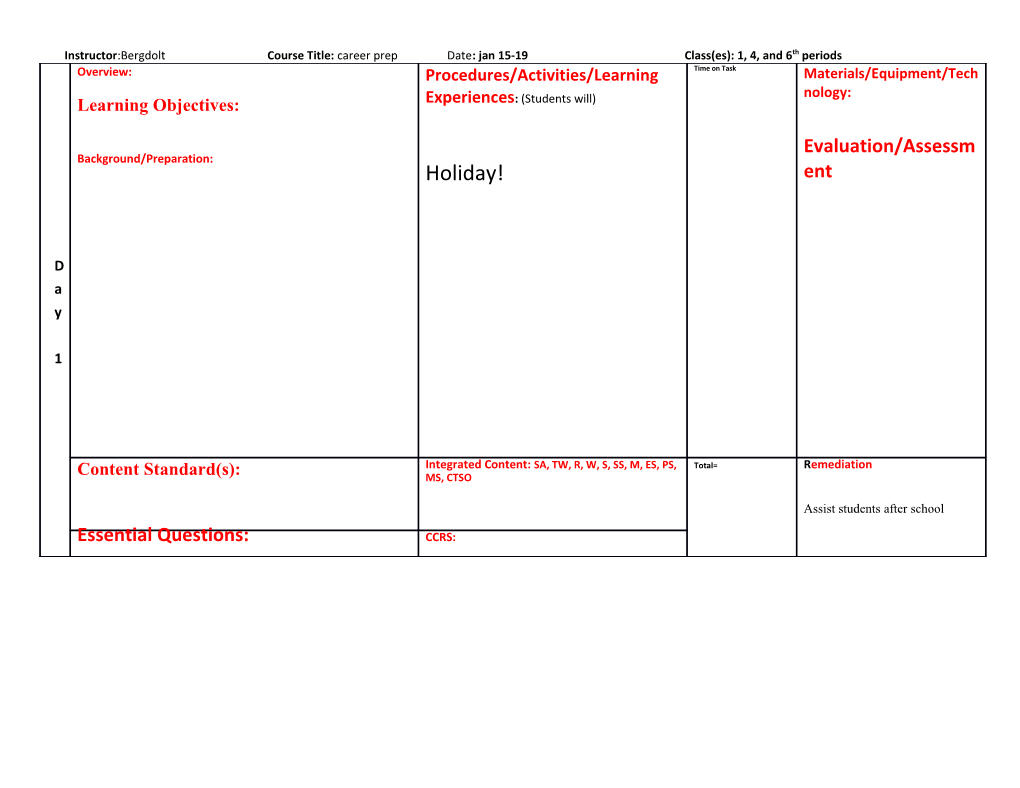

Instructor:Bergdolt Course Title: career prep Date: jan 15-19 Class(es): 1, 4, and 6th periods Overview: Procedures/Activities/Learning Time on Task Materials/Equipment/Tech nology: Learning Objectives: Experiences: (Students will)

Evaluation/Assessm Background/Preparation: Holiday! ent

D a y

1

Integrated Content: SA, TW, R, W, S, SS, M, ES, PS, Total= Remediation Content Standard(s): MS, CTSO

Assist students after school

Essential Questions: CCRS: Instructor:Bergdolt Course Title: career prep Date: jan 15-19 Class(es): 1, 4, and 6th periods Overview: Procedures/ Activities /Learning Experiences: Time on Task Materials/Equipment/Technolo (Students will) gy: Banking and Financial Institutions

Learning Objectives: Log in to Google Classroom Compare and contrast checking and savings accounts Type definitions for our new chapter – Evaluation/Assessment Evaluate services and related costs associated with financial “Checking Accounts” Strategies: institutions Describe the purpose of personal checks, cashier checks, and When done, work in Everfi Game titled Definitions money order “Financial Literacy” Everfi Describe the different ways to avoid fees like Overdraft fees and ATM fees

D a Background/Preparation: y :

2 Content Standard(s): Integrated Content: SA, TW, R, W, S, SS, M, ES, PS, Total= Remediation MS, CTSO Evaluate services and related costs associated with financial Meet after and before school with institutions in terms of personal banking needs students Demonstrate how to manage a checking and savings account, balance bank statements, and use online financial services

Essential Questions: CCRS: What can financial institutions do for me What are the costs associated with financial institution services What are the ways to avoid fees associated with financial services

*Provisions for individual differences will be made based upon specifications in the student’s Career/Tech Implementation Plan. Available Industry Credential: Course/Program Culminating Product: Instructor:Bergdolt Course Title: career prep Date: jan 15-19 Class(es): 1, 4, and 6th periods Overview: Procedures/ Activities /Learning Experiences: Time on Task Materials/Equipment/Technol (Students will) ogy: Banking and Financial Institutions

Learning Objectives: Bell - Types of Checking Accounts Concept Webs activity Evaluation/Assessment Compare and contrast checking and savings accounts Strategies: Evaluate services and related costs associated with financial institutions Build “Fake” checks. Save checks as a PDF and Bell Describe the purpose of personal checks, cashier checks, and upload to Google Classroom. (we will build these money order together using Microsoft Word Tools) Built Fake Checks Describe the different ways to avoid fees like Overdraft fees and ATM fees Save checks as a PDF and upload to your google Evefi classroom account

Work in Everfi “Financial Literacy” Game D a Background/Preparation: y :

3 Content Standard(s): Integrated Content: SA, TW, R, W, S, Total= Remediation SS, M, ES, PS, MS, CTSO Evaluate services and related costs associated with financial Meet with students after school institutions in terms of personal banking needs Demonstrate how to manage a checking and savings account, balance bank statements, and use online financial services

Essential Questions: CCRS: What can financial institutions do for me What are the costs associated with financial institution services What are the ways to avoid fees associated with financial services Instructor:Bergdolt Course Title: career prep Date: jan 15-19 Class(es): 1, 4, and 6th periods Overview: Procedures/ Activities /Learning Experiences: Time on Task Materials/Equipment/Technol (Students will) ogy: Banking and Financial Institutions Evaluation/Assessment Learning Objectives: Strategies: Teacher demonstration – How to fill in a check. Compare and contrast checking and savings accounts Evaluate services and related costs associated with financial Student Demo – Take a student volunteer to go to 5 drawn checks institutions board (screen) to fill in a blank check Describe the purpose of personal checks, cashier checks, and money order Describe the different ways to avoid fees like Overdraft fees Log into Google Classroom. Complete “Draw out and ATM fees Parts of a Check” activity . - First check is written to D “Motor Parts”. Use your own paper. a y If time, work in “Everfi” Financial Literacy. Background/Preparation: 4 Content Standard(s): Integrated Content: SA, TW, R, W, S, SS, M, ES, PS, Total= Remediation MS, CTSO Evaluate services and related costs associated with financial Meet with students after school institutions in terms of personal banking needs Demonstrate how to manage a checking and savings account, balance bank statements, and use online financial services Essential Questions: CCRS: What can financial institutions do for me What are the costs associated with financial institution services What are the ways to avoid fees associated with financial services

*Provisions for individual differences will be made based upon specifications in the student’s Career/Tech Implementation Plan. Available Industry Credential: Course/Program Culminating Product: Instructor:Bergdolt Course Title: career prep Date: jan 15-19 Class(es): 1, 4, and 6th periods

: