Financial Reporting and Analysis Chapter 3 Solutions Additional Topics in Income Determination Exercises

Exercises E3-1. Long-term construction contract accounting Requirement 1: Under the completed-contract method, revenue is recognized when the contract is complete. However expected losses are recognized immediately in their entirety. Since Project 2 is estimated to have a $20,000 loss ($300,000 - $280,000 - $40,000 = $20,000 loss), this loss would be recognized in 2008. Requirement 2: For Project 1, $240,000 of the total costs of $360,000 has been incurred, or 2/3 of the total costs. The contract price of $420,000 less estimated costs of $360,000 gives an estimated profit of $60,000. Current profit from Project 1 is then 2/3 times $60,000, or $40,000. Project 2 estimates a $20,000 loss ($300,000 - $280,000 - $40,000) which is recognized immediately. Adding these amounts the total gross profit would be $20,000 ($40,000 - $20,000 = $20,000).

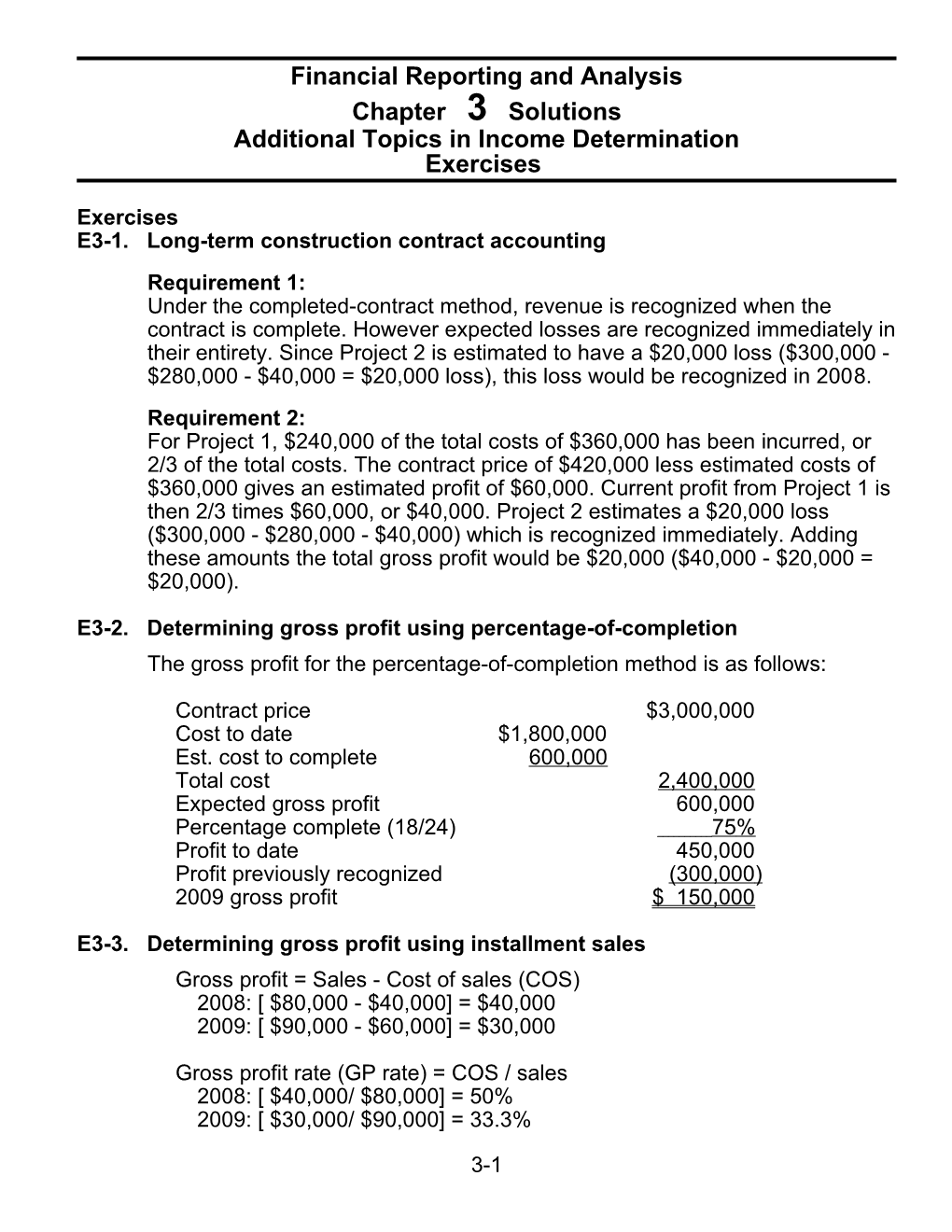

E3-2. Determining gross profit using percentage-of-completion The gross profit for the percentage-of-completion method is as follows:

Contract price $3,000,000 Cost to date $1,800,000 Est. cost to complete 600,000 Total cost 2,400,000 Expected gross profit 600,000 Percentage complete (18/24) 75 % Profit to date 450,000 Profit previously recognized (300,000 ) 2009 gross profit $ 150,000

E3-3. Determining gross profit using installment sales Gross profit = Sales - Cost of sales (COS) 2008: [ $80,000 - $40,000] = $40,000 2009: [ $90,000 - $60,000] = $30,000

Gross profit rate (GP rate) = COS / sales 2008: [ $40,000/ $80,000] = 50% 2009: [ $30,000/ $90,000] = 33.3%

3-1 2008 Deferred gross profit: Deferred gross profit = GP rate x Accounts Receivable (AR) on 2008 sales @12/31/2008 50% x $60,000 = $30,000 Deferred gross profit on 2008 balance sheet

2009 Deferred gross profit: Deferred gross profit = 2008 GP rate x AR on 2008 sales @ 12/31/2009 50% x $30,000 = $15,000

Deferred gross profit = 2009 GP rate x AR on 2009 sales @ 12/31/2009 33.3% x $69,000 = $23,000

Total deferred gross profit to be reported = $38,000 on 12/31/2009 [$15,000 + $23,000].

E3-4. Determining deferred gross profit using the installment sales method

The total deferred gross profit equals the deferred gross profit from 2007 sales plus the deferred gross profit from 2008 sales.

200 8 200 7 Sales $900,000 $600,000 Collections 2007 sales (300,000) 2008 sales (300,000) Written off 2007 (200,000 ) 2008 (50,000 ) 550,000 100,000 Gross profit % x 40 % x 30 % Deferred gross profit $220,000 $ 30,000

Total deferred gross profit = $30,000 + $220,000 = $250,000.

3-2 E3-5. Determining realized gross profit using the installment method

Sales price of plant $ 1,500,000 Book value of plant (1,000,000) Gross margin on sale $ 500,000

Gross margin rate=$500,000/$1,500,000=33%

Cash collected in 2008:

Down payment on 1/2/08 $ 300,000 Installment payment 12/31/08 300,000 600,000 x 33% Gross profit in 2008 (rounded) $ 200,000

E3-6. Determining installment accounts receivable

The installment sales receivable balance is computed below.

2008 2009 Installment sales ($300,000/.3) = $1,000,000 ($440,000/.4) = $1,100,000 Percentage of gross profit 0% ($300,000 - $120,000)/$300,000 = 60% recognized Decrease in installment 60% x $1,000,000 = $600,000 accounts receivable Remaining 2008 installment $1,000,000 - $600,000 = $400,000 sales receivable 2009 Ending installment $1,000,000 $1,100,000 sales receivable balance + 400,000 $1,500,000

E3-7. Determining realized gross profit on installment sales (AICPA adapted)

The cash collections and realized gross profit amounts are computed below.

Installment sales $280,000/.4 = $700,000 Cash collections $700,000 - $400,000 = $300,000 Gross profit percentage 40% Amount of gross profit to be recognized 40% x $300,000 = $120,000

3-3 E3-8. Determining deferred franchise fee revenue

Revenue from franchise sales is recognized when all material obligations of the franchisor have been substantially performed. The $60,000 down payment is revenue, because it is nonrefundable. The remaining payments are shown as unearned at their present value of $72,000.

E3-9. Determining revenue recognized with advanced fees

Revenue is recognized evenly over the contract year as it is earned at $45 per month = $540/12 months (when services are performed) and realized (cash collected) or realizable (accounts receivable).

E3-10. Determining deferred service contract revenue

When service contracts are sold, the entire proceeds are reported as deferred revenue. Revenue is recognized, and deferral reduced as the service is performed. Since repairs are made evenly (July 1 is average date) only 1/2 of the 40% of repairs will be in 2008.

2008 deferral ($600 x 1,000) $600,000 Earned in 2008 ($600,000 x 40% x 1/2) (120,000) Deferral 12-31-2008 $480,000

E3-11. Determining accounts receivable and deferred gross profit under installment sales Under installment accounting, neither revenue nor profit is recognized at the time a sale is made, but rather when cash is actually collected. The total gross profit on the installment sales equals $560,000 [40% x $1,400,000]. Of that amount, $240,000 was realized, leaving $320,000 [$560,000 - $240,000] as deferred gross profit. The installment sales collected in 2008 is the realized gross profit divided by the gross profit percentage:

$240,000/40% = $600,000.

The balance in the installment receivable account must then be $800,000 [$1,400,000 - $600,000].

E3-12. Determining gross profit and deferred gross profit under the installment Method Requirement 1: At December 31, 2008, Baker’s deferred gross profit is 40% of the amount owed after the down payment. 3-4 Sales $14,000,000 Down payment (1,400,000 ) Installment accounts receivable 12,600,000 Profit rate 40 % Deferred gross profit on installment receivables $ 5,040,000

Requirement 2: For 2009, Baker’s realized gross profit consists of collections from both 2008 and 2009 sales. Since the profit percentage (40%) is the same for both years, 40% times 2009 collections of $2,020,000 equals $808,000 of realized gross profit.

E3-13. Determining unearned franchise fees (AICPA adapted)

Initial franchise fees are not recognized as revenue until the franchisor makes substantial performance of the required services, and collection is reasonably assured. Since Potter Pie has not yet performed the required services, the initial franchise fee (21 x $30,000 = $630,000) is reported as Unearned franchise fees at 12/31/08. The estimated uncollectible amount ($20,000) normally would be recorded as a debit to Bad debt expense and a credit to Allowance for uncollectible accounts. However, since no revenue has yet been recognized, it is inappropriate to record bad debt expense following the matching principle. Instead, Unearned franchise fees is debited, because an unearned revenue should not be recorded when, in effect, no related asset has been received. Therefore, the net unearned franchise fees is $610,000 ($630,000 - $20,000).

E3-14. Cost recovery method (AICPA adapted)

The amount of gross profit recognized in 2008 related to these sales is $5,000 determined as follows.

Gross profit recognized from sales: Cash received from 2007 sales $3,000 Less remaining cost of 2007 sales to be recovered* (1,000) Cash received from 2008 sales in excess of cost ($12,000 collection - $9,000 cost) 3,000 Total gross profit recognized $5,000

*($8,000 cost of 2007 sales - $7,000 cash collected for Year 2007 sales.)

3-5 E3-15. Journal entries: point of sale, installment sales, and cost recovery methods.

Requirement 1: (1) To record sales—2008 DR Cash $200,000 DR Accounts receivable 400,000 CR Revenues $600,000

(2) To record cost of goods sold—2008 DR Cost of goods sold $390,000 CR Inventory $390,000

(3) To record cash collections—2009 $150,000 CR Accounts receivable $150,000

(4) To record cash collections—2010 DR Cash $150,000 CR Accounts receivable $150,000

Requirement 2: (1) To record installment sales—2008 DR Installment receivables $600,000 CR Inventory $390,000 CR Deferred gross profit 210,000

(2) To record collections on account—2008 DR Cash $200,000 CR Installment receivables $200,000

(3) To record collections on account—2009 DR Cash $150,000 CR Installment receivables $150,000

(4) To record collections on account—2010 DR Cash $150,000 CR Installment receivables $150,000

3-6 (5) To record realized gross profit—2010 DR Deferred gross profit $110,000 CR Realized gross profit $110,000

Gross profit is realized once cumulative cash collections exceed the cost of goods sold. ($200,000 + $150,000 + $150,000) = $500,000 – $390,000 = $110,000. Cumulative cash collections do not exceed the cost of goods sold until 2010; therefore, no gross profit is realized until then.

Requirement 3: (1) To record installment sales DR Accounts receivable—2008 installment sales $600,000 CR Installment sales revenue $600,000

(2) To record cost of goods sold DR Cost of installment goods sold $390,000 CR Inventory $390,000

(3) To record cash collections in 2008 DR Cash $200,000 CR Accounts receivable—2008 installment sales $200,000

(4) To defer gross profit on portion of current-period sales that are not yet collected DR Deferred gross profit (income statement) $140,000 CR Deferred gross profit—adjustment to accounts receivable $140,000

Gross profit = $600,000 – $390,000 = $210,000 Gross profit rate = Gross profit ÷ Sales = $210,000 ÷ $600,000 = .35 Deferred gross profit = Portion of current-period sales that are not yet collected x Gross profit rate = $400,000 x .35 = $140,000

(5) To record cash collections in 2009 DR Cash $150,000 CR Accounts receivable—2008 installment sales $150,000

3-7 (6) To recognize realized gross profit on installment sales of prior periods DR Deferred gross profit—adjustment to accounts receivable $52,500 CR Recognized gross profit on installment sales—prior year $52,500

Recognized gross profit = Cash collections during year x Gross profit rate = $150,000 x .35 = $52,500

(7) To record cash collections in 2010 DR Cash $150,000 CR Accounts receivable—2008 installment sales $150,000

(8) To recognize realized gross profit on installment sales of prior periods DR Deferred gross profit—adjustment to accounts receivable $52,500 CR Recognized gross profit on installment sales—prior year $52,500

Recognized gross profit = Cash collections during year x Gross profit rate = $150,000 x .35 = $52,500 E3-16. Journal entries; point of sale, installment sales and cost recovery methods Requirement 1 (point of sale method):

August 1, 2008 To record installment sale DR Installment receivables $400,000 CR Sales revenue $400,000

DR Cost of goods sold $100,000 CR Inventory $100,000

August 1, 2008 To record cash received from installment sale DR Cash $40,000 CR Installment receivables $40,000

3-8 August 1, 2009 To record cash received from installment sale DR Cash $90,000* CR Installment receivables $90,000 *$400,000-(10% x$400,000)=$360000÷4=$90,000 Requirement 2 (Installment sales method):

August 1, 2008 To record installment sale DR Installment receivables $400,000 CR Inventory $100,000

3-9 CR Deferred gross profit 300,000a a Gross profit rate = $300,000/$400,000 = 75%

August 1, 2008 To record cash received from installment sale DR Cash $40,000 CR Installment receivables $40,000

August 1, 2008 To recognize gross profit from installment sale DR Deferred gross profit $30,000 CR Realized gross profit $30,000b b Gross profit rate x cash collections = 75% x $40,000 = $30,000

August 1, 20069 To record cash received from installment sale DR Cash $90,000 CR Installment receivables $90,000

August 1, 2009 To recognize gross profit from installment sale DR Deferred gross profit $67,500 CR Realized gross profit $67,500c c Gross profit rate x cash collections = 75% x $90,000 = $67,500 Requirement 3 (Cost recovery method):

August 1, 2008 To record installment sale DR Installment receivables $400,000 CR Inventory $100,000 CR Deferred gross profit 300,000 August 1, 2008 To record cash received from installment sale DR Cash $40,000 CR Installment receivables $40,000 August 1, 2009 To record cash received from installment sale DR Cash $90,000 CR Installment receivables $90,000 August 1, 2009 To recognize gross profit from installment sale DR Deferred gross profit $30,000 CR Realized gross profit $30,000d dCumulative cash collected – cost of inventory = ($40,000 + $90,000) - $100,000 = $30,000

3-10 Requirement 4: Revenue recognition rules for installment sales under the point-of-delivery method require that while revenue related to the equipment can be recognized at the point-of-delivery, revenue related to financing is not to be recognized until the period during which it is earned. The amount of revenue recognized on August 1, 2008, then, would be equal to the present value of the installments. The interest component of each payment can be calculated using traditional computations for interest on outstanding receivables. Assuming a December 31 fiscal year-end, interest would be accrued for August through December using a debit to Interest Receivable and a credit to Interest Revenue on December of each year. On each subsequent August 1, the remaining amount of interest would be accrued, but the entire amount of accrual would not be converted into cash until Flintstone receives the payment.

E3-17. Franchise sales; revenue recognition

Requirement 1: April 1, 2008 To record franchise agreement and down payment DR Cash $60,000 DR Note receivable 240,000 CR Unearned franchise fee revenue $300,000 Requirement 2: August 15, 2008 To recognize franchise fee revenue DR Unearned franchise fee revenue $300,000 CR Franchise fee revenue $300,000

E3-18. Franchise sales. Requirement 1: To record signing of franchise agreement and receipt of first payment DR Cash ($150,000 x .20) $30,000 DR Franchise fee receivable ($150,000 - $20,000) 120,000 CR Earned franchise fee revenue ($150,000 x .5) $75,000 CR Unearned franchise fee ($150,000 x .5) 75,000

3-11 Requirement 2: To accrue interest on the unpaid franchise fee DR Interest receivable ($120,000 x .09 x 6/12) $5,400 CR Interest revenue $5,400

Requirement 3: To recognize remainder of franchise fee when earned at franchise opening DR Unearned franchise fee $75,000 CR Earned franchise fee revenue $75,000

E3-19. Revenue recognition: Bundled sales.

Requirement 1: To record cash receipt for bundled sale DR Cash $85,000 CR Unearned revenue $85,000

Requirement 2: To determine revenue to be recognized on bundled sales, first allocate the total revenue to the various elements being sold based on the relative fair values of the elements if they were sold separately as follows:

Percent of Contract Total Fair Price Fair value Value Allocation Tax return preparation software $ 70,000 70% $59,500 Training customer’s staff 10,000 10% 8,500 Customer support 15,000 15% 12,750 Software upgrade 5,000 5% 4,250 Totals $ 100,000 $85,000

3-12 Revenue to be recognized in 2008 is based on the percentage of the each element that has been rendered in 2008 as follows:

Contract Percentage Revenue Price Rendered Recognized Allocation in 2008 in 2008 Tax return preparation software $59,500 100% $59,500 Training customer’s staff 8,500 100% 8,500 Customer support (Oct.–Dec.) 12,750 25% 3,188 Software upgrade 4,250 0% - Totals $85,000 $71,188

To record revenue from bundled sale earned in 2008 DR Unearned revenue $71,188 CR Revenue $71,188

3-13 E3-20. Installment sales and cost recovery methods.

Requirement 1: Cost of goods sold $ 400,000 Recognized gross profit in 2008 75,000 Cash collected $ 475,000

The cost recovery method only recognizes gross profit when cash collections exceed cost of goods sold. Given that $75,000 in gross profit was recognized in 2008, cash collections must exceed cost of goods sold by that amount.

Requirement 2: % of Sales Sales $ 750,000 100.0% Cost of goods sold 400,000 53 .3% Gross profit 350,000 46.7%

Cash collected $ 475,000 x Gross profit percentage 0 .467 Recognized gross profit $ 221,667

Total gross profit $ 350,000 – Recognized gross profit 221,667 = Deferred gross profit $ 128,333

E3-21. Error Correction

Requirement 1:

2006 2007 2006 2007 Errors Ending Ending Depreciation Depreciation Inventory Inventory expense expense $15,000 $5,000 $12,500 $4,000 Effects overstated understated overstated understated $15,000 $12,500 2006 net income overstated No effect understated No effect $15,000 $5,000 $4,000 2007 net income understated understated No effect overstated Retained earnings $5,000 $12,500 $4,000 on 1/1/2008 Correct understated understated overstated

3-14 Therefore, retained earnings at January 1, 2008 is understated by: $5,000 + $12,500 - $4,000 = $13,500

Requirement 2: Adjusting entry: DR Inventory $5,000 DR Accumulated depreciation 8,500 CR Retained earnings on 1/1/2008— prior period adjustment $13,500

E3-22. Error correction / Prior period adjustment

Requirement 1:

2007 Errors 2007 2007 Depreciation Ending Inventory Repairs expense expense Effects $40,000 understated $70,000 overstated $3,000 understated 2007 net income $40,000 understated $70,000 understated $3,000 overstated Retained earnings on 1/1/2008 $40,000 understated $70,000 understated $3,000 overstated

Therefore, retained earnings at January 1, 2008 should be adjusted by: $40,000 + $70,000 - $3,000 = $107,000 (understatement)

Requirement 2: Adjusting entry: DR Inventory $40,000 DR Equipment 70,000 CR Accumulated depreciationa $3,000 CR Retained earnings— Prior period adjustment 107,000

a2007 depreciation expense = ($70,000 – $10,000) ÷ 10 x .5 = $3,000

3-15 E3-23. Error correction / Prior period adjustment

Requirement 1: 1) This error affected ending inventory in 2007 and beginning inventory in 2008. Because inventory errors “self-correct” over a two-year period, and the 2008 financial statements have been issued, no entry is required. However, if comparative financial statements are issued in 2009, income as presented for 2007 and 2008 should be restated to correct the error, making appropriate footnote disclosure of the correction.

2) To correct error and reflect remaining insurance at January 1, 2009: DR Prepaid insurance $21,000 CR Retained earnings—prior period adjustment $21,000

36-month policy – 15 months elapsed since inception = 21 months remaining at beginning of 2009.

$36,000 policy cost ÷ 36-month policy period = $1,000 per month expiration rate for the insurance coverage.

3) To correct error and reflect equipment and accumulated depreciation: DR Equipment $100,000 CR Retained earnings—prior period adjustment $80,000 CR Accumulated depreciation 20,000

Cost of equipment ÷ life = annual depreciation expense = $100,000 ÷ 5 = $20,000 per year. At the beginning of 2009, accumulated depreciation should reflect depreciation for one year (2008).

Requirement 2: 1) This error does not affect the 2009 financial statements. 2) Insurance expense should be recorded at the rate of $12,000 per year as the policy expires. If the error were not corrected, income in 2009 would be overstated by $12,000. At the end of 2009, $9,000 of the policy has yet to expire. This amount should be shown as “prepaid insurance” on the balance sheet and retained earnings increased by $9,000. 3) Failure to correct this error leaves total assets understated by $60,000 at the end of 2009. ($100,000 equipment cost – $40,000 accumulated depreciation for 2008 and 2009). Retained earnings are also understated by $60,000. Income in 2009 would be overstated by $20,000 because of the failure to record depreciation expense each year.

3-16 Financial Reporting and Analysis Chapter 3 Solutions Additional Topics in Income Determination Problems

Problems P3-1. Income measurement under alternative revenue recognition rules

Computation of net income under production basis

2008: 20,000 units x ($16.00 - $12.00) $80,000 2009: 4,000 units x ($13.00 - $16.00)1 -12,000 Total income $68,000

1Revision in expected revenue from liquidation sale.

Computation of net income under sales or delivery basis

2008: 16,000 units x ($16.00 - $12.00) $64,000 2009: 4,000 units x ($13.00 - $12.00) 4,000 Total income $68,000

Computation of net income under cash collection basis

2008: 14,000 units x ($16.00 - $12.00) $56,000 2009: 2,0002 units x ($16.00 - $12.00) = $8,000 4,0003 units x ($13.00 - $12.00) = 4,000 12,000 Total income $68,000

216,000 units sold – 14,000 units for which cash collections were received in 2008 = 2000 units for which collection occurred in 2009. 320,000 units produced – 16,000 units sold.

3-17 P3-2. Income determination under alternate bases of revenue recognition

Requirement 1: Income on a production basis

Agri Pro Income Statement Production Basis Revenues: Wheat sold: 10,000 bu. @ $2.40 = $24,000 Wheat produced and in inventory: 5,000 bu. @ ($3.00 - $.10)1 = 14,500 Total revenues $38,500 Cost of goods produced: Depreciation on equipment $3,000 Other production costs: 15,000 bu. @ $.50 = 7,500 (10,500) Gross profit 28,000

Selling and delivery expense: 10,000 bu. @ $.10 = $1,000 Miscellaneous administrative expense 4,000 Interest expense 5,000 (10,000) Net income $18,000 Alternate Solution Production Basis Sales revenue: 10,000 bu. @ $2.40 = $24,000 Cost of goods sold: Depreciation: 10,000 bu. @ $.202 = $2,000 Other production costs: 10,000 bu. @ $.50 = _5,000 (7,000) Gross profit $17,000 Selling and delivery expense: 10,000 bu. @ $.10 = 1,000 Miscellaneous administrative expense 4,000 Interest expense _5,000 (10,000) Operating income 7,000 Unrealized holding gain on inventory: 5,000 bu. x ($3.00 - $.10 - $.70)3 11,000 Net income $18,000

1Revenues should be recorded at net realizable value which is equal to the current selling price of $3.00 per bushel less selling and delivery costs of $.10 per bushel. $ 3 , 0 0 0 2Depreciation per bushel produced = = $.20/bu 1 5 , 0 0 0 3Other production costs = .50/bu Production costs/bushel $.70/bu Inventory carrying (book) value: 5,000 bu. @ $3.00 = $15,000 Accounts receivable: 10,000 bu. @ $2.40 x 1/4 = $6,000 3-18 Requirement 2: Income on sales basis

Agri Pro Income Statement Sales Basis

Revenues: 10,000 bu. @ $2.40 = $24,000 Cost of goods sold: $ 3 , 0 0 0 Depreciation on equipment: = $.20/bu. x 10,000 = 2,000 1 5 , 0 0 0 Other production costs: 10,000 bu. @ $.50 = 5,000 Gross profit $17,000 Selling and delivery expense: 10,000 bu. @ $.10 = 1,000 Miscellaneous administrative expense 4,000 Interest expense 5,000 (10,000) Net income $7,000

Inventory carrying (book) value: 5,000 bu. @ $.70 = $3,500 Accounts receivable: 10,000 bu. @ $2.40 x 1/4 = $6,000

3-19 Requirement 3: Cash collection basis

Agri Pro Income Statement Cash Collections Basis Revenues: 10,000 bu. @ $2.40 = $24,000 Less: 2,500 bu. sold but not collected on (2,500) @ $2.40 = (6,000) Revenue from bushels sold and collected $18,000 Cost of goods sold and collected: $ 3 , 0 0 0 Depreciation on equipment: = $.20 x 7,500 bu. = (1,500) 1 5 , 0 0 0 Other production costs: 7,500 bu. x $.50 = (3,750) Gross profit $12,750

Selling and delivery expense: 10,000 bu. x $.10 = $1,000 Miscellaneous administrative expense 4,000 Interest expense 5,000 (10,000) Net income $ 2,750

Inventory carrying (book) value: 5,000 bu. @ $.70 = $3,500

Accounts receivable: 10,000 bu. @ $2.40 x 1/4 = $6,000 Less: Deferred gross profit: 10,000 x 1/4 x ($2.40 - $.70) = (4,250) Accounts receivable net of deferred gross profit $1,750

3-20 P3-3. Determining pre-tax income and accounts receivable using the installment method

Installment Sales Method Sales (700 x $960) $672,000 Less: 40% sold, but not collected (268,800 ) Revenues from land sold and collected 403,200 Less: Cost of land sold and collected (700 x $350 x 60%) (147,000 ) Gross profit 256,200 Property taxes (75,000) Income before income taxes $181,200 Accounts receivable balance ($672,000 x 40%) $268,800 Less deferred gross profit (700 x 40% x ($960 - $350)) (170,800) $98,000

3-21 P3-4. Determining pre-tax income, inventory carrying value, and accounts receivable under sales and production basis.

Requirement 1: Production basis

Production Basis Barrels available 30,000 Ending inventory (6,000) Barrels sold 24,000

Revenues: Barrels sold (24,000 x $28) $672,000 Barrels in inventory (6,000 x $31) 186,000 Total revenues 858,000

Cost of oils produced: Direct production costs (30,000 x $12) (360,000) Depreciation expense (180,000) Gross profit 318,000 Property taxes (75,000) Income before income taxes $243,000

Alternative Production Basis

Sales (24,000 barrels x $28.00) $672,000 Cost of oils produced: Direct production costs (24,000 x $12) (288,000) Depreciation expense ($180/30 x 24,000) (144,000) Gross profit 240,000 Property taxes (75,000) 165,000 Unrealized holding gains in inventory [6,000 x ($31 - $18*)] 78,000 Income before income taxes $243,000 * Includes $180,000/30,000 = $6/barrel allocation of depreciation costs that are considered product costs.

Accounts receivable balance ($672,000 x 40%) $268,800 Inventory carrying value (6,000 x $31) $186,000

3-22 Requirement 2: Sales Basis

Sales (completed transaction) Basis Barrels available 30,000 Ending inventory (6,000) Barrels sold 24,000

Sales (24,000 x $28) $672,000 Cost of oils produced: Direct production costs (24,000 x $12) (288,000) Depreciation expense ($180/30 x 24,000) (144,000) Gross profit 240,000 Property taxes (75,000) Income before income taxes $165,000

Accounts receivable ($672,000 x 40%) $268,800

Inventory carrying value: $108,000 ((6,000 x $12) + ($180/30 x 6,000))

Requirement 3: Installment Basis

Installment Basis Barrels available 30,000 Ending inventory (6,000) Barrels sold 24,000

Sales (24,000 x $28 x.60) $403,200 Cost of oils produced: Direct production costs (24,000 x $12 x 60%) (172,800) Depreciation expense ($180/30 x 24,000 x 60%) (86,400) Gross profit 144,000 Property taxes (75,000) Income before income taxes $69,000

Accounts receivable (24,000 x $28 x 40%) $268,800 Less deferred gross profit [24,000 x 40% x ($28 - $18)] ($96,000) $172,800

Inventory carrying value: $108,000 [(6,000 x $12) + ($180/30 x 6,000)]

3-23 P3-5. Percentage-of-completion accounting (AICPA adapted)

Requirement 1: 1) Contract billings in 2008 $47,000 Accounts receivable: construction contracts (15,000) Cash collected $32,000

Requirement 2: 2) Construction in progress $50,000 Less: Profit included in above (10,000) Costs incurred to date $40,000

Let X = Total costs on project (in $000) $ 4 0 $ 8 0 0 X = $10 X

$32,000 - $40X = $10X 50X = $32,000 X = $640

Requirement 3: 3) Contract price $800,000 Total estimated expenses (640,000) Estimated total income $160,000

P3-6. Long-term construction contract accounting (AICPA adapted)

Completed-Contract Method Year 200 8 DR Construction in progress $290,000 CR Cash, payables, materials, etc. $290,000 DR Accounts receivable $260,000 CR Billings on contract $260,000 DR Cash $240,000 CR Accounts receivable $240,000 Since the project is incomplete, no revenue is recognized for the year 2008.

3-24 Balance Sheet Presentation at the End of 2008 Completed-Contract Method Current Assets: Construction in progress $290,000 Less: Billings on contract (260,000) Unbilled costs of construction $30,000

Accounts receivable $20,000

Year 200 9 DR Construction in progress $150,000 CR Cash, payables, materials, etc. $150,000 DR Accounts receivable $265,000 CR Billings on contract $265,000 DR Cash $285,000 CR Accounts receivable $285,000 DR Billings on contract $525,000 CR Construction in progress $440,000 CR Income on long-term construction contracts 85,000

Alternate entry: DR Construction expense $440,000 DR Billings on contract 525,000 CR Construction in progress $440,000 CR Construction revenue 525,000

3-25 Percentage-of-Completion Method Year 200 8 DR Construction in progress $290,000 CR Cash, payables, materials, etc. $290,000 DR Accounts receivable $260,000 CR Billings on contract $260,000 DR Cash $240,000 CR Accounts receivable $240,000

DR Construction in progress1 $60,000 CR Income on long-term construction contracts $60,000

Alternate entry: DR Construction in progress1 $ 60,000 DR Construction expense 290,000 CR Construction revenue $350,000

1Contract price $525,000 - Actual costs to date ($290,000) - Estimated costs to complete (145,000) Total estimated costs of project (435,000) Estimated total gross margin $90,000

Revenue earned during the period: ($290,000/$435,000) x $525,000 = $350,000 Gross margin earned during the period: ($290,000/$435,000) x $90,000 = $60,000

Balance Sheet Presentation at the End of 2008 Percentage-of-Completion Method Current Assets: Construction in progress $350,000 Less: Billings on contract (260,000) Unbilled costs of construction $90,000

Accounts receivable $20,000

3-26 Year 200 9 DR Construction in progress $150,000 CR Cash, payables, materials, etc. $150,000 DR Accounts receivable $265,000 CR Billings on contract $265,000 DR Cash $285,000 CR Accounts receivable $285,000 DR Construction in progress $25,000 CR Income on long-term construction contracts $25,000

Alternate Entry: DR Construction in progress $ 25,000 DR Construction expense 150,000 CR Construction revenue $175,000

Total 2008 2009 Construction revenue $525,000 $350,000 $175,000 Construction expense (440,000) (290,000) (150,000) Gross margin $ 85,000 $ 60,000 $ 25,000

P3-7. Determining income under installment sales method (AICPA adapted)

Income before income taxes on installment sale contract:

Sales $556,000 Cost of sales (417,000) Gross profit 139,000 Interest income (from following calculations) 27,360 Income before income taxes $166,360

Calculations to determine interest income on installment sale contract:

Cash selling price $556,000 Less: July 1, 2008, payment (100,000) 456,000 Interest rate 12% Annual interest $ 54,720 Interest July 1, 2008, to December 31, 2008 ($54,720 x 1/2) $ 27,360

3-27 P3-8. Revenue recognition for goods on consignment

Requirement 1: Englewood Marine Financial Summary Quarter Ended Description July 31 October 31 Revenues $ 392,0001 $ 700,0002 Cost of goods sold Sales x (1-.30) (274,400) (490,000) Gross profit $ 117,600 $ 210,000

117 boats shipped - 3 boats in inventory = 14 boats sold x $28,000 = $392,000 241 boats shipped - 14 boats previously sold - 2 boats in inventory = 25 boats sold x $28,000 = $700,000

Requirement 2: Since the boats were on consignment to the dealers, Englewood Marine still owns them and should include the boats in its finished goods – consigned inventory. The boats would be valued at cost as follows:

Englewood Marine Boats on Consignment Description July 31 October 31 Selling price per boat $ 28,000 $ 28,000 Number of boats x 3 x 2 84,000 56,000 Less gross profit @ 30% (25,200) (16,800) Cost of boats on consignment (Inventory) $ 58,800 $ 39,200

3-28 P3-9. Revenue recognition based on delivery performance

Requirement 1: Mogul’s fourth quarter sales to Composite should include only the deliveries made during that quarter since the material was sold f.o.b. Composite’s receiving dock. Sales for the fourth quarter of 2008 would be $281,000. Determined as follows:

Mogul Chemical Company December 2009 - Sales to Composite, Inc. Price per Date Delivered Pounds Pound Sales November 30, 2008 75,000 $1.00 $75,000 December 7, 2008 80,000 $1.00 80,000 December 14, 2008 60,000 $1.10 66,000 December 21, 2008 50,000 $1.20 60,000 December 2008 Sales $281,000

Requirement 2: It appears that Mogul has met several criteria required to recognize the Composite transaction as revenue during calendar year 2008, including:

Having a written fixed commitment and specific written delivery terms from the buyer; • The critical event has taken place, the production of the required materials in accordance with the buyers written instructions, so that the earning process appears to be complete except for delivery of the goods; • The amount to be collected is reasonably assured and is measurable with a reasonable degree of reliability; • Material destined for Composite is completely segregated and not subject to being used to fill other orders; • Material destined for Composite is complete and ready for shipment.

Requirement 3: Consistent with guidance in SEC SAB No. 101, Mogul should not include the Composite transaction as a receivable and sale in calendar year 2008 for the following reasons:

1. Mogul retained risk of ownership. 2. Composite did not request the “bill and hold” arrangement. Mogul did this unilaterally. 3. Mogul accepted Composite’s purchase order and delivery terms. Composite was unable to take delivery of the material early because it lacked storage facilities for raw material inventories.

3-29 If Mogul included this transaction in 2008 business and if the amount were material, an adjustment would be required to correctly report this as 2009 business.

P3-10. Revenue recognition on layaways

Requirement 1: February 28, 200 8 : DR Layaway—merchandise inventory $49,000 CR Retail inventory $49,000

DR Cash $45,000 CR Customer deposits (unearned revenue) $45,000

DR Customer deposits (unearned revenue) $30,000 CR Sales revenue $30,000

DR Cost of goods sold $24,000 CR Layaway—merchandise inventory $24,000

March 31, 200 8 : DR Layaway—merchandise inventory $50,000 CR Retail inventory $50,000

DR Cash $67,000 CR Customer deposits (unearned revenue) $67,000

DR Customer deposits (unearned revenue) $70,000 CR Sales revenue $70,000

DR Cost of goods sold $56,000 CR Layaway—merchandise inventory $56,000

April 30, 200 8 : DR Layaway—merchandise inventory $40,000 CR Retail inventory $40,000

DR Cash $51,000 CR Customer deposits (unearned revenue) $51,000

DR Customer deposits (unearned revenue) $60,000 CR Sales revenue $60,000

3-30 DR Cost of goods sold $48,000 CR Layaway—merchandise inventory $48,000

Requirement 2: DW Hooks Revenues Earned and Reconciliation of Layaways and Customer Deposits from January 31, 2008 to April 30, 2008 Sales Layaway Customer Revenue Inventory Deposits Earned Balance at January 31, 2008 $ 72,000 $ 55,000

February layaways 49,000 February deposits 45,000 February deliveries (24,000) (30,000) $ 30,000 Balance at February 28, 2008 97,000 70,000 30,000

March layaways 50,000 March deposits 67,000 March deliveries (56,000) (70,000) 70,000 Balance at March 31, 2008 91,000 67,000 100,000

April layaways 40,000 April deposits 51,000 April deliveries (48,000) (60,000) 60,000 Balance at April 30, 2008 $ 83,000 $ 58,000 $ 160,000

Requirement 3: The amount of cash received as a deposit should be recognized as a liability and titled such as “Customer deposits – layaway sales” or “Unearned revenue – layaway sales.” The amount would be reported on Hook’s balance sheet as a liability.

3-31 P3-11. Alternative Bases of Revenue and Income Recognition

Requirement 1: Three alternatives available to Quincy are the a) point of delivery method, b) installment sales method, and c) cost recovery method.

The point of delivery method calls for the recognition of all of the revenue and costs (difference = gross profit) related to the equipment in 2008 when the equipment is delivered to Tana Company.

The installment sales method calls for the recognition of gross profit to the extent that cash has been collected. The gross profit percentage for the sale must be computed and multiplied by the amount of cash collected during 2008.

The cost recovery method calls for the recognition of gross profit to the extent that cash collected in 2008 exceeds the cost of the equipment.

Requirement 2:

Point of Delivery: $200,000 (selling price) - $80,000 (cost) = $120,000

Installment Sales: Cash collected = Down payment on 7/1 $40,000 Quarterly payment on 10/1 40,000* Total cash collections in 2008 $80,000 * ¼ x ($200,000 - $40,000) = $40,000

Gross profit percentage = $120,000/$200,000 = 60% 60% x $80,000 = $48,000 total gross profit

Cost Recovery: Total cost = $80,000 which is equal to cash collected in 2008 ($80,000), so $0 profit is recognized.

Requirement 3: When uncertainty about cash collection of receivables related to these types of contracts can be adequately accounted for by establishing an allowance for uncollectible accounts, the point of delivery method should be used. However, when the uncertainty is so severe that an allowance cannot be reasonably estimated, one of the other two methods should be used. These are extraordinary cases, but in these situations, conservatism dictates that the cost recovery method is advisable.

3-32 P3-12. Bundled services

Requirement 1: Brio’s revenue recognition policies when bundled services are sold state that “Brio recognizes product revenue when persuasive evidence of an arrangement exists, the product has been delivered, the fee is fixed or determinable and collection of the resulting receivable is probable. Brio uses the residual method under which revenue is allocated to the undelivered elements based on vendor-specific objective evidence (VSOE) of the fair value of such undelivered elements. VSOE of the undelivered elements is determined based on the price charged when such elements are sold separately. The residual amount of revenue is allocated to the delivered elements and recognized as revenue.”

Thus, revenue on the contract would be recognized as follows:

Total Revenue per Contract $ 1,000,000 Less: Revenue assigned to undeliverables based on vendor-specific objective evidence: Technical support 120,000 Training 72,000 System implementation services 108,000 Software upgrades and enhancements 60,000 Total deferred revenue 360,000 Residual revenue assigned to delivered elements and recognized as revenue $ 640,000

Requirement 2: To record revenue on a contract with bundled services. DR Accounts receivable $1,000,000 CR Revenue $640,000 CR Deferred revenue 360,000

Requirement 3: When vendor-specific objective evidence does not exist to enable the undelivered elements to be valued, Brio accounts for the arrangement under the completed-contract method. Thus, no revenue would be recognized when the contract was signed and the software was shipped, but rather would be deferred until the undelivered services were rendered.

3-33 P3-13. Sales with right of return

Requirement 1: (1) To make provision for expected sales returns—2001 DR Sales returns $8,351,000 CR Allowance for sales returns and certain sales incentives $8,351,000

(2) To record actual sales returns—2001 DR Allowance for sales returns and certain sales incentives $5,935,000 CR Accounts receivable $5,935,000

(3) To make provision for expected sales returns—2002 DR Sales returns $16,286,000 CR Allowance for sales returns and certain sales incentives $16,286,000

(4) To record actual sales returns—2002 DR Allowance for sales returns and certain sales incentives $15,396,000 CR Accounts receivable $15,396,000

(5) To make provision for expected sales returns—2003 DR Sales returns $18,333,000 CR Allowance for sales returns and certain sales incentives $18,333,000

(6) To record actual sales returns—2003 DR Allowance for sales returns and certain sales incentives $16,749,000 CR Accounts receivable $16,749,000

The rising balance in the “allowance for sales returns and certain sales incentives” account is due to management anticipating (and deducting from revenue) more returns each year than have actually been occurring.

3-34 Requirement 2: As noted in Roxio’s policies regarding accounting for returns, considerable judgment is required to estimate the amount of goods that will ultimately be returned or price concessions that will be granted. Management indicates that adjustments might be needed periodically based on evolving experience. Thus, using the inherent subjectivity in this process, management can establish “cookie jar” reserves by overestimating returns. Management can also inflate income by underestimating the required amount of the allowance in any particular year. Given the loss in 2003, the fact that the allowance balance was steadily rising, and that the additions to the allowance were greater in 2003 than the previous two years, the evidence does not suggest that management was dipping into the “cookie jar” in 2003 to mitigate the poor results that year.

Requirement 3: Roxio, Inc. Selected financial data For the year ended March 31 ($ in 000s) 2001 2002 2003 Net revenues $ 121,908 $ 142,521 $ 120,408 Additions to allowance for sales returns 8,351 16,286 18,333 Gross Revenues $ 130,259 $ 158,807 $ 138,741

P3-14. Manipulation of Receivables

Accounts receivable turnover = sales ÷ average accounts receivable.

Days sales outstanding = 365 ÷ Accounts receivable turnover.

A growing days sales outstanding figure is often a telltale sign that a company’s receivables are impaired due to channel stuffing or other revenue recognition issues. This growth results from receivables growing at a faster rate than sales; the growth rate disparity is attributable to a lack of cash collections on the “managed” sales. The spike in Holman’s days sales outstanding figure was likely to raise questions by analysts (and auditors) about the company’s revenue recognition practices that the CFO probably did not wish to be raised. The actions taken, which were not disclosed, were intended to create an illusion of normal business activity and thus avert scrutiny of the growing trade receivables.

3-35 P3-15. Correction of errors and worksheet preparation

Error corrections worksheet Effect on income Accounts to be adjusted Description 2006 2007 2008 2009 Dr. Cr. Reported income $(18,000) $ 27,000 $ 25,000 N/A 1. Prepaid rent—2006 3,000 (3,000) Counterbalancing error Prepaid rent—2007 3,500 (3,500) Counterbalancing error Prepaid rent—2008 4,600 $ (4,600) Prepaid rent, Retained earnings, $4,600 $4,600 2. Accrued wages—2006 (7,000) 7,000 Counterbalancing error Accrued wages—2007 (9,500) 9,500 Counterbalancing error Accrued wages—2008 (6,200) 6,200 Retained earnings, Wage expense, $6,200 $6,200 3. Depreciation (2,500) (5,000) 4,000 Accumulated Depr., Retained earnings, $3,500 $3,500 4. Gain on machinery 1,000 Accumulated Depr., Gain on sale, $1,000 $1,000 5. Classification No correction needed for this type of error Adjusted income $(24,500) $ 20,000 $ 33,400

P3-16. Correcting errors / Prior period adjustment

1) Correcting entries in 2008 for equipment improperly expensed in 2007: DR Office equipmenta $5,000 CR Accumulated depreciation (1 year) $1,250 CR Retained earnings—prior period adjustment 3,750 aTo capitalize equipment purchased in 2007 and improperly expensed.

DR Depreciation expenseb $1,250 CR Accumulated depreciation $1,250 bAnnual depreciation expense = $5,000 ÷ 4 = $1,250

2) To capitalize vehicle improperly expensed in 2008: DR Vehiclec $18,000 CR Vehicle expense $18,000 cTo properly capitalize vehicle that was expensed when purchased.

DR Depreciation expensed $2,500 CR Accumulated depreciation $2,500

3-36 d2008 depreciation on capitalized vehicle = ($18,000 – $3,000) ÷ 3 x .5 = $2,500

3) To correct prepaid rent improperly charged to “Buildings” account: DR Prepaid rente $18,000 CR Buildings $18,000 eTo correctly record rent prepayment.

DR Rent expensef $9,000 CR Prepaid rent $9,000 f2008 adjusting entry to record use of warehouse for 6 months.

4) To correct error in accounting for bad debts: DR Accounts receivableg $23,500 CR Bad debt expense $23,500 gTo reverse improper write-off of account receivable in 2008.

DR Retained earnings—prior period adjustmenth $23,500 CR Accounts receivable $23,500 hTo correct overstatement of revenue in 2007 and record collection of account receivable.

5) To correct error in recording prepaid insurance: DR Insurance expensei $10,000 DR Prepaid insurance 10,000 CR Retained earnings—prior period adjustment $20,000 iTo correct overstatement of expense in prior year.

6) To record prior period adjustment for failure to accrue interest expense in 2007: DR Retained earnings—prior period adjustmentj $2,000 CR Interest expense $2,000 jTo correct failure to accrue interest in 2007 for 3 months = 3/12 x $8,000.

DR Interest expensek $2,000 CR Interest payable $2,000 k2008 adjusting entry to accrue interest for 3 months (Oct. 1 to Dec. 31, 2008).

3-37 P3–17 General Motors restatement

Requirement 1

January 5, 2004 DR Cash $75,000,000 CR Cost of goods sold $75,000,000 To record the receipt of a supplier rebate.

Requirement 2

January 5, 2004 DR Cash $75,000,000 CR Deferred supplier credits $75,000,000 To record the receipt of a supplier rebate.

“Deferred supplier credits” would appear among GM’s liabilities. At the end of the first year of the (three year) contract, two years remain. The deferred supplier credit that will be realized as purchases occur in the upcoming year should be categorized as a current liability. Credits that apply to subsequent years would be classified long-term liabilities.

Requirement 3

December 31, 2004 DR Deferred supplier credits $25,000,000 CR Cost of goods sold $25,000,000 To reflect portion (1/3) of previously received supplier credit that has been earned.

Requirement 4

December 31, 2004 DR Retained earnings $50,000,000 CR Deferred supplier credits $50,000,000 To restate 2004 financial statements.

Requirement 5

Recognizing the entire amount in the year of receipt (or credit being granted) of a supplier credit that relates to a multi-year supply agreement results in an income overstatement in the year of recognition and an understatement of income in the subsequent years of the supply agreement.

3-38 Financial Reporting and Analysis Chapter 3 Solutions Additional Topics in Income Determination Cases

C3-1. Smith’s Farm: Alternate bases of income determination

Requirement 1: Production Sales Collection Realized revenue $108,000 $108,000 $72,000 Cost of goods sold (21,000 ) _ (21,000 ) (14,000 ) Gross profit $87,000 $87,000 $58,000 Other expenses (25,000) (25,000) (25,000) Value added to unsold production [($3.60 - $.20) - $.50] 29,000 –– Net income $91,000 $62,000 $33,000

Requirement 2: Ending inventory ($3.60 - $.20) x 10,000 bu. $ 34,000 $.50 x 10,000 bu. $5,000 $5,000

Accounts receivable $36,000 $36,000 $36,000 Less: Deferred profit on sale ($3.60 - $.70) x 10,000 bu. –– –– ($29,000 ) $36,000 $36,000 $7,000

Requirement 3: Production Sales Realized revenues $ 28,000 $28,000 Less: Carrying value of inventory at 12/31/08 (34,000) (5,000) Less: Delivery costs _ (2,000 ) _ (2,000 ) Net income (loss) ($8,000 ) $21,000

The $8,000 loss on the production basis is straightforward. It represents the speculative loss of $.80 per bushel (i.e., $3.40 - $2.60)1 which occurred during 2009 times the 10,000 bushels that were held in inventory.

1$3.40 and $2.60 represent the net realizable values at the start of the year and the time of sale, respectively.

3-39 The $21,000 profit on the sales basis is more difficult to explain. It can’t be attributable to 2009 farming profit since Smith didn’t farm in 2009. Similarly, it can’t be considered speculative profit since Smith incurred a 2009 loss of $8,000 on speculation. The $21,000 figure is really a mixture of $29,000 of unrecognized 2008 farming profit and the 2009 speculative loss of $8,000. Thus, the sales basis does not provide a clear delineation of profit by source.

To generalize beyond farm settings, just as Smith was in two “businesses” (farming and speculation) so too most manufacturing concerns—albeit reluctantly—are in two businesses (operations and holding assets). Continuing the analogy, just as the sales basis “mixes” the profit source in a farm setting, so too the sales basis “mixes” the profit source in manufacturing settings. Insofar as these two profit sources (operations and holding assets) entail different risks and patterns of repeatability, then the sales basis provides a precarious basis for risk evaluation and cash flow forecasting.

3-40 C3-2. Determining gross profit under the percentage-of-completion method

Requirement 1: London, Inc. Schedule of Gross Profit (Loss)

Beta Gamma For the Year Ended September 30, 200 9 : Estimated gross profit (loss): Contract price $600,000 $800,000 Less: estimated total costs 400,000 820,000 Estimated gross profit (loss) $200,000 $(20,000)

Percent Complete: Costs incurred to date $360,000 $410,000 Total costs 400,000 820,000 Percent complete 90% 50%

Gross profit (loss) recognized $180,000 ($20,000 )

For year ended September 30, 20 10 : Estimated gross profit (loss): Contract price1 $560,000 $840,000 Less total costs 450,000 900,000 Estimated gross profit (loss) $110,000 $(60,000)

Percent complete: Cost incurred to date $450,000 $720,000 Total costs 450,000 900,000 Percent complete 100% 80%

Gross profit (loss) 110,000 (60,000) Less gross profit (loss) recognized in prior year (180,000) - (20,000 ) Gross profit (loss) recognized ($70,000 ) ($40,000 )

[1Original contract price ($600,000) minus late penalty for 4 weeks (4 x $10,000) = $560,000 ]

3-41 Requirement 2: London Inc. Schedule of Selected Balance Sheet Accounts September 30, 2009

Accounts receivable $115,000 ($315,000 + $440,000 - $275,000 - $365,000 = $115,000)

Costs and estimated earnings in excess of billings for Beta: Construction in progress $540,000 Less: Billings 315,000 Costs and estimated earnings in excess of billings $225,000

Billings in excess of costs and estimated earnings for Gamma: Construction in progress $390,000 Less: Billings 440,000 Billings in excess of cost ($ 50,000 )

Requirement 3: Under the completed-contract method London would recognize a loss of $20,000 on the Gamma project in 2009. In 2010, London would recognize $110,000 of profit on Beta ($560,000 - $450,000 = $110,000) and a $40,000 loss on Gamma ($60,000 total loss minus $20,000 recognized in 2009) for a total profit of $70,000.

3-42 C3-3. Stewart & Stevenson Services Inc.: Understanding accounts used for long- term construction contract accounting

Requirement 1: Stewart and Stevenson Services, Inc.

Construction in Progress Inventory Beginning balance $80,623 $689,362 Projects completed Costs added 685,879 (plug number) Profit added 126,647 Ending balance $203,787

Billings on Contract (Progress Payments) $55,258 Beginning balance Projects completed $689,362 (from above) 798,182 Progress billings (plug number) $164,078 Ending balance

Accounts Receivable Beginning balance $121,030 $776,046 Cash collected Progress billings 798,182 (plug number) (from above)

Ending balance $143,166

Requirement 2: Gross margin under the completed-contract method:

Beginning accrued profits + Gross margin under the percentage-of- completion method - Ending accrued profits

= $9,857 + $126,647 - $13,117 = $123,387

Sales revenue = $689,362 (See T-account for construction in progress)

Cost of goods sold = Sales revenue - Gross margin = $565,975

Gross margin rate = 17.9%

3-43 Requirement 3: Effects on the accounting equation:

Decrease in construction in progress = $13,117 (Accrued profits recorded under percentage of completion method as per balance sheet) Decrease in deferred tax liability ($13,117 x .40) = $5,247 Decrease in retained earnings ($13,117 - $5,247) = $7,870

The effect on deferred tax liability can be skipped for now.

Requirement 4: Stewart & Stevenson is one of a few long-term construction contract companies that explicitly provide information on the magnitude of accrued profits that is included in the inventory account. Consequently, in (2), we were able to precisely estimate their gross margin under the completed-contract approach. This part considers a more realistic scenario when such information is not available.

Estimation of gross margin under the completed-contract method:

Using the Year 2 gross margin rate: $689,362 (sales) x 15.6% = $107,540

Using the Year 1 gross margin rate: $689,362 (sales) x 17.0% = $117,192

Requirement 5: Obviously, the answer to part (2) provides the most accurate estimate of the profits under the completed contract method. Of the two estimates provided in (4), the one obtained using the Year 1 gross margin rate is closer to the gross margin in (2). This is consistent with the intuition that the higher gross margin contracts that were started in Year 1 are being completed during Year 2.

Requirement 6: Estimation of gross margin under the cash collection basis:

Using Year 2 gross margin rate: $776,046 (collections) x 5.6% = $121,063

Using Year 1 gross margin rate: $776,046 (collections) x 17.0% = $131,928

3-44 C3-4. Revenue recognition-membership fees

Numbers are rounded for presentation Requirement 1:

Uncle Mike’s Membership Fees Earned Year Ended Description Quarter Ended 12/31/08 3/31/08 6/30/08 9/30/08 12/31/08 Memberships sold 5,500 2,400 2,000 2,500 12,400 Fees collected $ 203,334 $ 65,667 $ 31,666 $16,667 $317,334

Est. Customer refunds (Fees collected x 30%) (61,000) (19,700) (9,500) (5,000) (95,200) Net unearned revenue $ 142,334 $ 45,967 $ 22,166 $11,667 $222,134

Earned revenue from: 1/1/08 to 3/31/08 $ 26,834 $ 38,500 $ 38,500 $38,500 $142,334 4/1/08 to 6/30/08 12,367 16,800 16,800 45,967 7/1/08 to 9/30/08 8,166 14,000 22,166 10/1/08 to 12/31/08 11,667 11,667 Membership fees earned $ 26,834 $ 50,867 $ 63,466 $80,967 $222,1341 1The total net membership fees earned are based on memberships actually sold minus the estimated cancellations. Even though actual cancellations turn out to be different from estimates we do not adjust the net membership revenues for this difference. Over time, we expect deviations of actual from estimated cancellations to net to zero.

Uncle Mike’s Membership Fees Earned Quarter Ended March 31, 2008 Quarter 1 Description Jan Feb March Information Memberships sold 2,000 2,000 1,500 5,500 Price $ 40.00 $ 36.67 $ 33.33 Fees collected (rounded) $80,000 $73,334 $50,000 $ 203,334 Less estimated refunds at 30% (24,000) (22,000) (15,000) (61,000) Unearned revenue 56,000 51,334 35,000 $ 142,334 Remaining months 12 11 10 Earned per month $ 4,667 $ 4,667 $ 3,500 Membership fee earned: Month 1 $ 4,667 $ 0 $ 0 $ 4,667 Month 2 4,667 4,667 0 9,334 Month 3 4,666 4,667 3,500 12,833 Total earned $14,000 $ 9,334 $ 3,500 $ 26,834

3-45 Uncle Mike’s Membership Fee Detail Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Ended Month Information April May June Information July August September Information October November December Information 12/31/08 Memberships sold 5,500 1,000 900 500 2,400 500 500 1,000 2,000 800 900 800 2,500 12,400 Price $ 30.00 $26.67 $23.33 $20.00 $16.67 $13.33 $10.00 $6.67 $ 3.33 Total (numbers rounded) $203,334 $30,000 $24,000 $11,667 $65,667 $10,000 $8,333 $13,333 $31,666 $8,000 $6,000 $2,667 $16,667 $317,334

Estimated customer refunds (Total x 30%) (61,000) 9,000 7,200 3,500 (19,700) 3,000 2,500 4,000 (9,500) 2,400 1,800 800 (5,000) (95,200)

Net unearned revenue $142,334 21,000 16,800 8,167 $45,967 7,000 5,833 9,333 $22,166 5,600 4,200 1,867 $11,667 222,134 Months 9 8 7 6 5 4 3 2 1 Earned per month 2,333 2,100 1,166 1,167 1,167 2,333 1,867 2,101 1,865

Membership fees earned by period 1/1/08 - 1/31/08 26,834 38,500 38,500 38,500 Quarter 1 $ 26,834 26,834 4/1/08 - 6/30/08 12,367 16,800 16,800 Quarter 2 $50,867 50,867 7/1/08 - 9/30/08 8,166 14,000 Quarter 3 $63,466 63,466 10/1/08 - 12/31/08 11,667 Year ended 12/31/08 $80,967 80,967 $222,134

3-46 Requirement 2: The membership fee should be credited to different balance sheet accounts. The portion that represents potential customer refunds (30%) should be recorded in a monetary liability account such as “Estimated customer refunds payable” while the remaining amount should be recorded in a nonmonetary liability account such as “unearned revenue.” As the membership fees are earned, they would be reported as revenue on the income statement and the “unearned revenue” account would be reduced appropriately. Requirement 3: In essence Uncle Mike’s is unable to demonstrate that the amount to be collected is measurable because it cannot accurately estimate membership refunds. Since customers have the unilateral right to cancel their membership at any time and receive a full refund up to the last day of the year, the membership fee cannot be fixed or determinable at any point before the end of the year. Accordingly, the revenue from such transactions should not be recognized in earnings prior to the refund privileges expiring on December 31. Net revenue earned would be based on actual memberships sold minus actual refunds provided, as detailed in the following schedule: Uncle Mike’s Membership Fees Earned Quarter Ended March 31, 2008 Quarter 1 Description Jan Feb March Information Memberships sold 2,000 2,000 1,500 5,500 Price $ 40.00 $ 36.67 $ 33.33 Unearned revenues $ 80,000 $ 73,334 $ 50,000 $ 203,334

Quarter 2 Description April May June Information Memberships sold 1,000 900 500 2,400 Price $ 30.00 $ 26.67 $ 23.33 Unearned revenues $ 30,000 $ 24,000 $ 11,667 $ 65,667

Quarter 3 Description July Aug Sept Information Memberships sold 500 500 1,000 2,000 Price $ 20.00 $ 16.67 $ 13.33 Unearned revenues $ 10,000 $ 8,333 $ 13,333 $ 31,666

Quarter 4 Description Oct Nov Dec Information Memberships sold 800 900 800 2,500 Price $ 10.00 $ 6.67 $ 3.33 Unearned revenues $ 8,000 $ 6,000 $ 2,667 $ 16,667

Total unearned revenues $ 317,334 Less: actual refunds (87,085) Net earned revenue on 12/31/2005 $ 230,249

3-47 C3-5. Revenue Recognition—Goods shipped to distributors with right of return

Requirement 1: SFAS No. 48, in addition to SAB 101, make it quite clear that unless the risks of ownership of a product are transferred from one party to another that the earnings process is not culminated. The facts of the case above indicate that distributors did not have the risks of ownership in that if the goods were not sold, they could be returned to GiveThree without consequence to the distributors.

In addition, any debits to a returns/allowance account related to sales of goods that may be return are to be made in the same period that the revenue from said sales is recognized.

The type of activity described in this case is formally known as “stuffing the channels” and has been a practice that has received a fair amount of attention from both standard setters and auditors in recent years. It is not illegal per se, but, under GAAP, “channel stuffers” are forbidden from recognizing revenues related to goods that are sent to a retail outlet without a binding sales contract existing between that outlet and the “stuffer.”

Requirement 2: Revenue should be recognized by GiveThree when the goods are sold to the distributors’ customers. The party getting the good from the distributor has taken the “risk of ownership” from GiveThree. Unless the goods are sold to the distributors’ customers, no revenue should be recognized by either GiveThree or the distributors of their products. In this example, the distributors are serving as nothing more than a consignment outlet for GiveThree.

Requirement 3: The issue described in this article is very similar to the issue described in this case. The SEC went to great efforts, during the time period 1998–2003, to identify and put an end to such practices. C3-6. Revenue Manipulation—Channel Stuffing

Requirement 1: In 2001, when it became clear that ClearOne would not meet sales projections, the company’s CEO devised a scheme for stuffing the distribution channel with ClearOne products. As soon as those products left ClearOne’s warehouse, ClearOne would record sales on its books. Thus, if ClearOne

3-48 shipped enough product the last week of a quarter then it could meet revenue projections. At the end of March 2001, the CEO instructed ClearOne’s Director of Manufacturing to assemble enough products to ship to distributors so that it would appear that ClearOne actually met its sales projections. The instructions were to “sweep the floor,” meaning to send all the ClearOne inventory on-hand, as well as everything that could be manufactured, to distributors to meet the quarterly sales projections. The CEO found a home for this inventory with one of ClearOne’s distributors. This distributor agreed to accept a large shipment of ClearOne products during the last week of March 2001. ClearOne’s CEO had a secret agreement with this distributor that he would not have to pay for that merchandise until he sold it. The CEO told the distributor that the transaction presented absolutely no risk to him. Contrary to GAAP, ClearOne recognized revenue and booked an account receivable for that transaction. ClearOne’s pattern of stuffing the distribution channel with its products and entering into secret agreements with its distributors continued each fiscal quarter thereafter. Requirement 2: The SEC claims that by the end of fiscal 2002, ClearOne had stuffed approximately $11.5 million of inventory into the distribution channel. Let’s assume this “channel stuffing” represents “sales” that should not have been recognized. As the SEC notes, often these shipments consisted of products that the distributors did not want and could not sell. Because most of this activity was alleged to have occurred in 2002, dividing this amount by ClearOne’s 2002 cost of goods sold percentage yields an estimate of revenue that was improperly recognized. $11,500,000 ÷ .405 = $28,395,061 estimated revenue overstatement. Requirement 3: Other data taken from ClearOne’s financial statements do not support revenue overstatement of approximately $28 million. Recognizing revenue requires the entry below. If this entry is entirely for sales that should not be recognized because the “buyer” has no obligation to pay for the shipped goods, then the $28 million should still be in accounts receivable. Yet this cannot be the case as the 2002 accounts receivable balance only stands at $20 million, and increased by just $16 million since 2000, a point in time before the SEC alleges any improper revenue recognition occurred. Similarly, product sales increased from fiscal 2000 to 2002 by only $15 million. Thus it would appear that the amount of channel stuffing that occurred was considerably less than $28 million, or that about half of the “stuffed” product was ultimately sold by the receiving distributor and paid for—although probably not in the quarter when the stuffing occurred. DR Accounts receivable $28,000,000 CR Product sales revenue $28,000,000 3-49 C3-7. Revenue recognition—software sales

Requirement 1: Software vendors often respond to changes in the industry by changing their business practices. For example, they are often forced to match competitors’ offers of return rights, trade-in credits, or exchange rights. In addition, a customer may have concerns when making a major technology purchase about rapid obsolescence, unfulfilled expectations, etc. When a vendor mitigates these concerns by giving their customers flexibility by way of certain rights of return (or cancellation), appropriate revenue recognition becomes an issue. AICPA Statement Of Position 97-2—Software Revenue Recognition, paragraph 8, states:

If the arrangement does not require significant production, modification, or customization of software, revenue should be recognized when all of the following criteria are met:

Persuasive evidence of an arrangement exists. Delivery has occurred. The vendor’s fee is fixed or determinable. Collectibility is probable.

Indus cites this paragraph in its stated revenue recognition policies. However, the existence of the “side letters” raises questions about the collectibility of the revenue from the contracts in question, thus it should be deferred.

Note to the instructor: The SEC filed suit against the CEO of Indus, Mr. Grabske, on the basis that “Mr. Grabske engaged in a scheme to overstate Indus’ revenue and earnings in the third quarter of Year 1 by misreporting revenues from two software sales transactions. Grabske directed other Indus employees to write “side letters” to the two customers, giving each a right to cancel their contracts, and to conceal those side letters from Indus’ accounting personnel.”1

1United States Of America, Plaintiff, v. WILLIAM GRABSKE, Defendant. No. CR 01-0324 CRB, United States District Court For The Northern District Of California 3-50 Requirement 2: Indus’ EPS reported in the third quarter would have been significantly reduced had revenue from the two contracts in question not been included. To see this, let’s restate the company’s income for the third quarter under two different sets of assumptions. Option 1 (see restated income in the table below) assumes that the average tax rate for the period applies to this revenue as well and that cost of sales for these two software contracts is negligible given the low variable costs associated with software; thus, income is increased by the after-tax amount of the revenue that was improperly recognized. Option 2 also makes the same assumption about the tax rate, but does assume that cost of sales for these two software contracts is recognized based on the company’s average gross profit rate. Under this set of assumptions income is also increased, but only by the after-tax amount of the gross profit on the two contracts.

Note to the instructor: The actual amount of these two contracts is unknown, but per the SEC’s complaint was “over $2 million.” Both options in the proposed solution assume the contracts totaled only $2 million and are thus somewhat conservative.

Indus International, Inc. Condensed Consolidated Statements of Operations ($ in 000s, Except Per Share Amounts) Three Months Ended 30-Sep-Year 1 Restated Restated Original Option 1 Option 2 Income before income taxes $ 5,678 $ 3,678 $ 4,672 Income taxes 2,158 1,398 1,775 Net income $3,520 $ 2,280 $2,897

EPS (basic) $ 0 .11 $ 0 .071 $0 .090 EPS (diluted) $ 0 .10 $ 0 .066 $0 .083

Shares used in computing EPS (basic) 32,196 Shares used in computing EPS (diluted) 34,750

3-51 In a climate where missing analysts’ estimates by $0.01 per share can negatively affect stock prices, the effect on Indus’ EPS of removing this revenue appears to be significant regardless of which alternative method of restating income is used.

Note to the instructor: The following information appeared in the SEC’s legal case against Mr. Grabske:

On October 28, Year 1, Indus issued a press release announcing its third quarter Year 1 financial results. Indus reported that it had met quarterly targets with revenues of $50.88 million and earnings of $3.52 million, or 10 cents per share on a diluted basis. Analysts estimated that fourth quarter revenue would be $52.3 million with earnings per share again at 10 cents. The next day Indus shares closed at slightly over $6.00. The financial report was false because Indus had improperly recognized over $2 million in revenue from two contracts with rights of cancellation and return. A couple of weeks later, Indus filed its Form 10Q for the third quarter with the Securities and Exchange Commission repeating the false financial information announced in the press release.

Over the next two months the price of Indus shares rose steadily. Then, on January 6, Year 2, Indus announced that it would not meet analysts’ expectations for the fourth quarter and instead, that earnings per share would be zero cents on revenue of approximately $43 million. The price of Indus shares fell from $11.69 to $8.94 on the next day of trading.

Three weeks later, on January 27, Year 2, Indus announced a fourth quarter Year 1 loss of .24 cents per share. Indus also announced that it would be restating its third quarter Year 1 financials and that the restatement would result in a drop of earnings from 10 cents per share to one cent per share. The next day Indus shares dropped from $9.69 to $7.63 per share. Four days later, however, shares of Indus rebounded to a price close to the price before the January 27, Year 2 announcement. Indus did not make any public statements that would have contributed to the rebound.

C3-8. Earnings management

The ethical issues involved are integrity and honesty in financial reporting, full disclosure, and accountant’s professionalism. In violating GAAP, the Chief Accounting Officer also violated the AICPA’s Code of Professional Conduct. Various parties are affected by the conduct of the Chief Accounting Officer (and others in Symbol’s management):

3-52 The Chief Accounting Officer plead guilty to criminal charges based on his conduct at Symbol, the result of which will be various monetary penalties and the loss of future employment opportunities. Symbol, after an SEC investigation, was charged with filing false and misleading financial statements. Symbol’s auditors are likely to be named in any shareholder lawsuits that are filed as a result of the false and misleading financial statements. The firm’s professional reputation cannot be enhanced by the fact that the firm did not detect earnings management schemes involving millions of dollars. Investors in Symbol’s stock suffered. Note to the instructor: In mid-1998, Symbol’s stock was trading in the low teens. By 2000, it had climbed to over $40 per share where it more or less remained before falling rapidly again to the low teens in mid-2001—about the time that it became public that the SEC was investigating Symbol’s reported earnings. (While this drop in share price may have been purely the result of a down market at the time, suits are certain to be filed that allege otherwise.) The accounting profession suffers in the eyes of the public whenever one of its members acts unprofessionally. Employees of Symbol are placed in a position where their superiors are pressuring them to engage in unethical and/or illegal practices.

Note to the instructor: Details of the SEC’s complaint against Symbol’s Chief Accounting Officer may be found at: www.sec.gov/litigation/complaints/comp18194.htm

3-53

C3-9. Franchise sales Requirement 1: The question, as posed, does not have a definitive answer, but serves to illustrate the judgment often required to operationalize seemingly straightforward accounting policies. Whether Austins should recognize revenue from the franchise fee in their 3rd quarter depends on what is meant by the phrase “substantially performed all material services” in the company’s revenue recognition policy. The franchisee’s restaurant had opened by the end of the quarter, so that criteria for revenue recognition was met—and thus any “pre-opening” services were presumably rendered. However, the “site team” did not complete its mission of providing assistance with the opening until October 10. The services performed by the site team were not substantially performed by September 30, 2008. If these services are deemed material, then revenue should be deferred.

Requirement 2: Entries for 2008: (1) To record signing of the franchise agreement and receipt of the initial payment. DR Installment receivables $400,000 DR Cash 100,000 CR Deferred franchise revenue $500,000

(2) To record revenue when Austins has substantially performed all material services covered by the franchise fee DR Deferred franchise revenue $500,000 CR Franchise revenue $500,000

(3) To accrue royalty revenue for the 4th quarter DR Royalty revenue receivable $4,625 CR Royalty revenue $4,625 Royalty revenue = $185,000 franchisee sales in 4th quarter x .025 = $4,625

(4) To record accrued interest on the installment receivable at December 31, 2008 DR Interest receivable $12,000 CR Interest revenue $12,000 Interest revenue = Installment receivable balance x .06 x 6/12 = $400,000 x .06 x 6/12 = $12,000

(5) To record costs of providing franchise services

3-54 DR Franchise expenses $34,000 CR Cash/various accounts $34,000

Entries for 2009: (1) To record receipt of royalty revenue accrued during the 4th quarter of 2008 DR Cash $4,625 CR Royalty revenue receivable $4,625

(2) To record receipt of payment and interest on installment receivable DR Cash $44,000 CR Installment receivables $20,000 CR Interest receivable 12,000 CR Interest revenue 12,000 Installment receivable ÷ term of agreement = Annual payment = $400,000 ÷ 20 years = $20,000 (3) To record accrued interest on the installment receivable at December 31, 2009 DR Interest receivable $11,400 CR Interest revenue $11,400 Interest revenue = Installment receivable balance x .06 x 6/12 = $380,000 x .06 x 6/12 = $11,400

(4) To record royalty revenue for the first 3 quarters DR Cash $17,350 CR Royalty revenue $17,350 Royalty revenue collected = $694,000 franchisee sales in first 3 quarters x .025 = $17,350

(5) To accrue royalty revenue for the 4th quarter DR Royalty revenue receivable $6,775 CR Royalty revenue $6,775 Royalty revenue = $271,000 franchisee sales in 4th quarter x .025 = $6,775

3-55 C3-10. Affiliated Computer Services (ACS): Restatements due to options backdating.

Requirement 1: The following quote is from Footnote 2 to ACS’s form 10-K/A for the year ended December 31, 2006.

The investigation concluded that in a significant number of cases Mr. Rich [CEO], Mr. King [president and COO] and/or Mr. Edwards [CFO] used hindsight to select favorable grant dates during the limited time periods after Mr. Deason [chairman of the board] had given the officers his authorization to proceed to prepare the paperwork for the option grants and before formal grant documentation was submitted to the applicable compensation committee. No evidence was found to suggest that grant dates which preceded Mr. Deason’s broad authorization were ever selected. In a number of instances, our stock price was trending downward at the time Mr. Deason’s authorization was given, but started to rise as the grant recommendation memoranda were being finalized. The investigation found that in those instances Mr. Rich, Mr. King and/or Mr. Edwards often looked back in time and selected as the “grant date” a date on which the price was at a low, notwithstanding that the date had already passed and the stock price on the date of the actual selection was higher. Recommendation memoranda attendant to these grants were intentionally misdated at the direction of Mr. Rich, Mr. King and/or Mr. Edwards to make it appear as if the memoranda had been created at or about the time of the chosen grant date, when in fact, they had been created afterwards. As a result, stock options were awarded at prices that were at, or near, the quarterly low and we effectively granted “in the money” options without recording the appropriate compensation expense. Thus, the internal investigation revealed that ACS did, in fact, backdate stock options without recording the appropriate compensation expense. Requirement 2: a) ACS restated its June 30, 2005 financial statements as follows: The balance sheet was restated. There were no changes in asset accounts. Deferred taxes payable was reduced; other long-term liabilities were increased to reflect additional income taxes payable associated with Section 162(m) deduction disallowances and accruals for related estimated penalties and interest. Additional paid-in capital was increased to adjust for additional stock- based compensation expense and excess tax benefits and adjustments related to section 162(m) deduction disallowances on stock option exercises; retained earnings was decreased.

3-56 Net income was decreased due to: o Increased wages and benefits expense related to stock-based compensation expense. o Increased other operating expenses because of estimated tax penalties associated with section 162(m) deduction disallowances. o Increased interest expense because of estimated interest expense on section 162(m) deduction disallowances. o Income tax expense was reduced due to income tax benefits for additional stock-based compensation expense and estimated interest expense, offset (somewhat) by additional income tax expense related to certain section 162(m) deduction disallowances. The operating section of the cash flow statement was affected. ACS uses the indirect method of presenting operating cash flows. Because that approach starts with net income (now reduced as a result of the restatement) several of the line items used to adjust net income to operating cash flow (unchanged) needed to be adjusted. b) The following journal entry is needed to restate ACS’s June 30, 2005 balance sheet:

DR Deferred taxes1 9,197 DR Retained earnings 46,561 CR Other long-term liabilities2 35,913 CR Additional paid-in capital3 19,845

1Deferred income taxes associated with additional stock-based compensation expense, net of reversals related to stock option exercises.

2Additional income taxes payable associated with Section 162(m) deduction disallowances and accruals for related estimated penalties and interest.

3 Adjustments for additional stock-based compensation expense and excess tax benefits and adjustments related to section 162(m) deduction disallowances on stock option exercises.

3-57