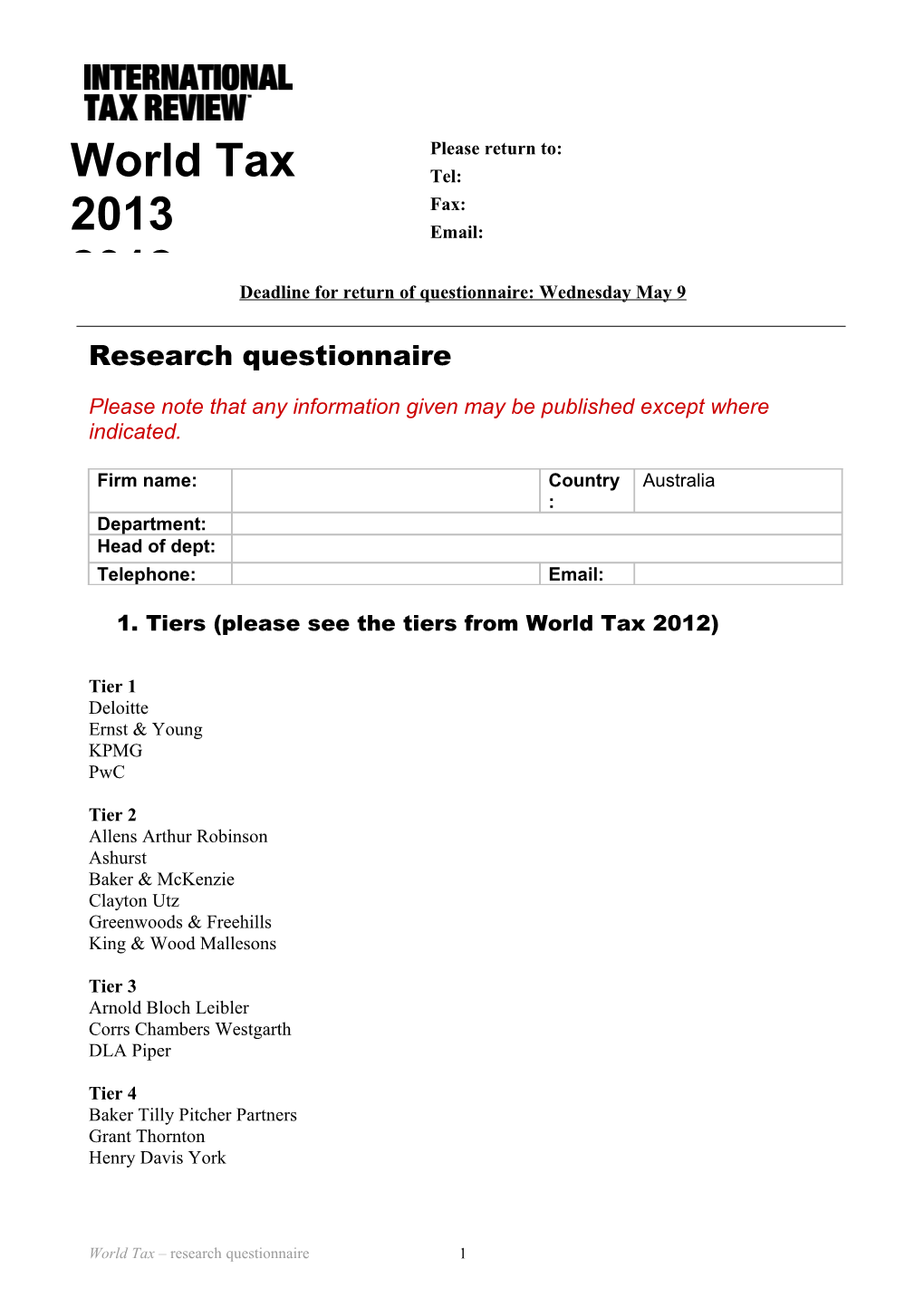

Please return to: World Tax Tel: Fax: 2013 Email:

2012 Deadline for return of questionnaire: Wednesday May 9

Research questionnaire

Please note that any information given may be published except where indicated.

Firm name: Country Australia : Department: Head of dept: Telephone: Email:

1. Tiers (please see the tiers from World Tax 2012)

Tier 1 Deloitte Ernst & Young KPMG PwC

Tier 2 Allens Arthur Robinson Ashurst Baker & McKenzie Clayton Utz Greenwoods & Freehills King & Wood Mallesons

Tier 3 Arnold Bloch Leibler Corrs Chambers Westgarth DLA Piper

Tier 4 Baker Tilly Pitcher Partners Grant Thornton Henry Davis York

World Tax – research questionnaire 1 TIER 1 – (strongest) - Which firm(s) should not be in Tier 1?......

TIER 2 - Which firm(s) should not be in Tier 2?......

TIER 3 - Which firm(s) should not be in Tier 3?......

TIER 4 – Which firms(s) should not be in Tier 4?

Are there any firms missing from the rankings? If so, which tier? Firm Tier 1. 2. 3.

Which firm(s) tax practice has noticeably declined over the past year?...... Why?…………………………………………………………………………………………

Which firm(s) tax practice has particularly improved over the past year?...... Why?......

World Tax – research questionnaire 2 Specialist areas - Recommend up to three individuals with specialist skills in the following areas (please do not include advisers from your own firm):

Corporate Tax Individual’s name Firm 1. 2. 3.

Tax controversy Individual’s name Firm/Chambers and litigatio n (includi ng barriste rs if applicab le) 1. 2. 3.

Transfer pricing Individual’s name Firm 1. 2. 3.

Capital markets Individual’s name Firm & financial products 1. 2. 3.

Cross-border Individual’s name Firm structuri ng 1. 2. 3.

M&A Individual’s name Firm 1. 2. 3.

Indirect Tax Individual’s name Firm 1. 2. 3.

World Tax – research questionnaire 3 2. Personnel

How many professionals are in your practice?

Partners Other fee earners

Indirect tax Transfer pricing Corporate tax Tax disputes

Please give the names and details of any tax partners who have joined your department since May 2011 (continue on a separate sheet if necessary).

Name From (position) Date hired

Please give the names and details of any tax professionals who have left your department since May 2011 (continue on a separate sheet if necessary).

Name To (position) Date left

3. Clients

Please give the name of five key tax clients that your firm has advised in the past two years (this information is for publication). Please also provide us with contact information for each of these clients (the contact information will NOT be published).

Company: Contact name: Position: Telephone: Email: World Tax – research questionnaire 4 OK to contact? [Y/N]

4. Recent work This information is for publication.

Please give the details of the most innovative transactions and other tax work (no more than three each for transfer pricing, corporate tax, transfer pricing and indirect tax) your tax practice has advised on since May 2011, which can be used for publication.

TRANSFER Deal 1 Deal 2 Deal 3 PRICING Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

World Tax – research questionnaire 5 CORPORATE Deal 1 Deal 2 Deal 3 TAX Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

INDIRECT TAX Deal 1 Deal 2 Deal 3 Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

World Tax – research questionnaire 6 TAX DISPUTES Deal 1 Deal 2 Deal 3 Brief description of matter:

Why was it innovative ?

Party/parties advised:

Tax professionals from your firm involved: Value (US$): Date completed:

5. Synopsis

Please give any other details of your tax practice which you would like us to take into consideration:

World Tax – research questionnaire 7 World Tax – research questionnaire 8