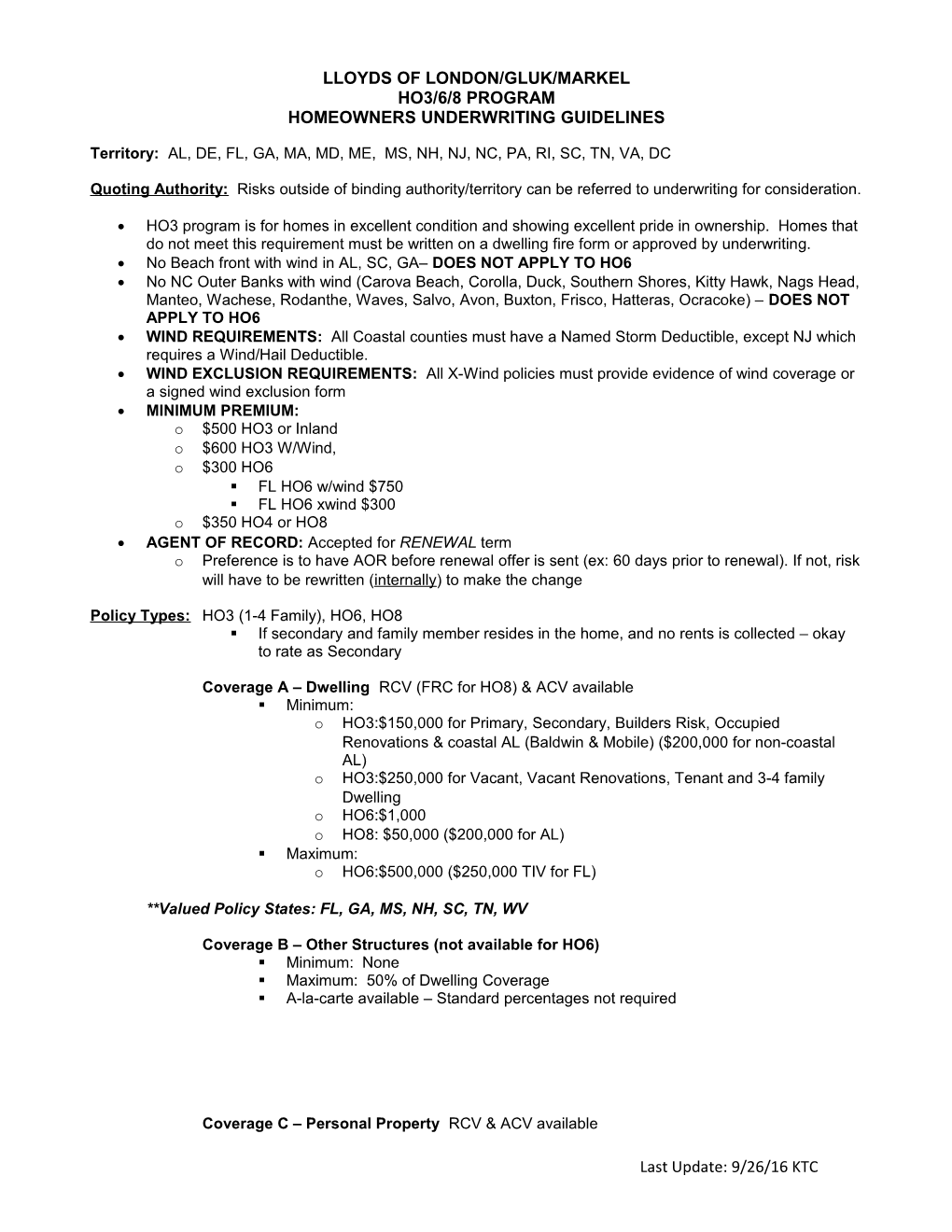

LLOYDS OF LONDON/GLUK/MARKEL HO3/6/8 PROGRAM HOMEOWNERS UNDERWRITING GUIDELINES

Territory: AL, DE, FL, GA, MA, MD, ME, MS, NH, NJ, NC, PA, RI, SC, TN, VA, DC

Quoting Authority: Risks outside of binding authority/territory can be referred to underwriting for consideration.

HO3 program is for homes in excellent condition and showing excellent pride in ownership. Homes that do not meet this requirement must be written on a dwelling fire form or approved by underwriting. No Beach front with wind in AL, SC, GA– DOES NOT APPLY TO HO6 No NC Outer Banks with wind (Carova Beach, Corolla, Duck, Southern Shores, Kitty Hawk, Nags Head, Manteo, Wachese, Rodanthe, Waves, Salvo, Avon, Buxton, Frisco, Hatteras, Ocracoke) – DOES NOT APPLY TO HO6 WIND REQUIREMENTS: All Coastal counties must have a Named Storm Deductible, except NJ which requires a Wind/Hail Deductible. WIND EXCLUSION REQUIREMENTS: All X-Wind policies must provide evidence of wind coverage or a signed wind exclusion form MINIMUM PREMIUM: o $500 HO3 or Inland o $600 HO3 W/Wind, o $300 HO6 . FL HO6 w/wind $750 . FL HO6 xwind $300 o $350 HO4 or HO8 AGENT OF RECORD: Accepted for RENEWAL term o Preference is to have AOR before renewal offer is sent (ex: 60 days prior to renewal). If not, risk will have to be rewritten (internally) to make the change

Policy Types: HO3 (1-4 Family), HO6, HO8 . If secondary and family member resides in the home, and no rents is collected – okay to rate as Secondary

Coverage A – Dwelling RCV (FRC for HO8) & ACV available . Minimum: o HO3:$150,000 for Primary, Secondary, Builders Risk, Occupied Renovations & coastal AL (Baldwin & Mobile) ($200,000 for non-coastal AL) o HO3:$250,000 for Vacant, Vacant Renovations, Tenant and 3-4 family Dwelling o HO6:$1,000 o HO8: $50,000 ($200,000 for AL) . Maximum: o HO6:$500,000 ($250,000 TIV for FL)

**Valued Policy States: FL, GA, MS, NH, SC, TN, WV

Coverage B – Other Structures (not available for HO6) . Minimum: None . Maximum: 50% of Dwelling Coverage . A-la-carte available – Standard percentages not required

Coverage C – Personal Property RCV & ACV available

Last Update: 9/26/16 KTC . Minimum: o HO3:None o HO6:$5,000 ($3,000 for VA) . Maximum: o HO3:70% of Dwelling Coverage o HO6:$250,000 . A-la-carte available – Standard percentage not required Coverage D – Loss of Use (Loss of Fair Rental Value for Tenant Occupied) . Minimum: None o Except for Alabama - $10,000 minimum required for Owner Occupied . Maximum: o HO3:40% of Dwelling Coverage o HO6:$100,000 . A-la-carte available – Standard percentages not required

Coverage E – Liability . Minimum: None . Maximum: $500,000 . Exception: $1,000,000 o With underwriter approval only. o Not available in all states. o Must have $500,000+ Dwelling o Homes with elevators and/or swimming pools are not eligible . Liability can be extended from a Primary dwelling to 1 location, up to a 4-Family dwelling o Photos (all sides of the home) and location address are required

Coverage F – Medical Payments To Others . Minimum: None . Maximum: $15,000

Optional: Loss Assessment . Minimum: o HO3:$1,000 (included) o HO6:$5,000 . Maximum: o HO3: $50,000 o HO6: $10,000

AOP – All Peril Deductible . Minimum: o $1,000 o $2,500 HO6 for FL with Wind o $1,000 HO6 for FL with HISCOX . Maximum: o $10,000

Last Update: 9/26/16 KTC Named Storm Deductible . AL (HO3) – 3% Baldwin, Mobile . AL (HO6) – Baldwin, Mobile (varies by distance to coast, see below) o Less than 5 miles from the coast – 5% o 5-10 miles from the coast – 3% o 10-25 miles from the coast – 2% o More than 25 miles from the coast - same as AOP . DE – 1% Kent, New Castle, Sussex . FL - 3% for the entire state regardless of distance to the coast o HO3, HO8 and HO6 Wind excluded in Broward, Miami-Dade, Palm Beach . GA - 1% Bryan, Camden, Chatham, Glynn, Liberty, McIntosh . MD – 1% Worcester . MS – o Tier 1 – Hancock, Harrison, Jackson . 1% Named Storm (not available 0-10 miles) . 2% Named Storm (standard 11 - 30 miles) . 3% Named Storm (standard 0 - 10 miles) o Tier 2 – Forrest, Greene, Lamar, Marion, Pearl River, Stone, Walthall (n/s only required on risks < 30 miles to the coast) . 1% Named Storm (not available 0-10 miles) . 2% Named Storm (standard) . NC – 2% Beaufort, Brunswick, Camden, Cateret, Chowan, Currituck, Dare, Hyde, Jones, New Hanover, Onslow, Pasquotank, Pender, Pamlico, Perquimans, Tyrell, & Washington . SC – 3% Beaufort, Charleston, Colleton, Georgetown, Horry . VA – 1% Accomack, Hampton, Newport News, Norfolk, Portsmouth, VA Beach

Wind/Hail Deductible . CT – 1% Fairfield, Middlesex, New Haven, New London Counties . MA – 1% Barnstable, Bristol, Dukes, Nantucket Counties o 1% within 2 miles of the coast for Essex and Plymouth Counties . ME- 1% Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, York Counties . NJ – 2% Atlantic, Cape May, Cumberland, Hudson, Monmouth, Middlesex, Ocean, Salem . NH – 1% Rockingham County . RI - 1% Bristol, Newport, Washington Counties

Optional: Mold – not available if risk has previous water damage history . Minimum: $5,000 . Maximum: $15,000

Optional: Water Sewer Back Up . Minimum: $5,000 . Maximum: $15,000

Optional: Personal Article/Scheduled Items & Personal Injury Info: . Items valued $5,000 or more will require a bill of sale and/or appraisal less than 3 years old . If the total value exceeds $50,000, a Central Station Alarm Burglar/Fire Alarm Certificate is required

Optional: Personal Injury . Not Available in New Jersey . Available for Primary homes only

Optional: HO6 Coverages . Flood (HO6 JJFL)

Last Update: 9/26/16 KTC Only available as follows; o States available; AL, CT, DE, FL, GA, ME, MD, MA, NH, NJ, NC, RI, SC, VT, VA o Risk within 1 mile to the coast: must be located on the second living floor or higher o Risk over 1 mile to the coast: can be on ground floor living area

. Earthquake HO6 – Automatic for all states and all occupancy types HO3, HO8 – can be purchased

. Sinkhole Automatic in FL ONLY for HO6 ONLY

Exclusions Available . Theft Exclusion . Water Exclusion

HO3/HO6/HO8 Occupancy: . Primary: o Must be occupied by the owner full time OR o Risk is a duplex and if named insured is occupying a portion of the residence due to the insured living on the premises and can over see the risk 100% of the time. . Secondary/Seasonal: o Occupied by the owner with 0-16 weeks rental exposure AND/OR WEEKEND rental is okay o If secondary and family member resides in the home and no rents are collected – okay to rate as Secondary . Tenant: o Occupied by a full-time tenant OR Seasonal tenant for more than 16 weeks o Tenant can not be sorority, fraternity, college students, half-way house residents, or specialized group living o Home must be inspected by insured, authorized representative or property management group every 2 weeks to confirm no loss exposure exists . Vacant: o Requires a 12 month policy term o If vacant for more than 1 year at new business underwriting approval is required o Utilities must be active with the exception of water to maintain climate control of the home o Home must be inspected (interior and exterior) by insured, authorized representative or property management group every 2 weeks to confirm no loss exposure exists o Maximum number of years vacant is 3 years, underwriting review will be required for alternate and proper risk placement o Vacant Home/Renovations Supplemental Questionnaire will be required at binding for review to confirm eligibility

. Occupied Renovation: o If home being demolished risk is NOT eligible o Home must be primary occupied o Requires a 12 month policy term

Last Update: 9/26/16 KTC o Renovations . If work is other than cosmetic a licensed contractor must be used. Contractor must carry a Commercial General Liability policy to exceed complete value of risk or a $1 million limit . If home is being elevated risk will NOT be covered during elevation as the General Liability policy in place will assume liability o Vacant Home/Renovations Supplemental Questionnaire will be required at binding for review to confirm eligibility . Vacant Renovation: o If home being demolished risk is NOT eligible o Requires a 12 month policy term o Maximum number of years vacant is 3 years, underwriting review will be required for alternate and proper risk placement o Renovations . If renovations are other than cosmetic, a licensed contractor with General Liability Coverage will be required at a limit to exceed the completed value of the risk or $1 million . If home is being elevated risk will NOT be covered during elevation as the General Liability policy in place will assume liability o Vacant Home/Renovations Supplemental Questionnaire will be required at binding for review to confirm eligibility . Builder’s Risk: o Requires a 12 month policy term o Work must be done by a licensed contractor with General Liability Coverage at limit to exceed completed value of risk or $1 million o Maximum number of years vacant is 3 years, underwriting review will be required for alternate and proper risk placement o Builder’s Risk Supplemental Questionnaire will be required within 30 days of binding for review to confirm eligibility . 3-4 Family Dwelling o Homeowner Associations or Condo Owners Associations may be written on the HO3 if in excellent condition o LLC/Corporation/Association Supplemental Questionnaire will be required at binding for review to confirm eligibility

Named Insured: . If home is owned by two people (ex: parents and child) but only one of the two people live in the home; we will write the risk and list the occupant as the named insured and list the other owner as an Additional Insured. . Estate Names and Trusts are acceptable . Insured in the name of a bank is not eligible . Construction companies as named insured ineligible; commercial coverage available through Special Risk Commercial department . LLC’s, HOA’s, COA’s – required LLC/HOA/COA Questionnaire Subject to fully completed LLC/Corporation/Association Questionnaire with approval from underwriting Must be for Individual use only, tax purposes, family protection, or as a personal investment. If in the name of an LLC, HOA, or COA is used for the individual’s sole income or any other business exposure the risk will require underwriting review A separate policy should be in place by the unit owner to cover contents

Named Insured Change by Endorsement: . Okay to process;

Last Update: 9/26/16 KTC If we are amending from family member to family member due to death and the deed list the other owner as the owner of the property we can process by endorsement; A new application including loss history will be required If we are amending the named insured into the “The Estate Of” due to a death we can process by endorsement; A new application including loss history will be required If the risk is currently written in the name of an LLC and the same members of the LLC are changing the name of the LLC we can process by endorsement

PC 9 ad PC10 . Requires approval from underwriting with a fully completed Protection Class Questionnaire at time of binding for review for eligibility . Properties without a responding fire department are not eligible with this program . Fire Department Requirements; o response time of 15 minutes or less o FD must have pumper trucks if risk is more than 1000 feet from hydrant and/or with alternate water source; if no pumper trucks the FD must have tanker trucks o Volunteer FD – ok if less than 15 minute response time (meaning arriving at the insured’s home within 15 minutes) or if home is alarmed . If Fire Department response time is 15+ minutes, vacant or isolated we will require o AOP $1,000 o Central Station Fire Alarm and/or Interior Sprinkler System Trampoline: . All policies contain trampoline exclusion (UTS 315s)

Swimming Pools: . Coverage is available for all occupancy types . Diving boards are acceptable with a maximum liability limit of $500,000 . All swimming pools must be fully fenced with a lockable gate. Please submit to underwriting if HOA or community does not allow fences on the property . Swimming Pool Exclusion form will be applied to any risk with a drained pool or unfenced pool

Acreage/Farming: . 6-25 acres; surcharge . 25+ acres requires underwriting approval . Farming Exposure o If for profit; details will be required for underwriting review . Rental of land or boarding of animals; details will be required for underwriting review

Business On Premises:

. Must be approved by underwriting o Provide type of business . Day care; provide number of children and advise if General Liability policy in place . Does business yield a product?; provide details o Location of business personal property o Any foot traffic on property; provide details o Is property commercially zoned? . Please note, coverage for customers with business on property may leave gaps in coverage; consult commercial department for alternative placement

Year Built & Updates:

Last Update: 9/26/16 KTC . Any age home with updates is eligible . Homes built in 1950 or earlier are subject to being endorsed with a Modified Functional Replacement Cost (FRC) and may not be eligible for Extended Replacement Cost (this is to be used as an underwriting tool as needed) o This is subject to underwriting discretion; . Condition and upkeep of home . Home being insured to value . Updates are required as follows: o Plumbing, Electrical, Heating: . Ineligible Polybutelene plumbing or fittings Aluminum wiring Knob and Tube wiring Fuses . Alternate heat source must be approved . Partial Wiring, Plumbing, Heating updates within 40 years; if not updated underwriting review will be required

o Roof: . Complete replacement within 20 years . Age requirements do not apply to slate, tile, or tin roofs, if properly sealed. . Tar paper rolled, plywood boards and stapled roofs are unacceptable regardless of age. . Flat Roofs require underwriting approval with minimum $2,500 water deductible. May not be available in all states. . Roof must be in excellent condition to qualify for HO3; if older than 20 years the ACV roof endorsement will apply. . Inspection will be ordered to confirm roof condition. If in poor condition, coverage may be canceled or limited

Construction Type - Interior & Exterior: Exterior: . NOT ELIGIBLE o Manufactured/Modular/Mobile Homes (**See Scottsdale for eligibility) o Underground or Earth Homes o Yurts o Balloon Construction o EIFS (Exterior Insulated Finish System; aka:Synthetic Stucco)

. SUBMIT FOR UNDERWRITING APPROVAL o Fiberglass Homes o Homes made of unconventional materials or unusual construction, design and/or not originally intended as a dwelling o Converted Structures o Solar Heated Homes

. ELIGIBLE o Homes built on stilts o Asbestos Siding –Pollution Liability Exclusion applies o Log Homes; requires minimum $2500 AOP deductible

Interior: . NOT ELIGIBLE o Polybutelene Plumbing

Last Update: 9/26/16 KTC o Fuses o Aluminum, Knob & Tube Wiring o Circuit Breakers with less than 100 amp o Primary heat source of kerosene heater, space heater, wood stove or fire place are not eligible . If primary heat source is not central heat/ air, unit must be thermostatically controlled and approved by underwriting . Operational Heating is required on all homes – portable units not acceptable

. SUBMIT FOR UNDERWRITING APPROVAL o Wood Burning Stove . Must be professionally installed, maintained to manufacturer’s recommendations . Must meet all codes, and used as a secondary heating source . Stove must have own lined masonry chimney and be at least 2 feet from any combustible wall . If manufacturer specifications allow for shorter clearances, supporting documentation is required o Alternate Heat Source Supplemental Questionnaire – will be required at binding to confirm eligibility. . If age of unit is over 20 years an inspection may be required

. If the installation was not inspected and installed by the insured we will require an inspection of the unit

. If surrounding wall distance is less than 36” risk is ineligible

. Must be cleaned annually

Mortgage Companies: . Risks with more than two mortgages are not acceptable . Prior forced place coverage must be disclosed . Mortgagee must not be an individual unless approved by management . Mortgagees on Condo Associations or 3-4 family dwellings must be for the Association, not for the individual unit owner

Additional Insured or Additional Interest: . Named insured’s are the only ones that have a right to request a policy to be endorsed and/or cancelled . Additional Insured has ownership in the home for coverage A & B but cannot request the policy to be endorsed and/or cancelled. . Additional Interest does not have ownership in the home, cannot request the policy to be endorsed and/or cancelled and only receives notifications of intent to cancel or non-renew or the declaration page for new business, renewals and endorsements.

Insurance-to-Value: . Home must be insured to 100% of value . 80% co-insurance penalty applies to all policies . Valued Policy States: FL, GA, MS, NH, SC, TN, WV

Arson or Fraud: . An applicant with a prior arson or fraud charge or conviction is unacceptable

Last Update: 9/26/16 KTC . If arson was committed by someone other than the insured, it must be submitted to underwriting for quoting

Bankruptcy/Foreclosure/Judgment/Lien: . Bankruptcy must be discharged – Must be submitted to underwriting for quoting . Homes in foreclosure or in immanent foreclosure are not acceptable . Judgment/Lien – must be disclosed and details provided for underwriting review . New purchase of home which was in foreclosure must be disclosed and subject to further questioning regarding condition of the home. May not be eligible for HO3 but could be written on a dwelling form

Lapse In Coverage/Force Placed Coverage: . Requires underwriting approval; details required . EDE (Existing Damage Exclusion) form applies

Animals/Pets: . All policies are issued with an animal liability exclusion . Animal Liability Buy Back coverage is available (on Primary, owner-occupied homes only), when the following exposures do not exist. o Farm Animals or Exotic Pets o Akita o Pitt Bull Terrier o Chow Chow o Doberman Pinscher o Rottweiler o Staffordshire Terrier o Bull Mastiff o Huskie o Alaskan Malamutes o Great Dane o St. Bernard o Rhodesian Ridgeback o Any Cross-breed of the above o Any wolf breed or hybrid

Claims: . All risks with claim history must be approved by underwriting prior to binding . Open Claims not eligible . Claims with a $0 pay out, must be disclosed . Property Damage claims: Past 3 years . Claims arising out of negligence: Past 5 years . Online Quoting Available if 1 claim, less than $5,000 pay out. . Please Submit: o 1 Claim with a $5,000+ pay out o More than 1 claim of any pay out amount

Property Inspections – not requested on HO6 . Homes written on an HO3 should show excellent maintenance and excellent pride in ownership; if inspection shows otherwise coverage may be moved to a dwelling form or cancelled . No photos required from agent at time of binding

Last Update: 9/26/16 KTC . Satisfactory inspection required for all new business within 60 days of the inception date, which will be ordered by Johnson & Johnson . Satisfactory inspection required every 4th renewal term . Exterior Only Inspections: Properties valued less than $1,000,000 . Exterior & Interior Inspections with cost value estimator: Properties valued $1,000,000+ . All inspections require photos with hazard identification o Post-Inspection Underwriting by Johnson & Johnson will take place to address any and all areas of concern identified by the inspection. These include: . Replacement Cost Adjustment . Hazard Mitigation . Rating Discrepancies

Common Inspection Recommendations: Inspections are subjective and are not limited to the following. Inspection recommendations must be completed within 30 days, or policy may be subject to a change in coverage or cancellation Handrails: Any set of steps that requires 4+ steps to climb (landing included as the top step), must have handrails to prevent a fall hazard. Underwriting will also consider the width of the steps to determine if an exception can be made. Also, If the city or county codes or ordinance does not require the handrails, the retail agent may inform underwriting, which will be taken into consideration Railings: Any porch which is 3+ feet above the ground requires a railing to prevent a fall hazard. If the city or county code or ordinance does not require railings around a raised porch, the retail agent may inform underwriting, which will be taken into consideration Pools: Must be fenced with a lockable gate, unless community does not allow fencing Debris: Must be removed to prevent a fall hazard Exposed Wiring: Must be secured Open Foundation: Must be closed Roof: Must be in good condition – no missing or curling shingles Roof Fascia: must be in good condition Business on Premises – If found, risk may not be eligible for liability Other structures: must be in good condition Abandoned Vehicles: must be removed from property Trampolines: If the policy does not have a Trampoline Excl Endt, the trampoline will be asked to be removed.

Last Update: 9/26/16 KTC