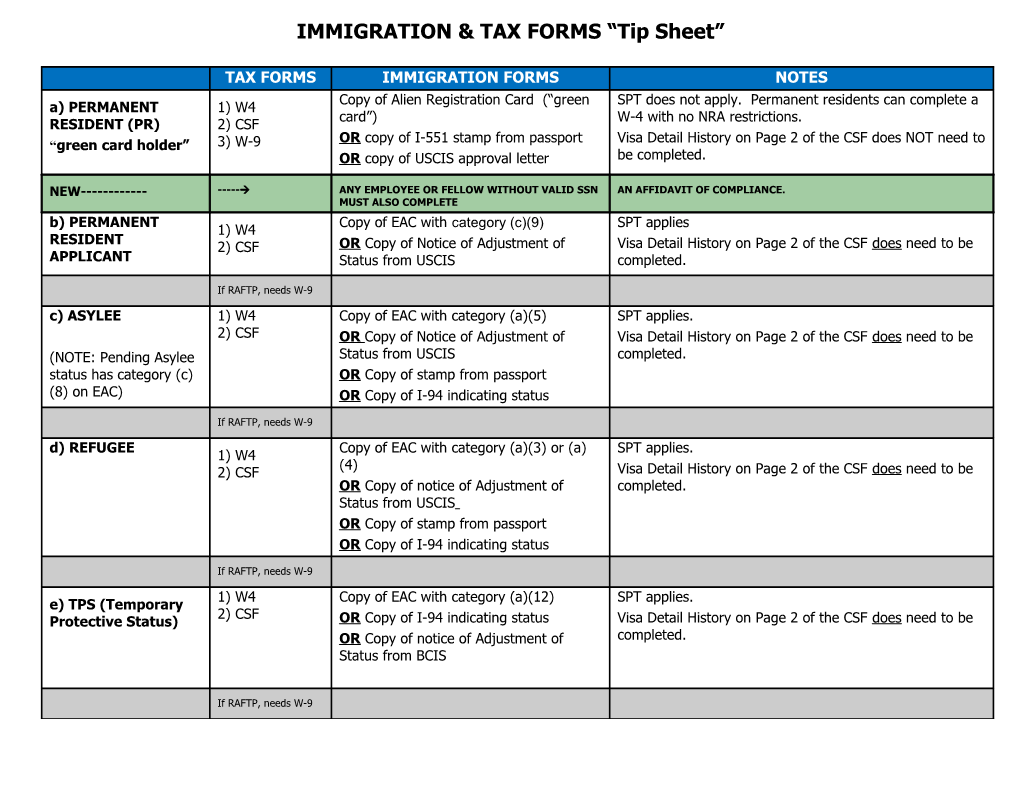

IMMIGRATION & TAX FORMS “Tip Sheet”

TAX FORMS IMMIGRATION FORMS NOTES Copy of Alien Registration Card (“green SPT does not apply. Permanent residents can complete a a) PERMANENT 1) W4 card”) W-4 with no NRA restrictions. RESIDENT (PR) 2) CSF OR copy of I-551 stamp from passport Visa Detail History on Page 2 of the CSF does NOT need to “green card holder” 3) W-9 OR copy of USCIS approval letter be completed.

NEW------ ANY EMPLOYEE OR FELLOW WITHOUT VALID SSN AN AFFIDAVIT OF COMPLIANCE. MUST ALSO COMPLETE b) PERMANENT Copy of EAC with category (c)(9) SPT applies 1) W4 RESIDENT 2) CSF OR Copy of Notice of Adjustment of Visa Detail History on Page 2 of the CSF does need to be APPLICANT Status from USCIS completed.

If RAFTP, needs W-9 c) ASYLEE 1) W4 Copy of EAC with category (a)(5) SPT applies. 2) CSF OR Copy of Notice of Adjustment of Visa Detail History on Page 2 of the CSF does need to be (NOTE: Pending Asylee Status from USCIS completed. status has category (c) OR Copy of stamp from passport (8) on EAC) OR Copy of I-94 indicating status

If RAFTP, needs W-9 d) REFUGEE Copy of EAC with category (a)(3) or (a) SPT applies. 1) W4 (4) 2) CSF Visa Detail History on Page 2 of the CSF does need to be OR Copy of notice of Adjustment of completed. Status from USCIS OR Copy of stamp from passport OR Copy of I-94 indicating status

If RAFTP, needs W-9 1) W4 Copy of EAC with category (a)(12) SPT applies. e) TPS (Temporary 2) CSF Protective Status) OR Copy of I-94 indicating status Visa Detail History on Page 2 of the CSF does need to be OR Copy of notice of Adjustment of completed. Status from BCIS

If RAFTP, needs W-9 IMMIGRATION & TAX FORMS “Tip Sheet”

TAX FORMS (Employee) TAX FORMS (Fellow) IMMIGRATION FORMS NOTES AGENCY CODE=360231 AGENCY CODE=360295 EMPLOYEE: FELLOW: COPY OF I-20 IF EMPLOYEE & FELLOW: F-1 STUDENT W-4, CSF W-4, CSF, AND COPY OF VISA** WILL NEED TWO W-4 IF TAX TREATY: 8233 & W8-BEN COPY OF I-94 FORMS. REP LETTER ALSO RAFTP needs W-9, W-9 attachment for treaty EMPLOYEE: RAFTP needs W-9, COPY OF I-20 The I-20 pages needed are 1 F-1 STUDENT W-4, CSF W-9 attachment for COPY OF VISA** & 3 for Optional Practical Optional Practical IF TAX TREATY: 8233 & treaty COPY OF I-94 Training/Curricular Practical Training Training REP LETTER ALSO. COPY OF A VALID EAC

ANY EMPLOYEE OR VALID SSN MUST ------ AFFIDAVIT OF FELLOW WITHOUT A ALSO COMPLETE AN COMPLIANCE. EMPLOYEE: FELLOW: COPY OF DS-2019 COPY IF EMPLOYEE & FELLOW: J-1 STUDENT W-4, CSF W-4, CSF, AND OF VISA** WILL NEED TWO COMPLETE IF TAX TREATY: 8233 & W8-BEN COPY OF I-94 SETS OF TAX PAPERWORK. REP LETTER ALSO. RAFTP needs W-9, W-9 attachment for treaty EMPLOYEE: COPY OF DS-2019 COPY NON-STUDENT J-1 W-4, CSF OF VISA** BE HAPPY! (DS-2019, SEC 4) IF TAX TREATY: 8233 & COPY OF I-94 REP LETTER ALSO. RAFTP needs W-9, W-9 attachment for treaty J-2 SPOUSE OR W-4 COPY OF VISA** Not eligible for tax treaty DEPENDENT OF ANY CSF COPY OF I-94 benefit ALWAYS FICA J-1 VISA HOLDERS If RAFTP, needs W-9 COPY OF A VALID EAC TAXABLE. Copy of the DS-2019 IMMIGRATION & TAX FORMS “Tip Sheet”

TAX FORMS (Employee) TAX FORMS (Fellow) IMMIGRATION FORMS NOTES AGENCY CODE=360231 AGENCY CODE=360295 H-1 TEMP WORKER- EMPLOYEE: COPY OF I-797 If RAFTP, and not using a tax SPECIAL W-4, CSF COPY OF VISA** treaty, needs only a W-9. OCCUPATION IF TAX TREATY: 8233 & COPY OF I-94 ALWAYS FICA TAXABLE. REP LETTER, W9 & W-9 ATTACHMENT

TN NAFTA WORK W-4 COPY OF VISA** ALWAYS FICA TAXABLE. VISA (RESIDENTS CSF COPY OF I-94 OF CANADA & NEEDS A W-9 MEXICO) FICA TAXABLE AT UMD ¬ A VISAS (STAFF OF W-4 COPY OF VISA** Not eligible for tax treaty FOREIGN CSF COPY OF I-94 benefit EMBASSIES) COPY OF A VALID EAC Exempt from counting days of presence in the US – stays a NRA for Tax Purposes. FICA TAXABLE AT UMD ¬ G-4 DEPENDENT OF W-4 COPY OF VISA** Not eligible for tax treaty G-1 (EMPLOYEE OF CSF COPY OF I-94 benefit INT’L. COPY OF A VALID EAC Exempt from counting days of ORGANIZATION) presence in the US – stays a NRA for Tax Purposes. NOTE: TAX FORMS NOTE: In section 3 of the NOTE: NOTE: NRAs MUST NOTE: FOR VISA HOLDERS W-4 NRAS MAY NOT USE RAFTPs CAN COMPLETE A W-4 AS NO SSN, MEANS NO TAX MUST BE LINE 3, BUT MAY USE COMPLETE W-4s “single”, 1 for FEDERAL & TREATY BENEFITS! COMPLETED EVERY LINE 4, IF APPLICABLE. W/O NRA ‘single’ 1 or 0 FOR STATE. JANUARY. RESTRCITIONS, ** CANADIANS MAY NOT HAVE A VISA, and SHOULD SUBMIT A COPY OF THEIR PASSPORT INSTEAD. IMMIGRATION & TAX FORMS “Tip Sheet”

KEY: CSF= CITIZENSHIP STATUS FORM W4 = EMPLOYEE WITHHOLDING ALLOWANCE USCIS = U.S. CITIZENSHIP and IMMIGRATION SVCS. W8-BEN = CERTIFICATE OF FOREIGN STATUS EAC = EMPLOYMENT AUTHORIZATION CARD W-9 = REQUEST for TAXPAYER ID NUMBER I-20 = CERTIFICATE of ELIGIBILTY (F-1 STATUS) W-9 attachment = UMD FORM FOR TAX TREATY USE DS-2019 = CERTIFICATE of ELIGIBILTY (J-1 STATUS) REP LETTER = REQUIRED ATTACHMENT FOR 8233 I-797 = H1-B1 APPROVAL NOTICE NRA = NONRESIDENT ALIEN FOR TAX PURPOSES (on this sheet) I-94 = DEPARTURE CARD RAFTP = RESIDENT ALIEN FOR TAX PURPOSES SPT = Substantial Presence Test (page 2 on the CSF)

ALL Foreign Nationals in Non Paid appointments should also submit a CSF with copies of the most current immigration documents attached. 07-05- 2012.