’s trucks to an alligator food supplier when he was involved in a collision with a cement truck. The cement truck incurred $5000 in damage. The company’s truck was a total loss. The actual cash value of the truck was $14,000, but it cost $37,000 to replace since it had to be specially designed to hold alligators. The employee was injured and incurred $5000 in medical bills. In addition, gasoline from the company’s truck spilled all over the roadway and into a nearby pond. It cost $20,000 to clean up the gasoline spill.

10. On September 2, 1991, a customer dropped his camera into the alligator pit. Since the camera was worth $2000, the customer decided to try to retrieve it. He asked a friend to distract the alligators while he climbed over the fence to get the camera. One alligator wasn’t fooled and grabbed the camera-retrieving customer for his dinner. The company immediately reported this loss to its insurer. The estate of the customer sued the company. On March 12, 1994, the company was found 60% liable for the death of the customer and the estate is awarded $120,000 in bodily injury damages (60% of the $200,000 the jury felt the damages equaled), but nothing for the camera.

11. The company had a local hauling company pick up its trash. On December 4, 1991, one of the employees of the trash hauler found that there was a small alligator in a trash can when he was emptying it. The alligator bit the employee. The employee incurred $20,000 in medical bills and $10,000 in lost wages. The employee collected Workers’ Compensation benefits from his employer’s insurer and then sued Alligator Alley for the damages as well. The company provided notice about this loss on March 18, 1992. On April 13, 1995, the court awarded the employee $200,000 in damages to cover his medical expenses, wage loss and pain and suffering. 12. On January 13, 1992, one of the company’s employees visited the company grounds for a picnic with his family. (The company provided free passes to employees if they want to use the facilities on their days off.) He decided to show off his bravery in front of his kids by feeding one of the alligators a peanut butter sandwich out of his hand. The alligator didn’t like the peanut butter as much as it liked the hand, so it tried to drag the employee into the pool. Fortunately, the employee was able to extricate himself, just in time to avoid drowning, but ended up losing several fingers. The company provided notice about this loss on January 18, 1992. The employee incurred $30,000 in medical bills and $20,000 in lost wages. He sued the company for negligence and, on August 23, 1996, won an award for the medical and wage loss and another $100,000 in pain and suffering. In addition, one of his children sued the company for the mental anguish of seeing his father mutilated by an alligator. The child won an award of $40,000 on September 15, 1996.

13. The owner of Alligator Alley flew to Chicago for a zoological conference and rented a car to visit the local zoos. She declined the extra insurance on the rental car, but the rental company automatically provided $20,000 per person bodily injury liability, $40,000 per accident bodily injury liability and $15,000 per accident property damage liability coverage. On March 10, 1992, while driving around Chicago, she ran into a van full of soccer players on their way to a game. The company provided notice about this loss on March 18, 1992. Six of the players were injured. Each of the six sued her and was awarded $50,000 on May 14, 1995. In addition, she is held liable for $18,000 damage to the van and $10,000 damage to the rental car. Finally, she was injured herself and incurred $2,000 in medical bills.

14. On April 14, 1992, the spouse of one of the company’s employees contracts the topical illness described in question 6. Evidently, she contracted it from contact with her husband’s clothing from work. The company provided notice about this loss on April 18, 1992. She was hospitalized and incurred $40,000 in medical bills. She filed a suit against the company and on July 10, 1996, won an award for her medical bills plus $100,000 in pain and suffering.

15. One of the company’s trucks broke down on May 28, 1992, and was taken to a garage for repairs. The garage provided the company with sports car so the employee who drove the truck in can return to Alligator Alley. While testing out how fast the sports car could go, the employee flipped the car and injures himself. It cost $13,000 to repair the sports car and the employee incurred $10,000 in medical bills and lost $3,000 in wages. The company provided notice about this loss on May 29, 1992. 16. On June 15, 1992, an employee of Alligator Alley was driving one of the company’s trucks with a trailer attached on business. When the truck hit a bump, the trailer detached and ran into the front window of a florist shop, causing extensive damage. The owner of the florist shop sued Alligator Alley and, on December 14, 1995, won an award of $62,500 for damage to the shop and its contents.

17. On August 24, 1992, Hurricane Andrew hit Florida, and Alligator Alley, causing extensive damage to the buildings and property, and injuring several employees. The three trucks were swept away by the tide and never found. The actual cash value of each was $14,000. The company provided notice about this loss on August 28, 1992.

18. During the storm, one employee was hit by flying debris while at work. She incurred $12,000 in medical bills and would have missed work for three months (her salary was $3000 a month), but Alligator Alley was closed, permanently, as a result of the storm. In addition, her spouse filed a claim against the company for loss of services since she was not able to help him repair their own house after the storm. A court awarded him $20,000 for this loss. The company provided notice about this loss on September 14, 1992.

19. Hurricane Andrew also broke the fencing around the alligator pits, freeing all the alligators. One alligator went into a nearby house that was also damaged by the storm. When the homeowners’ insurance adjuster came to examine the damage the storm caused to the house, the alligator scared him to death. On November 17, 1996, Alligator Alley was found liable for this death and the court awarded the estate of the adjuster $200,000. The company provided notice about this loss on October 18, 1992.

20. Another alligator escaped to the pond in a nearby housing complex. On November 14, 1992, this alligator attacked a resident and caused severe injuries. It took awhile before the former owner of the alligator was identified so the company did not provide notice about this claim until June 18, 1994. When the injured person learned that it belonged to Alligator Alley, he sued and was awarded $50,000 in bodily injury damages on March 5, 1997. Finance 341 Assignment 6 Answer Sheet

Name:______

1. 11.

2. 12.

3. 13.

4. 14.

5. 15.

6. 16.

7. 17.

8. 18.

9. 19.

10. 20.