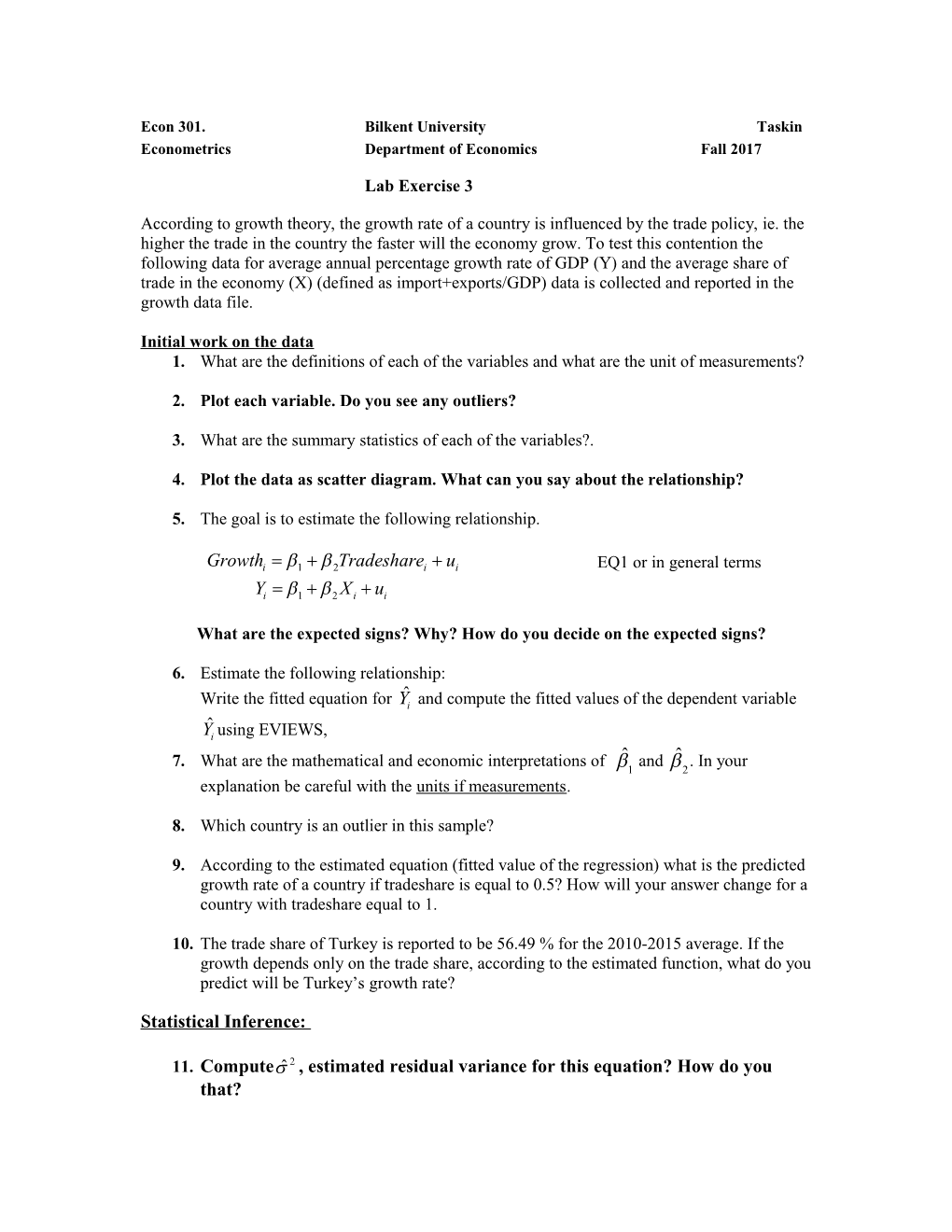

Econ 301. Bilkent University Taskin Econometrics Department of Economics Fall 2017

Lab Exercise 3

According to growth theory, the growth rate of a country is influenced by the trade policy, ie. the higher the trade in the country the faster will the economy grow. To test this contention the following data for average annual percentage growth rate of GDP (Y) and the average share of trade in the economy (X) (defined as import+exports/GDP) data is collected and reported in the growth data file.

Initial work on the data 1. What are the definitions of each of the variables and what are the unit of measurements?

2. Plot each variable. Do you see any outliers?

3. What are the summary statistics of each of the variables?.

4. Plot the data as scatter diagram. What can you say about the relationship?

5. The goal is to estimate the following relationship.

Growthi 1 2Tradesharei ui EQ1 or in general terms

Yi=b1 + b 2 X i + u i

What are the expected signs? Why? How do you decide on the expected signs?

6. Estimate the following relationship: ˆ Write the fitted equation for Yi and compute the fitted values of the dependent variable ˆ Yi using EVIEWS, 7. What are the mathematical and economic interpretations of ˆ and ˆ . In your b1 b2 explanation be careful with the units if measurements.

8. Which country is an outlier in this sample?

9. According to the estimated equation (fitted value of the regression) what is the predicted growth rate of a country if tradeshare is equal to 0.5? How will your answer change for a country with tradeshare equal to 1.

10. The trade share of Turkey is reported to be 56.49 % for the 2010-2015 average. If the growth depends only on the trade share, according to the estimated function, what do you predict will be Turkey’s growth rate?

Statistical Inference:

11. Computesˆ 2 , estimated residual variance for this equation? How do you that? ˆ 12. What is the estimated value of Vaˆr( 2 ) ?

13. Construct a 95% confidence interval for b2 .

14. Test the null hypothesis that b2 =0. What happens to the model if this is true?

15. What is the value of Sum of Squared Residuals? If you omit 10 observations what will happen to the Sum of Squared Residuals?

16. What is the R2? How will you interpret this value? If you drop 10 observations will this statistics change?

17. Re-estimate the equation excluding the outlier country Malta from the sample.

How does the estimate of b2 change? Compare two estimates of your answer to question of ‘how much?’ Theoretically which approach will give more reliable results?