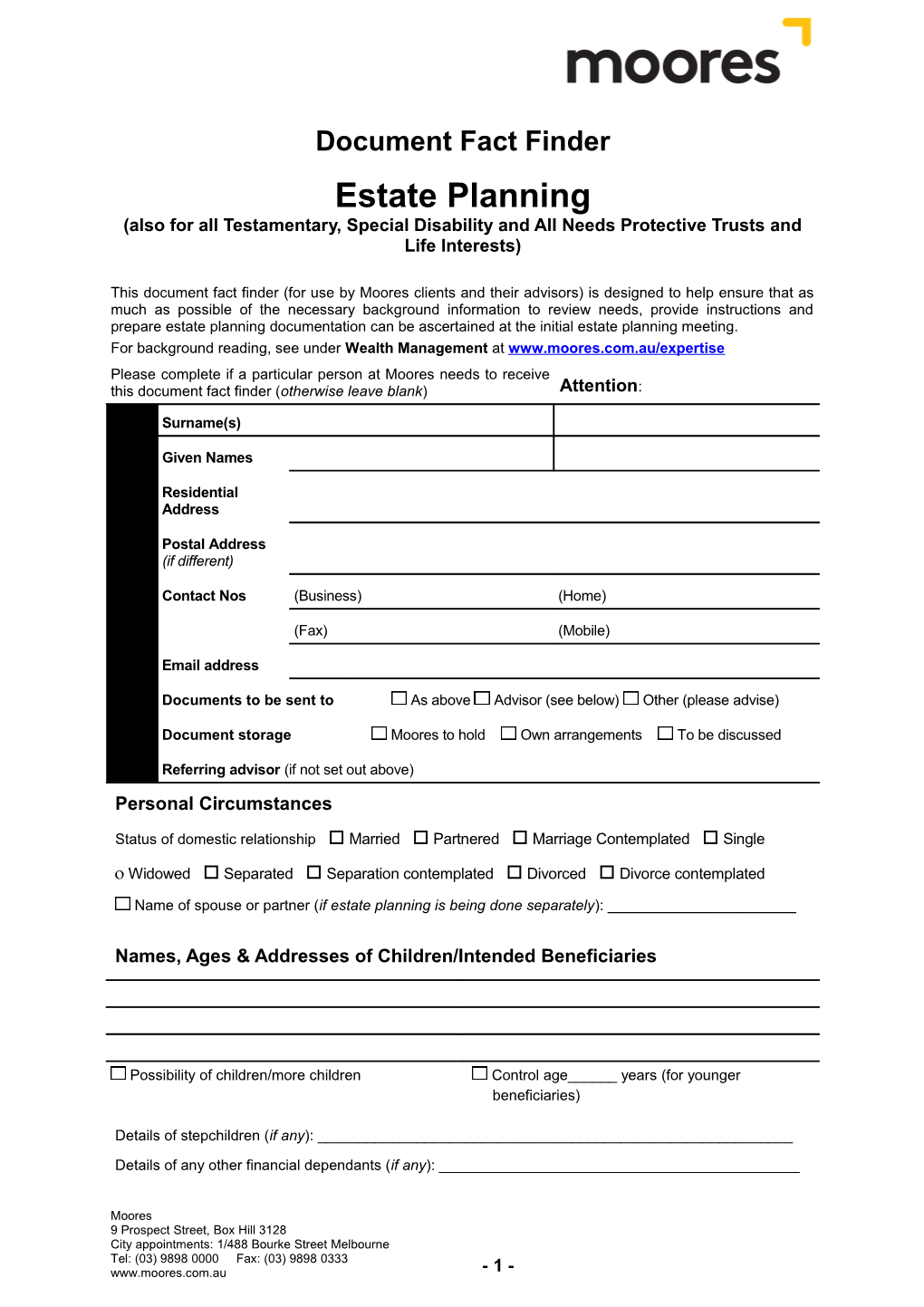

Document Fact Finder Estate Planning (also for all Testamentary, Special Disability and All Needs Protective Trusts and Life Interests)

This document fact finder (for use by Moores clients and their advisors) is designed to help ensure that as much as possible of the necessary background information to review needs, provide instructions and prepare estate planning documentation can be ascertained at the initial estate planning meeting. For background reading, see under Wealth Management at www.moores.com.au/expertise Please complete if a particular person at Moores needs to receive this document fact finder (otherwise leave blank) Attention:

S Surname(s) L I Given Names A T

E Residential

D Address

L Postal Address A (if different) N

O Contact Nos (Business) (Home) S

R (Fax) (Mobile) E P Email address

Documents to be sent to As above Advisor (see below) Other (please advise)

Document storage Moores to hold Own arrangements To be discussed

Referring advisor (if not set out above) Personal Circumstances

Status of domestic relationship Married Partnered Marriage Contemplated Single

Widowed Separated Separation contemplated Divorced Divorce contemplated

Name of spouse or partner (if estate planning is being done separately): ______

Names, Ages & Addresses of Children/Intended Beneficiaries

Possibility of children/more children Control age______years (for younger beneficiaries)

Details of stepchildren (if any): ______

Details of any other financial dependants (if any): ______

Moores 9 Prospect Street, Box Hill 3128 City appointments: 1/488 Bourke Street Melbourne Tel: (03) 9898 0000 Fax: (03) 9898 0333 www.moores.com.au - 1 - Document Fact Finder

Proposed exclusion of, or reduced benefit for, a spouse, partner or child from benefit from the Will, superannuation fund or family trust No Yes – reason: ______

Specific Objectives and Concerns re Intended Beneficiaries (to be discussed at initial meeting)

Risk of relationship breakdown Risk of challenge to Wills and superannuation benefits

Education of children/grandchildren Risk of bankruptcy Financial susceptibility

Benevolent giving – on death Benevolent giving – during lifetime

Vulnerability or Disability of an Intended Beneficiary (if any – to be discussed at initial meeting)

Intellectual disability Acquired illness or injury Other ______

Does the intended beneficiary have, or is likely to have, dependants? Yes No

Likelihood of assessment as having a severe disability for Govt means testing purposes? High Low

Guardians of Young Children (if applicable)

Full Names, Addresses & Relationship (if any)

Initial Guardians Reserve Guardian

Documents and Information to be brought to Initial Meeting (if applicable)

Summary of ownership of key assets (see next page) and CGT register (if any)

Financial estate plans (if any – including details of particular objectives to be achieved)

Self managed super fund and family trust Deeds

Copies of any superannuation death benefit nominations – binding or non-binding

Most recent statements of financial position for trusts/companies (including loan accounts) & SMSFs

Life and other insurance policy statements Details of existing or anticipated personal executorships

Existing Will(s), power(s) of attorney and any binding or non-binding relationship agreements

Details of any sureties/personal guarantees Shareholder/other and intra business agreements

Pricing: Following an initial meeting to identify estate planning objectives and options, Moores will provide one or more costed options in relation to the completion of estate planning documentation and the preparation of any strategic advice. (Choices and options for executors, as well as financial and other attorneys will also be discussed at the initial meeting.) Payment terms will be 21 days from the date of Moores’ invoice, with interest payable in the event of late payment.

- 2 - Document Fact Finder

Ownership of Investment Assets (attach a diagram or flow chart for “tiered’ structures)

Significant “Non-Super” Assets Owner, eg joint, Estimated Associated Pre/Post eg family home, shares portfolio, business family trust Value Debt 1985 (CGT)

Name(s) of Superannuation Fund(s) Member Membership Phase, ie benefit Current If an SMSF, show all member (pension) or investment Bal balances (growth) an ce

Life Insurance Type of cover, eg Nominated Beneficiary Level of Insured Insurance Co death, TPD, trauma eg super fund, self owned Cover

Any asset transfers that need (or may need) to be anticipated/taken into account (if any) eg anticipated non-concessional contributions to superannuation; lifetime gifts; future inheritances; transfers to SMSFs of business proceeds or commercial premises; transfers to a private ancillary fund/other charitable trust

Ownership of Business Assets (if any – attach a diagram or flow chart for tiered structures, as well as copies of all intra business agreements, eg shareholder and funded “buy-sell” agreements)

Business Owner, eg trustee Estimated Associated Pre/Post of family trust Value Debt CGT

Statement of Advice: This document is for Moores’ information gathering purposes only and should not be regarded as being comprehensive nor be relied on as (or in substitution for) legal, personal financial or other professional advice. See under Wealth Management at www.moores.com.au/expertise for the latest version of this and other Moores document fact finders.

© Moores Legal Pty Ltd ACN 005 412 868

- 3 - Document Fact Finder

July 2013

- 4 -