MARKING GUIDE

Unit No: FNSINC401A

Apply Principles of Professional Practice to Work in the Financial Services Industry

ASSESSMENT EVENT/S Event 1 of 3 (30% of total assessment mark)

ASSESSMENT CONDITIONS/ INSTRUCTIONS TO STUDENTS See attached

Due Date:

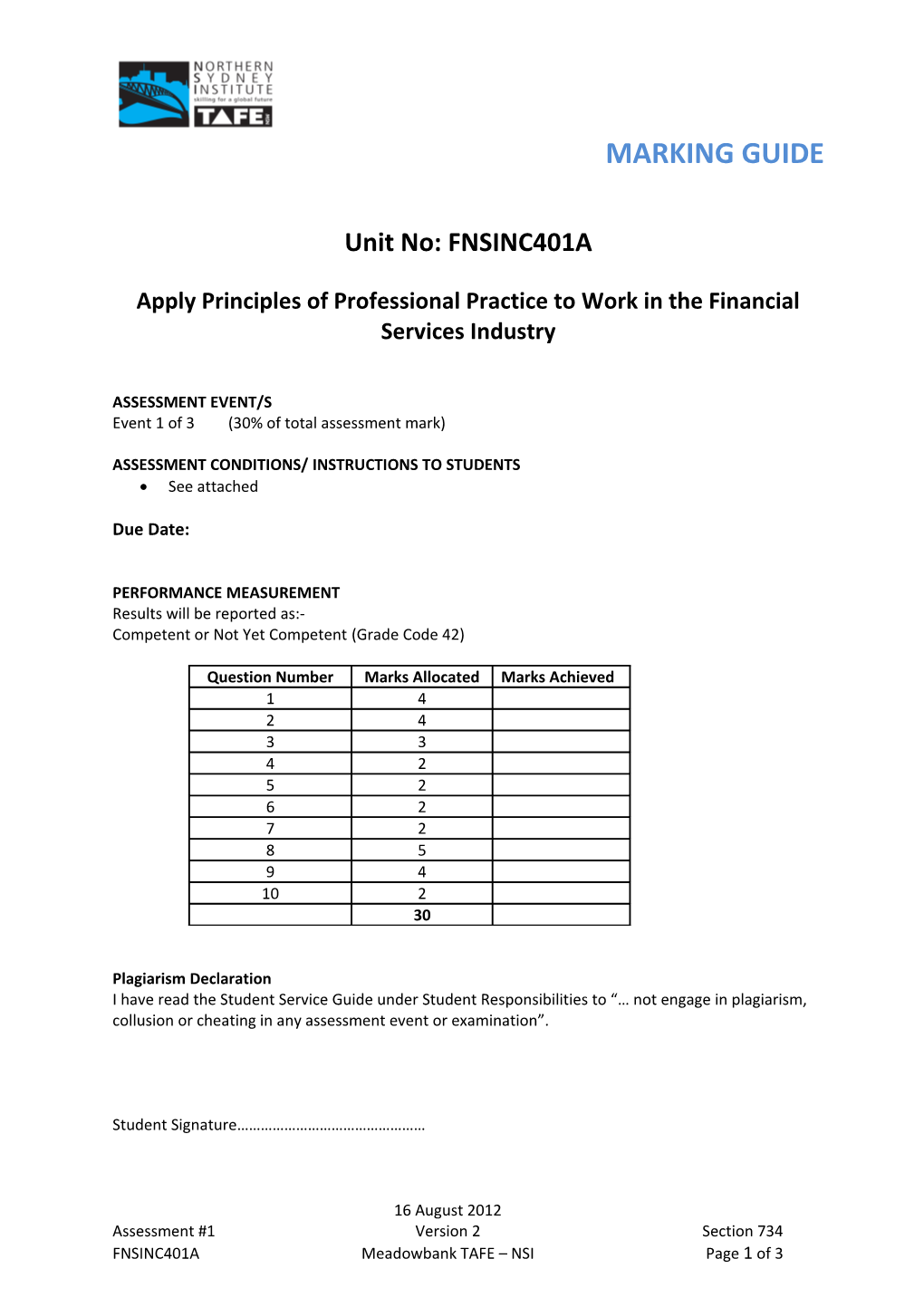

PERFORMANCE MEASUREMENT Results will be reported as:- Competent or Not Yet Competent (Grade Code 42)

Question Number Marks Allocated Marks Achieved 1 4 2 4 3 3 4 2 5 2 6 2 7 2 8 5 9 4 10 2 30

Plagiarism Declaration I have read the Student Service Guide under Student Responsibilities to “… not engage in plagiarism, collusion or cheating in any assessment event or examination”.

Student Signature…………………………………………

16 August 2012 Assessment #1 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 1 of 3

1. Name the two main policy tools of the government and describe how each of these work. FISCAL – to stimulate and support economic growth - increased spending & decreased taxation MONETARY – influence financial conditions and supply of money in the economy – worked by way of manipulation of interest rates – RBA responsible for formulating and implementing monetary policy

2. List and explain the aims of the Commonwealth Government with respect to inflation & unemployment. Low employment Low inflation Tax cuts - taxpayers will have more money to spend which will increase consumption of goods and services As demand increases businesses will order more supplies and increase supply of products to meet the consumer demands As businesses expand, employment opportunities will increase and unemployment rate will decrease RBA will continually tighten and loosen monetary policy in order to prevent inflation spilling over it’s average target range Sustainable economic growth Sustainable current account deficient

3. List and explain the three main areas of taxation? Company Tax – profit available for distribution to shareholders Personal Tax – investment income (derived from investments made) eg shares, dividends, interest received as well as employee income – wages & salaries Direct and Indirect Taxes – such as GST on goods and services consumed along with Commonwealth and State Taxes like stamp duty & land tax

4. Expansionary fiscal policy produces a budget what? How does this occur? DEFICIT – due to revenue received from taxation reduced due to lower tax rate; Govt spending or costs such as bonus payments have increased; Govt spends more than the revenue it receives

5. What is monetary policy and what organization is responsible for the implementation of this? Monetary policy is how the government influences the financial conditions and supply of money in the economy to achieve economic growth, increased employment and lower inflation. RBA is responsible for: - Formulating and implementing monetary policy - Control of inflation - Stability of the currency of Australia - Maintenance of full employment in Australia - Economic prosperity and welfare of the people of Australia

6. To stimulate the economy what happens to interest rates? Explain how/why this occurs. Interest rates are manipulated under the Monetary Policy tool used by the government. This is to increase spending power. Interest rates are raised to tighten monetary policy and slow the economy or reduced to create liquidity and stimulate the economy (more money to spend)

16 August 2012 Assessment #1 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 2 of 3 7. List and explain the area of the economy on which the government spends the most money. Welfare Health Education Defence Ie First home buyers grant; education tax refund; cash bonuses paid to pensioners, carers and low income households; infrastructure programmes; training and learning; baby bonus; family allowance; tax bonus; unemployment payments etc

8. List and explain the five broad sectors that make up the financial system. Household or Consumer Business Finance Government Overseas

The household sector receives income from the business sector in exchange for labour. The business sector receives income from the consumer by way of purchases. This income is received by the finance sector as savings. The government sector receives in the form of taxation and goods are purchased from the business sector and sold to the overseas sector.

9. List and explain who the four financial market participants are. Borrowers and lenders Financial Intermediaries Investors Professional Investors / Brokers

The flow of funds is facilitated by borrowers and lenders who are the users within the financial system. With the help of the financial intermediaries, funds invested are loaned out to borrowers and lenders for a fee (interest).

10. Name two major global influences which impact on Australia’s GDP (Economic performance), and explain how this has occurred. GFC – 2006 – Substantial losses with loans default and delinquent rates began to rise in 2006 (US) Too many loans made to people with little capacity to repay them. This is seen as the trigger for a credit crunch that ballooned into a financial crisis within a year. Crises began to spread to Europe and other emerging markets globally. The Aust $ dropped 25% against the US dollar from mid 2008. The Aust $ has been increasing in power on the exchange rate which is making our exports too expense and our imports extremely cheap.

Increase in oil prices (since 2008) has increased costs of production, transportation, travel etc.

16 August 2012 Assessment #1 Version 2 Section 734 FNSINC401A Meadowbank TAFE – NSI Page 3 of 3