Orbital Gateway Scripts

** Any sections or transactions within sections that are not supported should be noted as not applicable (n/a)

** If you do not support any of the requested elements such as AVS, CVD or purchase Level 2, run the transaction without those elements. Please note: Both AVS and CVD are highly recommended. If your business typically processes purchase cards you may want to consider adding the purchase card level 2 data. Please see the credit card 101 document for more information about AVS, CVD and purchase card if needed. This document can be found on the download page at www.paymentech.net/download .

** Please email the completed script to your certification analyst. Use Test cards numbers provided in the test document.

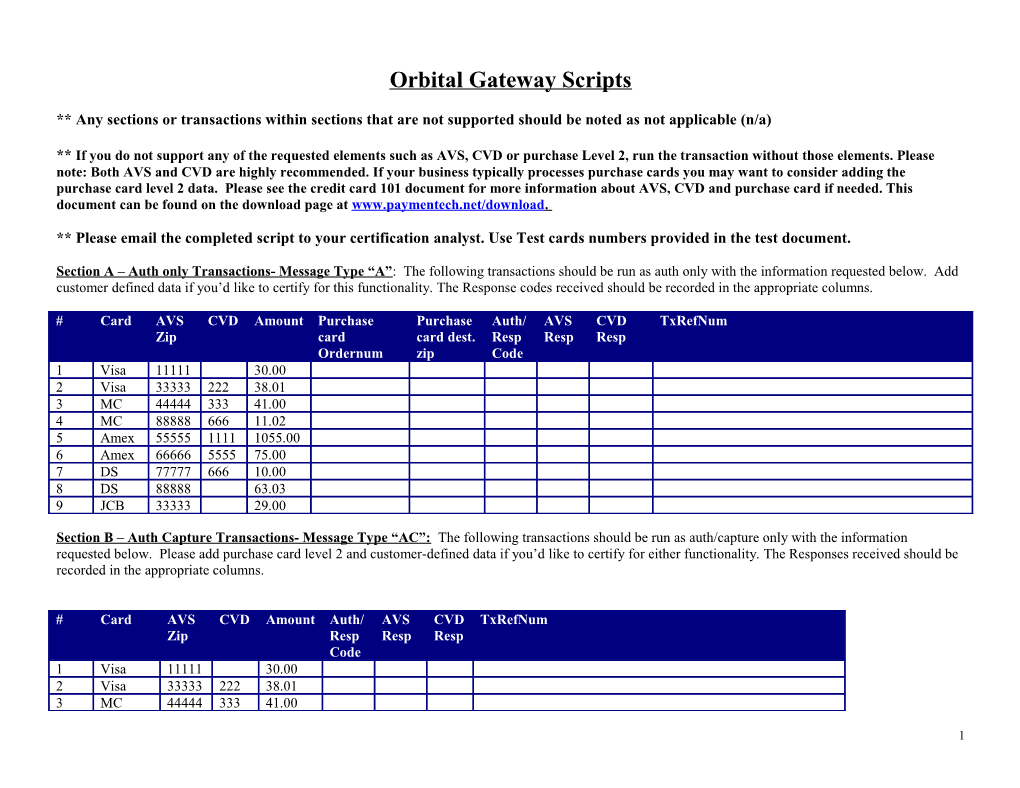

Section A – Auth only Transactions- Message Type “A”: The following transactions should be run as auth only with the information requested below. Add customer defined data if you’d like to certify for this functionality. The Response codes received should be recorded in the appropriate columns.

# Card AVS CVD Amount Purchase Purchase Auth/ AVS CVD TxRefNum Zip card card dest. Resp Resp Resp Ordernum zip Code 1 Visa 11111 30.00 2 Visa 33333 222 38.01 3 MC 44444 333 41.00 4 MC 88888 666 11.02 5 Amex 55555 1111 1055.00 6 Amex 66666 5555 75.00 7 DS 77777 666 10.00 8 DS 88888 63.03 9 JCB 33333 29.00

Section B – Auth Capture Transactions- Message Type “AC”: The following transactions should be run as auth/capture only with the information requested below. Please add purchase card level 2 and customer-defined data if you’d like to certify for either functionality. The Responses received should be recorded in the appropriate columns.

# Card AVS CVD Amount Auth/ AVS CVD TxRefNum Zip Resp Resp Resp Code 1 Visa 11111 30.00 2 Visa 33333 222 38.01 3 MC 44444 333 41.00

1 4 MC 88888 666 11.02 5 Amex 55555 4444 1055.00 6 Amex 66666 5555 75.00 7 DS 77777 666 10.00 8 DS 88888 63.03 9 JCB 33333 29.00

Section C – Mark For Capture: The following transactions will mark the previous auth only transactions for capture. The number corresponds to the number of the authorization previously completed in Section A. If you will be capturing the full amount use the amount listed under the “Amount” column. If you will be splitting shipments, the please follow the amount given under the “split shipment amount” column. This is the amount you will capture.

# Card Amount Split Auth/Resp TxRefNum Shipment Code amount A-1 Visa 30.00 10.00 A-3 MC 41.00 20.00 A-5 Amex 1055.00 500.00 A-7 DS 10.00 10.00 A-9 JCB 29.00 29.00

Section D – Return Transactions: The following transactions should be completed as returns, with all standard transaction data.

# Card Amount Auth/Resp TxRefNum Code 1 Visa 12.00 2 MC 11.00 3 Amex 1055.00 4 DS 10.00 5 JCB 29.00

Section E – Force: The following transactions should be completed as prior sales, with all standard transaction data, and additional information as requested. Use approval codes as listed in the table below.

# Card Amount Auth TxRefNum 2 Code 1 Visa 12.00 654544 2 MC 11.00 158945 3 Amex 1055.00 198543 4 DS 10.00 098756 5 JCB 29.00 098757

Section F – Voids: The following transactions are void of previously completed transactions. If you will only processing full voids then follow the amount given in the “Amount” column. If you will be splitting shipments please follow the amounts listed in the split shipment amount column as you did in section C, this is to void the leftover amount.

# Amount Split ship amount to TxRefNum be voided A-1 30.00 20.00 A-5 1055.00 500.00 B-9 29.00 29.00

Section G – Stored Value Transactions: The following transactions should be run as indicated, with all standard transaction data, and additional information as requested. The response code received should be recorded in the appropriate column.

# Card Tran Description CVD Amount Response/Auth TxRefNum Value Code 1 Stored Value Issuance/Add Value 16.00 2 Stored Value Issuance/Add Value 30.00 3 Stored Value Activation 25.00 4 Stored Value Activation 50.00 5 Stored Value Block Activation of 5 cards ($30 EACH) 150.00 6 Stored Value Redemption 98.00 7 Stored Value Redemption 40.00 8 Stored Value Redemption 56.00 9 Stored Value Void # 2 30.00 10 Stored Value Balance Inquiry 11 Stored Value Void # 8 56.00 12 Stored Value Issuance/Add Value 16.00 13 Stored Value Deactivation 0.00 14 Stored Value Deactivation 0.00 3 15 Stored Value Reactivation 35.00 16 Stored Value Reactivation 25.00 17 Stored Value Block Activation of 10 cards ($25 each) 250.00 18 Stored Value Block Activation of 150 cards ($10 each) 1500.00 19 Stored Value Block Activation of 200 cards ($10 each) 2000.00

Section H –Prior Stored Value Transactions: Your certification analysts will give you auth codes for the prior transactions via phone or email. Provide us the card numbers that you want to use and we will then give you the auth code to use during certification.

# Card Tran Description Amount Card# Response/Auth TxRefNum Code 20 Stored Value Prior Issuance/Add Value 29.00 Card Card Card 21 Stored Value Prior Issuance/Add Value 3.00 Card Card Card 22 Stored Value Prior Issuance/Add Value 31.00 Card Card Card 23 Stored Value Prior Activation 56.00 Card Card Card 24 Stored Value Prior Activation 50.00 Card Card Card 25 Stored Value Prior Redemption 56.00 Card Card Card 26 Stored Value Prior Redemption 42.00 Card Card Card 27 Stored Value Prior Redemption 49.00 Card Card Card

Section I – Interface Version- This MIME-Header field is used by the Client to identify information about their implementation to assist Paymentech in providing production support. This information will be logged distinctly for research purposes. For example, if our SDK’s are used, they pass the SDK type and Version Number in this field. Another example would be any Third Party Software Provider should log their Software name and version number in this field, such that Paymentech knows how the interface is being managed. A Merchant could place information about their development version and implementation language. Please work with your Certification Analyst to best identify what values should be used in this field. This field will be checked on the transactions sent. Give us the information below so that we can verify what you are populating in this field. Skip the fields that do not apply. Which DTD your Software Software Programming Language used using. name Version

Section J – End of Day Settlement: Please tell us how you plan on settling your transactions at the end of the day

Manually through the Virtual Terminal ______Auto settle ______What time of the day would you like your auto settle set up for? ______What time zone are you in? End of Day XML message______4 5 Section K – Retry Logic: When processing transactions over the internet, there is a risk that a response to a request will not be received. To address this problem and avoid duplicate authorizations, we offer additional functionality, Retry Logic. Retry logic is HIGHLY recommended. For more information please consult the Orbital Gateway Specifications and the retry specification on the download page. Please follow the scripts below to certify for retry logic.

First Set – Transactions sent for the first time.

# Card OrderID Trace number TxRefNum Auth Response code 1 Visa 2 MC 3 Visa 4 Amex 5 DS

Second Set- Retry using the same OrderID and Trace Number.

# Card OrderID Trace number TxRefNum Auth Response code 1 Visa 2 MC 3 Visa 4 Amex 5 DS

Third Set- One transaction that was resent but using a different trace number.

# Card OrderID Trace number TxRefNum Auth Response code 1 Visa

6 Section L- Customer Profiles: Customer Profiles provides the ability for you store information about your customer on the Orbital Gateway. This simplifies transaction processing and eliminates the risk associated with the merchant storing sensitive information. Please see the specifications to learn more about Customer profiles. To certify for customer profiles, complete the scripts below.

Add- Perform an add profile transaction using information below.

# Func Card Details Customer Profile Number TxRefNum -tion 1 Add Visa Populate- Name, Address, City, State, Zip code and email. 2 Add MC Populate- Name and zip code

Update the customer profiles you created above. Use the corresponding numbers to update.

# Func- Card Details Customer Profile Number TxRefNum tion 1 Update Amex Change card to American Express 2 Update MC Add address and phone to profile

Retrieve- Retrieve the first customer profile created.

# Func- Card Customer Profile Number TxRefNum tion 1 Retrieve Visa

Authorize using the customer profile from the corresponding number.

# Func- Card Amount Details Customer Profile Number TxRefNum tion 1 Auth Amex 25.00 Override address and zip with new. 2 Auth MC 30.00

7 Auth Capture- perform an auth capture utilizing the previously created profile.

# Func- Card Amount Details Customer Profile Number TxRefNum tion 1 AC Amex 45.00 2 AC MC 50.00 Override zip code

Refund- Perform a refund transaction utilizing the previously created profile.

# Func Card Amount Customer Profile Number TxRefNum -tion 1 Auth Amex 10.00 2 Auth MC 15.00

Add Profile during authorization – Create a new profile during an authorization.

# Function Card Amount Details Customer Profile Number TxRefNum 1 Auth/add Amex 65.00 Populate address, zip and phone profile number. 2 Auth/add MC 70.00 Populate zip and phone number. profile

Add Profile during auth/capture– Create a new profile during an auth capture.

# Function Card Amount Details Customer Profile Number TxRefNum 1 AC/add Amex 30.00 Populate address, zip and phone profile number. 2 AC/add MC 50.00 Populate address and zip. profile

8 Delete Profile - Delete the Profiles created in the auth or auth capture above.

# Function Card Customer Profile Number TxRefNum 1 Delete Amex Profile 2 Delete MC Profile

Error Processing- Please follow the instructions for the two transactions below. This is to ensure that you can handle error messages.

# Function Card Details Response TxRefNum 1 Auth/capture or Visa Use customer profile – auth only 45461SAAX 2 Add profile MC Add profile but do not include customer name.

9