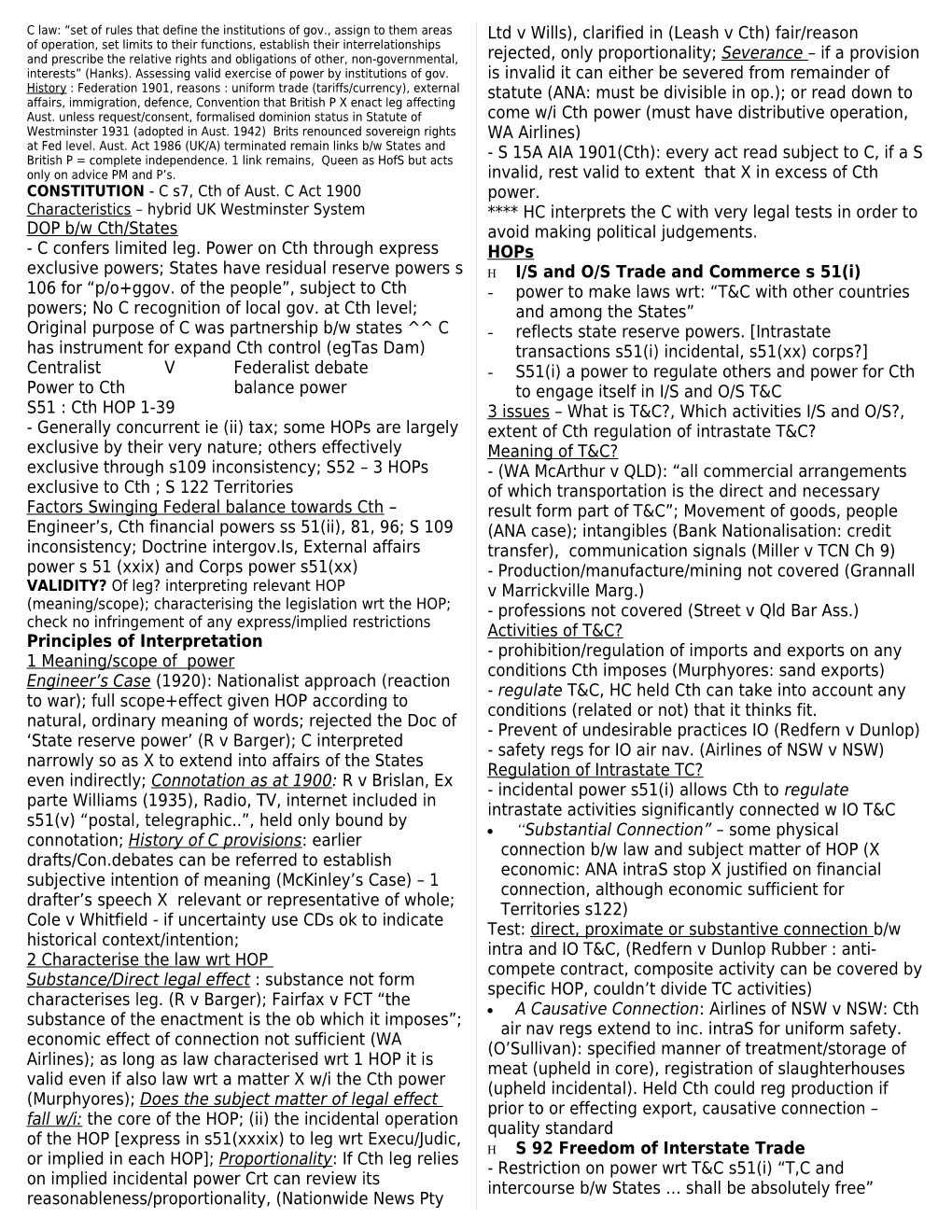

C law: “set of rules that define the institutions of gov., assign to them areas Ltd v Wills), clarified in (Leash v Cth) fair/reason of operation, set limits to their functions, establish their interrelationships and prescribe the relative rights and obligations of other, non-governmental, rejected, only proportionality; Severance – if a provision interests” (Hanks). Assessing valid exercise of power by institutions of gov. is invalid it can either be severed from remainder of History : Federation 1901, reasons : uniform trade (tariffs/currency), external statute (ANA: must be divisible in op.); or read down to affairs, immigration, defence, Convention that British P X enact leg affecting Aust. unless request/consent, formalised dominion status in Statute of come w/i Cth power (must have distributive operation, Westminster 1931 (adopted in Aust. 1942) Brits renounced sovereign rights WA Airlines) at Fed level. Aust. Act 1986 (UK/A) terminated remain links b/w States and British P = complete independence. 1 link remains, Queen as HofS but acts - S 15A AIA 1901(Cth): every act read subject to C, if a S only on advice PM and P’s. invalid, rest valid to extent that X in excess of Cth CONSTITUTION - C s7, Cth of Aust. C Act 1900 power. Characteristics – hybrid UK Westminster System **** HC interprets the C with very legal tests in order to DOP b/w Cth/States avoid making political judgements. - C confers limited leg. Power on Cth through express HOPs exclusive powers; States have residual reserve powers s I/S and O/S Trade and Commerce s 51(i) 106 for “p/o+ggov. of the people”, subject to Cth - power to make laws wrt: “T&C with other countries powers; No C recognition of local gov. at Cth level; and among the States” Original purpose of C was partnership b/w states ^^ C - reflects state reserve powers. [Intrastate has instrument for expand Cth control (egTas Dam) transactions s51(i) incidental, s51(xx) corps?] Centralist V Federalist debate - S51(i) a power to regulate others and power for Cth Power to Cth balance power to engage itself in I/S and O/S T&C S51 : Cth HOP 1-39 3 issues – What is T&C?, Which activities I/S and O/S?, - Generally concurrent ie (ii) tax; some HOPs are largely extent of Cth regulation of intrastate T&C? exclusive by their very nature; others effectively Meaning of T&C? exclusive through s109 inconsistency; S52 – 3 HOPs - (WA McArthur v QLD): “all commercial arrangements exclusive to Cth ; S 122 Territories of which transportation is the direct and necessary Factors Swinging Federal balance towards Cth – result form part of T&C”; Movement of goods, people Engineer’s, Cth financial powers ss 51(ii), 81, 96; S 109 (ANA case); intangibles (Bank Nationalisation: credit inconsistency; Doctrine intergov.Is, External affairs transfer), communication signals (Miller v TCN Ch 9) power s 51 (xxix) and Corps power s51(xx) - Production/manufacture/mining not covered (Grannall VALIDITY? Of leg? interpreting relevant HOP v Marrickville Marg.) (meaning/scope); characterising the legislation wrt the HOP; - professions not covered (Street v Qld Bar Ass.) check no infringement of any express/implied restrictions Activities of T&C? Principles of Interpretation - prohibition/regulation of imports and exports on any 1 Meaning/scope of power conditions Cth imposes (Murphyores: sand exports) Engineer’s Case (1920): Nationalist approach (reaction - regulate T&C, HC held Cth can take into account any to war); full scope+effect given HOP according to conditions (related or not) that it thinks fit. natural, ordinary meaning of words; rejected the Doc of - Prevent of undesirable practices IO (Redfern v Dunlop) ‘State reserve power’ (R v Barger); C interpreted - safety regs for IO air nav. (Airlines of NSW v NSW) narrowly so as X to extend into affairs of the States Regulation of Intrastate TC? even indirectly; Connotation as at 1900: R v Brislan, Ex - incidental power s51(i) allows Cth to regulate parte Williams (1935), Radio, TV, internet included in intrastate activities significantly connected w IO T&C s51(v) “postal, telegraphic..”, held only bound by “Substantial Connection” – some physical connotation; History of C provisions: earlier connection b/w law and subject matter of HOP (X drafts/Con.debates can be referred to establish economic: ANA intraS stop X justified on financial subjective intention of meaning (McKinley’s Case) – 1 connection, although economic sufficient for drafter’s speech X relevant or representative of whole; Territories s122) Cole v Whitfield - if uncertainty use CDs ok to indicate Test: direct, proximate or substantive connection b/w historical context/intention; intra and IO T&C, (Redfern v Dunlop Rubber : anti- 2 Characterise the law wrt HOP compete contract, composite activity can be covered by Substance/Direct legal effect : substance not form specific HOP, couldn’t divide TC activities) characterises leg. (R v Barger); Fairfax v FCT “the A Causative Connection: Airlines of NSW v NSW: Cth substance of the enactment is the ob which it imposes”; air nav regs extend to inc. intraS for uniform safety. economic effect of connection not sufficient (WA (O’Sullivan): specified manner of treatment/storage of Airlines); as long as law characterised wrt 1 HOP it is meat (upheld in core), registration of slaughterhouses valid even if also law wrt a matter X w/i the Cth power (upheld incidental). Held Cth could reg production if (Murphyores); Does the subject matter of legal effect prior to or effecting export, causative connection – fall w/i: the core of the HOP; (ii) the incidental operation quality standard of the HOP [express in s51(xxxix) to leg wrt Execu/Judic, S 92 Freedom of Interstate Trade or implied in each HOP]; Proportionality: If Cth leg relies - Restriction on power wrt T&C s51(i) “T,C and on implied incidental power Crt can review its intercourse b/w States … shall be absolutely free” reasonableness/proportionality, (Nationwide News Pty - Provision applies to both Cth/State laws (James v Cth) >Public authority – tax enabled by statute s 81 funds - S 92 about free trade: outlaws “discriminatory burden paid into CRF, (Logan Downs) on interstate trade of a protectionist kind” (Cole v >Public purpose – (Air Caledonie): obiter all elements of Whitfield); Ie protectionist policies like quotas, + stops a tax not necessarily necessary; upheld in (Blank Tape discrimination towards interS traders giving local Royalties) royalty fee collected by a Society for traders protection and thus a competitive/market distribution to artists, still held to be a tax even though advantage didn’t go into CRF. - States ^ likely to protect own interests but Cth rarely >Fees for services – (Egg Marketing Board): quid pro legs. wrt particular Sts so X usually practically effected quo indicates FforS; (Air Caledonie) arrival tax X a fee by s92 for service because not on request/direction; (Harper v Issues : interpret of absolutely free? among States? Minister for Sea Fisheries) charge for TC&I? privilege/acquisition/use of property X a tax. Purpose of s92: Absolutely Free? > Penalties – penalty is imposed for failure to discharge Free trade theory – invalidates laws which and antecedent legal obligation discriminate against interstate trade; (Fox v Robins: > Arbitraty Taxes – tax invalid if arbitrary ie not wrt leg. higher licence fee paid by retailers if wine ascertainable criteria w sufficiently general application contained fruit grown outside WA, thus burdened (DFCT v Truhold Benefit, MacCormick v FCT) import of fruit/wine into WA. Burden on interS trade, 1. Is the levy revenue raising or otherwise this view prevails today) regulatory? Individual rights theory – (McAurthur’s Case): strikes If in substance revenue raising then w/i tax power down any leg. which burdens individual’s rights to s51(ii), if regulatory ie designed to regulate some trade I/S, don’t have to show law discriminates b/w activity which may or may not be w/I Cth power (Fairfax interstate traders and local traders, just against v FCT: may look to substance to characterise but must individual. regard ob. imposed) - limitations (very formalistic): criterion of operation test 2. Infringe any restrictions on tax power? – 1. Protection only if law directly effects an activity of - s51(ii) cannot descriminate b/w State or parts of States I/S trade, or 2. Permissible regulation – valid even if - s99 revenue law cannot give preference to one State burdened I/S T&C if public policy ie safety standards, or part of traffic regs, hygiene, provided they are reasonable and - s 114 Cth cannot tax property of the states proportionate in op and X discriminatory against I/S T&C - s 88 Custom duties must be uniform throughout the (Mikasa) Cth Miller’s Case – HC said no clear interpretation of s92 - S55 two limbs 1. law of tax must only impose tax (Air Now HC more form than substance: Caledonie, Blank Tape) 2. law imposing tax shall only - 1998 Cole v Whittfield (crayfish size), held not have one subject of taxation, law of excise only deal discriminatory because applied to all; gave no unfair with excise (Mutual Pools) advantage; protectionist in character but Ok because Other Revenue Powers designed to protect legitimate local interest (crayfish C doesn’t require tax imposed by law but (Wooltops stocks). Reject indiv. rights theory Case) held that this is required at Fed level; Cth can also - discrimination not limited to on face but inc raise revenue by borrowing, payment for services (Cth descrimination by practical effect, substance/purpose of Co.s) provided by Cth, exercise delegated power (Cobb the legislation. & Co v Kropp), anticipatory collection. - Castlemain v Tooheys Formula (bottle deposit system): Appropriations Power ss 82,83 must protect legitimate local need/interest protected - S81 all payments to CRF; S 83 P controls of finance, P not just to protect local trade; measures must be must authorise taxes/appropriation of Cth revenue thus necessary, appropriately adapted + proportional. Exec.is made responsible to P for spending, subject to S Achieve object without excess. 53 Senate can block supply but cannot amend/initiate, Financial Powers appropriate/taxation Bills; they cannot be imposed for S51(ii) Tax: not exclusive power but concurrent; ordinary annual services of gov., and S54 leg shall deal restriction wrt to taxation but so as not to descriminate with A only b/w States and parts of States; s90 customs and excise Forms of Appropriation are exclusive to the Cth 1 by Act for standing appropriation Tax 3 elements and 3 exclusions 2 by an annual appropriation act – for ordinary annual 1. Is levy a tax? Latham J “Tax is a compulsory services or other purposes eg capital exaction of money by a public authority for public works/grants s96 (not subject to s 53) purposes, enforcable by law, and not a payment for Scope of Appropriations Power - “for purposes of the services rendered” (Matthews v Chickory Marketing Cth” s81 Board), exclusions : not a payment for services >narrow view: only purposes w/I Cth range of leg rendered, not a penalty, not an arbitrary tax. powers ie HOPs (Pharmaceutical Benefits Case) >wide view: any purpose the P thinks fit – appropriation - stops discrimination b/w Aust-made and imported by P not justicable but an internal concern b/w P and the goods Executive (AAP Case) Criterion of Liability v Substance Executive’s Spending Power – s61 COL: Dennis Hotels – tax X excise unless COL is the - Ex bound to comply with terms of appropriation taking of a step in the process from production to pt of (Brown v West) consumption - Ex can enter into contracts and other commercial Substance: determine the practical effect of the tax, ie arrangements is it absorbed in final cost of the product (Phillip Morris Grants - s96 Case, Harper ) - Cth = 75% of all revenue, States = 25% ie proclusion Licence Fees – Dennis Hotels Formula: backdating, through exclusivity in s90, Cth gains vertical fiscal levy calculated by ref to quantity/value goods handled imbalance in prior period is not an excise but privilege for - Cth must :. provide essential funding for States to carrying on business which is subject of the licence function, States must compete for funding - confined to licence fees for the sale/distribution of - Uniform Taxation scheme introduced during WW2, Cth goods ie Dennis Hotels (liquor), Dickenson’s Arcade needed ^ control over country’s revenue, fused (tabacco), Sleigh (petroleum), Cth/State income tax, Cth took total amount and Reciepts : a tax on reciepts held to be an excise refunded States in form of s96 grants (States were duty in WA v Chamberlain Industries politically forced to comply with the scheme). Local or Imported Goods?: all goods irrespective of - S96 provides Cth P can grant to States on any terms it origin Parton v Milk Board; maybe limited to good sees fit. produced in Australia and preferably w/I State - Cth can discriminate b/w States (Moran v C of T) imposing the tax by the minority in Philip Morris, - States need the funding and Cth can impose Gosford Meats, Capital Duplicators (no 2). conditions with the grants so can control areas that are External Affairs Power s51(xxix) - how the Cth not w/i their HOP. has gained unintended power over the States - Restrictions: cannot put conditions on grants for States A. Any person, place or thing external to Australia to renounce any C power (1st Uniform Tax Case) (physically external) Excise Duties s90 - Submerged Lands Act Case: HC held Cth had - s 90 provides Cth w exclusive power to impose duties sovereignty over the territorial sea and continental shelf of customs/excise/granting of bounties on the export of persuant to international Geneva convention and goods external to Australia, boundry line is low water mark - provision effectively restricts State power but does not - Polyukhovich : war crimes charges, validity challenged, infer power on the Cth (already derives power from validity upheld under external affairs power because s51(ii); (Capital Duplicators No 1): held s90 also dealt with occurences happening outside Australia ie procludes the Territories power also covers external acts/conduct. Basic def. of excise duty – tax on goods, need to - Cth could enact law/prescribe offences overseas – but satisfy both not enforcable. Tax? – see s51(ii), (def.:Chikory, exclusions:Air - States can enact leg. operating beyond their boundries Caledonie) if sufficient nexus b/w the leg’s subject matter and the Not a Tax – most challenges = fee for a services interests of the State. Ie Qld regulates off-coast fishing rendered vessels which effect the state’s fishing industry. Qld CC (Air Caledonie) no request/consent X= fee for service; extends 200 km out. (Hopper v Egg Marketing Board) was a FforS because B. Foreign relations/ diplomacy egg dealings = levy, ie quid pro quo; (Parton v Milk Treaties and Conventions Board) = not fee for service, was a tax on milk; (Mutual fundamental distinction b/w sign/ratify T&C’s and Pools) tax on interest in land is not an excise implimenting domestically. Domestic application only Tax on goods ? – Centralist v Federalist views of s90 through Act of P (Walker v Baird)(unlike USA- automatic scope (Peterswald v Bartley) : on quantity or value of domestic app.), sign/ratify decided by Cth Executive w goods wrt production or manufacture; BUT HC moved authority from s61, criticism of Executive for enter 900 away in broad view of (Parton Milk Board) excise duty is treaties w/o reference to P/States/people and tend to not just imposed on manufacture/production but all leave domestically latent, Recent official inclusion of P stages up to, not including consumption (Australian in process goods, o/s goods, wholesale, retail, distribution). - Teo Case: Malaysian, deport drug offences, married - Dickensen’s Arcade : a tax on consumption is not an Aussie, children. Australia party to UN Convention on excise the Rights of the Child 1991. HC stayed deportation, >most recent case Ha v NSW same view as Peterswald, held Teo had a reasonable expectation that since view customs/excise duties complimentary opposites, Australia was a party to the C they would act by it even mutually exclusive, one import one export if terms not adopted/implimented into the domestic effect/law, so Executive must give adequate admin. NOW CAT accepted but still regard purpose wrt shelf consideration to convention obs. Cos. (Fencott v Muller) - Cth can impliment conventions through a specific hop (2) Extent of regulation? Tasmanian Dam Case 3 or ExAffP views expressed - States can implement an international treaty into law >all activities of s.51(xx) corp (3/4) by the residual power “health, welfare, good gov. of the >all activities of Tcorps done for the purposes of their people”. trading activities >>Scope of Power - 1965 Convention on Descrimination >only activities where the nature of the corporation as - 1975 Racial Descrimintation Act implemented by Cth. TorF corp is significant in the way the law operates wrt but not under HOP: wide view – any treaty, narrow those activities (2) view : matter of I character (R v Burgess) (3) Does power extend to incorporation and/or - Koowata v Peterson : (descrimination against Abs land winding up? rights) Majority – any TC, Xaff plenary power ie no > no power of incorporation: (The Corporations Act restrictions implied. Policy: if Cth signs ITC it assumes I Case) obligations thus must be given the leg capacity/power > Position as to winding-up unclear. to implement/enact those ob, insufficient to depend on Compulsory Acquistition – s51(xxxi) – wrt states to impliment non-uniformly, Minority - must be acquisition of property on just terms from any State or indisputably international in character; Clarified in Tas person for any purpose in respect of which the P has Dams Case : any ITC is external affair not matter what power to make laws. the subject matter but must be “reasonably considered, >Acquisition : must be compulsory, by Cth or some appropriate and adapted” so //s purpose of T body/person authorised by Cth (TPC v Tooth) >>2 Restrictions: entry into treaty bona fide (ie not >purpose: purpose w/i Cth power, unclear whether Cth simply for Cth gain control over an area of law through must use property for self (Clunies-Ross v Cth) Xaff power) >property: any interest recognised at law (realty or - leg. reasonably adapted+ appropriate (reasonable // personlty) [statutory right = property (Health Insurance b/w the obs and legislation, R v Burgess, “there must Commission v Peverell)] be a faithful pursuit of the purpose of the convention in >just terms: if leg doesn’t mention compensation then terms of the legislation” Dixon J) JT implied (Dalziel’s), if leg provides unjust terms law Incidental Applications: (Industrial Relations Act invalid (GraceBros v Cth) Case) – Held terms of C need not be too precise – - factors in determining JT: CL principles of comp freedom to impliment leg that //s general obligations (Nelungaloo v Cth), practice of other legeslatures, or purpose providing proportional, Cth can choose interests of the community (Grace Bros v Cth), from obs providing does not change character/nature reasonable man test (Johnston Fear) of the remain obs.; Can leg on . Cth Aquired Places : s52(i) exclusive power to leg recommendation/requests of I bodies (obiter in R wrt “all places aquired by Cth for public purposes” vBurgess) if matter of “international concern”; >place = any area of the earth’s surface (Worthing v Richardson v Forestry Commision : TasDams-like Rowell) legislation delayed damage while waited for results of >acquired = purchase, gift, c acq, transfer inquiry into heritage listing. Held legislation was >public purpose = not limited to HOP (Worthing) “r/a/a”, illustrates incidental app. of power >State law apply to Cth land w/i State? Pre-federation Laws on face dealing w Foreign Relations – state law continues to apply (R v Bamford), State law extradition, exclusion/deportation of aliens/prevention enacted after (Worthing v Rowell) or before (R v Phillips) of sedition against Gov of sister dominion. Cth acquires does X apply International Concern – can enact leg. not the CTH & STATE EXECUTIVE POWER subject of specific obligations but . Composition & Powers recommendations/requests of I bodies (Industrial - Executive exists at both federal and state levels Relations Act Case: recs of IOL followed) - Comprises: Queen's rep. (GG or G), Ministers of Corporations Power s51(xx) – power wrt “Foreign State (form Exec Council); Queen at both Cth/State corporations, and trading or financial corporations level possesses only one power: power to formed w/i the limits of Cth” appoint/dismiss her reps.; “Executive power vested - “foreign corporations” covers all corporations formed in the Queen exercisable by GG”; s2 Queens outside Aust. appoints GG; power of the GG (solely ie s64 (1) Characteristics of “trading or financial” corp? 2 appoint /dismiss Ministers, C convention qualifies approaches powers - GG must always act on advice of > Purposes Test: incorporated for TorF purposes (R v Ministers, principally PM) in "exceptional TPT; ex parte St.George County Council) circumstances" GG may act w/o advice "reserve >Current Activities Test: corp’s current activities power" ie after general election when no “substantially” TorF (National Football League Case, party/coalition achieves majority in LH, Gov. loses confidence of LH, Gov. acts illegally (Lang Affair), supply blockage (1975 crisis), Gov. advises a discrimination – held power to considered was J power dissolution of P for early election, PM/P refuses to therefore invalid because body was not a Crt under s71 resign upon leaving leadership of Gov. party. >Non-judicial power cannot be vested in s71 Crts . Principal Powers of the Governor-General in (Boilermaker’s Case: Cth industrial dispute, Crt Council: (s.63) exercised s51(35) industrial law power. Originally power - s.32 issue writs for general elections of HofR, s.64 to make/enforce awards – this held unC because award establish Depts of State, s.67 appoint of Cth public power deemed legislative (making new law on new servants, s.72 appoint federal justices employment rights) but enforce power was ok because . Principal Powers of the Governor-General judicial. Therefore had to create Industrial Relations per se: Commission) P: s.5 convene/prorogue sessions of P, dissolve Simultaneous J and Non-J Powers? HofR, s56 recommend appropriation, s.57 double - Joski’s Case : non-judicial power out of judiciary not as dissolution, order joint sitting, s58 grant/refuse convenient royal assent; Executive: s.62 chooses members of > appointment of federal judges in their personal the Federal Executive Council, s.64 capacity to non-judicial bodies (Drake’s Case: which appoint/dismiss Q's Ministers of St, s.68 challenged the appointment of a Federal judge as Commander in Chief of defence forces President of AAT) Appointment & Dismissal: - not expressly stated > conferral of non-judicial power on federal judges in in Cs, Convention : those who form a government their personal capacity (Hilton v Wells: interception must possess the confidence of majority of the warrant by legislation) LHofP Exception : Persona Designata/Incompatability Doctrine - Executive Power Royal prerogative powers, (HC in Grollo&Palmer) : appointment or conferral of power to engage in contracts/business enterprises, persona designata power cannot be incompatable with (NSW v Bardolph), powers delegated to the the exercise of Federal Judicial Power. Executive by P; Executive power exercised in form ** SOP held not to apply in most States but Kable v DPP of an Order in Council; both Cth (s.61, AAP Case) & held that sep wrt judicial and non-judicial powers State (s.7 of Australia Acts 1986) Exec possess imposed limit on State leg power. these 3 types of power P Usurping Judicial Process (either by proporting to JUDICIARY use judicial power or interferring in judicial process) . Doctrine of Separation of Powers - P cannot usurp/interfere with the judicial process egs - Montesque “The Spirit of the Laws” SOP to prevent Bill of Attainder (crim law operating tyranny and protect the individual’s liberty; retrospectively is not BofA [Polyuchovich]), Interpretation of the C: supports SOP through 1st alteration of rights in pending litigation was sentence s71 and implied through structure (3 separate ‘commanding the Crt’(Lyanage v Queen) cf non- defining CHS) (Dignan’s, Boilermaker’s, Wilson usurp because only interfered with substantive [Hindmarsh Island], Kable); three arms of government – rights (BLF v Cth) LEJ, w separate functions/powers/personnel; Australia: Judicial Independence - 4 C mechanisms designed to fairly strict seperation b/w judicial and non-judicial protect judicial independence: A. Security of Tenure: powers; Nothing comparable to ch3 in the State Cal but Executive appoints judges cF USA (Alexander's Case), Cth ch3 is starting to encroach through CL on the states. dismissal s.72(ii) for good reason (corruption, Separation of legislative & executive power – no strict incompetence etc); B. Contempt of Crt: conduct which seperation (overlap of memebership) (Dignan’s); challenges, denies, interferes with judicial authority and delegated leg.limited : cannot be so wide as to not impedes the admin. of justice (R v Dunbabin; ex parte be characterisable under a Cth HOP, can’t Williams); C. Judicial Immunity: (Mostyn v Fabrigas); D. delegate whole HOP (unCal), P must retain control Doctrine of Separation of Powers over the delegation (ie can take it back) (Wishart v Defining Judicial Power: test : resolution of an Fraser, Giris v F.C.T.) existing dispute b/w parties whereby there must be a Separation of Judicial and Non-Judicial Power determination of the existing rights of those parties; not - Boilermakers case: “in a Federal system the absolute to make law (create new rights) or to enforce/administer independence of the judiciary is the bulwark of the C law, power challenged Wilson (Hindmarsh island case: against encroachment ” report carried out by a judge) - S71 HC/other Fed Crts created by P and such other Express Restrictions on Power (Inconsistency s Crts vested with Fed jurisdiction ie State SCs 109, Freedom of religion s 116, Rights of residents of > Judicial power of the Cth can only be vested in a s71 different States s 117) judicial body (Wheat Case, Brandy) (exception Inconsistency - s 109 : “When a law of a State is contempt of P, martial law in ADF) inconsistent with a law of the Cth, the latter shall (Wheat Case): Interstate Comission had Cth vested in it prevail, and the former shall to the extent of the – invalid : powers judicial and X a Crt; (Brandy’s): inconsistency be invalid.” Commission given power to determine issue of 3 issues in application of s 109: meaning of "law": essential pre-requisite to depending upon the extent to which they are subject to operation of s.109 is that there be a valid Cth law and a ministerial control St Bank NSW v CofTax valid State law. Acts of P, Regulations (O’Sullivan v The C: Although intergovernmental immunities Noarlunga Meat Ltd (No. 1)), State or Federal Industrial inevitably arises in federal system, little coverage in C Awards (Ex parte McLean), A Ministerial Order pursuant Can the Crowns bind each other? to an Act of P (Colvin v Bradley Bros), Land Title (Cth v HC thus left to resolve issue of intergovernmental NSW), CL (R v Kidman)] immunities w/o clear guidance from HC 1904-1920: meaning of "to the extent of the inconsistency be Acceptance of a doctrine of intergovernmental invalid": despite reference to "invalid", an inconsistent immunity HC recognised govs of Cth/States were immune State law is not rendered void by s.109, rather it simply from each other’s laws. Ie adoption of the doctrine of State becomes inoperative for the period inconsistency exists reserve powers D’Emden v Pedder, Deaken & Lyne v (Butler v A-G Vic) Webb, Railway Servants 1920-1947: Rejection of the doctrine of intergovernmental immunity Engineers - Only provisions of State law which are inconsistent w Case rejected both the doctrine of State reserve powers and Cth law become inoperative (Viskauskas v Niland) the doctrine of intergovernmental immunity. New approach unless severance is not possible (Wenn v A-G Vic) interpret the Cth’s HOPs according to their natural meaning meaning of "inconsistency": Inconsistency direct or giving them full scope and effect without reserving any part indirect. of their scope for State. Accordingly HC upheld application of DIRECT s.51 (xxxv) the conciliation&arbitration power, to the impossible to obey both laws (Daniell), settlement of industrial disputes involving State Governments when one law permits that which the other law and their instrumentalities.Australian Railways Union v prohibits (Colvin v Bradley Bros.), when Cth imposes an Victorian Railways Commissioners upheld application of a ob. or confers a right then State modifies it (Clyde Cth industrial award to State railway employees, recognised that Cth could X force appropriation of State revenue to Engineering v Cowburn) satisfy award rates of pay.Engineers left open whether Cth - direct inconsistency where both Cth and State provide could tax State Govs (outside s.114) or affect their royal the same criminal offence or whose elements are prerogative rights. Resolved later.1947: Melbourne substantially the same? (Ex Parte McLean) Corporation Principle - Qualification to Engineers INDIRECT inconsistency may arise where the Cth Case Melbourne Corp v Cth (State Banking Case), HC attempts “to cover the field” and State law trespasses - majority invalid s. 48 of the Banking Act 1945 (Cth). consider 3 matters: Melbourne Corporation principle consists of two Does the Cth intend to cover the field? (intention limbs: may be expressed or implied - implied intention: the “(1)a prohibition against discrimination which involves subject-matter of the law, the comprehensive nature of the placing on the States of special burdens or its provisions, the need for uniformity in the law Wenn v disabilities; and (2)a prohibition against laws of general A-G (Vic), Ex parte McLean). Cth may indicate it does application which operate to destroy or curtail the not intend to cover the field in which case only if direct continued existence of the States or their capacity to inconsistency will s.109 apply (ex parte GM Acceptance function as governments.” 1st limb prohibits laws which Corp. Aust, McWaters v Day). However, Cth X give single out the States and discriminate against them. In retrospective effect to such a declaration not to cover both Melbourne Corporation v Cth and Q.E.C. v Cth the field exclusively (University of Wollongong v invalidity arose from a breach of this limb. Richardson Metwally) ‘this Act is intended and shall be deemed v Forestry Commission (tasdam-like delay) never to have been intended to exclude the operation of recognised that nature of a legislative power may a law of state or territory that furthers the object of the permit special treatment of part of a State without convention and is capable of operating concurrently infringing the Melbourne Corporation principle. with this Act’, majority held not Cally valid 2nd limb prohibits laws of general application only if Which “field” is covered? rather drastic nature: ie they operate to destroy or Has the State intruded on this field? (Airlines of NSW curtail the continued existence of the States or their v NSW (No. 2), Hospital Benefits Case) capacity to function as govs. Given narrow scope no Cth & State Immunity: to what extent can Cth instance of its breach has arisen yet. regulate State Govs and their instrumentalities and Cth Regulation of the States Engineers Case: No visa versa? degree of State immunity recognised apart from 1. Does the legislation purport to bind the Crown? limited protection afforded by the Melbourne Test is the intention of P (express or implied) Bropho v Corporation principle. Cth can tax Western Australia rejected inflexible approach that State/instrumentalities (Payroll Tax Case, Vic Crown bound by neccessary implication if it is “manifest v Cth); It can abrogate State royal prerogative from the very terms of the statute”, adopted more powers (FCT v Official Liquidation of Farley, flexible approach to implying such an intention Second Uniform Tax Case (Vic v Cth) 2. Who falls under the “umbrella” of the Crown? State Regulation of the Cth Unsettled position. Apart from the Gov. (ie Ministers/Depts/public servants), Appears accepted despite Engineers that Cth enjoys statutory bodies may also come w/i the “Crown” some degree of immunity from State regulation. Interpretation of width varies from total to partial. Application of Engineers Case: Pirrie v McFarlane: Cth defence personnel not immune from State traffic laws; West v CofTaxation: Former Cth public servants not immune from State taxation. Recognition of Cth Immunity Uther’s case per Dixon J (in dissent); Essendon Corp v Criterion Theatres; Cth v Bogle per Fullagar J (obiter); Cases above wide views of general Cth immunity expressed by Dixon/Fullagar; Cth v Cigamatic overruled Uther v FCT: recognised that Cth’s royal prerogative powers are immune from State regulation; Henderson’s Case: majority held Cth Executive immune from any State law which purported to affect its capacities but X immune in respect of any transactions which Cth engaged in w/i those capacities ie distinguished capacity and exercise of that capacity. **Section 109: S109 provides Cth w a mechanism of self-protection by ability to enact prevailing inconsistent law. Aust. Coastal Shipping Commission v O’Reilly **Despite any doctrine of Cth immunity but subject to s109, Cth has subjected itself to State law pursuant to the Judiciary Act 1903 (Cth) ss 64, 79 and 80. Maguire v Simpson, Implied Rights: (Cth/State Immunity, Freedom of Political Discussion) FREEDOM OF POLITICAL DISCUSSION: Nationwide News, Australian Capital Television ABORIGINAL NATIVE TITLE: Mabo v Queensland IMPLEMENTATION OF INTERNATIONAL HUMAN RIGHTS COVENTIONS Implied rights : Nationwide News Pty Ltd v Wills (IRA – act invalid breached implied right to freedom of p comm in rep gov), Aust Capital TV [No.2] confirmed implied right wrt political/public matters, Theophanous, Stephens, Lange Mechanisms of Cal Reform (s 128 of C, HC interpretation, Cth & State co-operative arrangements) * Section 128 Amendment: Basic Procedure - Amendment Bill passed by an absolute majority in both Houses of Cth P, w/i 2-6 mths after Bill's passage through P it must be submitted to a referendum and approved by a majority of electors in a majority of States and a majority of all electors (ie in States & those Territories represented in HofReps). Record of Amendment: 9/42 proposed amendments successful recognise human rights but should be legislation that recognises it Express rights and Freedoms: freedom of - Hypocracy: Australia has ratified international interstate T&C: section 92, acquisition of property on Covenant on Civil and Political Rights and adopted just terms: section 51(xxxi), discrimination b/w states optional protocol, (Consti case about consideration and preference: sections 51(ii) & 99, freedom of of treaties in decisions), but no commitment religion: section 116; discrimination on basis of state domestically through legislative implementation (as residence: section 117, trial by jury: s 80, popular in USA) automatically, should bring Constitution in elections: s 24 McKinlay v Cth line with International obligations not just CL Implied rights and freedoms: - Greater nationalism, // republic movement Original Cconvention – said didn’t need because no - would change the process of the HC bringing less struggle against tyranny, ideology of utilitarianism, legalistic more expansion of balancing rights and attachment to UK Parliament, White Australia policy. policies/principles (structure >> form tendancy, Review of Constitution in 1988 recommended BR. good or bad?? debatable). Human Rights Bill withdrawn 1986. CON . Express rights under Australian Constitution - Court’s competent to interpret, don’t want explosion Express Human Rights in the Constitution but in of rights as in US, not democratic because transfers practice they are not absolute power to unrepresentative judiciary from the - no coherent thread, fragmented because of much representative legislature. original oppositon - if not broke don’t fix it: “If society is tolerant and - s24 constitution of the House of Reps. Made up of rational, it does not need a Bill of Rights, if it is not, people directly chosen Ie right to vote but criticisms no Bill of Rights will preserve it” – Sir Gibbs 1990 of preference systems and party alliances (ideology of utilitarian ideas) - s 51 legislative powers of Parliament (xxxi) - lack of a struggle against tyranny in Australia rather acquisition of property on just terms – ie right to fair evolved compensation for acquisition - inflexibility possible conflict/override with laws - s80 right to trial by jury express for trial of indictment but is it really a right because executive Possible models? : NZ BofR not entrenched Act of decides what is an indictment and only for Cth Parliament but legislate consistently with it. Canada – offences, also inadequacy of representative juries “a entrenched Charter. Or bringing into effect the jury consistes of 12 people…” international convention by legislation. s 116 freedom of religion, but only for Cth C, and - egs of content: fundamental freedoms, mobility and hypocritical because elsewhere in Constitution God work rights, equality rights, legal rights, group involved in the act of Federation, limited to not in rights, community rights, override clause? (justified conflict with laws of the land, non-violent beliefs not an rights), inc Civil and political rights? Economic and excuse in war. social rights? Community and Cultural rights? - s 117 freedom from discrimination based upon state Privacy? Entrenched? HC final interpreter? Change residence role of HC? Can we trust HC in this? . Implied rights – can be implied from structure of the C (ie SOP separate chapters) or from Common law doctrines derived from the C Freedom of Political Discussion (Nationwide v Wills, ACTV) upheld as implicit right in C Confusion in CL : above cases started off queries of implied rights, Theophonis [Cth] and Stevens [extends to states] (freedom of political communication), Lange defamation, restricts implied rights no Constitutional defence for defamation wrt politics but CL defence. Levi (duck case) law reasonably appropriate for safety reasons. Leeth v Commonwealth: legal equality was “necessary implication” of the C Murphy dicta – wide interpretation of implied rights supporting overall human rights

PRO: - Patchy record of civil liberties in CL and patchy coverage in Constitution - Uncertainties of judicial activism not always consistent, international pressure on courts to