12. a. Price Discrimination and Consumer Surplus

A monopoly, under certain circumstances, may be able to increase their profits by abandoning a single- price policy for its output. This possibility of selling identical goods at different prices is referred to as price discrimination.

Definition: A monopoly employs price discrimination if it is capable of selling otherwise identical units of output at different prices.

Whether price discrimination is viable depends critically on the inability of buyers of the good to resell it. When resale is not permitted or is very expensive, price discrimination becomes feasible.

Perfect Price Discrimination

It may be possible to charge each buyer the maximum price he would be willing to pay for the good provided that each buyer can be individually (separately) identified by the monopolist. This tactic of perfect (or first degree) price discrimination leads to the monopolist obtaining all existing consumer surplus.

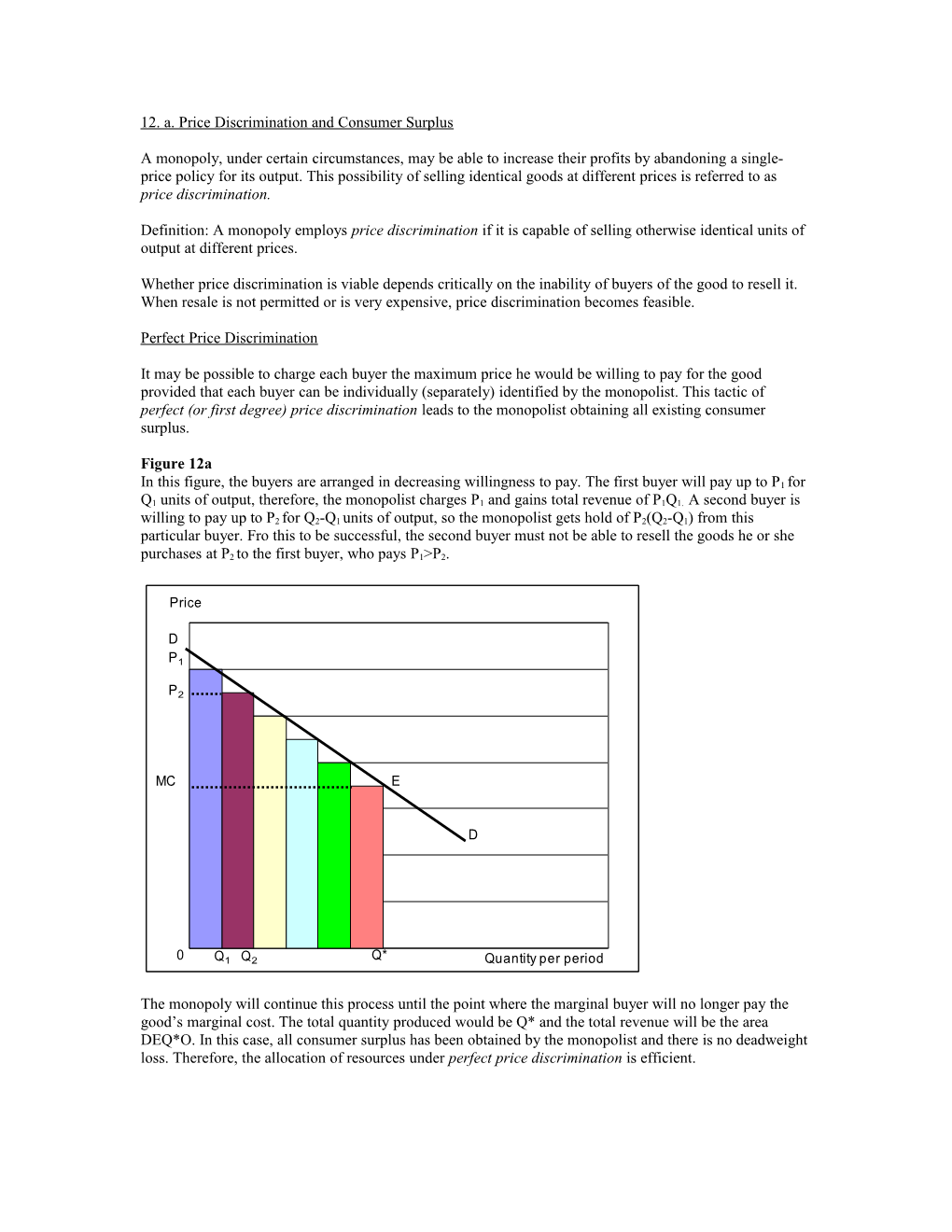

Figure 12a

In this figure, the buyers are arranged in decreasing willingness to pay. The first buyer will pay up to P1 for Q1 units of output, therefore, the monopolist charges P1 and gains total revenue of P1Q1. A second buyer is willing to pay up to P2 for Q2-Q1 units of output, so the monopolist gets hold of P2(Q2-Q1) from this particular buyer. Fro this to be successful, the second buyer must not be able to resell the goods he or she purchases at P2 to the first buyer, who pays P1>P2.

Price

D

P1

P2

MC E

D

0 Q1 Q2 Q* Quantity per period

The monopoly will continue this process until the point where the marginal buyer will no longer pay the good’s marginal cost. The total quantity produced would be Q* and the total revenue will be the area DEQ*O. In this case, all consumer surplus has been obtained by the monopolist and there is no deadweight loss. Therefore, the allocation of resources under perfect price discrimination is efficient. Sample Question

Suppose the market for competition quality soccer balls (Q, measured in soccer balls bought per year) has a linear demand curve of the form: Q = 2,000 – 20P Or P = 100 – Q/20

And that the costs to a monopoly soccer ball producer are given by: TC = 0.05Q2 + 10,000 At what quantity will the monopolist produce? How many soccer balls will be sold?

Because there are relatively few high-quality soccer ball available for sale, the monopolist may find it possible to discriminate perfectly among competitive soccer players. In this situation the monopoly will choose to produce the quantity for which the marginal buyer pays exactly the marginal cost of a soccer ball. P = 100 – Q/20 = MC = .1Q Therefore Q* = 666