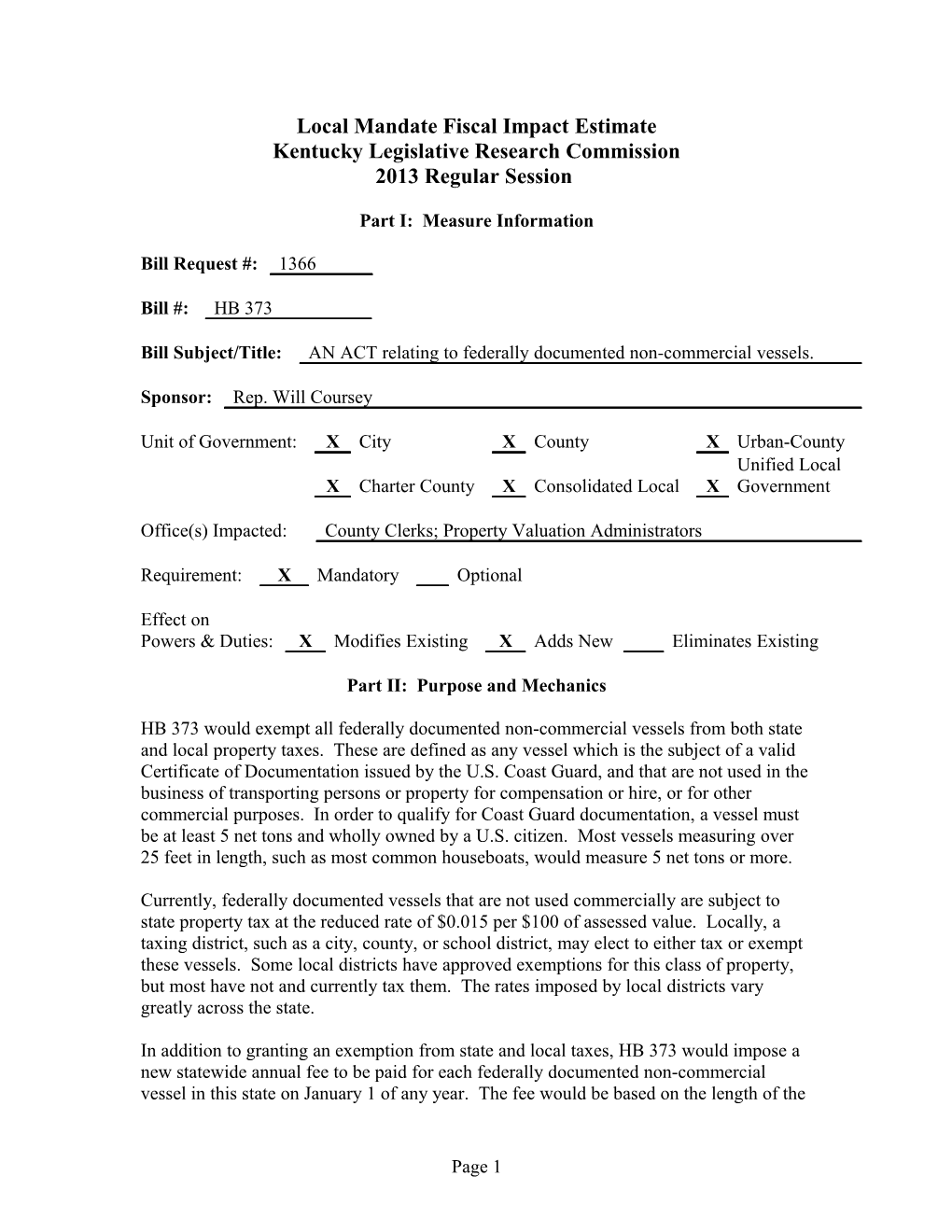

Local Mandate Fiscal Impact Estimate Kentucky Legislative Research Commission 2013 Regular Session

Part I: Measure Information

Bill Request #: 1366

Bill #: HB 373

Bill Subject/Title: AN ACT relating to federally documented non-commercial vessels.

Sponsor: Rep. Will Coursey

Unit of Government: X City X County X Urban-County Unified Local X Charter County X Consolidated Local X Government

Office(s) Impacted: County Clerks; Property Valuation Administrators

Requirement: X Mandatory Optional

Effect on Powers & Duties: X Modifies Existing X Adds New Eliminates Existing

Part II: Purpose and Mechanics

HB 373 would exempt all federally documented non-commercial vessels from both state and local property taxes. These are defined as any vessel which is the subject of a valid Certificate of Documentation issued by the U.S. Coast Guard, and that are not used in the business of transporting persons or property for compensation or hire, or for other commercial purposes. In order to qualify for Coast Guard documentation, a vessel must be at least 5 net tons and wholly owned by a U.S. citizen. Most vessels measuring over 25 feet in length, such as most common houseboats, would measure 5 net tons or more.

Currently, federally documented vessels that are not used commercially are subject to state property tax at the reduced rate of $0.015 per $100 of assessed value. Locally, a taxing district, such as a city, county, or school district, may elect to either tax or exempt these vessels. Some local districts have approved exemptions for this class of property, but most have not and currently tax them. The rates imposed by local districts vary greatly across the state.

In addition to granting an exemption from state and local taxes, HB 373 would impose a new statewide annual fee to be paid for each federally documented non-commercial vessel in this state on January 1 of any year. The fee would be based on the length of the

Page 1 vessel, at the rate of $8 per foot as set out in the bill. If enacted, it would require a statutory amendment to change this rate. Every qualifying vessel would be required to register with the county clerk no later than May 15 of the year, and pay the annual fee at that time. The fee revenues would be shared between the state and local taxing districts as follows: 1. 30% of the amount collected to the state general fund; and 2. 70% to be distributed among the local taxing districts in the county where the vessel is to be principally operated, on a pro rata basis according to the proportion that each district’s prevailing personal property tax rate bears to the total aggregate tax rate imposed by all the districts in that county. A local taxing district that has elected to exempt these vessels from tax and therefore currently receives no revenue from them would begin to receive a portion of the fee revenues from all vessels principally operated in that district under this bill, which would amount to an increase in revenues.

Part III: Fiscal Explanation, Bill Provisions, and Estimated Cost

The fiscal impact of HB 373 on local governments is indeterminable, because of a lack of reliable data necessary to determine if any given district would collect more or less revenue under the current property tax system or the new annual fee system established by this bill. Depending on many variables, such as: the location and valuation of boats as of Jan. 1 in a given year; tax rates; current tax exemptions allowed; etc., some districts may realize a positive net impact, while others may collect less revenue under the annual fee than they currently collect from the property tax. It is also impossible to estimate if the total impact collectively across all local governments, and also the state general fund, would be positive, negative, or revenue neutral.

Regarding possible impacts the bill may on duties of local officials, HB 373 would place a new duty on county clerks, who would have to process registrations of these vessels and accept annual fee payments. The office of the county clerk already currently processes many similar registrations and fee/tax collection functions, so while this would add an additional duty, it is one that presumably each county clerk would be able to manage with minimal change in staffing or procedures. The clerks are compensated for executing this new duty by retaining a 4% commission on the total amount of fee collected, which is the same level of commission allowed to clerks for state and local motor vehicle property taxes collected by them.

Also, by virtue of exempting these vessels from local property taxation, this bill would relieve property valuation administrators from the duty to locate and assess them for tax purposes.

Data Source(s): LRC Staff; Department of Revenue

Preparer: Eric Kennedy Reviewer: MCY Date: 2/20/13

Page 2