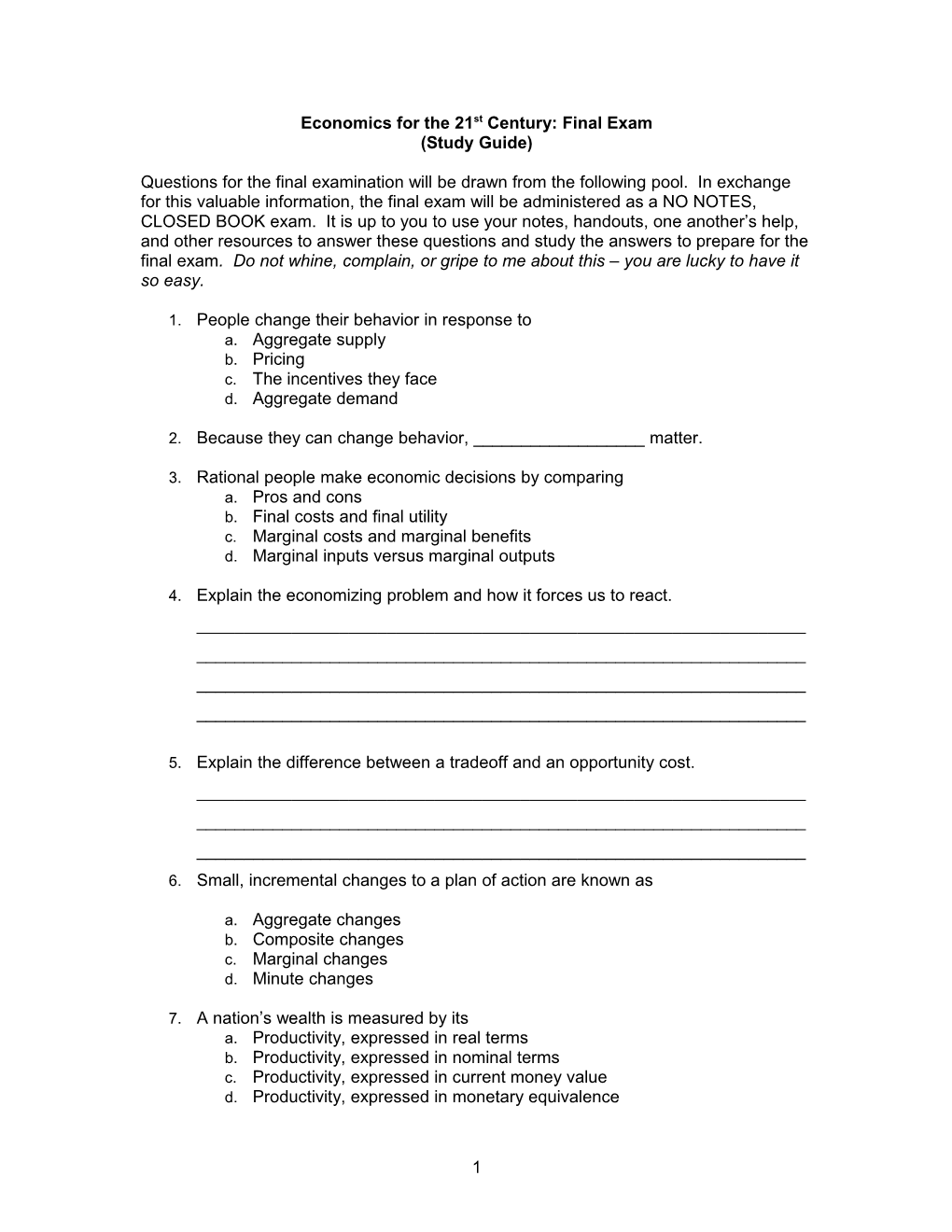

Economics for the 21st Century: Final Exam (Study Guide)

Questions for the final examination will be drawn from the following pool. In exchange for this valuable information, the final exam will be administered as a NO NOTES, CLOSED BOOK exam. It is up to you to use your notes, handouts, one another’s help, and other resources to answer these questions and study the answers to prepare for the final exam. Do not whine, complain, or gripe to me about this – you are lucky to have it so easy.

1. People change their behavior in response to a. Aggregate supply b. Pricing c. The incentives they face d. Aggregate demand

2. Because they can change behavior, ______matter.

3. Rational people make economic decisions by comparing a. Pros and cons b. Final costs and final utility c. Marginal costs and marginal benefits d. Marginal inputs versus marginal outputs

4. Explain the economizing problem and how it forces us to react. ______

5. Explain the difference between a tradeoff and an opportunity cost. ______6. Small, incremental changes to a plan of action are known as

a. Aggregate changes b. Composite changes c. Marginal changes d. Minute changes

7. A nation’s wealth is measured by its a. Productivity, expressed in real terms b. Productivity, expressed in nominal terms c. Productivity, expressed in current money value d. Productivity, expressed in monetary equivalence

1 8. The equation Y = C + I + G + NX is a simple expression of a. GDP-I b. GDP-E c. GNP d. NIF

9. Identify the three groups of goods and services that make up Gross Domestic Product. a. ______b. ______c. ______

10. Define the term Gross Domestic Product (GDP). ______

11. All of the following are basic characteristics of a market economy except a. Equity b. Limited government c. Competition d. Self-interest

1. Rational people make economic decisions by comparing a. Pros and cons b. Final costs and final utility c. Marginal costs and marginal benefits d. Marginal inputs versus marginal outputs

12. When planning economic policy, government considers all of the following policy goals except a. Freedom b. Stability c. Efficiency d. Competition

2. Recently, entrepreneurs in Mexico City have been selling “hits” of oxygen at $1.60 / minute. This would imply that in Mexico City clean air is relatively ______and is a/an ______.

a. Dirty, economic bad b. Rare, luxury good c. Scarce, economic good d. Clean, free good

2 13. Money that is minted from precious metals and/or that can approximate the four functions of money is known as a. Fiat money b. Valued money c. Commodity money d. Tender money

14. Money serves all of the following functions except a. A medium of exchange b. A store of value c. A unit of account d. A price substitute

15. If there is enough of an item to satisfy wants, even if the price of the item is zero, that item is said to be a a. Transaction-neutral commodity b. Free good c. Price-neutral good d. Free commodity

16. How long would it take for you to double $1,000 at an annual rate of 4%?

______

17. The President of the United States desires a tax policy that promotes investment in high-risk businesses while correcting for market inefficiencies by allowing middle-class and low-income families to keep more of their income. If you were the President’s tax advisor, which of the following would you recommend, and why? a. A progressive income tax with substantial tax credits for investment b. A regressive income tax with earned-income credits for people making less than 150% of the poverty level c. A proportional “flat tax” of 5% on all earned income between 150% and 300% of the poverty level and rising to 20% of earned income d. A national sales tax of 5% on all items except food and clothing e. A progressive tax on earned income combined with a 25% capital gains tax on investment income over $200, 000.

I would advise he President to choose option _____ because ______

3 18. John pays 35% income tax on his first $100, 000 of income, 47% on his second $100, 000 of income, and 65% on any amount greater than $200, 000. This is an example of a tax policy that is a. Regressive b. Progressive c. Proportional d. Revenue Neutral

19. The system invented in London, England whereby bankers lent out more money then they had gold and silver to cover it is referred to as a a. Deposit Reserve System b. Fractional Reserve System c. Partial Asset Reserve System d. Deposit Insurance System

20. Name three institutions that satisfy the following definition of economic institutions: “Well-established arrangements and structures that are part of the culture or society. a. ______b. ______c. ______

21. The Fed’s chief body for monetary policymaking is the a. FOMC b. CFRB c. BOG d. FDIC

22. All of the following are basic characteristics of a market economy except a. Equity b. Limited government c. Competition d. Self-interest

3. If unemployment is too high, the fed will likely a. Raise interest rates, thereby increasing the cost of money to retard growth b. Lower interest rates, thereby decreasing the cost of money to increase economic growth c. Raise interest rates in order to increase the return on investments, which will put people back to work d. Lower interest rates in order to decrease the money supply and increase purchasing power

23. Explain what is meant by re-pricing as a principle of taxation. Include an example.______

4 24. When planning economic policy, government considers all of the following policy goals except e. Freedom f. Stability g. Efficiency h. Competition

25. The range of FICO scores runs from: a. 0 – 800 b. 300 – 850 c. 350 – 800 d. 0 - 850

26. Explain the term “universal default”. ______

27. Because the risk of investing in money market funds is so low, would one also expect that returns would be high, or low? Explain.

______

28. If you buy a company’s stock, you a. Own a part of the company b. Have lent money to the company c. Are liable for the company’s debts d. Will earn back your original investment, plus interest

29. Angelo charged $500 in August and made an on-time payment of $450 against the balance. But in September he was charged interest on the full $500.00. This is most likely because his credit card company uses a. Two-cycle average daily balance billing b. One-cycle average daily balance billing c. Multi-cycle finance charge assessment billing

30. Dividing your savings and investments between different categories of investments such as stocks, bonds, real assets, and cash is called a. Diversification b. Asset distribution c. Asset Allocation d. Conservation of wealth

5 31. Since deflation is accompanied by lower demand, we can predict that a. During a deflationary cycle, employment will rise and the amount of income saved will decrease b. During a deflationary period, unemployment will rise and the amount of income saved will increase c. During a deflationary period, unemployment will fall and the amount of income saved will rise d. During a deflationary period, employment will fall, as will the amount of income saved

32. Explain the difference between self-liquidating credit and non-self-liquidating credit, giving an example for each type. ______33. Why is deflation caused by an increase in the supply of goods is “good.” ______

34. Which one of the following monetary actions should the Fed take to fight deflation? a. Lower interest rates b. Raise interest rates c. Lower marginal taxes d. Sell treasury bills

35. Comparing the change in price of two substitutes over time, demonstrate that nominal prices may change leaving relative prices the same (all other things being equal).

36. Draw a simple graph showing the relationship between demand for a product and the supply of that product, where equilibrium is established at P3 (out of 5 price levels) and Q5 (out of 10 supply levels).

6 37. The idea developed by David Ricardo that, if an individual, firm or country can produce a good or service at a lower opportunity cost than its competitors, than it should produce that good or service, is called a. Absolute advantage b. Marginal advantage c. Comparative advantage d. Singular advantage

38. In the process of making Product X, the Acme Manufacturing company failed to conduct proper quality and safety studies; as a result, it was forced to recall over $10, 000 worth of defective product and faced several class action law suits. Ultimately, the company was forced into liquidation. This type of market failure would best be classified as a. Market Power b. Externality c. Internality d. Market Abnormality

39. Explain what is meant by the coordinating function of price. ______

40. John Maynard Keynes theorized that although a single individual might benefit by saving money during times of deflation, the general population will suffer because if too many people save, aggregate demand will drop, production will decline, workers will lose their jobs and, in the end, savings will be either flat or will decline. This is called the Paradox of Thrift or the Savings paradox. Using your critical thinking skills, which of the following might be a good argument against Keynes’ theory? a. The amount someone saves is money he would not have spent anyway, because he will only save the amount that exceeds his demand for goods and services; therefore, the amount he plans to spend will not change; therefore, aggregate demand will not fall, nor will savings decrease b. Unless people just shove the money under a mattress, it is in a bank. Thus, it is available to lend. Banks will desire to lend the money to

7 consumers who will spend it: thus, production of demanded goods and services will remain steady and aggregate consumption will not decline c. If demand drops, then prices will fall; and, although wages might follow, the overall effect on spending and savings will be slight or even negligible. d. Arguments a and c both make sense e. Arguments b and c both make sense

41. What is inflation (be exact!), and what distinguishes it from hyperinflation? ______

42. The most commonly used tool for measuring the impact of inflation on the economic decisions of American consumers is the a. Gross Domestic Price Deflator b. Consumer Price Index c. Personal Consumption Expenditure Deflator d. Producer Price Index

43. Use the information provided below to answer the question that follows. V = (P ´ Y)/M Where: V = velocity; P = the price level; Y = the quantity of output; M = the quantity of money In 2008 Economy X produced 100, 000 widgets (domestically). The price level supported a value of $5.00 per widget. The money supply in January of 2007 was $25, 000; but in November the Fed injected an additional $25, 000 into the economy. What was the velocity of money in economy X for 2008? ______(Show your math).

44. Explain the difference between nominal and real (physical) variables. ______

8 45. Land, labor, capital and, many economists add – entrepreneurial ability, are known as a. Economic variables b. Factors of production c. Production integrals d. Economic composites

46. The idea that all capital belongs to labor and that capitalism produces misery for workers as the drive for profits leads to increased mechanization reflects the thinking of a. Hume b. Marx c. Bastiat d. Von Mises

47. The idea that markets are “self-coordinating” as each person looks to his or her own self-interest reflects the thinking of a. David Ricardo b. Karl Marx c. Adam Smith d. Henry Hazlitt

48. The idea that a nations can obtain wealth only by selling more goods than they purchase, is best attributed to the a. Mercantilists b. Physiocrats c. Classicists d. Neo-classicists

49. The idea that direct government spending is necessary to revive an economy n deep recession is associated most directly with a. J. M. Keynes b. L. V. Mises c. C. Menger d. W. Williams

9 50. The idea that people’s choices reflect their understanding of what is likely to happen in the future is known as a. The “Greater Fool” theory b. The Rational Expectations Theory c. The Marginal Utility Theory d. The Theory of Anticipatory Opacity 51. Explain and give an example of comparative versus absolute advantage. ______52. Explain how trade can make everyone better off, and how specialization facilitates trade. ______53. Explain the difference between a “pegged” and floating exchange rate? Which one is more prevalent today? Why? ______54. What are the advantages to the United States of a weak U.S. dollar, in relation to other currencies? What are the disadvantages? ______

10 55. Global currency trading is facilitated through a. COMEX, a centralized exchange trading agency based in Brussels, Belgium b. FOREX, a centralized exchange trading agency headquartered in New York City, New York. c. A global system of private brokers d. The central banks of trading countries 56. The argument that an economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy is expressed in the a. Mundell-Fleming Model b. Berkshire-Hathaway Model c. Rozencrans-Gilderstern Model d. Georges-Blanc Model 57. Identify one major organization that exists to facilitate global trade and explain how it seeks to accomplish its mission. ______58. Sometimes, when a local currency does not reflect its true value against its pegged currency, a ______may develop. a. Currency shortage b. Currency surplus c. Currency barter system d. Black market currency exchange

59. Given data, construct a graph demonstrating the Production Possibility Curve, Production Possibility Fro

60. Identify two ways in which an economy’s Production Possibilities Frontier may be expanded. ______

61. Given a table of Demand and a table of supply, construct a graph showing the relationship between Demand, Supply, and Equilibrium.

11