MODULE DESCRIPTION FORM

1. Module Code: 2. Module Title: Corporate Taxation 3. Level: 6 Semester: 2/ 3 Credits: 15 4. First year of presentation: 2010 Administering Faculty: Law 5. Pre-requisite: Advanced Research Methods Co-requisite modules: None Excluded combinations: None

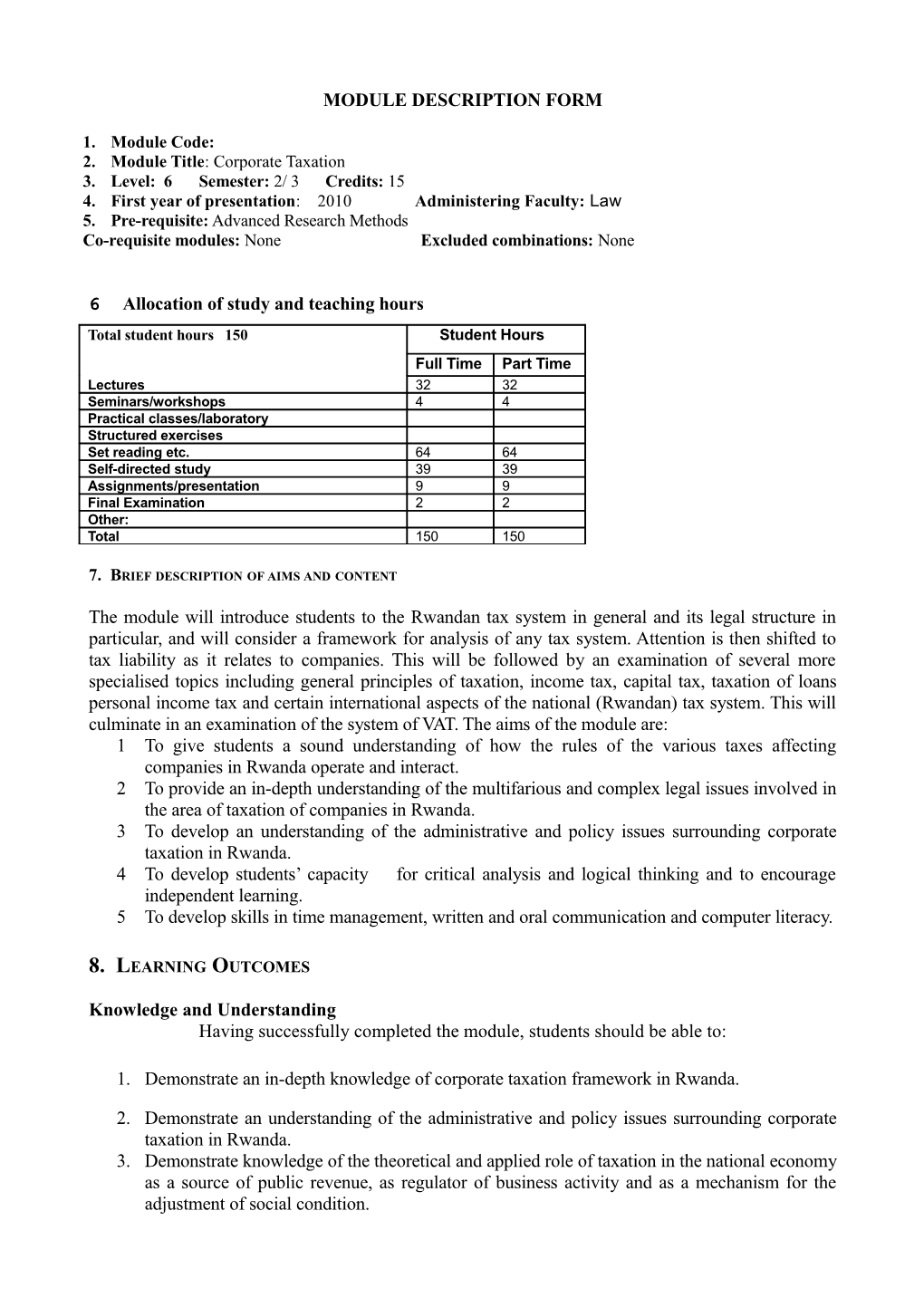

6 Allocation of study and teaching hours Total student hours 150 Student Hours Full Time Part Time Lectures 32 32 Seminars/workshops 4 4 Practical classes/laboratory Structured exercises Set reading etc. 64 64 Self-directed study 39 39 Assignments/presentation 9 9 Final Examination 2 2 Other: Total 150 150

7. BRIEF DESCRIPTION OF AIMS AND CONTENT

The module will introduce students to the Rwandan tax system in general and its legal structure in particular, and will consider a framework for analysis of any tax system. Attention is then shifted to tax liability as it relates to companies. This will be followed by an examination of several more specialised topics including general principles of taxation, income tax, capital tax, taxation of loans personal income tax and certain international aspects of the national (Rwandan) tax system. This will culminate in an examination of the system of VAT. The aims of the module are: 1 To give students a sound understanding of how the rules of the various taxes affecting companies in Rwanda operate and interact. 2 To provide an in-depth understanding of the multifarious and complex legal issues involved in the area of taxation of companies in Rwanda. 3 To develop an understanding of the administrative and policy issues surrounding corporate taxation in Rwanda. 4 To develop students’ capacity for critical analysis and logical thinking and to encourage independent learning. 5 To develop skills in time management, written and oral communication and computer literacy.

8. LEARNING OUTCOMES

Knowledge and Understanding Having successfully completed the module, students should be able to:

1. Demonstrate an in-depth knowledge of corporate taxation framework in Rwanda.

2. Demonstrate an understanding of the administrative and policy issues surrounding corporate taxation in Rwanda. 3. Demonstrate knowledge of the theoretical and applied role of taxation in the national economy as a source of public revenue, as regulator of business activity and as a mechanism for the adjustment of social condition. Cognitive/Intellectual skill /Application of Knowledge Having successfully completed the module, students should be able to: 4. Compare the different basis of the assessment of company tax, analyse the effect of such taxes upon corporate savings and investment, capital structures and distribution, and explain the interaction between corporate and personal taxes. 5. Evaluate corporate tax legislation, its impact upon shareholders, companies and the economy, as well as consider questions of equity and efficiency of corporate income tax. 6. Evaluate the existing body of corporate taxation knowledge and recognise areas of controversy.

Communication/ICT/Numeracy/Analytic Techniques/Practical Skills Having successfully completed the module, students should be able to:

7. Advice companies on issues which relate to Rwandan tax law. 8. Research and analyse current legal issues relating to corporate taxation. 9. Research legal information on corporate taxation from a number of paper and electronic sources.

General transferable skills Having successfully completed the module, students should be able to:

10. Be competent in analysis of complex materials drown from a number of academic disciplines. 11. Present complex legal issues in writing. 12. Demonstrate improved ability to present arguments orally. 13. Be able to contribute as part of a team in researching legal problems. 14. Utilise information technology for legal writing and research. 15. Work independently

9. INDICATIVE CONTENT

- General principles of taxation - Theories of taxation - Income tax - Capital tax - Personal income tax - Taxation of groups of companies - Foreign: domicile and residence-Relevance to Rwanda’s taxation - Tax `avoidance - Stamp duty - VAT - Administration and enforcement - Proposals for reform

LEARNING AND TEACHING STRATEGY

The traditional method will be used: structured lectures, interactive seminars, group discussions, group activities, presentations, directed reading/research, case studies, coursework. 10. ASSESSMENT STRATEGY

The module will be assessed by one research essay of about 2000 words on a topic related to the module, coursework, and a 2-hour written exam containing essays and problematic scenarios will be taken at the end of the semester session, although other forms of assessment may be used.

11. Assessment Pattern

Component Weighting (%) Learning objectives covered Formative: essay 40 1,2,3,4,5,8,12 Summative: 2-hour exam 60 1,2,3,4,5

13. STRATEGY FOR FEEDBACK AND STUDENT SUPPORT DURING MODULE

Structured exercises and oral presentations Discussing cases during lectures A seminar component in the teaching Revision sessions in seminar classes on key areas of exam preparation Written work per module which will be marked and detailed comments provided by tutor Students will have access to tutor in relation to the module

14. INDICATIVE RESOURCES Text (include number in library or URL) (Inc ISBN) James. S., and Nobles, C., The Economics of Taxation. Prince Hall. ISBN: 97 8027 3646303 Foulks, L., Business Taxation. Kaplan Publishers ISBN: 0748345167

These textbooks will be supplemented by other texts that will be provided along with detailed module outline.

Journals

Journal of Business Law References to other journals will be provided along with detailed course summary.

Key websites and on-line resources www.amategeko.net www.primature.gov.rw www.primature.gov.rw/journal/archives.htm In addition to the above students will be directed to specialist sites

Teaching/Technical Assistance The module team will conduct seminars and will be available for individual help Students will receive handouts and useful links to wed-base resources

Laboratory space and equipment

Computer requirements

For easy internet research, computers will be allocated.

Others

13: Please add anything else you think is important

14: Teaching Team

Prof. Deo Mbonyinkebe Odeth Uwineza Innocent Musonera Aimable Havugiyaremye