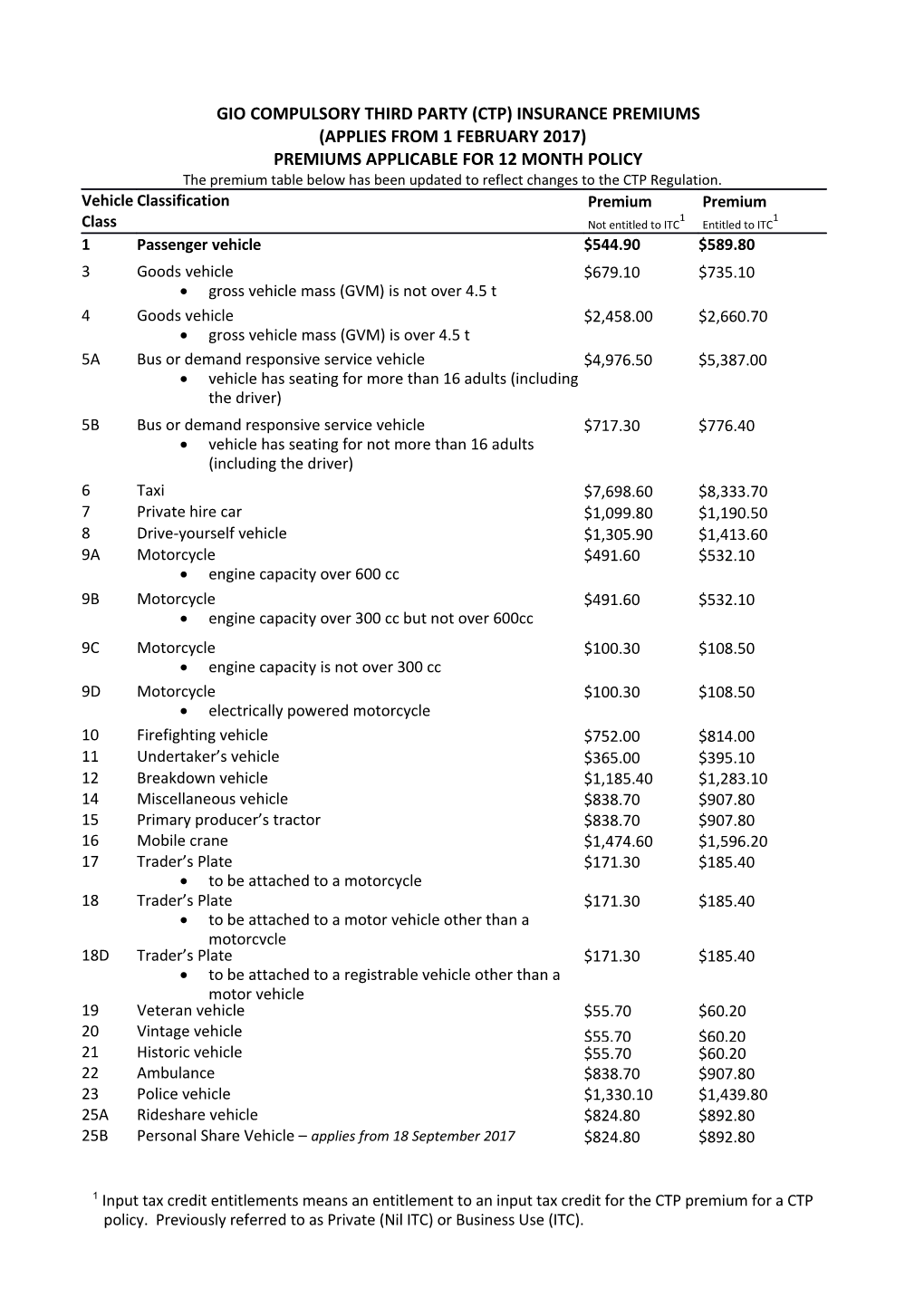

GIO COMPULSORY THIRD PARTY (CTP) INSURANCE PREMIUMS (APPLIES FROM 1 FEBRUARY 2017) PREMIUMS APPLICABLE FOR 12 MONTH POLICY The premium table below has been updated to reflect changes to the CTP Regulation. Vehicle Classification Premium Premium 1 1 Class Not entitled to ITC Entitled to ITC 1 Passenger vehicle $544.90 $589.80 3 Goods vehicle $679.10 $735.10 gross vehicle mass (GVM) is not over 4.5 t 4 Goods vehicle $2,458.00 $2,660.70 gross vehicle mass (GVM) is over 4.5 t 5A Bus or demand responsive service vehicle $4,976.50 $5,387.00 vehicle has seating for more than 16 adults (including the driver) 5B Bus or demand responsive service vehicle $717.30 $776.40 vehicle has seating for not more than 16 adults (including the driver) 6 Taxi $7,698.60 $8,333.70 7 Private hire car $1,099.80 $1,190.50 8 Drive-yourself vehicle $1,305.90 $1,413.60 9A Motorcycle $491.60 $532.10 engine capacity over 600 cc 9B Motorcycle $491.60 $532.10 engine capacity over 300 cc but not over 600cc 9C Motorcycle $100.30 $108.50 engine capacity is not over 300 cc 9D Motorcycle $100.30 $108.50 electrically powered motorcycle 10 Firefighting vehicle $752.00 $814.00 11 Undertaker’s vehicle $365.00 $395.10 12 Breakdown vehicle $1,185.40 $1,283.10 14 Miscellaneous vehicle $838.70 $907.80 15 Primary producer’s tractor $838.70 $907.80 16 Mobile crane $1,474.60 $1,596.20 17 Trader’s Plate $171.30 $185.40 to be attached to a motorcycle 18 Trader’s Plate $171.30 $185.40 to be attached to a motor vehicle other than a motorcycle 18D Trader’s Plate $171.30 $185.40 to be attached to a registrable vehicle other than a motor vehicle 19 Veteran vehicle $55.70 $60.20 20 Vintage vehicle $55.70 $60.20 21 Historic vehicle $55.70 $60.20 22 Ambulance $838.70 $907.80 23 Police vehicle $1,330.10 $1,439.80 25A Rideshare vehicle $824.80 $892.80 25B Personal Share Vehicle – applies from 18 September 2017 $824.80 $892.80

1 Input tax credit entitlements means an entitlement to an input tax credit for the CTP premium for a CTP policy. Previously referred to as Private (Nil ITC) or Business Use (ITC).