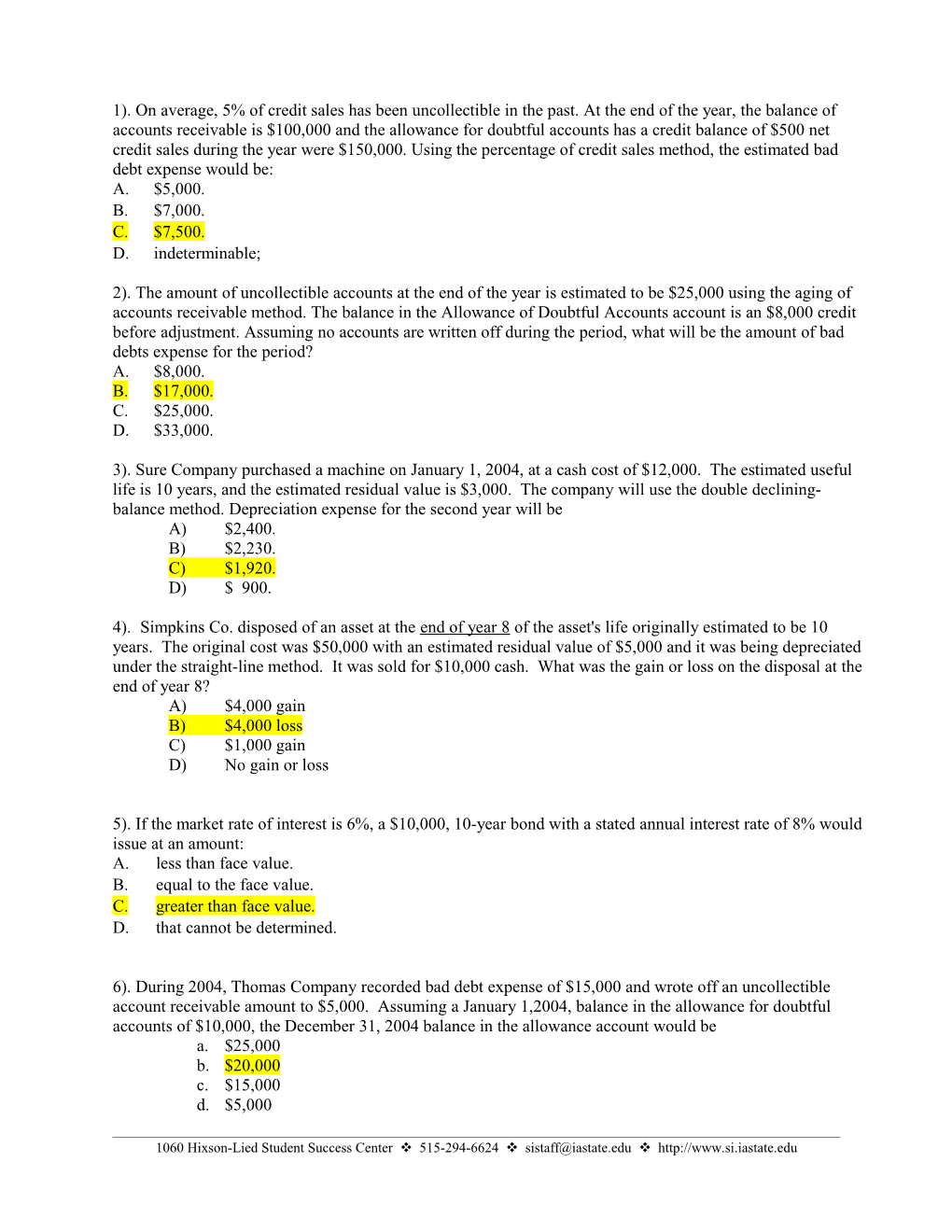

1). On average, 5% of credit sales has been uncollectible in the past. At the end of the year, the balance of accounts receivable is $100,000 and the allowance for doubtful accounts has a credit balance of $500 net credit sales during the year were $150,000. Using the percentage of credit sales method, the estimated bad debt expense would be: A. $5,000. B. $7,000. C. $7,500. D. indeterminable;

2). The amount of uncollectible accounts at the end of the year is estimated to be $25,000 using the aging of accounts receivable method. The balance in the Allowance of Doubtful Accounts account is an $8,000 credit before adjustment. Assuming no accounts are written off during the period, what will be the amount of bad debts expense for the period? A. $8,000. B. $17,000. C. $25,000. D. $33,000.

3). Sure Company purchased a machine on January 1, 2004, at a cash cost of $12,000. The estimated useful life is 10 years, and the estimated residual value is $3,000. The company will use the double declining- balance method. Depreciation expense for the second year will be A) $2,400. B) $2,230. C) $1,920. D) $ 900.

4). Simpkins Co. disposed of an asset at the end of year 8 of the asset's life originally estimated to be 10 years. The original cost was $50,000 with an estimated residual value of $5,000 and it was being depreciated under the straight-line method. It was sold for $10,000 cash. What was the gain or loss on the disposal at the end of year 8? A) $4,000 gain B) $4,000 loss C) $1,000 gain D) No gain or loss

5). If the market rate of interest is 6%, a $10,000, 10-year bond with a stated annual interest rate of 8% would issue at an amount: A. less than face value. B. equal to the face value. C. greater than face value. D. that cannot be determined.

6). During 2004, Thomas Company recorded bad debt expense of $15,000 and wrote off an uncollectible account receivable amount to $5,000. Assuming a January 1,2004, balance in the allowance for doubtful accounts of $10,000, the December 31, 2004 balance in the allowance account would be a. $25,000 b. $20,000 c. $15,000 d. $5,000

1060 Hixson-Lied Student Success Center v 515-294-6624 v [email protected] v http://www.si.iastate.edu Use the following data to answer the next two questions:

Austin Corporation sold its $1,000,000, 7%, ten-year bonds to the public on January 1, 2004. The bonds pay interest annually, beginning on December 31, 2004. Austin received $1,153,420 in cash at the issuance of the bonds. The market rate of interest when the bonds were sold was 5%.

7) Compute the amount of the premium that Austin Corporation should amortize on December 31, 2004, assuming the effective-interest method is used. A) $70,000 B) $57,671 C) $50,000 D) $12,329

8). What is the carrying value of the bond on December 31, 2005 assuming the effective- interest method is used? A) $1,000,000 B) $1,128,146 C) $1,135,782 D) $1,153,420

9). On January 1, 2004, Summer Corporation sold a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming effective-interest amortization is used, the interest expense on the 2005 income statement would be (to the nearest dollar) a. $ 1,247. b. $ 983 c. $ 779. d. $ 740.

10). Wilson Co. wrote off a customer’s $4,000 past due account on May 1. The company uses the allowance method. As a result of the write off: a. net income was not affected b. bad debt expense increased $4,000 c. net accounts receivable decreased $4,000 d. the balance in the allowance account increased $4,000

11). Intangible assets include A) Natural resources, patents, and trademarks. B) Accounts receivable, franchises, and trademarks. C) Copyrights, licenses, and land. D) Leaseholds, patents and copyrights

12). In 1998, Delta Air Lines had a fixed asset turnover of 1.63 compared to Southwest Airlines of 1.10. What is the most likely cause of Delta's higher ratio? (Hint: Fixed Asset Turnover Ratio = Net Sales ÷ Average Fixed Assets) A) Delta is less efficient in generating net sales from its operational assets. B) Delta is more efficient at generating net income from employing its operational assets. C) Delta is able to generate greater sales from its operational assets. D) Delta is able to generate less net income from its operational assets. 13). The Widget Tool and Die Company buys a $400,000 stamping machine that has an estimated residual value of $20,000. The company expects the machine to produce two million units. It makes 400,000 units during the current period. If the units-of- production method is used, the depreciation expense for this period is: A) $80,000. B) $400,000. C) $76,000. D) $380,000.

14). A contingent liability that is “reasonably possible” but “cannot reasonably be estimated” A) must be recorded and reported as a liability. B) does not need to be recorded or reported as a liability. C) must only be disclosed as a note to the financial statements. D) must be reported as a liability, but not recorded.

15). Company G bought a delivery truck for $73,000 on January 1, 2004. They estimate the useful life of the truck to be 10 years and its residual value to be $8,000. If Company G uses the units-of-production method when they have estimated the truck will be driven 500,000 miles over its life, what is the depreciation expense in 2005 when the truck is driven 60,000 miles? a. $8760 b. $8820 c. 7800 d. 9108

16). When goods are sold to a customer with credit terms of 2/15, n/30, the customer will a. receive a 15% discount if they pay within 2 days. b. receive a 2% discount if they pay 15% of the amount due within 30 days. c. receive a 15% discount if they pay within 30 days. d. receive a 2% discount if they pay within 15 days.

17). Which of the following statements is true? a. Depreciation expense is added to net income in the operating activities section of the statement of cash flows because it had no cash effect on net income under the indirect method. b. Depreciation is a non-cash expense that reduces net income but involves no outflow of cash. c. The only cash effect for depreciation is the tax savings provided by its deduction to derive taxable income. d. All of above are true. 18). On September 1, 2010, a business received a $25,000 note. The agreement indicated that 10% interest would be paid on the note, which is due on September 1, 2011. What is the amount of interest earned on this note during the year ended December 31, 2010? a. $0 b. $625 c. $833.33 d. $2500

19). Allocating the cost of intangible assets over their limited useful lives is called: a. Depreciation b. Amortization c. Depletion d. Impairment 20). What is the times interest earned ratio given that current liabilities was 24,000, income tax expense was 9,500, interest expense was 6,200, interest payable was 2,000, and net income was 20,500? e. 16 times f. 15.16 times g. 9.71 times h. 5.84 times