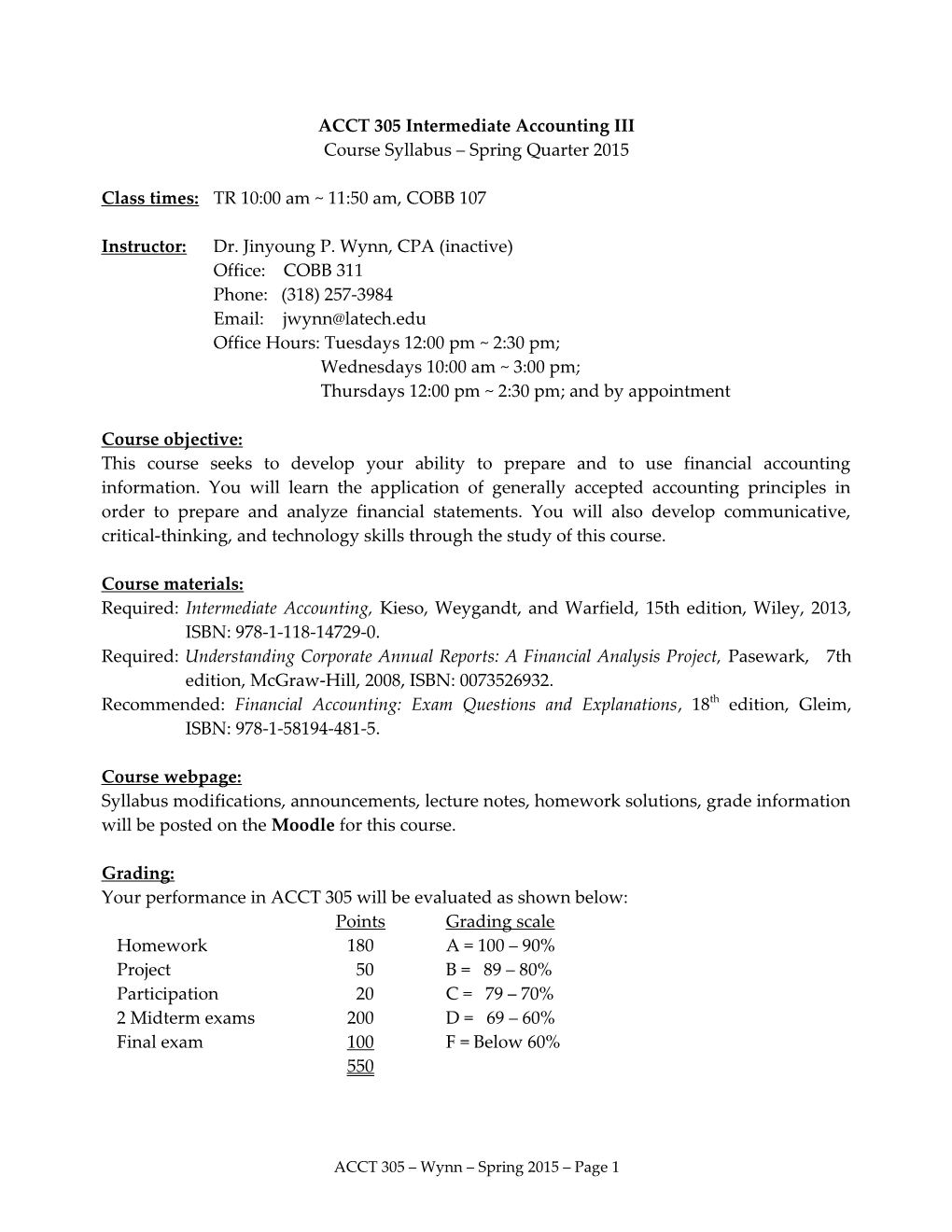

ACCT 305 Intermediate Accounting III Course Syllabus – Spring Quarter 2015

Class times: TR 10:00 am ~ 11:50 am, COBB 107

Instructor: Dr. Jinyoung P. Wynn, CPA (inactive) Office: COBB 311 Phone: (318) 257-3984 Email: [email protected] Office Hours: Tuesdays 12:00 pm ~ 2:30 pm; Wednesdays 10:00 am ~ 3:00 pm; Thursdays 12:00 pm ~ 2:30 pm; and by appointment

Course objective: This course seeks to develop your ability to prepare and to use financial accounting information. You will learn the application of generally accepted accounting principles in order to prepare and analyze financial statements. You will also develop communicative, critical-thinking, and technology skills through the study of this course.

Course materials: Required: Intermediate Accounting, Kieso, Weygandt, and Warfield, 15th edition, Wiley, 2013, ISBN: 978-1-118-14729-0. Required: Understanding Corporate Annual Reports: A Financial Analysis Project, Pasewark, 7th edition, McGraw-Hill, 2008, ISBN: 0073526932. Recommended: Financial Accounting: Exam Questions and Explanations, 18th edition, Gleim, ISBN: 978-1-58194-481-5.

Course webpage: Syllabus modifications, announcements, lecture notes, homework solutions, grade information will be posted on the Moodle for this course.

Grading: Your performance in ACCT 305 will be evaluated as shown below: Points Grading scale Homework 180 A = 100 – 90% Project 50 B = 89 – 80% Participation 20 C = 79 – 70% 2 Midterm exams 200 D = 69 – 60% Final exam 100 F = Below 60% 550

ACCT 305 – Wynn – Spring 2015 – Page 1 Homework (180 points, 15 points each): Homework problems can be found in the Student Companion Webpage as follows: http://bcs.wiley.com/he-bcs/Books?action=index&itemId=1118147294&bcsId=8063. Fourteen assignments will be collected. Only top 12 scores will count for a total of 180 points; the lowest two scores will be dropped. You are encouraged to discuss these assignments with each other and work together. A solution copied from other person’s work or any other source is NOT acceptable.

Project (50 points): An individual project involves the analysis of the financial statements of a corporation. You are required to complete the Pasewark workbook. The most recent annual financial statements of a corporation can be obtained from the corporate website or the Security and Exchange Commission’s EDGAR database.

Participation (20 points): For each class, I expect you to read the material and be prepared to discuss the day’s topics. Your participation is expected in the following ways: demonstrating preparedness for class, staying alert and attentive throughout class, volunteering to answer questions, making insightful comments, and asking thoughtful questions.

Examinations: The exams will be closed book. You may use a calculator. Calculators may be financial or scientific calculators. No other electronic devices such as laptops, cell phones, tablets are permitted. Students are expected to take exams at the scheduled times. Only in the case of a well-documented emergency or university-sponsored activity will an exam be rescheduled. You must get the instructor’s prior approval.

Academic dishonesty and plagiarism policies: Ethics are very important in accounting, in the world of business, and in education. The instructor will assume, unless there is evidence to the contrary, that you are an ethical student. In accordance with the Academic Honor Code, students pledge the following: “Being a student of higher standards, I pledge to embody the principles of academic integrity.” Academic honesty as specified in the University’s Academic Honor Code is expected and required of all students. Cheating on examinations or plagiarism will result in disciplinary actions.

For students with disabilities: Qualified students needing testing or classroom accommodations based on a disability are encouraged to make their requests to me at the beginning of the quarter either during office hours or by appointment. Note: Prior to receiving disability accommodations, verification of eligibility from the Testing and Disability Services

ACCT 305 – Wynn – Spring 2015 – Page 2 Office is needed. Disability information is confidential. Information for Testing and Disability Services may be obtained in Wyly Tower 318 or www.latech.edu/ods.”

Emergency Notification System (ENS): Emergency Notification System: All Louisiana Tech students are strongly encouraged to enroll and update their contact information in the Emergency Notification System. It takes just a few seconds to ensure you’re able to receive important text and voice alerts in the event of a campus emergency. For more information on the Emergency Notification System, please visit http://www.latech.edu/administration /ens.shtml.

ACCT 305 – Wynn – Spring 2015 – Page 3 ACCT 305 – Spring 2015 – Course Schedule* E=Exercise; CA=Concepts for Analysis DATE TOPICS ASSIGNMENT Mar 12 Thursday Chapter 16: Dilutive securities and earnings per share E16-1B, E16-7B, E16-11B Mar 17 Tuesday Chapter 16: Dilutive securities and earnings per share E16-13B, E16-15B (a) & (b) only, E16-25B Mar 19 Thursday Chapter 17: Investments E17-1B, E17-2B, E17-6B Mar 24 Tuesday Chapter 17: Investments E17-4B, E17-11B, E17-16B Mar 26 Thursday Chapter 18: Revenue recognition E18-15B, E18-16B, E18-23B Mar 31 Tuesday Chapter 18: Revenue recognition E18-13B, E18-25B, E18-27B Apr 2 Thursday Exam I (Chapters 16, 17, & 18) Apr 7 Tuesday Chapter 19: Accounting for income taxes E19-5B, E19-6B, E19-9B Apr 9 Thursday Chapter 19: Accounting for income taxes E19-13B, E19-16B, E19-25B Apr 14 Tuesday Chapter 20: Pensions and postretirement benefits E20-11B, E20-15B, CA20-1 Apr 16 Thursday Chapter 20: Pensions and postretirement benefits E20-7B, E20-16B, E20-24B Apr 21 Tuesday Exam II (Chapters 19 & 20) Apr 23 Thursday Chapter 21: Accounting for leases E21-1B, E21-2B, E21-4B Apr 28 Tuesday Chapter 21: Accounting for leases E21-7B, E21-10B, E21-15B Apr 30 Thursday Chapter 22: Accounting changes and error analysis E22-6B, E22-11B, E22-18B May 5 Tuesday Chapter 23: Statement of cash flows E23-1B, E23-2B, E23-15B May7 Thursday Chapter 24: Full disclosure in financial reporting E24-2B, E24-3B, CA24-12

* Due date for final project May 12 Tuesday Catch-up and Review May 14 Thursday Final exam (Chapters 21, 22, 23, & 24) * Course schedule is subject to change at instructor’s discretion.

ACCT 305 – Wynn – Spring 2015 – Page 4