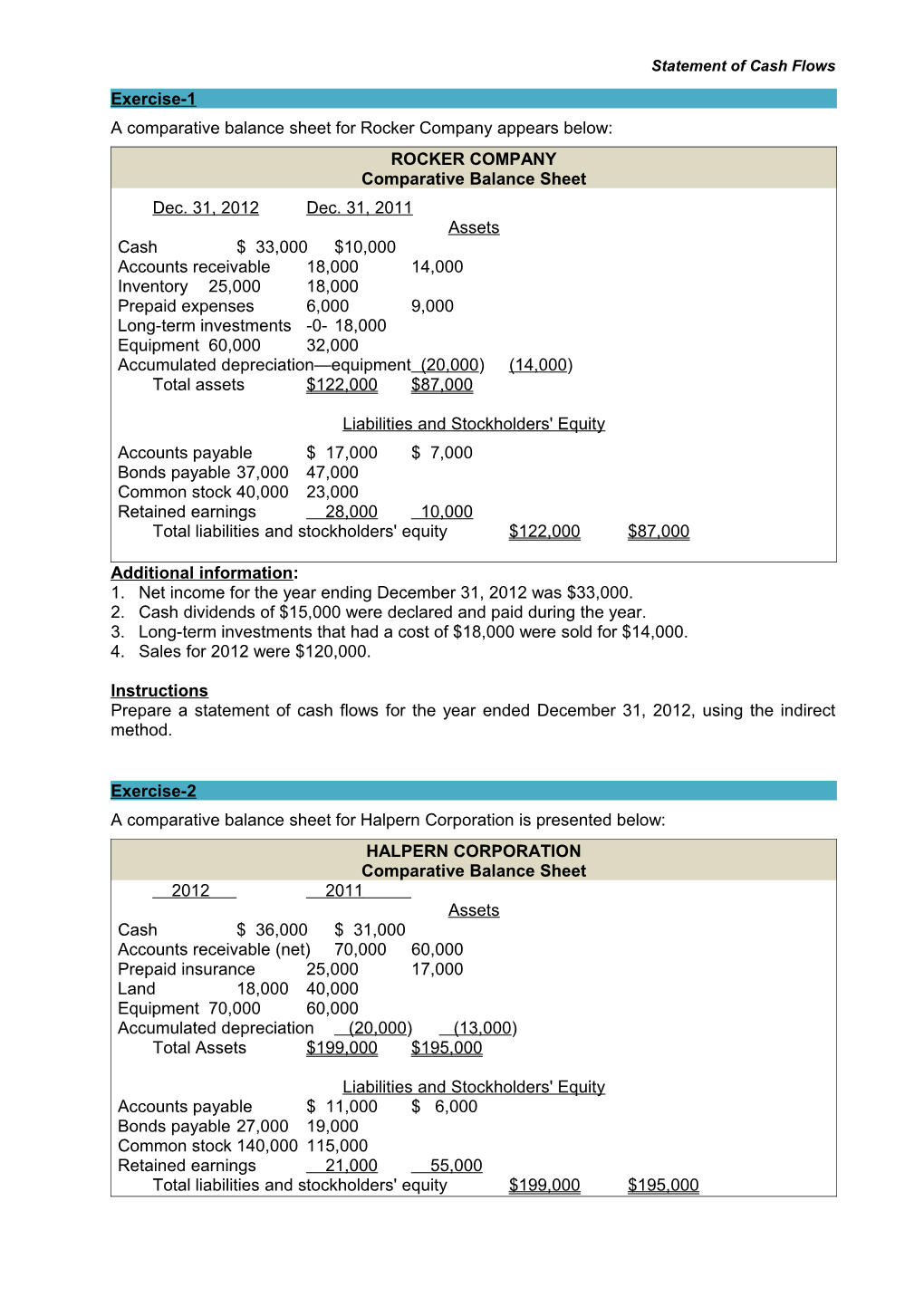

Statement of Cash Flows Exercise-1 A comparative balance sheet for Rocker Company appears below: ROCKER COMPANY Comparative Balance Sheet Dec. 31, 2012 Dec. 31, 2011 Assets Cash $ 33,000 $10,000 Accounts receivable 18,000 14,000 Inventory 25,000 18,000 Prepaid expenses 6,000 9,000 Long-term investments -0- 18,000 Equipment 60,000 32,000 Accumulated depreciation—equipment (20,000) (14,000) Total assets $122,000 $87,000

Liabilities and Stockholders' Equity Accounts payable $ 17,000 $ 7,000 Bonds payable 37,000 47,000 Common stock 40,000 23,000 Retained earnings 28,000 10,000 Total liabilities and stockholders' equity $122,000 $87,000

Additional information: 1. Net income for the year ending December 31, 2012 was $33,000. 2. Cash dividends of $15,000 were declared and paid during the year. 3. Long-term investments that had a cost of $18,000 were sold for $14,000. 4. Sales for 2012 were $120,000.

Instructions Prepare a statement of cash flows for the year ended December 31, 2012, using the indirect method.

Exercise-2 A comparative balance sheet for Halpern Corporation is presented below: HALPERN CORPORATION Comparative Balance Sheet 2012 2011 Assets Cash $ 36,000 $ 31,000 Accounts receivable (net) 70,000 60,000 Prepaid insurance 25,000 17,000 Land 18,000 40,000 Equipment 70,000 60,000 Accumulated depreciation (20,000) (13,000) Total Assets $199,000 $195,000

Liabilities and Stockholders' Equity Accounts payable $ 11,000 $ 6,000 Bonds payable 27,000 19,000 Common stock 140,000 115,000 Retained earnings 21,000 55,000 Total liabilities and stockholders' equity $199,000 $195,000 Statement of Cash Flows Additional information: 1. Net loss for 2012 is $20,000. 2. Cash dividends of $14,000 were declared and paid in 2012. 3. Land was sold for cash at a loss of $4,000. This was the only land transaction during the year. 4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash. 5. $22,000 of bonds were retired during the year at carrying (book) value. 6. Equipment was acquired for common stock. The fair value of the stock at the time of the exchange was $25,000.

Instructions Prepare a statement of cash flows for the year ended 2012, using the indirect method.

Exercise-3 The following information is available for Modre Corporation for the year ended December 31, 2012:

Collection of principal on long-term loan to a supplier $15,000 Acquisition of equipment for cash 10,000 Proceeds from the sale of long-term investment at book value 22,000 Issuance of common stock for cash 25,000 Depreciation expense 30,000 Redemption of bonds payable at carrying (book) value 34,000 Payment of cash dividends 14,000 Net income 20,000 Purchase of land by issuing bonds payable 40,000

In addition, the following information is available from the comparative balance sheet for Modre at the end of 2011 and 2012:

2012 2011 Cash $ 67,000 $14,000 Accounts receivable (net) 20,000 15,000 Prepaid insurance 17,000 13,000 Total current assets $104,000 $42,000

Accounts payable $ 30,000 $19,000 Salaries payable 4,000 7,000 Total current liabilities $ 34,000 $26,000

Instructions Prepare Modre's statement of cash flows for the year ended December 31, 2012 using the indirect method. Statement of Cash Flows Exercise4 Towson Company prepared the tabulation below at December 31, 2012. Net Income $340,000 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense, $43,000 Increase in accounts receivable, $50,000 Decrease in inventory, $13,000 Amortization of patent, $4,000 Increase in accounts payable, $5,600 Decrease in interest receivable, $7,000 Increase in prepaid expenses, $6,000 Decrease in income taxes payable, $1,500 Gain on sale of land, $5,000 Net cash provided (used) by operating activities Instructions Show how each item should be reported in the statement of cash flows. Use parentheses for deductions.

Exercise-5 The current sections of Marie Inc.'s balance sheets at December 31, 2011 and 2012, are presented here. Marie's net income for 2012 was $200,000. Depreciation expense was $24,000. 2012 2011 Current assets Cash $115,000 $99,000 Accounts receivable 105,000 89,000 Inventory 153,000 172,000 Prepaid expense 27,000 22,000 Total current assets $400,000 $382,000 Current liabilities Accrued expenses payable $ 15,000 $ 5,000 Accounts payable 85,000 92,000 Total current liabilities $100,000 $ 97,000

Instructions Prepare the net cash provided by operating activities section of the company's statement of cash flows for the year ended December 31, 2012, using the indirect method.