October 4, 2005

Research Associate: Priti Jain Editor: James Weber, CFA

Research Digest Sr. Editor: Ian Madsen, CFA [email protected] 800-767-3771 x417

www.zackspro.com 155 North Wacker Drive Chicago, IL 60606 Royal Dutch Shell plc (RDSA - NYSE) $62.97 Shares per ADS – 2:1 Note: All new or revised material since last report has been highlighted. Reason for Report: Non Earnings Update

Overview Royal Dutch Shell plc is a large integrated oil and gas exploration, production, and refining and marketing company, with operations and assets worldwide. There are few areas of the world in which it does not have a presence. RDS’s head office is located in The Hague, Netherlands, with employees totaling 71,400. Additional information about the company can be found at: www.shell.com. The company operates on a calendar year basis.

On July 20, 2005, Royal Dutch and Shell Transport and Trading completed their merger and the name of the new company is Royal Dutch Shell plc. The shareholders of Royal Dutch/Shell approved the plan to amalgamate on June 28, 2005 (Royal Dutch holders receiving 60% of the share capital in ‘A’ shares of the new company with Shell holders receiving 40% in ‘B’ shares). The stock began trading effective on July 20, 2005 under the tickers RDSA for the old RD and RDSB for the old SC. RDS is negotiating with the Dutch government for the changes in corporate tax law that would ultimately allow the merger of the two stocks into one under the ticker RDS.

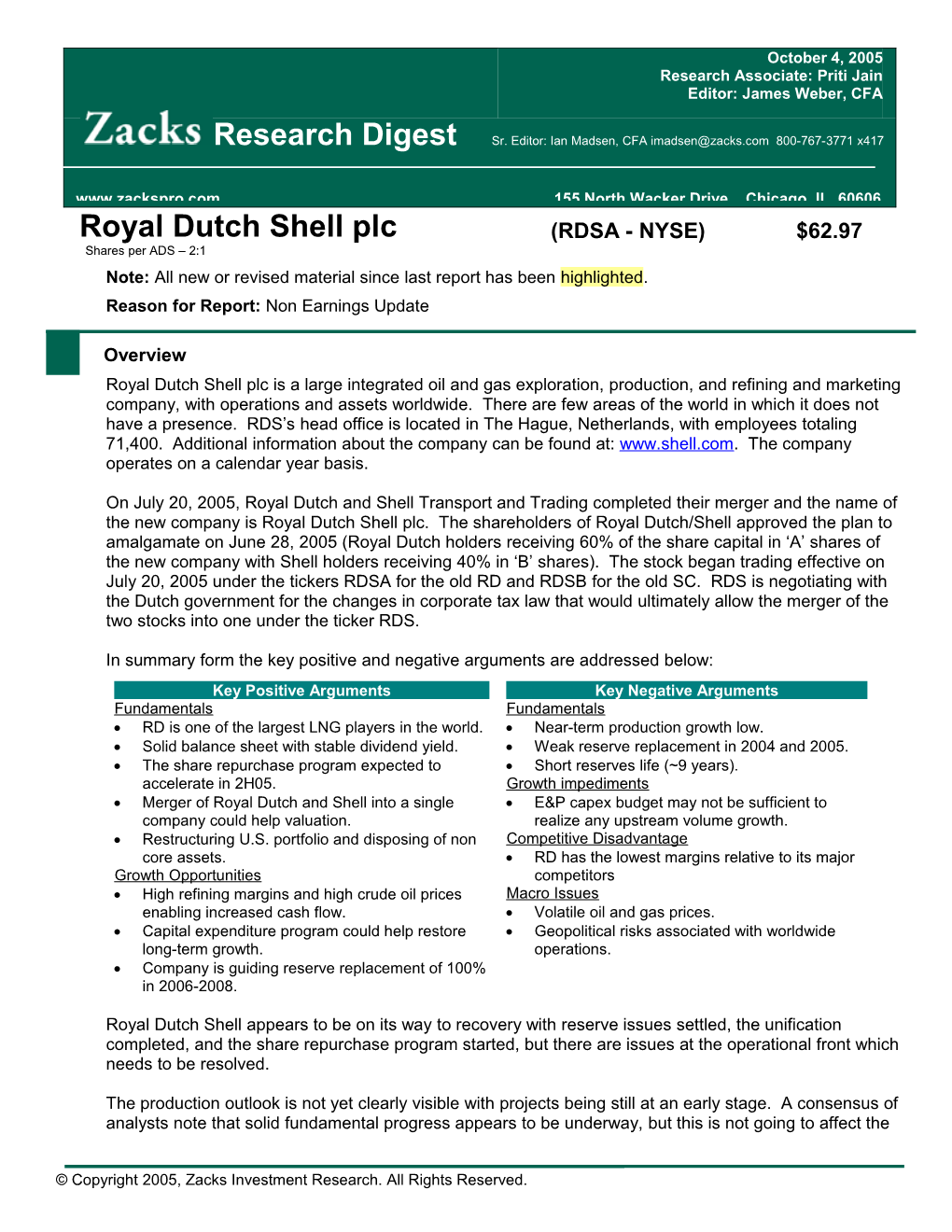

In summary form the key positive and negative arguments are addressed below: Key Positive Arguments Key Negative Arguments Fundamentals Fundamentals RD is one of the largest LNG players in the world. Near-term production growth low. Solid balance sheet with stable dividend yield. Weak reserve replacement in 2004 and 2005. The share repurchase program expected to Short reserves life (~9 years). accelerate in 2H05. Growth impediments Merger of Royal Dutch and Shell into a single E&P capex budget may not be sufficient to company could help valuation. realize any upstream volume growth. Restructuring U.S. portfolio and disposing of non Competitive Disadvantage core assets. RD has the lowest margins relative to its major Growth Opportunities competitors High refining margins and high crude oil prices Macro Issues enabling increased cash flow. Volatile oil and gas prices. Capital expenditure program could help restore Geopolitical risks associated with worldwide long-term growth. operations. Company is guiding reserve replacement of 100% in 2006-2008.

Royal Dutch Shell appears to be on its way to recovery with reserve issues settled, the unification completed, and the share repurchase program started, but there are issues at the operational front which needs to be resolved.

The production outlook is not yet clearly visible with projects being still at an early stage. A consensus of analysts note that solid fundamental progress appears to be underway, but this is not going to affect the

© Copyright 2005, Zacks Investment Research. All Rights Reserved. near-term outlook. The analysts generally are concerned about low production growth outlook and a low return on capital in the current high oil price environment. However, there is also an opinion that the Company is on track to turn around with increasing cash flow, high capital expenditure, and new upstream projects in hand. The downstream business adds another positive in the strong refining margins environment as does the planned $3-$5 billion share buyback in 2005.

Revenue

Royal Dutch Shell generates revenue through four primary business segments: (1) Exploration & Production (E&P), (2) Gas & Power, (3) Oil Products/Refining and Marketing, and (4) Chemicals, each of which are further segmented into (a) United States and (b) Global – excluding U.S. A fifth operating segment represents Other Industries. Segment Operating Income No analyst consistently projected revenue for individual business segments. Very few analysts gave detailed models for operating income either. The table below highlights the group’s segmental operating income for the past and the future estimates.

Segment Earnings After Tax Year-over-Year growth $ Millions 2004A 2005E 2006E 2007E 04-05E 05E-06E 06E-07E US $3,051 $4,454 $5,100 $4,400 46.0% 14.5% -13.7% International $7,096 $8,572 $9,960 $8,600 20.8% 16.2% -13.7% Total E&P $10,163 $12,497 $13,600 $11,898 23.0% 8.8% -12.5% US $140 ($78) $150 $200 -155% 294% 33.3% International $1,367 $1,360 $1,140 $1,300 -0.5% -16.2% 14.0% Gas & Power $1,470 $1,278 $1,368 $1,664 -13.1% 7.1% 21.6% US $1,515 $1,842 $1,586 $600 21.6% -13.9% -62.2% International $4,611 $5,099 $3,551 $2,100 10.6% -30.4% -40.9% Total R&M $6,106 $6,878 $5,858 $4,343 12.6% -14.8% -25.9% Chemicals $1,538 $1,708 $1,395 $1,058 11.1% -18.4% -24.2% For specific details on operating income, please refer the ZACKS Research Digest Spreadsheet.

Exploration & Production (53% of Total Earnings in 2Q05): Total adjusted E&P earnings were $2,894 million excluding the net charges of $149 million (from mark-to-market valuations, divestment gains, and net tax charges). The earnings were the second highest ever, up 20% from a year ago, but below 1Q05 record of almost $3 billion. Compared with a year ago, earnings benefited from higher realized oil and gas prices, which more than offset lower production. However, sequentially the impact of lower production volumes, because of seasonal demand (especially natural gas in Western Europe), exceeded the benefits from higher oil and gas prices. During 2Q05, realized prices averaged $40.30/boe, up 39% and 12%, respectively; $48.01/b for oil, up 42% and 10%, and $4.60/mcf for gas, up 34% and 6%.

Production Metrics: Oil and gas production averaged 3.5 million barrels of oil equivalent per day (mmboe/d) down 1.5% from a year ago. The decline was mainly due to normal field decline, asset sales, facility maintenance, and lower entitlement under production sharing contracts due to higher oil and gas prices. Excluding the last three factors, production was higher 2% y/y.

Outlook: New production volumes from the UK, Malaysia and the U.S. helped to offset field declines. Guidance for 2005 and 2006 are unchanged at 3.5 - 3.8 mmboe/d. The company expects production to average 3.8 - 4.0 mmboe/d in 2009. The analysts expect full year 2005 volumes to average 3.5 mmboe/d, at the low end of the 3.5 - 3.8 mmboe/d range.

Zacks Investment Research Page 2 www.zackspro.com The company’s "Big Cat" high potential exploration drilling program is off to a good start in 2005. Three discoveries have been made in Nigeria, one in Norway, and one in Australia out of eight wells drilled. New projects are also in progress – LNG, Iran LNG, and Qatar LNG among others. Over the 2005-09 periods, the sanctioning of LNG reserves should provide Royal Dutch Shell with a long-lived resource addition. The company expects to nearly double its LNG capacity by 2009.

Management increased its 2005 exploration budget by $300 million, from $1.5 billion to $1.8 billion, following the huge cost over-run at the Sakhalin project. The company has also indicated that the spending program for 2006 is expected to rise. While cost inflation is an industry wide issue, following the cost increases at Sakhalin, cost control at RDS will likely face increased scrutiny going forward (B. of America). As upstream margin pressure continues, the exceptional upstream macro environment is not benefiting the bottom line.

The company's 2004 reserve replacement is estimated at just 25%-40%. Management said rebooking of re-categorized reserves would likely be delayed, as such, 2005 reserve replacement is also expected to be below 100%. The reserve downgrade has left the company with a considerably weaker reserve position.

Gas & Power (4.3% of Total Earnings in 2Q05): The operating earnings were $237 million, which excluded a $226 million charge primarily related to the divestment of certain assets. The income was down 26% and 45%, respectively from a year ago and the prior period. Benefits from the impact of higher LNG prices and volumes were more than offset by the impact from the sale of midstream assets, lower trading profits, and LNG shipping results. The 2% increase in LNG sales volumes as a result of North West Shelf project expansion, which came on stream in 4Q04, was partially offset by scheduled maintenance of other facilities elsewhere.

Oil Products (37% of Total Earnings in 2Q05): Earnings were $2,028 million up 30% from $1,546 million a year ago and 40% sequentially. Stronger refining margins were partially offset by lower marketing margins and lower volumes. Oil product sales were down slightly from a year ago and essentially unchanged sequentially, averaging 7,458 Mbls/d.

Volumes: Throughput volumes averaged 3,981 mbd, down 5% from a year ago and 2% sequentially, mainly due to asset sales. Adjusted for asset sales, average throughput volume increased by 1% from a year ago.

Chemicals (6% of Total Earnings in 2Q05): Earnings were $339 million (excluding legal and environmental charges of $80 million), down 9% from a year ago and 49%, sequentially, despite a 26% increase in realized prices, mainly due to sharply higher feedstock and energy costs and decline in sales volume. Chemical sales volumes fell 9% year/year due primarily to a planned reduction in lower margin volumes.

Margins

RD has the lowest margins relative to its major competitors. While the company has been trying for several years to restructure its U.S. portfolio, some analysts still believe that more has to be done while some analysts think that it is turning a corner. The disposal program has been effectively executed with nearly $15 billion likely to have been completed by end 2005 and more to come (LPG business) in 2006.

In downstream, management continued with the implementation of its strategy for reshaping the portfolio during the quarter. Much is expected of management’s attempt to turn around its U.S. downstream operations, though the results are expected to take longer to show up than initially indicated.

Zacks Investment Research Page 3 www.zackspro.com There is a continued increase in the level of costs, which contributed to the lower than expected increase in net income per barrel. However, this is industry wide and the analyst (MorganStanley) sees no evidence that the company is suffering disproportionately.

Earnings Per Share

EPS per ADR 2003A 2004A Q105A Q205A Q305E Q405E 2005E 2006E Average $3.59 $5.22 $1.58 $1.53 $1.68 $1.53 $6.53 ↑ $6.43 ↑ Y-o-Y Growth 45.4% 37.4% 24.4% 24.3% 2.7% 25.1% -1.4% Qrtly. Growth 6.0% -3.2% 9.6% -8.8% Low $3.59 $5.22 $1.58 $1.53 $1.75 $1.70 $6.78 $7.44 High $3.59 $5.22 $1.58 $1.53 $1.53 $1.36 $6.15 $5.10 # of Estimates 4 4 9 9 Royal Dutch Shell had an adjusted net income of $5,170 million or $1.53/share ($0.05 below consensus), 23% above the year-ago period, but down 3% sequentially. Compared with a year ago, earnings benefited from higher oil and gas prices and better downstream results on strong refining margins, which more than offset the negative impact from lower production and income from chemical, gas and power segments, and slightly higher effective income tax rate. Hurricane Katrina has increased the commodity prices. Based on higher commodity prices, most of the analysts increased their 2005 and 2006 EPS estimates. For specific details on EPS forecasts please refer the ZACKS Research Digest Spreadsheet.

Target Price/Valuation

The average target price is $71.15 per ADR. The target price ranges from $63 (Friedman, Billings) to $78 (MorganStanley). The valuation methods include EV/DACF and P/E multiples on 2006 estimates. The lowest price target of $63 is given by 15x mid-cycle earnings estimate. The analysts are equally divided in their opinions. Of the nine analyst recommendations, three are positive, three are neutral, and three are negative. Out of six analysts providing price targets, four have increased their price targets based on high commodity prices.

Rating Distribution Positive 33% Neutral 33% Negative 33% Average Target Price $71.15 Digest High $78 Digest Low $63 Number of Analysts 9

Risks to the price target include volatile oil and gas prices, drilling and production results, successful restructuring, regulatory risks and geopolitical risks.

Zacks Investment Research Page 4 www.zackspro.com Upcoming Events

Event Date 3Q05 Earnings Results Expected by end of October, 2005

Long-Term Growth

Royal Dutch Shell’s long term growth is contingent on its ability to reduce operating costs and achieve meaningful reserve replacements. With one of the shortest reserves life (of 9.4 years) amongst the peer group, RDS has significantly less visibility. Near-term production is declining and future production growth is uncertain. The unification is complete but the analysts think the focus is on fundamentals which still remain weak. While material acquisitions to replenish reserves would improve the growth outlook, it appears unlikely in the current macro environment. However, new projects for building LNG capacity are in progress and the company has indicated a material improvement in the success rate of exploration, giving some visibility on long term prospects. Capital expenditure is being increased to rebuild the upstream business and return the company to longer-term growth. Though 80% of capital spending over the medium-term is scheduled for E&P, it still faces upward risks due to continued high costs. Even if the company is able to maintain flat production, this is still well below the 3%–4% average growth rate expected from the other major integrated oil companies in 2005. With regard to its refining and marketing operations, the outlook is fairly positive with refining margins on the rise. Strong commodity prices and refining margins will continue to increase cash flow and strengthen its balance sheet.

Capital Structure/Solvency/Cash Flow/Governance/Other

Operating cash flow was a record $8.4 billion in 2Q05 and $16.5 billion for 1H05. Debt was $13.4bn and debt ratio was 13.2%; capex was $4.1 billion in the quarter and is expected to be $15 billion for the year. The quarterly dividend was at €0.23 per A share and 15.9p per B share or $0.5538 per ADS. The dividend is unchanged from the first quarter in Euro terms. However, currency effects lowered the dividend to U.S. ADS holders from the first quarter.

The Company plans to repurchase shares totaling about $3 - $5 billion this year. Repurchases are expected to start up after August 9, 2005. Buybacks were curtailed during the second quarter to comply with requirements for the unification process. RDS expects to return substantially all of its free cash flow to shareholders in the form of higher dividends and share repurchases.

RDS recently completed its unification (More than 95% of RD shares have been exchanged into newly issued RDS/A shares. Once fully exchanged, RD shares will not be listed.) The company will just trade under one ticker (RDS).

On July 7, 2005, Gazprom of Russia and Royal Dutch/Shell Group of Companies signed a Memorandum of Understanding in London regarding shares swap in Zapolyarnoye-Neocomian and Sakhalin-II projects.

Zacks Investment Research Page 5 www.zackspro.com Individual Analyst Opinions

POSITIVE RATINGS

Merrill – Buy (Price Target $70.90/ADR) – (7/28/05): The analysts note that longer-term portfolio issues remain a concern and also question the quality of new projects and related costs. They have concerns about an acquisition at some stage and a possible material hike in medium term capex guidance. But they are positive on the downstream business, global leadership in LNG, and significant cash available for share repurchase. They see few short term positive fundamental catalysts but on a 12-month view, valuation looks compelling and should limit downside risk.

MorganStanley – Overweight ($78/ADR or GBp 2150 per share) – (9/13/05): The analysts raised the price target from $72.50 (GBp2065 per share). They believe 2Q05 upstream volumes lower-than- expected declines more than offset by new field start-ups. The Sakhalin problem is disappointing but believes it is an aftershock from the reserve problems of last year. They believe RDS stumbled but is turning. With the current valuation gap and expected major share buyback program, they believe now is the time to be more positive on the shares.

Oppenheimer – Buy – (8/3/05): The analysts believe the stock is likely to continue to outperform the S&P 500 in the next 12 months and beyond. The unification is aimed at improving management decisions, while giving the company the financial flexibility to make large strategic stock-based acquisitions. It is a positive move but only a first step, as much more needs to be done to fully restore operating excellence and investor confidence. The analysts think expanding US natural gas exposure remains a top priority and key to future acquisitions.

NEUTRAL RATINGS

Johnson Rice – Equal Weight (8/1/05): The analysts maintain their Equal Weight rating, finding the shares of peers BP and XOM more attractive on a returns and production profile basis.

B. of America – Neutral ($67/ADR) – (9/06/05): The analysts raised the price target to $67 from $60. Lack of volume growth and questions about cost control in its major projects leaves RDS with the least compelling near term story among the majors. A re-start of the share buyback will help, but that effectively helps remove underperformance rather than create a reason for outperformance. The analyst sees better opportunities elsewhere in the sector and thinks there is still a lot of work to do with the asset base.

Bernstein – Market Perform ($76/ADR) – (8/17/05): The analysts raised the price target to $76 from $70. While operationally Shell made a good start to 2005 with improvements in margins, the announcement of 100% cost overruns in Sakhalin has dampened stock sentiment. With RDS unlikely to close the reserve gap with peers in the next 4 years, an uninspiring exploration program, rising costs, and an unwillingness to cut deep with upstream divestments, the analyst think the turnaround challenge is significant.

NEGATIVE RATINGS

Bear Stearns – Underperform – (7/29/05): The analysts continue to rate RDS Underperform. They believe upside from current levels is limited by lack of oil and gas production growth, slow progress in improving returns, and management credibility issues.

Zacks Investment Research Page 6 www.zackspro.com Friedman, Billings – Underperform ($63/ADR) – (7/29/05): The analysts reiterate their Underperform rating due to the minimal upstream production volume growth expected over the next few years, and a $63/ADS share price target.

CIBC – Sector Underperformer ($72/ADR) – (9/11/05): The analysts maintain a Sector Underperformer rating but raised the price target to $72 from $70. The decision to combine operations under a single structure is a tangible sign that RDS has made significant progress on governance issues. However, operationally, upstream production growth appears limited because of a relatively short list of attractive projects and natural decline in some existing fields.

Copy Editor: Joyoti Das

Zacks Investment Research Page 7 www.zackspro.com