ChangeWave Research: Home TV Service Providers and Market Trends October 12, 2011

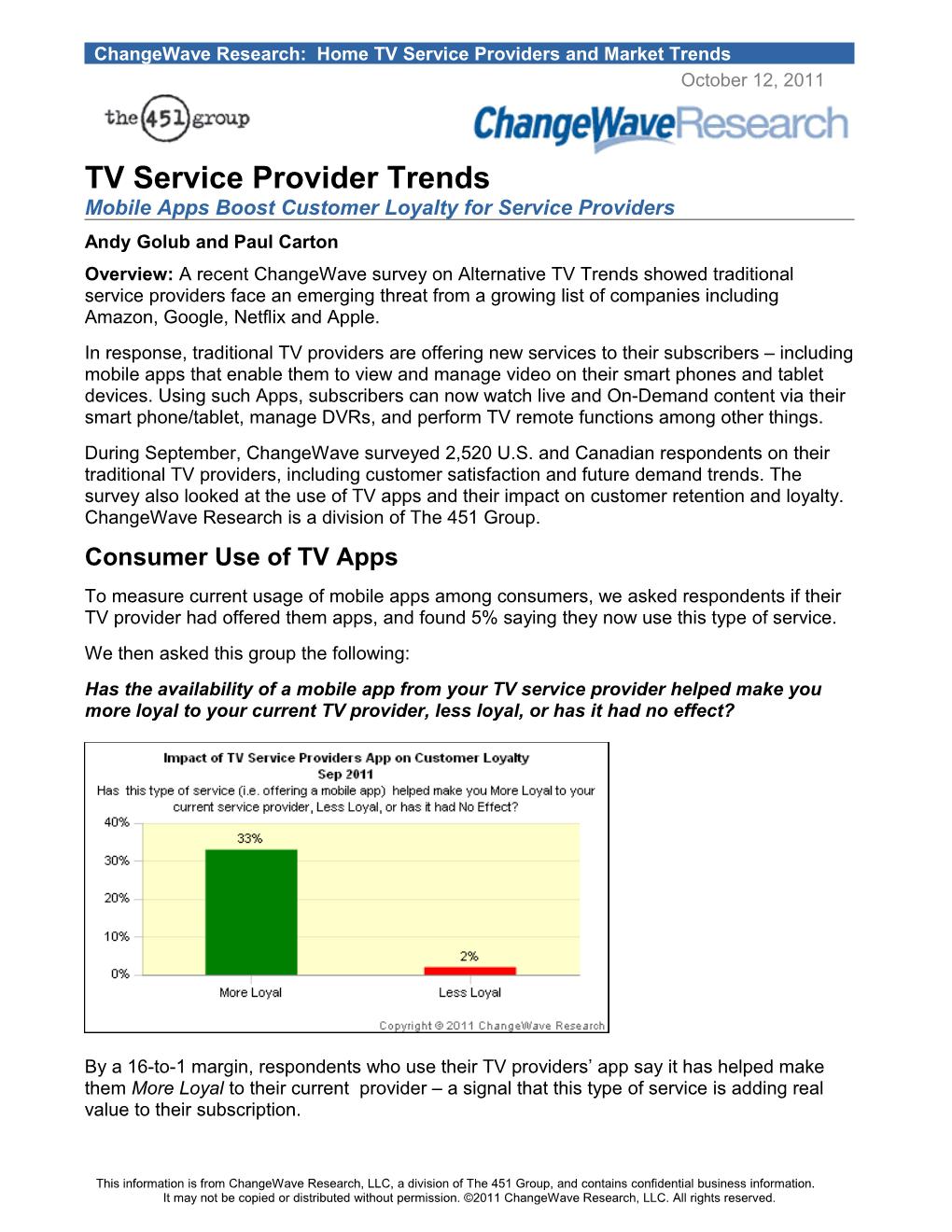

TV Service Provider Trends Mobile Apps Boost Customer Loyalty for Service Providers Andy Golub and Paul Carton Overview: A recent ChangeWave survey on Alternative TV Trends showed traditional service providers face an emerging threat from a growing list of companies including Amazon, Google, Netflix and Apple. In response, traditional TV providers are offering new services to their subscribers – including mobile apps that enable them to view and manage video on their smart phones and tablet devices. Using such Apps, subscribers can now watch live and On-Demand content via their smart phone/tablet, manage DVRs, and perform TV remote functions among other things. During September, ChangeWave surveyed 2,520 U.S. and Canadian respondents on their traditional TV providers, including customer satisfaction and future demand trends. The survey also looked at the use of TV apps and their impact on customer retention and loyalty. ChangeWave Research is a division of The 451 Group. Consumer Use of TV Apps To measure current usage of mobile apps among consumers, we asked respondents if their TV provider had offered them apps, and found 5% saying they now use this type of service. We then asked this group the following: Has the availability of a mobile app from your TV service provider helped make you more loyal to your current TV provider, less loyal, or has it had no effect?

By a 16-to-1 margin, respondents who use their TV providers’ app say it has helped make them More Loyal to their current provider – a signal that this type of service is adding real value to their subscription.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

HBO GO. Another app that is only available to traditional TV subscribers is HBO GO – a service that enables HBO subscribers to watch any HBO content on their iPad, iPhone or Android smart phone. We asked respondents currently using the HBO GO service if it is having any impact on their likelihood of canceling their paid TV subscription. Two-in-five (40%) said it has made them Less Likely to cancel (8% Significantly Less; 32% Somewhat Less) – another sign that this type of app service is helping increase customer loyalty. In a further encouraging finding for HBO, 35% of users say they’re Very Satisfied with the HBO GO service and another 42% say they’re Somewhat Satisfied.

* Don’t Know/NA = 14% The survey also looked at the traditional TV service providers in terms of customer satisfaction, intention to switch providers, and future demand. Customer Satisfaction The Fiber-Optic service providers continue to lead the industry in customer satisfaction – with 33% of their TV customers saying they’re Very Satisfied.

This compares to 27% for Satellite companies and just 12% for Cable companies. We note that the satisfaction ratings for all three types have trended downward since ChangeWave’s previous survey in June. This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 2 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Looking at the individual providers, Verizon FiOS (40% Very Satisfied; down 5-pts) remains the industry leader, followed by DIRECTV (32%; down 2-pts), Bright House (27%; down 1-pt) and AT&T U-verse (25%; down 6-pts).

Similarly, nearly every provider has seen a decline since the previous survey, likely related to the growing sense of discontent among consumers generally as the economy has weakened. Customer Loyalty towards Traditional Providers We asked respondents if they plan on switching TV providers in the next six months, and found 9% saying they plan to make a change – 1-pt lower than in our June survey. In line with previous ChangeWave findings, Fiber-Optic providers have the lowest churn rate – with just 7% of their customers saying they’ll switch. This compares to 10% for Cable and 11% for Satellite.

At the provider level, Verizon FiOS maintains its number one standing, with only 5% of their customers saying they plan on switching in the next six months. That’s 2-pts better than previously.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 3 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

We note that Cox (6%) and DISH Network (9%) have each improved 4-pts over their weaker ratings of the previous survey. Reasons for Switching – Price, Price, Price. Price (64%) remains the overwhelming reason respondents plan to switch providers in the next six months – up 6-pts since June and matching an all-time high.

In another sign of how price sensitive consumers are at the present moment, three-in-four planned switchers (76%) say if their provider reduced the cost of a subscription they could keep them as a customer.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 4 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Top Problems as Reported By Customers. Two issues stand out as the biggest problems respondents are experiencing with their service providers: Too Many Unwanted Channels (27%) Outages/Service Issues (10%) Importantly, major differences exist among the various providers, as can be seen from the following charts: Too Many Unwanted Channels Outages/Service Issues

Similar to previously, when it comes to Having Too Many Unwanted Channels, Cablevision ranks best (22%) while DISH Network ranks worst (37%).

Regarding Outages and Service Issues, Verizon FiOS leads the industry with only 1% of their customers reporting it as a problem, while Charter ranks worst with 19%. Future Demand Trends among Traditional Providers In terms of the next six months, Verizon FiOS (19%; down 1-pt) and DIRECTV (17%; down 3-pts) remain the top two choices among respondents planning to switch – however both are down slightly from the previous survey.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 5 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

AT&T U-verse (13%; up 1-pt) has moved to third place, while DISH Network (10%; down 3- pts) has fallen to fourth. The Cable companies, led by Comcast, bring up the rear in terms of likelihood of gaining switchers.

Bottom Line: Traditional TV service providers are searching for value added options to counteract the growing interest in alternative TV. In this regard, the survey results show mobile apps do help boost customer loyalty. But while many providers now offer these apps, they vary in quality. Some only let you schedule recordings, act as a remote control, or create ‘favorite’ lists, while others actually let you watch live TV and view on-demand movies and TV shows. In our next TV Trends survey, we’ll look at which app features are ranked highest and lowest by consumers, and whether mobile apps and other value-added offerings are enough to keep potential cord cutters from dropping out of the traditional TV market altogether. Summary of Key Findings Mobile Apps Boost TV Provider Customer Customer Loyalty Customer Loyalty for Satisfaction Ratings Ratings Service Providers 33% of Fiber-Optic Only 5% of Verizon FiOS 5% currently use an app customers say they’re Very customers say they’ll switch offered by their traditional TV Satisfied with their TV Cox (6%) service provider service Time Warner (8%) Among this group, one-in- 27% of Satellite customers DISH Network (9%) three (33%) say it makes are Very Satisfied AT&T U-verse (10%) them more loyal to their TV 12% of Cable customers are Bright House (10%) provider Very Satisfied DIRECTV (11%) Impact of HBO GO Service Satisfaction by Provider Comcast (11%) Among respondents using Verizon FiOS (40% Very Cablevision (11%) HBO GO service, 40% say it Satisfied) Charter (13%) makes them Less Likely to DIRECTV (32%) cancel their paid TV Bright House (27%) Price is Key Reason for subscription AT&T U-verse (25%) Consumers Switching HBO GO Customer DISH Network (23%) Price (64%; up 6-pts) Satisfaction Rates: Cox (18%) remains the top reason customers plan to switch --35% Very Satisfied Comcast (12%) --42% Somewhat Satisfied Time Warner (10%) Future Demand Trends: --6% Somewhat Unsatisfied Cablevision (9%) Preferences of Switchers --3% Very Unsatisfied Charter (3%) Verizon FiOS (19%) --14% Don’t Know/NA DIRECTV (17%) AT&T U-verse (13%) DISH Network (10%) Comcast (6%)

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 6 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Table of Contents

Summary of Key Findings...... 6

The Findings...... 8

Consumer Use of TV Apps...... 8

Customer Satisfaction: Traditional Home TV Providers...... 10

Customer Loyalty...... 12

Future Demand Trends...... 17

Other Industry Trends...... 19

ChangeWave Research Methodology...... 20

About ChangeWave Research...... 20

About The 451 Group...... 20

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 7 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

The Findings

Introduction: A recent ChangeWave survey on Alternative TV Trends showed traditional service providers face an emerging threat from a growing list of companies including Amazon, Google, Netflix and Apple. In response, traditional TV providers are offering new services to their subscribers – including mobile apps that enable them to view and manage video on their smart phones and tablet devices. Using such Apps, subscribers can now watch live and On-Demand content via their smart phone/tablet, manage DVRs, and perform TV remote functions among other things. During September, ChangeWave surveyed 2,520 U.S. and Canadian respondents on their traditional TV providers, including customer satisfaction and future demand trends. The survey also looked at the use of TV apps and their impact on customer retention and loyalty. Consumer Use of TV Apps To measure current usage of mobile apps among consumers, we asked respondents if their TV provider had offered them apps, and found 5% saying they now use this service. Several TV service providers now offer apps for viewing/managing video through mobile devices - including smart phones and tablets. These apps enable you to watch On-Demand content, manage your DVR, and can even act as a remote control for your TV, among other things. Does your TV service provider offer an app that enables you to watch/manage video through mobile devices?

Current Previous Survey Survey Sep ’11 Jun ‘11 Yes, and I Currently Use the App 5% 5% Yes, But I Don’t Use the App 24% 25% No, My TV Service Provider Doesn’t Offer This Type of App 14% 15% Don’t Know 55% 52% We then asked this group the following question: Has the availability of a mobile app from your TV service provider helped make you more loyal to your current TV provider, less loyal, or has it had no effect?

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 8 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Current Survey Sep ‘11 More Loyal 33% Less Loyal 2% No Effect 62% By a 16-to-1 margin, respondents who use their TV providers’ app say it has helped make them More Loyal to their current provider – a signal that this type of service is adding real value to their subscription.

HBO Go. Another app that is only available to traditional TV subscribers is HBO Go – a service that enables HBO subscribers to watch any HBO content on their iPad, iPhone or Android smart phone.

We asked respondents currently using the HBO Go service if it is having any impact on their likelihood of canceling their paid TV subscription.

Does the HBO Go service make you less likely to cancel your paid TV Service, more likely, or does it have no effect on your likelihood of canceling?

Current Survey Sep ‘11 Makes Me Significantly Less Likely to 8% Cancel Makes Me Somewhat Less Likely to Cancel 32% No Effect on My Likelihood of Canceling 51% Makes me More Likely to Cancel 0% Don’t Know / NA 4% Two-in-five (40%) said it has made them Less Likely to cancel (8% Significantly Less; 32% Somewhat Less) – another sign that this type of app service is helping increase customer loyalty.

In a further encouraging finding for HBO, 35% of users say they’re Very Satisfied with the HBO Go service and another 42% say they’re Somewhat Satisfied. For those who currently use the HBO Go service, how satisfied are you?

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 9 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

* Don’t Know/NA = 14% The survey also looked at the traditional TV service providers in terms of customer satisfaction, intention to switch providers, and future demand.

Customer Satisfaction: Traditional Home TV Providers The Fiber-Optic service providers continue to lead the industry in customer satisfaction – with 33% of their TV customers saying they’re Very Satisfied.

This compares to 27% for Satellite companies and just 12% for Cable companies. We note that the satisfaction ratings for all three types have trended downward since ChangeWave’s previous survey in June.

Here’s a closer look at satisfaction ratings by type of provider: How satisfied are you with your current TV programming service provider?

Fiber-Optic Service Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Very Satisfied 33% 38% 36% 43% 40% Somewhat Satisfied 52% 50% 51% 47% 46%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 10 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Somewhat Unsatisfied 12% 8% 10% 8% 11% Very Unsatisfied 3% 3% 1% 1% 2% Don't Know/No Answer 0% 2% 1% 2% 1%

Satellite Service Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Very Satisfied 27% 29% 26% 28% 26% Somewhat Satisfied 51% 51% 54% 56% 56% Somewhat Unsatisfied 16% 16% 15% 13% 15% Very Unsatisfied 5% 3% 4% 2% 2% Don't Know/No Answer 1% 1% 1% 1% 1%

Cable Service Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Very Satisfied 12% 16% 14% 14% 12% Somewhat Satisfied 58% 56% 55% 57% 55% Somewhat Unsatisfied 22% 21% 23% 21% 24% Very Unsatisfied 6% 6% 7% 7% 7% Don't Know/No Answer 2% 1% 1% 1% 1%

Looking at the individual providers, Verizon FiOS (40% Very Satisfied; down 5-pts) remains the industry leader, followed by DIRECTV (32%; down 2-pts), Bright House (27%; down 1-pt) and AT&T U-verse (25%; down 6-pts).

Customer Satisfaction Rating by Individual Provider – Very Satisfied Rating

Similarly, nearly every provider has seen a decline since the previous survey, likely related to the growing sense of discontent among consumers generally as the economy has weakened.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 11 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Satisfaction Rating by Individual Provider – Very Satisfied Rating Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Verizon FiOS 40% 45% 41% 48% 47% DIRECTV 32% 34% 29% 37% 30% Bright House 27% 28% 30% 30% 31% AT&T U-Verse 25% 31% 28% 36% 31% DISH Network 23% 23% 24% 16% 22% Cox 18% 17% 20% 16% 19% Comcast 12% 15% 12% 14% 11% Time Warner 10% 12% 12% 13% 11% Cablevision 9% 13% 6% 6% 12% Charter 3% 9% 7% 7% 6% Customer Loyalty towards Traditional Providers We asked respondents if they plan on switching TV providers in the next six months, and found 9% saying they plan to make a change – 1-pt lower than in our June survey. Do you plan on switching cable, satellite or fiber-optic TV service providers in the next six months? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Yes 9% 10% 10% 8% 10% No 72% 74% 72% 73% 72% Don’t Know 18% 16% 18% 19% 18% In line with previous ChangeWave findings, Fiber-Optic providers have the lowest churn rate – with just 7% of their customers saying they’ll switch. This compares to 10% for Cable and 11% for Satellite.

At the provider level, Verizon FiOS maintains its number one standing, with only 5% of their customers saying they plan on switching in the next six months. That’s 2-pts better than previously. This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 12 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

We note that Cox (6%) and DISH Network (9%) have each improved 4-pts over their weaker ratings of the previous survey.

A Closer Look at Switchers by Individual Provider: Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Verizon FiOS 5% 7% 6% 4% 7% Cox 6% 10% 8% 8% 11% Time Warner 8% 9% 9% 7% 13% DISH Network 9% 13% 11% 16% 12% AT&T U-Verse 10% 10% 9% 8% 6% Bright House 10% 9% 12% 8% 9% DIRECTV 11% 10% 9% 7% 9% Comcast 11% 12% 14% 11% 13% Cablevision 11% 9% 14% 9% 6% Charter 13% 14% 11% 9% 12%

Reasons for Switching – Price, Price, Price. Price (64%) remains the overwhelming reason respondents plan to switch providers in the next six months – up 6-pts since June and matching an all-time high.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 13 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

If yes, what is the primary reason behind your plans to switch TV service providers? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Price 64% 58% 64% 51% 63% New Service Features 2% 3% 6% 8% 4% Prospect of Better Customer Service 5% 7% 4% 6% 4% Bundling of Services 6% 7% 5% 11% 7% Technical Problems 2% 5% 2% 6% 4% Moving/Relocating 5% 4% 4% 3% 3% Fiber-Optic Service Now Available 6% 8% 9% 9% 9% In another sign of how price sensitive consumers are at the present moment, three-in-four planned switchers (76%) say if their provider reduced the cost of a subscription they could keep them as a customer. Is there anything your current cable, satellite or fiber-optic TV service provider could do to keep you as a customer? (Choose No More Than Two)

Another 18% say A-La-Carte Programming Options and 11% Benefits/Rewards for Long- Term Customers could also help to prevent them from switching. This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 14 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Current Previous Previous Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Reduce Price 76% 74% 75% A-La-Carte Programming Options 18% 18% 21% Benefits/Rewards for Long-Term Customers 11% 8% 7% More Reliable TV Service 10% 7% 5% Better Quality Programming 9% 13% 11% Cheaper/Free Set Top Boxes 7% 3% 7% Cheaper/Free DVR Service 4% 6% 8% Bundling of Services (e.g., Internet, Phone) 3% 2% 2% Improved Customer Service 3% 6% 7% Increased Capabilities of DVRs 2% 1% 2% Online Movie Rentals 0% 1% 0% Nothing Can Keep Me as a Customer 6% 6% 6% Other 5% 6% 3%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 15 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Top Problems as Reported By Customers. Two issues stand out as the biggest problems respondents are experiencing with their service providers: Too Many Unwanted Channels (27%) Outages/Service Issues (10%)

What is the biggest problem you currently experience with your TV Service Provider? Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Too Many Unwanted Channels 27% 25% 26% 23% 24% Outages/Service Issues 10% 9% 9% 11% 11% Lack of Good Programming/Channels 8% 8% 8% 8% 8% Don’t Like Menu Structure 6% 5% 5% 5% 5% Too Slow When Changing Channels 5% 6% 5% 7% 5% DVR Issues 3% 3% 4% 4% 3% Not Enough HD Content 2% 3% 4% 3% 4% Poor Picture Quality 1% 1% 2% 2% 1% Lack of Internet Applications 1% 1% 1% 1% 1% Not Enough On Demand/ Pay Per View Content 1% 1% 2% 2% 1% Channel Blackouts (due to licensing disputes) 1% 1% 1% NA NA Do Not Experience Problems 19% 20% 19% 20% 19% Other 11% 9% 10% 10% 12% Importantly, major differences exist among the various providers, as can be seen from the following charts: Too Many Unwanted Channels Outages/Service Issues

Similar to previously, when it comes to Having Too Many Unwanted Channels, Cablevision ranks best (22%) while DISH Network ranks worst (37%). Regarding Outages and Service Issues, Verizon FiOS leads the industry with only 1% of their customers reporting it as a problem, while Charter ranks worst with 19%.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 16 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Here’s a look at the complete results by individual provider:

Cable Time DISH Bright Charte DIRECT Verizo AT&T Total - Comcast Cox Warne Networ House r V n FiOS U-Verse vision r k Too Many 27% 28% 22% 23% 26% 33% 26% 26% 37% 25% 23% Unwanted Channels Outages/Service 10% 13% 13% 19% 11% 9% 9% 10% 13% 1% 14% Issues Lack of Good 8% 3% 11% 11% 9% 7% 6% 6% 9% 7% 4% Programming/ Channels Don’t Like Menu 6% 5% 8% 10% 6% 6% 6% 6% 3% 7% 3% Structure Too Slow When 5% 5% 7% 8% 4% 4% 8% 10% 1% 6% 5% Changing Channels DVR Issues 3% 8% 4% 0% 4% 4% 4% 4% 2% 6% 6% Not Enough HD 2% 3% 0% 10% 2% 3% 3% 1% 2% 2% 2% Content Poor Picture Quality 1% 3% 3% 1% 1% 0% 2% 1% 1% 0% 0% Lack of Internet 1% 0% 0% 0% 1% 1% 0% 1% 1% 0% 1% Applications Not Enough On 1% 0% 0% 0% 1% 0% 1% 1% 0% 2% 2% Demand/ Pay Per View Content Channel Blackouts 1% 0% 1% 1% 1% 1% 2% 1% 1% 0% 3% (due to licensing disputes) Do Not Experience 19% 26% 24% 10% 16% 15% 20% 20% 23% 31% 24% Problems Other 11% 3% 7% 8% 15% 14% 11% 12% 6% 9% 11% No Answer 5% 5% 1% 0% 4% 3% 3% 2% 1% 2% 3%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 17 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Future Demand Trends among Traditional Providers In terms of the next six months, Verizon FiOS (19%; down 1-pt) and DIRECTV (17%; down 3-pts) remain the top two choices among respondents planning to switch – however both are down slightly from the previous survey.

AT&T U-verse (13%; up 1-pt) has moved to third place, while DISH Network (10%; down 3- pts) has fallen to fourth. The Cable companies, led by Comcast, bring up the rear in terms of likelihood of gaining switchers.

What TV programming service provider are you most likely to switch to?

Fiber-Optic Service Providers Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Verizon FiOS TV 19% 20% 25% 18% 21% AT&T U-verse TV 13% 12% 13% 17% 20% Satellite Service Providers Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 DIRECTV 17% 20% 22% 20% 15% DISH Network 10% 13% 9% 11% 12% Bell Canada/ExpressVu 2% 1% 1% 2% 1%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 18 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Cable Service Providers Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Comcast 6% 6% 6% 5% 6% Time Warner (Road Runner) 3% 1% 2% 3% 1% Cox 2% 0% 1% 1% 2% Bright House Networks 1% 0% 0% 1% 1% Cablevision 1% 1% 1% 0% 1% Shaw 1% 0% 1% 0% 1% WOW! (Wide Open West) 1% 0% 1% 1% 0% Charter 0% 1% 0% 1% 0% Mediacom 0% 0% 0% 0% 0% Rogers 0% 0% 0% 0% 0% Don’t Know / Other Current Previous Previous Previous Previous Survey Survey Survey Survey Survey Sep ‘11 Jun ‘11 Mar ‘11 Dec ‘10 Sep ‘10 Don’t Know 10% 7% 8% 8% 6% Other 13% 16 % 10% 12% 13%

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 19 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

Other Industry Trends

The FOX Network recently halted “next-day streaming” of its content on FOX.com and Hulu except for paid subscribers to Dish TV and Hulu Plus. Everyone else must now wait 8-days from the air date in order to view FOX content for free. How important is the availability of free “next-day streaming” to you?

* Don’t Know/NA = 14%

Importance of “Next-Day Streaming.” We also asked all respondents about the importance of free “next-day streaming” content:

While 6% of respondents say free “next day streaming” content is Very Important to them and 13% Somewhat Important, that is far outweighed by the 22% who say it’s Not Very Important and 45% who say it’s Not Important at all.

Some consumers who use their TV providers' mobile app to watch TV programming on tablets or smart phones report they're watching less TV on their home television. Others report they're watching more TV on their home television. Which of the following best describes the impact of your TV providers' mobile app on your home television watching habits?

Current Survey Sep ‘11 Because of my TV provider's mobile app, I now 8% watch less TV on my home television Because of my TV provider's mobile app, I now 2% watch more TV on my home television I continue to watch the same amount of TV on my 88% home television as previously Other 2% A total of 8% of respondents using their TV providers’ app say it is causing them to watch Less TV at Home. While not a huge number, it shows that the growing availability of mobile video content is having an impact on home TV viewership.

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 20 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Home TV Service Providers and Market Trends

ChangeWave Research Methodology

This report presents the findings of a September 6-16, 2011 survey on trends in the home TV service providers market. A total of 2,520 U.S. and Canadian respondents participated.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

The Research Network is assembled from senior technology and business executives in leading companies of select industries. More than half of members (53%) have advanced degrees (e.g., Master's or Ph.D.) and 91% have at least a four-year bachelor's degree.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research ChangeWave Research, an independent division of The 451 Group, is a survey research firm that identifies and quantifies change in corporate buying & business trends, telecom trends, and consumer spending & electronics trends. The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com. ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report. About The 451 Group The 451 Group is a leading technology-industry analyst company focused on the business of enterprise IT innovation. The company's analysts provide critical and timely insight into the market and competitive dynamics of innovation in emerging technology segments. The 451 Group is headquartered in New York, with offices in key locations, including San Francisco, Washington, DC, London, Boston, Seattle and Denver. For additional information on The 451 Group, go to: www.the451group.com. For More Information: ChangeWave Research Telephone: 301-250-2363 7101 Wisconsin Ave. Fax: 240-200-3988 Suite 1350 www.ChangeWaveResearch.com Bethesda, MD 20814 [email protected]

This information is from ChangeWave Research, LLC, a division of The 451 Group, and contains confidential business information. 21 It may not be copied or distributed without permission. ©2011 ChangeWave Research, LLC. All rights reserved.