FAMILY COURT OF AUSTRALIA

Section 1: Agency overview and resources

1.1 STRATEGIC DIRECTION

The strategic direction statement for the Family Court of Australia can be found in the 2012–13 Portfolio Budget Statements. There has been no change to the Family Court’s strategic direction as a result of Additional Estimates.

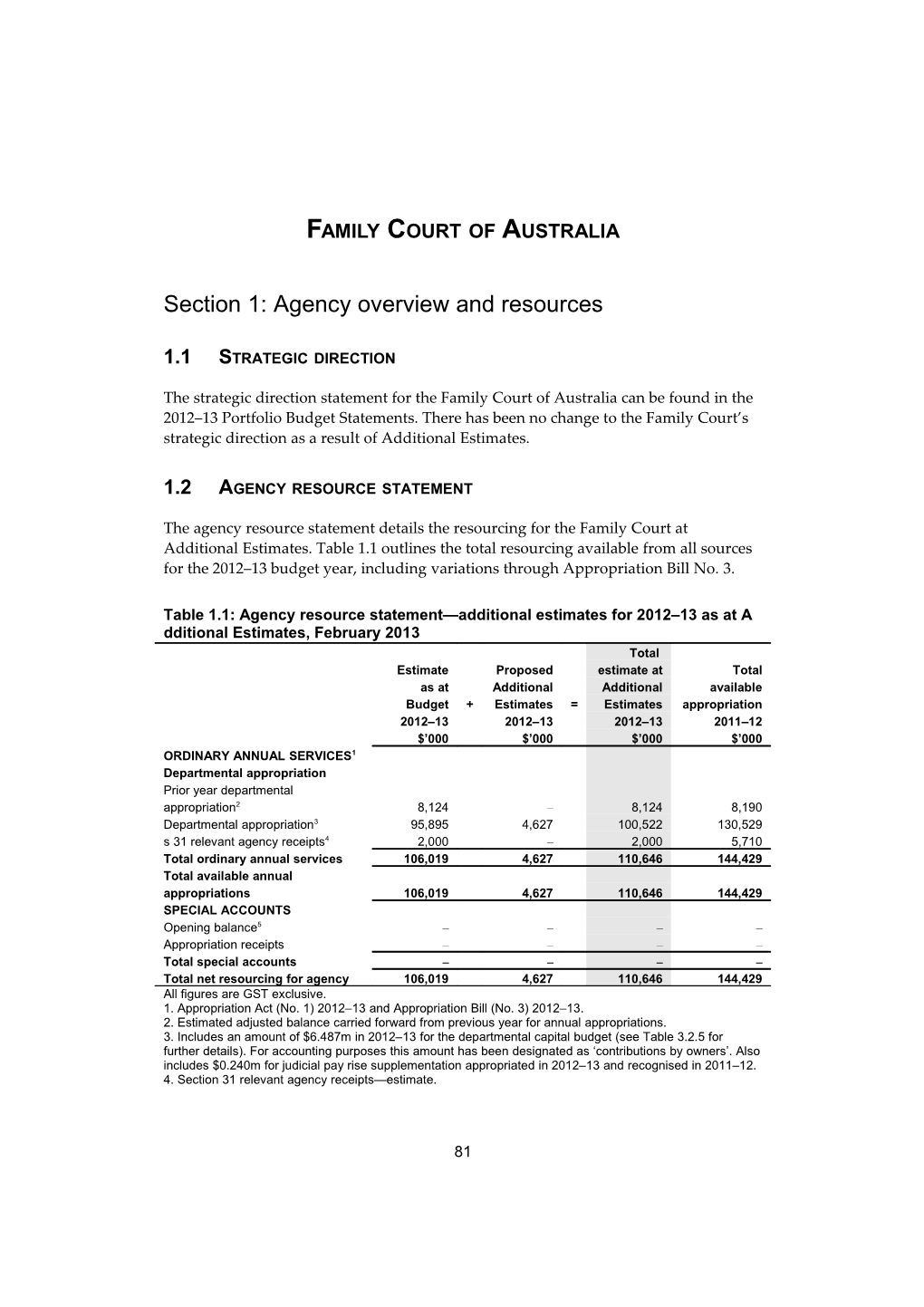

1.2 AGENCY RESOURCE STATEMENT

The agency resource statement details the resourcing for the Family Court at Additional Estimates. Table 1.1 outlines the total resourcing available from all sources for the 2012–13 budget year, including variations through Appropriation Bill No. 3.

Table 1.1: Agency resource statement—additional estimates for 2012–13 as at A dditional Estimates, February 2013 Total Estimate Proposed estimate at Total as at Additional Additional available Budget + Estimates = Estimates appropriation 2012–13 2012–13 2012–13 2011–12 $’000 $’000 $’000 $’000 ORDINARY ANNUAL SERVICES1 Departmental appropriation Prior year departmental appropriation2 8,124 – 8,124 8,190 Departmental appropriation3 95,895 4,627 100,522 130,529 s 31 relevant agency receipts4 2,000 – 2,000 5,710 Total ordinary annual services 106,019 4,627 110,646 144,429 Total available annual appropriations 106,019 4,627 110,646 144,429 SPECIAL ACCOUNTS Opening balance5 – – – – Appropriation receipts – – – – Total special accounts – – – – Total net resourcing for agency 106,019 4,627 110,646 144,429 All figures are GST exclusive. 1. Appropriation Act (No. 1) 2012–13 and Appropriation Bill (No. 3) 2012–13. 2. Estimated adjusted balance carried forward from previous year for annual appropriations. 3. Includes an amount of $6.487m in 2012–13 for the departmental capital budget (see Table 3.2.5 for further details). For accounting purposes this amount has been designated as ‘contributions by owners’. Also includes $0.240m for judicial pay rise supplementation appropriated in 2012–13 and recognised in 2011–12. 4. Section 31 relevant agency receipts—estimate.

81 Family Court of Australia

5. Estimated opening balance for special accounts (less ‘Special Public Money’ held in accounts such as Other Trust Moneys accounts or Services for Other Entities and Trust Moneys accounts). For further information on special accounts see Table 3.1.1.

1.3 AGENCY MEASURES TABLE Table 1.2 summarises new government measures taken since the 2012–13 Budget. The table is split into revenue and expense measures, with the affected program identified.

Table 1.2: Agency 2012–13 measures since Budget 2012–13 2013–14 2014–15 2015–16 Program $’000 $’000 $’000 $’000 Revenue measures Courts—additional funding and changes in fees 1.1 Administered revenues 598 1,196 1,260 1,260 Total revenue measures 598 1,196 1,260 1,260 Expense measures Courts—additional funding and changes in fees 1.1 Departmental expenses 3,976 7,206 6,741 6,869 Fire Services Levy—reduction1 1.1 Departmental expenses (20) (21) (22) (22) Targeted savings—public service 1.1 efficiencies Departmental expenses (5) (6) (6) (6) Total expense measures 3,951 7,179 6,713 6,841 Prepared on a Government Finance Statistics (fiscal) basis. 1. Measure announced in 2012–13 Budget but not previously reported in a portfolio statement.

1.4 ADDITIONAL ESTIMATES AND VARIATIONS The following tables detail the changes to the resourcing for the Family Court at Additional Estimates, by outcome. Table 1.3 details the additional estimates and variations resulting from new measures since the 2012–13 Budget in Appropriation Bill No. 3. Table 1.4 details additional estimates or variations through other factors, such as parameter adjustments.

Table 1.3: Additional estimates and variations to outcomes from measures since 2012–13 Budget Program 2012–13 2013–14 2014–15 2015–16 impacted $’000 $’000 $’000 $’000 OUTCOME 1 Increase in estimates (administered) Courts—additional funding and changes in fees 1.1 598 1,196 1,260 1,260 Net impact on estimates for Outcome 1 (administered) 598 1,196 1,260 1,260 Increase in estimates (departmental) Courts—additional funding and changes in fees 1.1 3,976 7,206 6,741 6,869 Decrease in estimates (departmental) Fire Services Levy—reduction 1.1 (20) (21) (22) (22) Targeted savings—public service

82 Family Court of Australia efficiencies 1.1 (5) (6) (6) (6) Net impact on estimates for Outcome 1 (departmental) 3,951 7,179 6,713 6,841 Table 1.4: Additional estimates and variations to outcomes from other variations Program 2012–13 2013–14 2014–15 2015–16 impacted $’000 $’000 $’000 $’000 OUTCOME 1 Increase in estimates (departmental) Supplementation for judicial and related offices salary increases (Remuneration Tribunal Determination 2012/09) 1.1 667 423 417 413 Realignment of property-related funding for the Commonwealth Law Courts 1.1 317 318 320 322 Decrease in estimates (departmental) Changes in wage and price indices 1.1 – (394) (539) (621) Consolidation of court libraries 1.1 (308) (1,247) (1,256) (1,267) Departmental capital budget— changes in wage and price indices 1.1 – (31) (47) (56) Net impact on estimates for Outcome 1 (departmental) 676 (931) (1,105) (1,209)

1.5 BREAKDOWN OF ADDITIONAL ESTIMATES BY APPROPRIATION BILL

Table 1.5 details the additional estimates sought for the Family Court through Appropriation Bill No. 3. The Family Court has no additional estimates through Appropriation Bill No. 4.

Table 1.5: Appropriation Bill (No. 3) 2012–13 2011–12 2012–13 2012–13 Additional Reduced Available1 Budget Revised Estimates Estimates $’000 $’000 $’000 $’000 $’000 DEPARTMENTAL PROGRAMS Outcome 1 As Australia’s specialist superior family court, determine cases with complex law and facts, and provide national coverage as the appellate court in family law matters 130,529 95,895 100,522 4,627 – Total departmental 130,529 95,895 100,522 4,627 – 1. 2011–12 available appropriation is included to allow a comparison of this year’s appropriation with what was made available for use in the previous year.

83 Family Court of Australia

Section 2: Revisions to outcomes and planned performan ce

2.1 OUTCOME AND PERFORMANCE INFORMATION

There are no changes to the Family Court’s outcome and performance information as reported in the 2012–13 Portfolio Budget Statements.

OUTCOME 1

Outcome 1 strategy There are no changes to the strategy for Outcome 1 as reported in the 2012–13 Portfolio Budget Statements.

Table 2.1: Budgeted expenses and resources for Outcome 1 2012–13 2011–12 Revised Actual estimated Outcome 1: As Australia’s specialist superior family court, determine cases with complex law and facts, and provide national coverage as expenses expenses the appellate court in family law matters $’000 $’000 Program 1.1: Provision of a Family Court Departmental expenses Departmental appropriation1 127,417 95,795 Expenses not requiring appropriation in the budget year2 15,779 30,861 Total expenses for Outcome 1 143,196 126,656

2011–12 2012–13 Average staffing level (number) 574 567 1. Departmental appropriation combines ‘Ordinary annual services (Appropriation Act No. 1 & Bill No. 3)’ and ‘Revenue from independent sources (s 31)’. 2. Expenses not requiring appropriation in the budget year are made up of depreciation and amortisation expenses of $7.161m, liabilities assumed by related entities of $9.565m and resources received free of charge of $14.135m.

Program 1.1 expenses 2012–13 2013–14 2014–15 2015–16 2011–12 Revised Forward Forward Forward Actual budget year 1 year 2 year 3 $’000 $’000 $’000 $’000 $’000 Annual departmental expenses 127,417 95,795 97,533 95,683 96,329 Expenses not requiring appropriation in the budget year1 15,779 30,861 32,067 32,129 32,477 Total program expenses 143,196 126,656 129,600 127,812 128,806 1. Expenses not requiring appropriation in the budget year are made up of depreciation and amortisation expenses, liabilities assumed by related entities and resources received free of charge.

84 Family Court of Australia

Section 3: Explanatory tables and budgeted financial stat ements

3.1 EXPLANATORY TABLES

Estimates of special account flows Special accounts provide a means to set aside and record amounts used for specified purposes. Table 3.1.1 shows the expected additions (receipts) and reductions (payments) for each account used by the Family Court. The corresponding table in the 2012–13 Portfolio Budget Statements is Table 3.1.2.

Table 3.1.1: Estimates of special account flows Opening Closing balance Receipts Payments Adjustments balance 2012–13 2012–13 2012–13 2012–13 2012–13 2011– 2011–12 2011–12 2011–12 2011–12 12 Outcome $’000 $’000 $’000 $’000 $’000 Litigants’ Fund Special 1 806 400 400 – 806 Account—FMA Act s 20 (A)1 1 647 299 140 – 806 Total special accounts 2012–13 Budget estimate 806 400 400 – 806 Total special accounts 2011–12 actual 647 299 140 – 806 FMA Act = Financial Management and Accountability Act 1997. (A) = Administered. 1. The purpose of this account is to hold client moneys paid as a surety following the issuance of court orders.

3.2 BUDGETED FINANCIAL STATEMENTS

3.2.1 Analysis of budgeted financial statements Departmental The Family Court’s budgeted departmental income statement has been updated: • to reflect the 2011–12 operating result (an operating deficit of $11.654m) • for the impact of judicial salary increases of approximately $0.427m in 2012–13 and $1.253m across the forward years (per Remuneration Tribunal Determination 2012/09) • for the additional court funding and changes in court fees ($3.976m in 2012–13 and $20.816m across the forward years) • for the realignment of property-related funding for the Commonwealth Law Courts ($0.317m in 2012–13 and $0.960m across the forward years)

85 Family Court of Australia

• to reflect the government’s targeted savings measures ($0.005m in 2012–13 and $0.0 18m across the forward years) • to reflect the Fire Services Levy reductions ($0.020m in 2012–13 and $0.065m across the forward years) • for the impact of consolidating court library services ($0.308m in 2012–13 and $3.77 0m across the forward years), and • for indexation changes across the forward years.

The Family Court’s budgeted departmental balance sheet has been updated to reflect the impact of the closing balances from 2011–12, which has resulted in a decrease in equity of $2.070m for 2011–12 and 2012–13. The change in equity is primarily due to a reduction in reserves and an increase in accumulated deficits.

Administered The Family Court’s schedule of budgeted income and expenses administered on behalf of government and schedule of budgeted assets and liabilities administered on behalf of government have been updated for the respective results and closing balances from 2011–12. This update has resulted in a flow-through impact on the schedule of budgeted assets and liabilities administered on behalf of government across the forward estimates.

86 Family Court of Australia

3.2.2 Budgeted financial statements Departmental Table 3.2.1: Budgeted departmental comprehensive income statement (showing net cost of services) Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 EXPENSES Employee benefits 73,759 75,565 76,348 76,539 77,310 Suppliers 61,650 43,930 45,942 43,556 43,578 Depreciation and amortisation 7,353 7,161 7,310 7,717 7,918 Write-down and impairment of assets 6 – – – – Losses from asset sales 276 – – – – Finance costs 152 – – – – Total expenses 143,196 126,656 129,600 127,812 128,806 LESS: OWN-SOURCE INCOME Own-source revenue Sale of goods and rendering of services 2,706 640 640 640 640 Other 601 1,360 1,360 1,360 1,360 Total own-source revenue 3,307 2,000 2,000 2,000 2,000 Gains Other 8,426 23,700 24,757 24,412 24,559 Total gains 8,426 23,700 24,757 24,412 24,559 Total own-source income 11,733 25,700 26,757 26,412 26,559 Net cost of (contribution by) services 131,463 100,956 102,843 101,400 102,247 Revenue from government 120,078 93,795 95,533 93,683 94,329 Surplus (deficit) attributable to the Australian Government (11,385) (7,161) (7,310) (7,717) (7,918) OTHER COMPREHENSIVE INCOME Changes in asset revaluation surplus (269) – – – – Total other comprehensive income (269) – – – – Total comprehensive income (loss) (11,654) (7,161) (7,310) (7,717) (7,918) Total comprehensive income (loss) attributable to the Australian Government (11,654) (7,161) (7,310) (7,717) (7,918)

Note: Impact of net cash appropriation arrangements 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 Total comprehensive income (loss) less depreciation/amortisation expenses previously funded through revenue appropriations (4,301) – – – – Plus depreciation/amortisation expenses previously funded through revenue appropriations1 (7,353) (7,161) (7,310) (7,717) (7,918) Total comprehensive income (loss) as per the statement of comprehensive income (11,654) (7,161) (7,310) (7,717) (7,918) Prepared on Australian Accounting Standards basis. 1. From 2010–11, the government introduced net cash appropriation arrangements where Appropriation Act No. 1 or Bill No. 3 revenue appropriations for the depreciation and amortisation expenses of Financial Management and Accountability Act 1997 agencies were replaced with a separate capital budget (the departmental capital budget) provided through Appropriation Act No. 1 or Bill No. 3 equity appropriations. See Table 3.2.5 for information on the departmental capital budget.

87 Family Court of Australia

Table 3.2.2: Budgeted departmental balance sheet (as at 30 June) Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 ASSETS Financial assets Cash and cash equivalents 1,402 1,402 1,402 1,402 1,402 Trade and other receivables 8,222 9,522 10,822 10,822 10,822 Other financial assets 183 183 183 183 183 Total financial assets 9,807 11,107 12,407 12,407 12,407 Non-financial assets Land and buildings 19,950 19,390 19,996 19,567 18,898 Property, plant and equipment 14,991 15,048 13,825 13,590 13,897 Intangibles 4,523 4,352 3,992 3,819 3,370 Inventories 63 63 63 63 63 Other non-financial assets 1,493 1,493 1,493 1,493 1,493 Total non-financial assets 41,020 40,346 39,369 38,532 37,721 Total assets 50,827 51,453 51,776 50,939 50,128 LIABILITIES Payables Suppliers 4,467 4,467 4,467 4,467 4,467 Other payables 1,982 1,982 1,982 1,982 1,982 Total payables 6,449 6,449 6,449 6,449 6,449 Provisions Employee provisions 21,967 23,267 24,567 24,567 24,567 Other provisions 3,316 3,316 3,316 3,316 3,316 Total provisions 25,283 26,583 27,883 27,883 27,883 Total liabilities 31,732 33,032 34,332 34,332 34,332 Net assets 19,095 18,421 17,444 16,607 15,796 EQUITY Parent entity interest Contributed equity 10,728 17,215 23,548 30,428 37,535 Reserves 16,879 16,879 16,879 16,879 16,879 Retained surplus (accumulated deficit) (8,512) (15,673) (22,983) (30,700) (38,618) Total parent entity interest 19,095 18,421 17,444 16,607 15,796 Total equity 19,095 18,421 17,444 16,607 15,796 Prepared on Australian Accounting Standards basis.

88 Family Court of Australia

Table 3.2.3: Departmental statement of changes in equity—summary of moveme nt (budget year 2012–13) Asset Contributed Retained revaluation equity/ Total earnings reserve capital equity $’000 $’000 $’000 $’000 Opening balance as at 1 July 2012 Balance carried forward from previous period (8,512) 16,879 10,728 19,095 Adjustment for changes in accounting policies – – – – Adjusted opening balance (8,512) 16,879 10,728 19,095 Comprehensive income Surplus (deficit) for the period (7,161) – – (7,161) Total comprehensive income (7,161) – – (7,161) Of which: Attributable to the Australian Government Government (7,161) – – (7,161) Transactions with owners Contributions by owners Departmental capital budget – – 6,487 6,487 Sub-total transactions with owners – – 6,487 6,487 Estimated closing balance as at 30 June 2013 (15,673) 16,879 17,215 18,421 Closing balance attributable to the Australian Government (15,673) 16,879 17,215 18,421 Prepared on Australian Accounting Standards basis.

89 Family Court of Australia

Table 3.2.4: Budgeted departmental statement of cash flows (for the period ended 30 June) Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 OPERATING ACTIVITIES Cash received Goods and services 5,294 640 640 640 640 Appropriations 117,162 92,491 94,233 93,683 94,230 Net GST received 6,588 4,867 4,867 4,867 4,867 Other – 1,360 1,360 1,360 1,360 Total cash received 129,044 99,358 101,100 100,550 101,097 Cash used Employees 63,534 63,732 65,262 67,435 68,107 Suppliers 65,313 30,759 30,971 28,248 28,123 Net GST paid – 4,867 4,867 4,867 4,867 Total cash used 128,847 99,358 101,100 100,550 101,097 Net cash from (used by) operating activities 197 – – – – INVESTING ACTIVITIES Cash used Purchase of property, plant, equipment and intangibles 13,685 6,487 6,333 6,880 7,107 Total cash used 13,685 6,487 6,333 6,880 7,107 Net cash from (used by) investing activities (13,685) (6,487) (6,333) (6,880) (7,107) FINANCING ACTIVITIES Cash received Contributed equity 13,685 6,487 6,333 6,880 7,107 Total cash received 13,685 6,487 6,333 6,880 7,107 Net cash from (used by) financing activities 13,685 6,487 6,333 6,880 7,107 Net increase (decrease) in cash held 197 – – – – Cash and cash equivalents at the beginning of the reporting period 1,205 1,402 1,402 1,402 1,402 Cash and cash equivalents at the end of the reporting period 1,402 1,402 1,402 1,402 1,402 Prepared on Australian Accounting Standards basis.

90 Family Court of Australia

Table 3.2.5: Departmental capital budget statement Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 NEW CAPITAL APPROPRIATIONS Capital budget—Act No. 1 (DCB) 10,024 6,487 6,333 6,880 7,107 Total new capital appropriations 10,024 6,487 6,333 6,880 7,107 Provided for: Purchase of non-financial assets 10,024 6,487 6,333 6,880 7,107 Total items 10,024 6,487 6,333 6,880 7,107 PURCHASE OF NON-FINANCIAL ASSETS Funded by capital appropriation—DCB1 10,024 6,487 6,333 6,880 7,107 Funded internally from departmental resources2 3,661 – – – – TOTAL AMOUNT SPENT 13,685 6,487 6,333 6,880 7,107 RECONCILIATION OF CASH USED TO ACQUIRE ASSETS TO ASSET MOVEMENT TABLE Total purchases 13,685 6,487 6,333 6,880 7,107 Total cash used to acquire assets 13,685 6,487 6,333 6,880 7,107 Consistent with information contained in the statement of asset movements and the budgeted statement of cash flows. DCB = departmental capital budget. 1. Does not include annual finance lease costs. Includes purchases from current and previous years’ DCBs. 2. Includes funding from current and prior year appropriations.

91 Family Court of Australia

Table 3.2.6: Statement of asset movements (2012–13) Other property, Computer plant & software & Buildings equipment intangibles Total $’000 $’000 $’000 $’000 As at 1 July 2012 Gross book value 26,484 21,110 9,281 56,875 Accumulated depreciation/ amortisation and impairment (6,534) (6,119) (4,758) (17,411) Opening net book balance 19,950 14,991 4,523 39,464 CAPITAL ASSET ADDITIONS Estimated expenditure on new or replacement assets By purchase—appropriation ordinary annual services1 2,550 2,894 1,043 6,487 Total additions 2,550 2,894 1,043 6,487 OTHER MOVEMENTS Depreciation/amortisation expense (3,110) (2,837) (1,214) (7,161) Total other movements (3,110) (2,837) (1,214) (7,161) As at 30 June 2013 Gross book value 29,034 24,004 10,324 63,362 Accumulated depreciation/ amortisation and impairment (9,644) (8,956) (5,972) (24,572) Closing net book balance 19,390 15,048 4,352 38,790 Prepared on Australian Accounting Standards basis. 1. ‘Appropriation ordinary annual services’ refers to funding provided through Appropriation Act (No. 1) 2012–13 and Appropriation Bill (No. 3) 2012–13 for depreciation and amortisation expenses, departmental capital budgets or other operational expenses.

92 Family Court of Australia

Administered Table 3.2.7: Schedule of budgeted income and expenses administered on behalf of government (for the period ended 30 June) Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 EXPENSES ADMINISTERED ON BEHALF OF GOVERNMENT Other expenses 50 – – – – Total expenses administered on behalf of government 50 – – – – LESS: OWN-SOURCE INCOME Own-source revenue Non-taxation revenue Other revenue 2,468 3,102 3,700 3,764 3,764 Total non-taxation revenue 2,468 3,102 3,700 3,764 3,764 Total own-source revenues administered on behalf of government 2,468 3,102 3,700 3,764 3,764 Total own-source income administered on behalf of government 2,468 3,102 3,700 3,764 3,764 Net cost of (contribution by) services (2,418) (3,102) (3,700) (3,764) (3,764) Surplus (deficit) 2,418 3,102 3,700 3,764 3,764 Total comprehensive income (loss) 2,418 3,102 3,700 3,764 3,764 Prepared on Australian Accounting Standards basis.

93 Family Court of Australia

Table 3.2.8: Schedule of budgeted assets and liabilities administered on behalf o f government (as at 30 June) Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 ASSETS ADMINISTERED ON BEHALF OF GOVERNMENT Financial assets Cash and cash equivalents 11 11 11 11 11 Total financial assets 11 11 11 11 11 Total assets administered on behalf of government 11 11 11 11 11 LIABILITIES ADMINISTERED ON BEHALF OF GOVERNMENT Total liabilities administered on behalf of government – – – – – Net assets/(liabilities) 11 11 11 11 11 Prepared on Australian Accounting Standards basis.

Table 3.2.9: Schedule of budgeted administered cash flows (for the period ended 30 June) Revised Forward Forward Forward Actual budget estimate estimate estimate 2011–12 2012–13 2013–14 2014–15 2015–16 $’000 $’000 $’000 $’000 $’000 OPERATING ACTIVITIES Cash received Other 2,468 3,102 3,700 3,764 3,764 Total cash received 2,468 3,102 3,700 3,764 3,764 Cash used Other 50 – – – – Total cash used 50 – – – – Net cash from (used by) operating activities 2,418 3,102 3,700 3,764 3,764 Net increase (decrease) in cash held 2,418 3,102 3,700 3,764 3,764 Cash and cash equivalents at the beginning of the reporting period 31 11 11 11 11 Cash from Official Public Account for: Appropriations 81 – – – – Cash to Official Public Account for: Transfers to other entities (Finance—whole of government) 2,519 3,102 3,700 3,764 3,764 Cash and cash equivalents at the end of the reporting period 11 11 11 11 11 Prepared on Australian Accounting Standards basis.

94 Family Court of Australia

3.2.3 Notes to the financial statements Basis of accounting The budgeted financial statements have been prepared on an accrual accounting basis, having regard to Statements of Accounting Concepts, and in accordance with the Finance Minister’s Orders, Australian Accounting Standards and other authoritative pronouncements of the Australian Accounting Standards Board.

Departmental Revenue from government Appropriations for departmental programs (adjusted for any formal additions and reductions) are recognised as revenue, except for certain amounts which relate to activities that are reciprocal in nature, in which case revenue is recognised only when it has been earned. Appropriations receivable are recognised at their nominal amounts.

Income—resources received free of charge Resources received free of charge are recorded as either revenue or gains depending on their nature, that is, whether they have been generated in the course of ordinary activities.

Expenses—resources provided free of charge The Family Court provides resources free of charge to the Federal Magistrates Court in accordance with sections 90, 92 and 99 of the Federal Magistrates Act 1999. Resources provided free of charge include: • court staff, who perform work on behalf of the Federal Magistrates Court, and • accommodation, including access to courtrooms.

It is estimated that the cost of resources provided free of charge by the Family Court to the Federal Magistrates Court during 2012–13 will be $32.220m.

Employee expenses Employee expenses consist of wages and salaries, superannuation, leave and other entitlements, separations and redundancies and other employee benefits.

Supplier expenses Supplier expenses consist of administrative expenses including operating lease rentals and supply of goods and services to the Family Court.

Assets Assets are made up of cash, receivables, prepayments, intangibles (computer software), inventories, land and buildings, infrastructure, plant and equipment.

95 Family Court of Australia

Liabilities The Family Court’s liabilities are made up of employee salaries, superannuation and leave entitlements, property lease make-good provisions and amounts owed to creditors.

Administered Administered cash transfers to and from Official Public Account Revenue collected by the Family Court for use by the government rather than the Family Court is administered revenue. Collections are transferred to the Official Public Account maintained by the Department of Finance and Deregulation. Conversely, cash is drawn from the Official Public Account to make payments under parliamentary appropriation on behalf of government. These transfers to and from the Official Public Account are adjustments to the administered cash held by the Family Court on behalf of the government and reported as such in the statement of cash flows.

Revenue All administered revenues are revenues relating to the core operating activities performed by the Family Court on behalf of the Australian Government.

Fees are charged for access to the Family Court’s services. Administered fee revenue is recognised when an application for service is lodged with the Family Court. It is recognised at its nominal amount. Collectability of debts is reviewed at balance date. Allowances are made when collection of a debt is no longer probable.

96