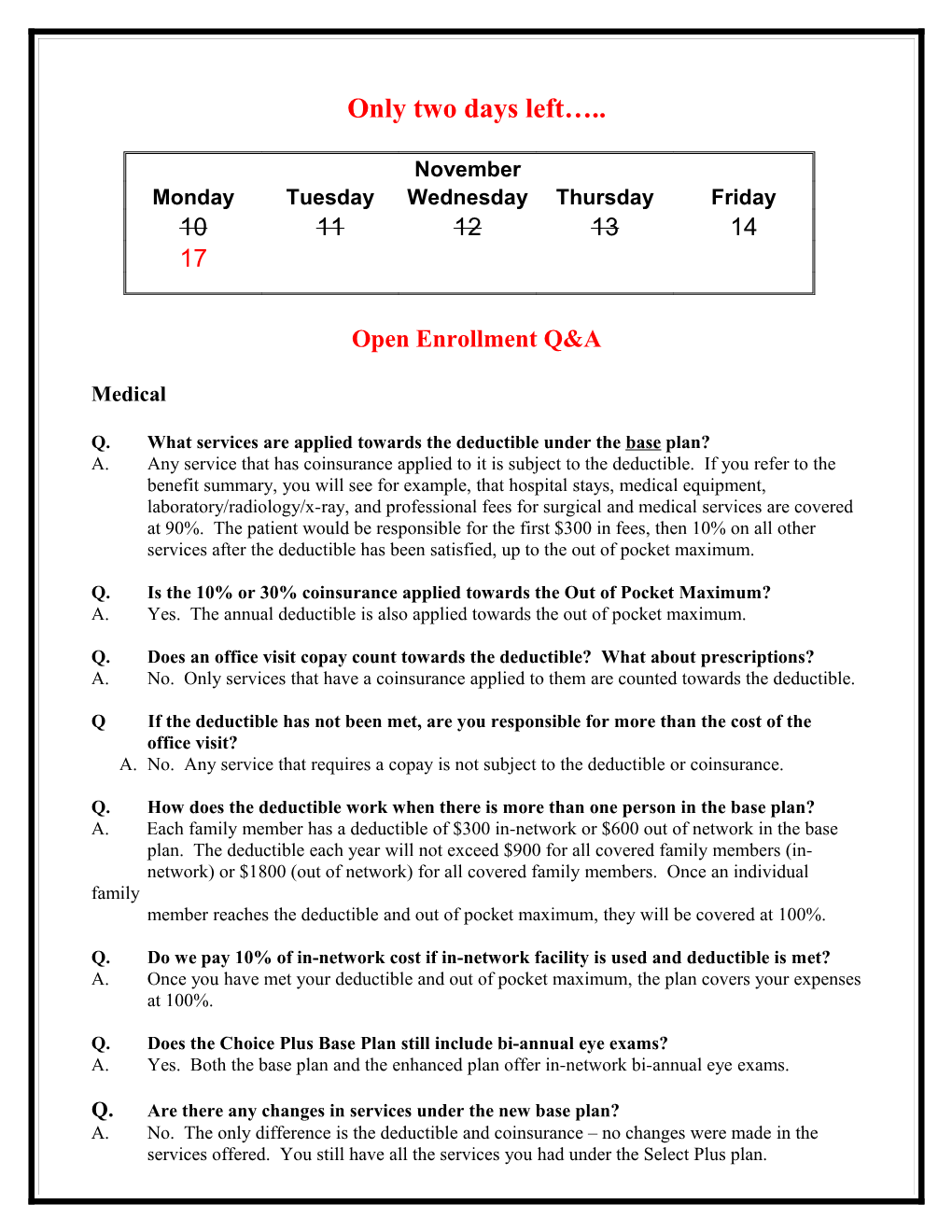

Only two days left…..

November Monday Tuesday Wednesday Thursday Friday 10 11 12 13 14 17

Open Enrollment Q&A

Medical

Q. What services are applied towards the deductible under the base plan? A. Any service that has coinsurance applied to it is subject to the deductible. If you refer to the benefit summary, you will see for example, that hospital stays, medical equipment, laboratory/radiology/x-ray, and professional fees for surgical and medical services are covered at 90%. The patient would be responsible for the first $300 in fees, then 10% on all other services after the deductible has been satisfied, up to the out of pocket maximum.

Q. Is the 10% or 30% coinsurance applied towards the Out of Pocket Maximum? A. Yes. The annual deductible is also applied towards the out of pocket maximum.

Q. Does an office visit copay count towards the deductible? What about prescriptions? A. No. Only services that have a coinsurance applied to them are counted towards the deductible.

Q If the deductible has not been met, are you responsible for more than the cost of the office visit? A. No. Any service that requires a copay is not subject to the deductible or coinsurance.

Q. How does the deductible work when there is more than one person in the base plan? A. Each family member has a deductible of $300 in-network or $600 out of network in the base plan. The deductible each year will not exceed $900 for all covered family members (in- network) or $1800 (out of network) for all covered family members. Once an individual family member reaches the deductible and out of pocket maximum, they will be covered at 100%.

Q. Do we pay 10% of in-network cost if in-network facility is used and deductible is met? A. Once you have met your deductible and out of pocket maximum, the plan covers your expenses at 100%.

Q. Does the Choice Plus Base Plan still include bi-annual eye exams? A. Yes. Both the base plan and the enhanced plan offer in-network bi-annual eye exams.

Q. Are there any changes in services under the new base plan? A. No. The only difference is the deductible and coinsurance – no changes were made in the services offered. You still have all the services you had under the Select Plus plan. Flexible Spending Account (FSA)

Q. When will the deduction for the Flexible Spending Account be taken out of my pay? A. Your annual election (up to $5000 for dependent care and $7000 for un-reimbursed medical expenses) for the FSA is divided by 12 and deducted from your paycheck every month. For biweekly paid staff the deduction is taken in the second payroll each month.

Q. How does the Flexible Spending Account Consumer Card Work? A. Your entire annual election amount for health related expenses will be credited to your FSA at the beginning of the year. When you incur an eligible expense at a pharmacy or doctors office that accepts the Visa card, you simply swipe your card and the expense is paid by debiting your card (similar to an ATM transaction). A record of the transaction is made at United; you do not have to submit any paperwork for reimbursement. United Healthcare will reimburse for eligible health expenses as the expense is incurred, even if the funds have not been deducted from your salary.

Dependent care can only be reimbursed when there are sufficient funds in your account to cover the cost and they are not available through the Consumer Card program.

All enrollees in the FSA program will receive instructions from HR in early December on how to activate their FSA account(s) with United.

Q. Do I have to use the Consumer Card? A. No. You have the option of submitting receipts directly to United Healthcare for reimbursement. Reimbursements can be done in one of two ways – direct deposit or a check mailed to your home address. All enrollees in the FSA program will receive instructions from HR in early December on how to activate their FSA account(s) with United.

Q. What time period will the FSA cover? A. Expenses can be incurred between January 2009 and March 2010. All expenses must be submitted no later than June 15th for reimbursement.

Important Reminder:

All enrollment applications are due in HR by November 17 th. Applications received after the deadline cannot be accepted or processed.