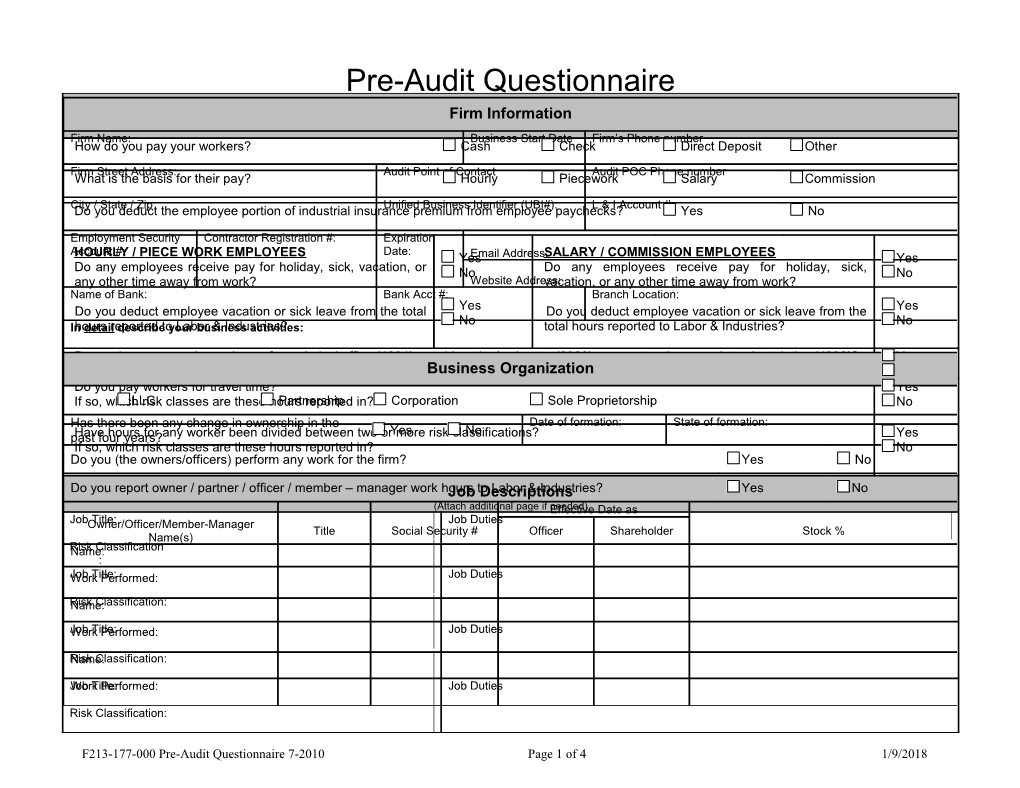

Pre-Audit Questionnaire

WorkerFirm Information Information Firm Name: Business Start Date Firm’s Phone number How do you pay your workers? Cash Check Direct Deposit Other Firm Street Address: Audit Point of Contact Audit POC Phone number What is the basis for their pay? Hourly Piecework Salary Commission

CityDo /you State deduct / Zip the employee portion of industrial insuranceUnified premium Business from Identifier employee (UBI#): paychecks?L & I Account # Yes No

Employment Security Contractor Registration #: Expiration AccountHOURLY #: / PIECE WORK EMPLOYEES Date: Email Address:SALARY / COMMISSION EMPLOYEES Yes Yes Do any employees receive pay for holiday, sick, vacation, or No Do any employees receive pay for holiday, sick, No any other time away from work? Website Address:vacation, or any other time away from work? Name of Bank: Bank Acct #: Branch Location: Do you deduct employee vacation or sick leave from the total Yes Do you deduct employee vacation or sick leave from the Yes No No Inhours detail reported describe to your Labor business & Industries? activities: total hours reported to Labor & Industries?

Do you have any workers who perform clerical office (4904), outside sales/estimator (6303), or construction superintendent duties (4900)? Yes Business Organization No Do you pay workers for travel time? Yes If so, which LLC risk classes are these hours Partnership reported in? Corporation Sole Proprietorship No Has there been any change in ownership in the Date of formation: State of formation: Yes No pastHave four hours years? for any worker been divided between two or more risk classifications? Yes If so, which risk classes are these hours reported in? No Do you (the owners/officers) perform any work for the firm? Yes No

Do you report owner / partner / officer / member – manager work hoursJob toDescriptions Labor & Industries? Yes No (Attach additional page if needed)Effective Date as JobOwner/Officer/Member-Manager Title: Job Duties Title Social Security # Officer Shareholder Stock % Name(s) RiskName: Classification : JobWork Title: Performed: Job Duties

RiskName: Classification:

JobWork Title: Performed: Job Duties

RiskName: Classification:

JobWork Title: Performed: Job Duties

Risk Classification:

F213-177-000 Pre-Audit Questionnaire 7-2010 Page 1 of 4 1/9/2018 Subcontractor / Independent Contractor Information (Attach additional page if needed) Please list all individuals or businesses that performed services for your business that are not on your payroll. Examples would be individuals/businesses you issue IRS form 1099,casuaul/temporary labor, janitorial services, lawn care services, computer services, plumbing services or other repair services. Please be prepared to supply the supporting documentation at the time of the audit.

Subcontractor Information Contract Information Did the Amount Paid Name of L&I Acct Contractor's Brief Description/Nature of subcontractor Address Location UBI # During Audit Subcontractor # Lic # Contract Work bring workers? Period Yes/ No For Example: 123 Ash Ave, 601 344 211, 707- NW Contractors Seattle WA 98122 567 00 nwcont*235 Roofing, Inside Carpentry Yes $57,800

F213-177-000 Pre-Audit Questionnaire 7-2010 Page 2 of 4 1/9/2018 Contractor Information (Attach additional page if needed) Please list all contractors that hired your firm during the audit period.

Name: Unified Business Identifier (UBI): Phone #:

I, the undersigned, declare that I am the authorized representative of the firm submitting this questionnaire and that the answers contained, including any accompanying information, have been examined by me and that the matters and things set forth are true, correct and complete. Signature required (if a corporation, corporate officer must sign) Title: Date:

F213-177-000 Pre-Audit Questionnaire 7-2010 Page 3 of 4 1/9/2018 F213-177-000 Pre-Audit Questionnaire 7-2010 Page 4 of 4 1/9/2018