Answers to Analytical Questions Chapter 1 What is Macroeconomics?

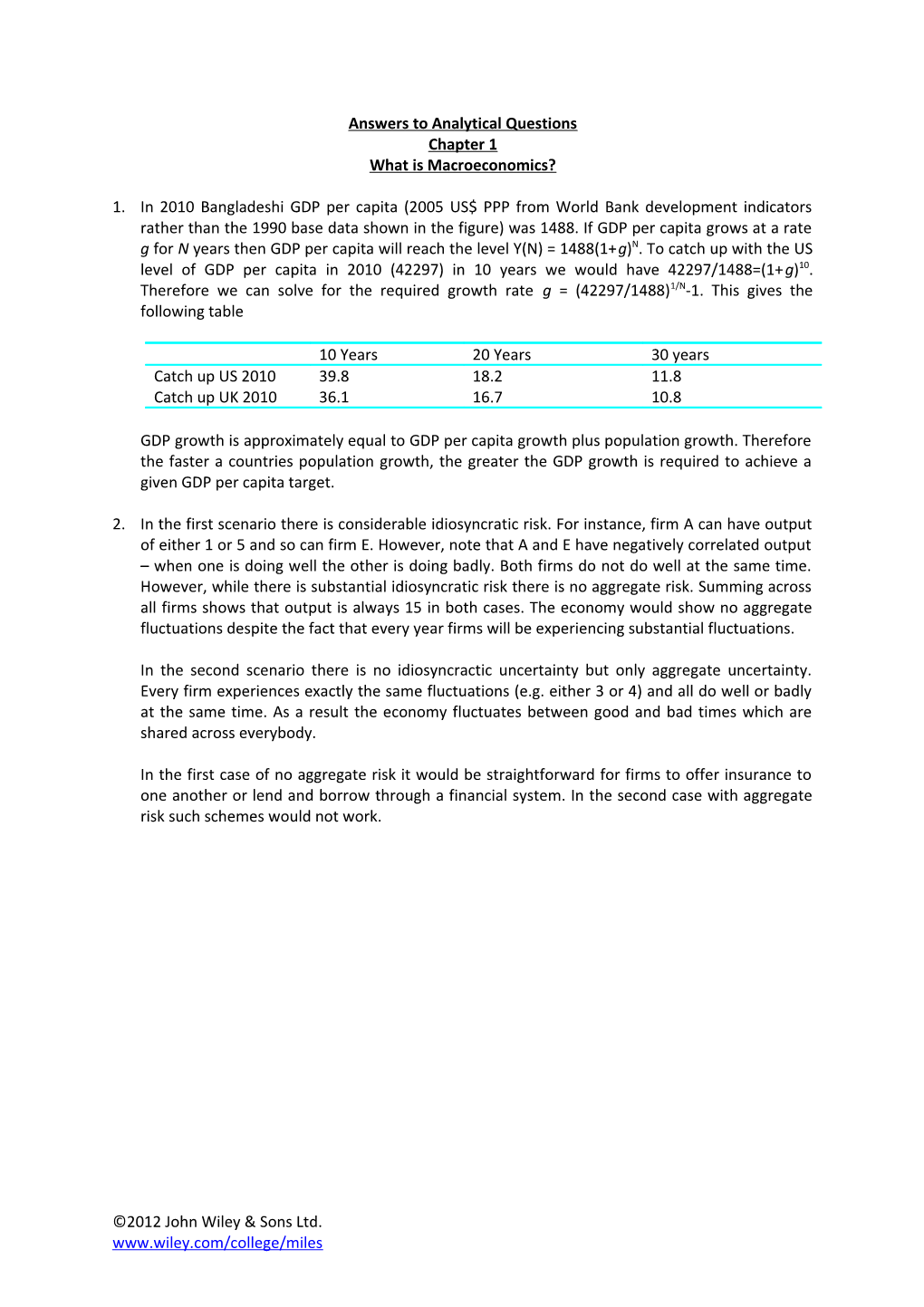

1. In 2010 Bangladeshi GDP per capita (2005 US$ PPP from World Bank development indicators rather than the 1990 base data shown in the figure) was 1488. If GDP per capita grows at a rate g for N years then GDP per capita will reach the level Y(N) = 1488(1+g)N. To catch up with the US level of GDP per capita in 2010 (42297) in 10 years we would have 42297/1488=(1+g)10. Therefore we can solve for the required growth rate g = (42297/1488)1/N-1. This gives the following table

10 Years 20 Years 30 years Catch up US 2010 39.8 18.2 11.8 Catch up UK 2010 36.1 16.7 10.8

GDP growth is approximately equal to GDP per capita growth plus population growth. Therefore the faster a countries population growth, the greater the GDP growth is required to achieve a given GDP per capita target.

2. In the first scenario there is considerable idiosyncratic risk. For instance, firm A can have output of either 1 or 5 and so can firm E. However, note that A and E have negatively correlated output – when one is doing well the other is doing badly. Both firms do not do well at the same time. However, while there is substantial idiosyncratic risk there is no aggregate risk. Summing across all firms shows that output is always 15 in both cases. The economy would show no aggregate fluctuations despite the fact that every year firms will be experiencing substantial fluctuations.

In the second scenario there is no idiosyncractic uncertainty but only aggregate uncertainty. Every firm experiences exactly the same fluctuations (e.g. either 3 or 4) and all do well or badly at the same time. As a result the economy fluctuates between good and bad times which are shared across everybody.

In the first case of no aggregate risk it would be straightforward for firms to offer insurance to one another or lend and borrow through a financial system. In the second case with aggregate risk such schemes would not work.

©2012 John Wiley & Sons Ltd. www.wiley.com/college/miles