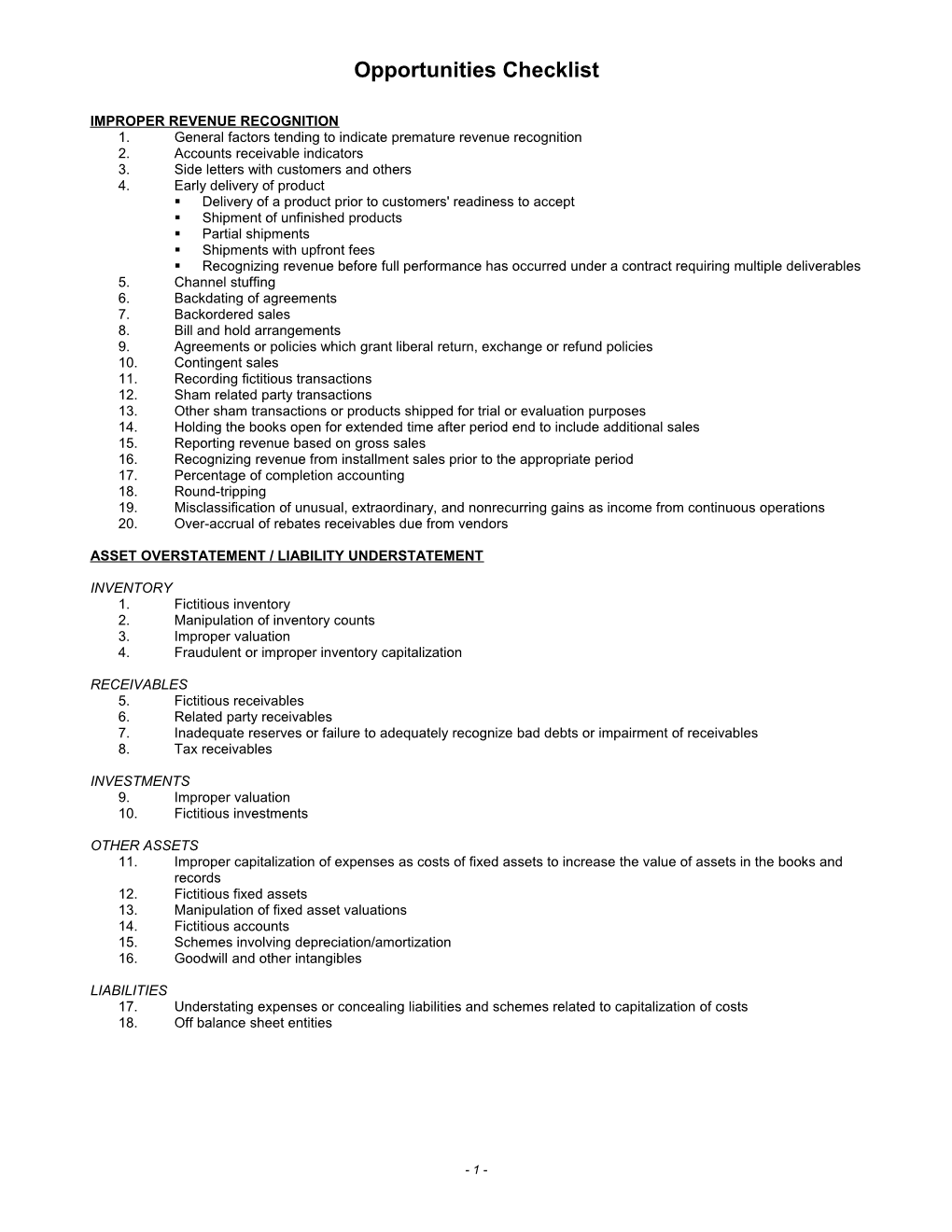

Opportunities Checklist

IMPROPER REVENUE RECOGNITION 1. General factors tending to indicate premature revenue recognition 2. Accounts receivable indicators 3. Side letters with customers and others 4. Early delivery of product . Delivery of a product prior to customers' readiness to accept . Shipment of unfinished products . Partial shipments . Shipments with upfront fees . Recognizing revenue before full performance has occurred under a contract requiring multiple deliverables 5. Channel stuffing 6. Backdating of agreements 7. Backordered sales 8. Bill and hold arrangements 9. Agreements or policies which grant liberal return, exchange or refund policies 10. Contingent sales 11. Recording fictitious transactions 12. Sham related party transactions 13. Other sham transactions or products shipped for trial or evaluation purposes 14. Holding the books open for extended time after period end to include additional sales 15. Reporting revenue based on gross sales 16. Recognizing revenue from installment sales prior to the appropriate period 17. Percentage of completion accounting 18. Round-tripping 19. Misclassification of unusual, extraordinary, and nonrecurring gains as income from continuous operations 20. Over-accrual of rebates receivables due from vendors

ASSET OVERSTATEMENT / LIABILITY UNDERSTATEMENT

INVENTORY 1. Fictitious inventory 2. Manipulation of inventory counts 3. Improper valuation 4. Fraudulent or improper inventory capitalization

RECEIVABLES 5. Fictitious receivables 6. Related party receivables 7. Inadequate reserves or failure to adequately recognize bad debts or impairment of receivables 8. Tax receivables

INVESTMENTS 9. Improper valuation 10. Fictitious investments

OTHER ASSETS 11. Improper capitalization of expenses as costs of fixed assets to increase the value of assets in the books and records 12. Fictitious fixed assets 13. Manipulation of fixed asset valuations 14. Fictitious accounts 15. Schemes involving depreciation/amortization 16. Goodwill and other intangibles

LIABILITIES 17. Understating expenses or concealing liabilities and schemes related to capitalization of costs 18. Off balance sheet entities

- 1 - ASSET MISAPPROPRIATION

CASH 1. Cash skimming: unrecorded sales or receivables 2. Cash skimming: theft of cash receipts 3. Cash skimming: understated sales or receivables 4. Lapping (converting a customer payment and then using subsequent customer payment to cover the previous customer’s account) 5. Fraudulent disbursements: creation of fictitious vendors by an employee or suing shell companies to: . Convert monies by having the shell bill the entity for goods or services it does not receive, or . Purchase goods or services, which are then marked up and sold to the employer through the shell. 6. Fraudulent disbursements (Disbursement of company funds including the issuance of false credits, refunds, rebates and bribes to legitimate vendors for which the employee receives a kickback) 7. Fraudulent disbursements: over-billing schemes (Schemes wherein the paying employee with the aid of a sub contractor or supplier, adds an illegal payment to a legitimate business expense or trade payable. The third party then forwards the excess payment to the intended recipient or returns it to the payer.) 8. Fraudulent disbursements: pay and return schemes (Schemes where an employee improperly pays a vendor or pays a vendor for an invoice twice. The employee then calls the vendor and requests that the improperly issued or duplicate check be returned. The employee then intercepts the incoming check and cashes it.) 9. Fraudulent disbursements: check kiting 10. Fraudulent disbursements: theft of company checks and check tampering 11. Fraudulent disbursements: Expense report schemes 12. Personal purchases

PAYROLL 13. Payroll fraud: fictitious employees (creating fictitious employees on the payroll and converting the pay checks issued to such employees) 14. Payroll fraud: falsified sales or hours 15. Payroll fraud: falsified wages 16. Payroll fraud: workers’ compensation

INVENTORY 17. Theft of inventory 18. Misappropriation of Inventory: False Sales, Write-Offs and Other Debts

FIXED ASSETS 19. Theft of fixed assets

REVENUE AND ASSETS OBTAINED BY FRAUD 1. Fraud against the government or customers 2. Antitrust

COSTS AND EXPENSES AVOIDED BY FRAUD 1. Fraud against suppliers or employees 2. Environmental, Health and Safety violations 3. Improper labour practices 4. Tax fraud 5. Money laundering

EXPENDITURES AND LIABILITIES FOR AN IMPROPER PURPOSE 1. Payments to government officials (FCPA bribery, FCPA violations) 2. Illegal political contributions 3. Commercial bribery

FINANCIAL MISCONDUCT BY A MEMBER OF SENIOR MGMT OR THE BOARD 1. Use of corporate assets to commit illegal conduct 2. Insider trading 3. Unauthorized compensation 4. Failure to pay taxes 5. Travel expense fraud or abuse 6. Receipt of free or below market goods and services from vendors, suppliers, etc. 7. Related party transactions 8. Conflicts of interest 9. CV and Academic deception

- 2 -