Managerial Accounting Accounting 102 Fall 2007 Course Syllabus

Course Description: Introduction to management's use of accounting information for planning, control, and decision-making within an organization. Covers both traditional and contemporary topics, including product costing, overhead, budgeting, cash flow, financial statement analysis, and the advanced manufacturing environment.

Units of Credit: 4 Semester Units

Prerequisites: Accounting 101

Class Times / Location: Tuesday & Thursday 6:30pm to 9:05pm Business Education 108

Instructor Information:

Richard Pagel Office Location: Administration Building Office Hours: By Appointment Telephone: (714) 432-5111 Instructor Website: http://occonline.occ.cccd.edu/online/rpagel/ E-mail: [email protected] Wiley PLUS Website: http://edugen.wiley.com/edugen/class/cls37321/

Required Course Text and Material:

1) Managerial Accounting, 3rd Edition Authors: Weygandt, Kieso, Kimmel

2) Wiley Plus for Managerial Accounting

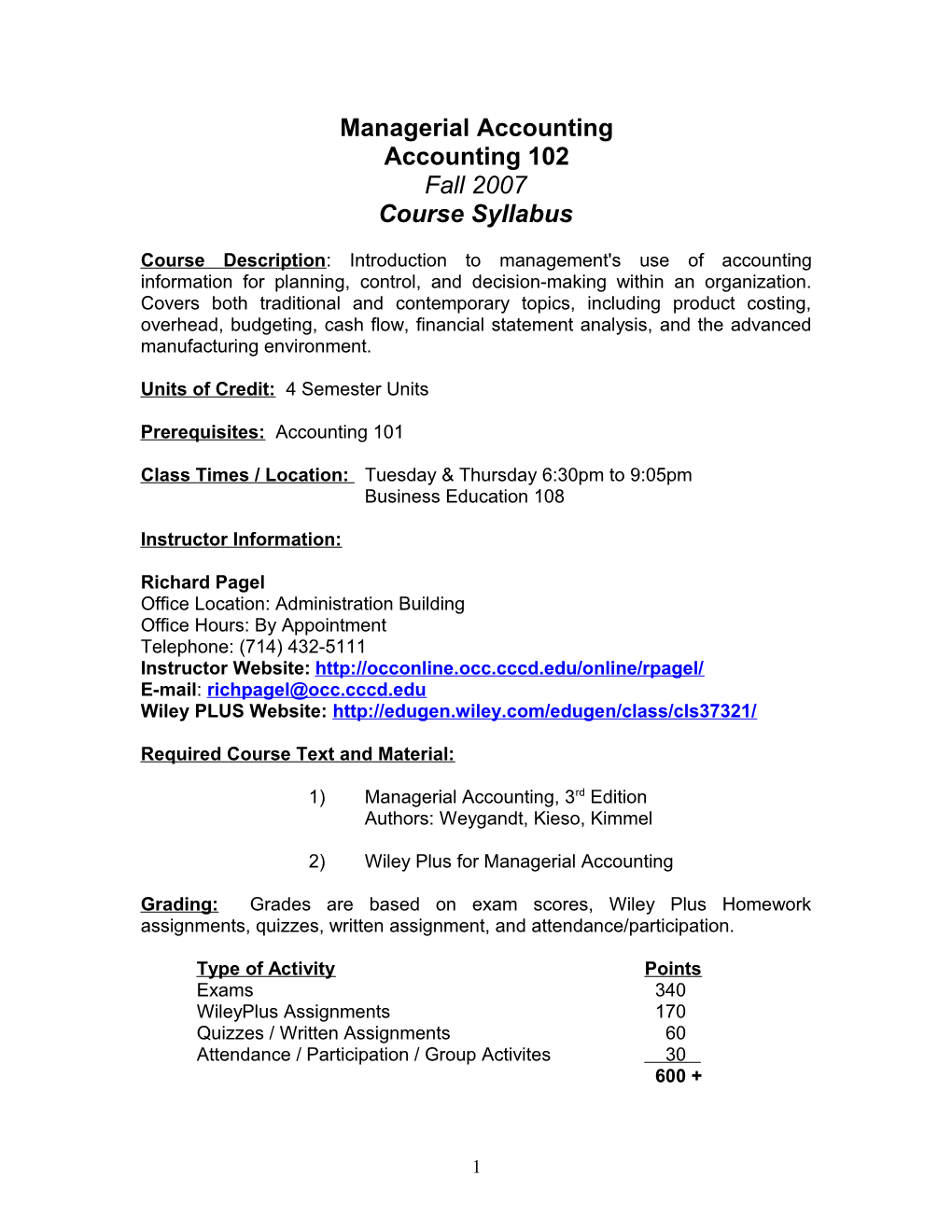

Grading: Grades are based on exam scores, Wiley Plus Homework assignments, quizzes, written assignment, and attendance/participation.

Type of Activity Points Exams 340 WileyPlus Assignments 170 Quizzes / Written Assignments 60 Attendance / Participation / Group Activites 30 600 +

1 Grading Scale:

Grade Points

A 600+ - 540 B 539 - 480 C 479 - 390 D 389 - 300 F 299 or lower

Types of Graded Activities

Exams: There are four exams: two inter-term exams (70 points), one mid-term exam (100 points) and one final exam (100 points).

IMPORTANT: Make-up exams and quizzes will ONLY be given with prior approval and Make-up exam appointment from the instructor. NO Make-up Exam will be offered for the Final Exam.

WileyPlus Assignments: See Wiley Plus Website for Assignments.

Quizzes / Written Assignments: Two Quizzes will be given during the semester for 25 points each.

One written assignment (of at least one page in length) on Financial Analysis. The written assignment will be worth 10 points.

Attendance / Participation / Group Activities: Attendance and participation is a required part of this course. Students who miss 4 or fewer classes will be given 10 extra credit points. Students who arrive late or leave early will be maked as ½ an absence.

If a student arrives late (after role call), it is the student’s responsibility to inform the instructor of their attendance. (Students should inform the instructor the same day of the class).

Classroom Information

1) ON-TIME: Students who are unavoidably late should enter the rear door and quietly take the nearest available seat. It is your responsibility to notify the instructor if you are late for attendance purposes (see Attendance).

If you are aware you need to leave early, please sit in the rear of the classroom and exit from the rear of the classroom.

2 2) CELL PHONES: Turn off cell phones and pagers when entering the classroom. Wait until the break or after class to return phone calls. Please use phones outside the classroom.

3) BE PREPARED: Each class bring your textbook, writing materials, calculator and any required assignments.

4) RESPECT OTHER STUDENTS AND THE INSTRUCTOR: Do not talk with other students during lecture time. If you have a question, please raise your hand and you will be called. During group activities you will have an opportunity to talk and interact with others.

5) IMPORTANT DATES

September 21, 2007 Last day to withdraw to avoid a “W” November 16, 2007 Last day to withdraw with a “W”

WITHDRAWING IS YOUR RESPONSIBILITY

6) NO FOOD OR DRINK IN CLASSROOM

7) CHEATING: If you are caught cheating on an exam or quiz you will receive a zero score for that exam or quiz.

3 Weekly Schedule and Topics (REVISED 9/9/07)

Week Dates Chapters / Topics Exam/Quiz Dates 1 8/28 & 8/30 Introduction Chapter1: Managerial Accounting 2 9/4 & 9/6 Chapter 2: Job Order Cost Accounting 3 9/11 & 9/13 Chapter 3: Process Cost Quiz #1 9/11 Accounting 4 9/18 & 9/20 Chapter 4: Activity Based Costing 5 9/25 & 9/27 Chapter 5: Cost Volume-Profit Exam 9/25 (Chapters 1 to 4) 6 10/2 & 10/4 Chapter 6: Incremental Analysis 7 10/9 & 10/11 Chapter 7: Variable Costing: A Decision-Making Perspective 8 10/16 & 10/18 Chapter 8: Pricing Mid-Term Exam 10/16 (Chapters 1 to 7) 9 10/23 & 10/25 Chapter 9: Budgetary Planning 10 10/30 & 11/1 Chapter 10: Budgetary Control and Responsibility Accounting 11 11/6 & 11/8 Chapter 11: Standard Costs and Quiz #2 11/8 Balanced Score Card 12 11/13 & 11/15 Chapter 12: Planning for Capital Investments 13 11/20 Chapter 12: Planning for Capital Exam 11/20 Investments (Chapters 8 to 12) 14 11/27 & 11/29 Chapter 13: Statement of Cash Flows 15 12/4 & 12/6 Chapter 14: Financial Analysis: The Written Big Picture Assignment 16 12/11 & 12/13 Chapter 14: Financial Analysis: The Final Exam 12/13 Big Picture & Finals Week (Chapters 1 to 14)

4