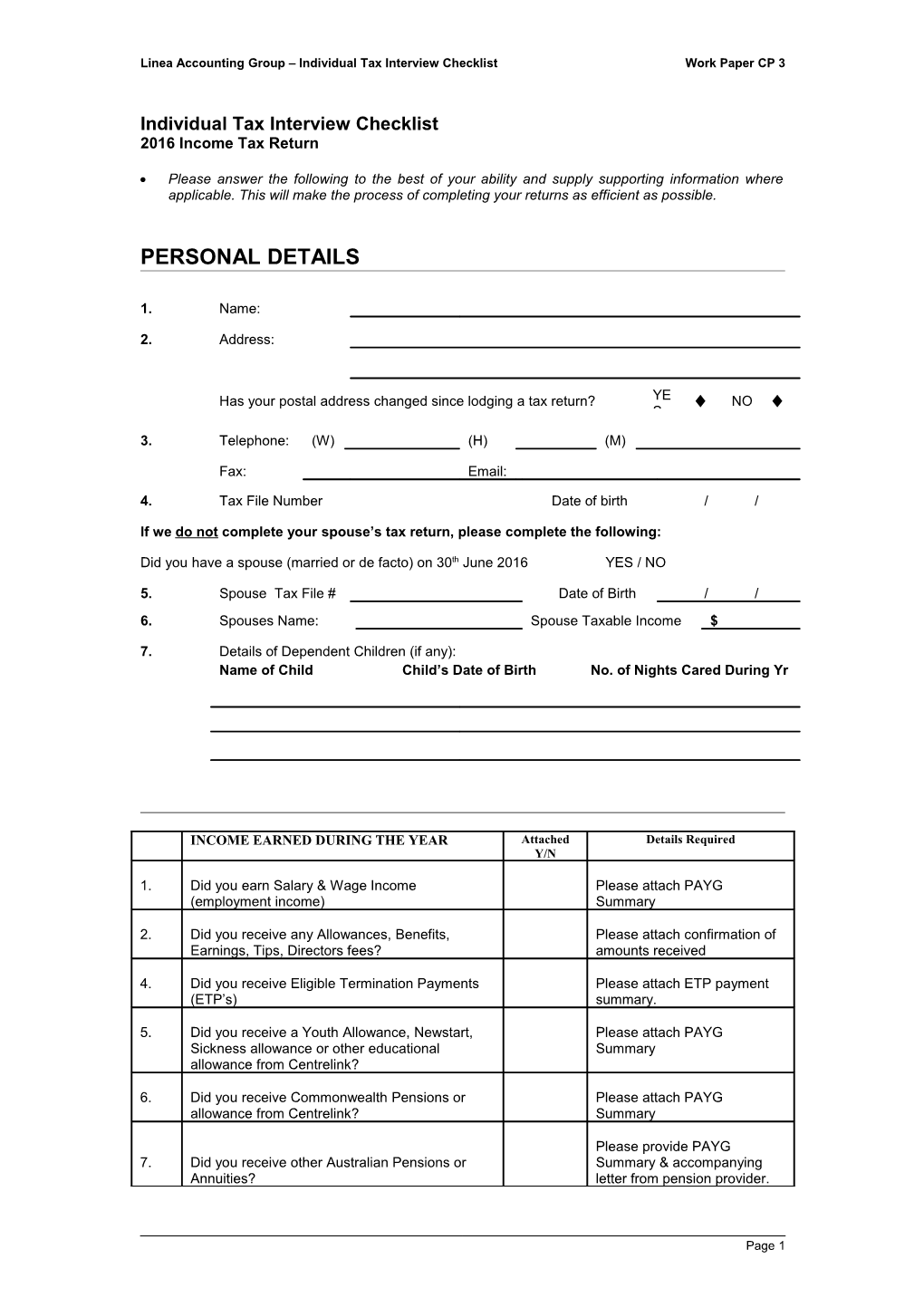

Linea Accounting Group – Individual Tax Interview Checklist Work Paper CP 3

Individual Tax Interview Checklist 2016 Income Tax Return

Please answer the following to the best of your ability and supply supporting information where applicable. This will make the process of completing your returns as efficient as possible.

PERSONAL DETAILS

1. Name:

2. Address:

Has your postal address changed since lodging a tax return? YE NO S

3. Telephone: (W) (H) (M)

Fax: Email:

4. Tax File Number Date of birth / /

If we do not complete your spouse’s tax return, please complete the following:

Did you have a spouse (married or de facto) on 30th June 2016 YES / NO

5. Spouse Tax File # Date of Birth / / 6. Spouses Name: Spouse Taxable Income $

7. Details of Dependent Children (if any): Name of Child Child’s Date of Birth No. of Nights Cared During Yr

INCOME EARNED DURING THE YEAR Attached Details Required Y/N

1. Did you earn Salary & Wage Income Please attach PAYG (employment income) Summary

2. Did you receive any Allowances, Benefits, Please attach confirmation of Earnings, Tips, Directors fees? amounts received

4. Did you receive Eligible Termination Payments Please attach ETP payment (ETP’s) summary.

5. Did you receive a Youth Allowance, Newstart, Please attach PAYG Sickness allowance or other educational Summary allowance from Centrelink?

6. Did you receive Commonwealth Pensions or Please attach PAYG allowance from Centrelink? Summary

Please provide PAYG 7. Did you receive other Australian Pensions or Summary & accompanying Annuities? letter from pension provider.

Page 1 Linea Accounting Group – Individual Tax Interview Checklist Work Paper CP 3

8. Did you receive Interest income from any Please provide summary of source? ALL interest received.

9. Did you receive Dividend income from shares Please provide ALL Dividend held? Statements received from Companies.

10. Did you receive Partnership and Trust Please provide partnership distribution income? distn details and/or fund manager annual tax statement.

11. Did you receive Income from running your own Please download business business during the year? checklist website.

12. Did you incur any Capital Gain/ (Loss) during the Please provide original year in relation to property/shares/business? purchase & sell contracts for each share/property investment.

13. Did you receive Foreign Source Income, Foreign Please provide written Assets or Property? confirmation.

14. Did you receive Rental Income from a property Please provide agents annual held in your name or in partnership? tax statement, summary of expenditure & loan statements. For new purchases, include contract of purchase /statement of adjustments /Solicitors letters. Please also provide Depn schedule from Quantity Surveyors (if available)

15. Did you receive income from Life Insurance Please provide written Companies and Friendly Societies? confirmation.

16. Did you earn any other income from sources not Please provide written already mentioned? confirmation.

DEDUCTIONS Attached Details Required Y/N

D1 Did you use a Motor Vehicle for work related Logbook / Receipts / Klms purposes? travelled / original cost

Method 1: Cents per klm (up to 5000 km) Your claim is based on set rate per business km 1.Number of business klms up to a maximum of 5000 business km’s per car 2. Type of Car per year. You do not need written evidence, but 3. Engine Capacity you need to be able to show how you worked out (1.6 litre / 2.0 litre etc) your business km’s.

Method 2: Log Book Your claim is based on the business use 1. Bus. % from your log book. percentage of the expenses for the car. 2. Fuel Expenses include running costs and decline in 3. Registration fee value. To work out your business use 4. Insurance percentage, you need a logbook and the 5.Repairs & Maintenance odometer readings for the logbook period. 6.Parking You can claim fuel and oil costs based on either 7. Tolls your actual receipts or you can estimate the, 8. Car Washes expenses based on odometer records that show 9 Depreciation/Lease/HP

Page 2 Linea Accounting Group – Individual Tax Interview Checklist Work Paper CP 3

readings from the start and the end of the period Charges (Tax Advisor to you had the car during the year. You need complete) – please supply written evidence for all other expenses for the purchase / loan contracts car.

D2 Did you incur Travel (other than m/v) expenses Please provide travel in relation to work related income? logbook/diary record.

D3 Did you incur any work related uniform, clothing, Receipts for purchase & laundry and dry cleaning expenses cleaning costs.

D4 Did you incur any work related self education Receipts for purchase. expenses. Example: student union, books, stationary, travel.

D5 Other work related expenses. Receipts for purchase &/or. Example: union fees, stationary, seminars, Home office electricity, meals, home office, telephone, subscriptions, Home office gas sun protection products.

D7 Did you have any Interest & dividend deductions Provide detail of expenses

D9 Did you make any gifts or donations? Receipts

D10 Did you incur a cost for managing tax affairs or Receipt & klms travelled to preparation of a prior year tax return? visit tax agent.

D12 Did you have a deductible amount of undeducted Located on the PAYG purchase price of Australian pension or annuity? Payment Summary.

D13 Did you make a personal superannuation Provide S.82 AAT form from contribution? Superannuation Fund. (Doesn’t include employer contributions)

D14 Did you incur any expenses from forestry Receipts activities?

D15 Did you incur any other costs NOT covered Please provide receipts and above, which are related to your income earnt? details.

TAX OFFSETS Attached Details Required Y/N

Did you make any superannuation contributions Please provide receipts and T7 on behalf of spouse? other documents.

T9 Did you incur medical expenses in excess of Please provide summary of $2,218 after Medicare reimbursement? out of pocket medical exp.

T10 Did you maintain a parent, spouse’s parent or invalid relative? OTHER DETAILS

Do you have private health insurance? If yes, please provide copy of Private Health Insurance Tax Statement.

Do you have a HECS or supplement loan?

Any other information you may feel relevant.

Page 3 Linea Accounting Group – Individual Tax Interview Checklist Work Paper CP 3

If you have completed all details above and do not have any questions, you have the option to forward these details to our office to complete your income tax return for you without the need of having an appointment, or alternatively you can call 03 9370 0999 to make an appointment.

Please bring this checklist with you if you decide to have an appointment with us.

Once your income tax return is complete, we will mail the tax return to you for signature.

TAXPAYER’S DECLARATION

I declare that all the information I have given is true and correct.

Taxpayer’s Signature: Date: / /

Page 4