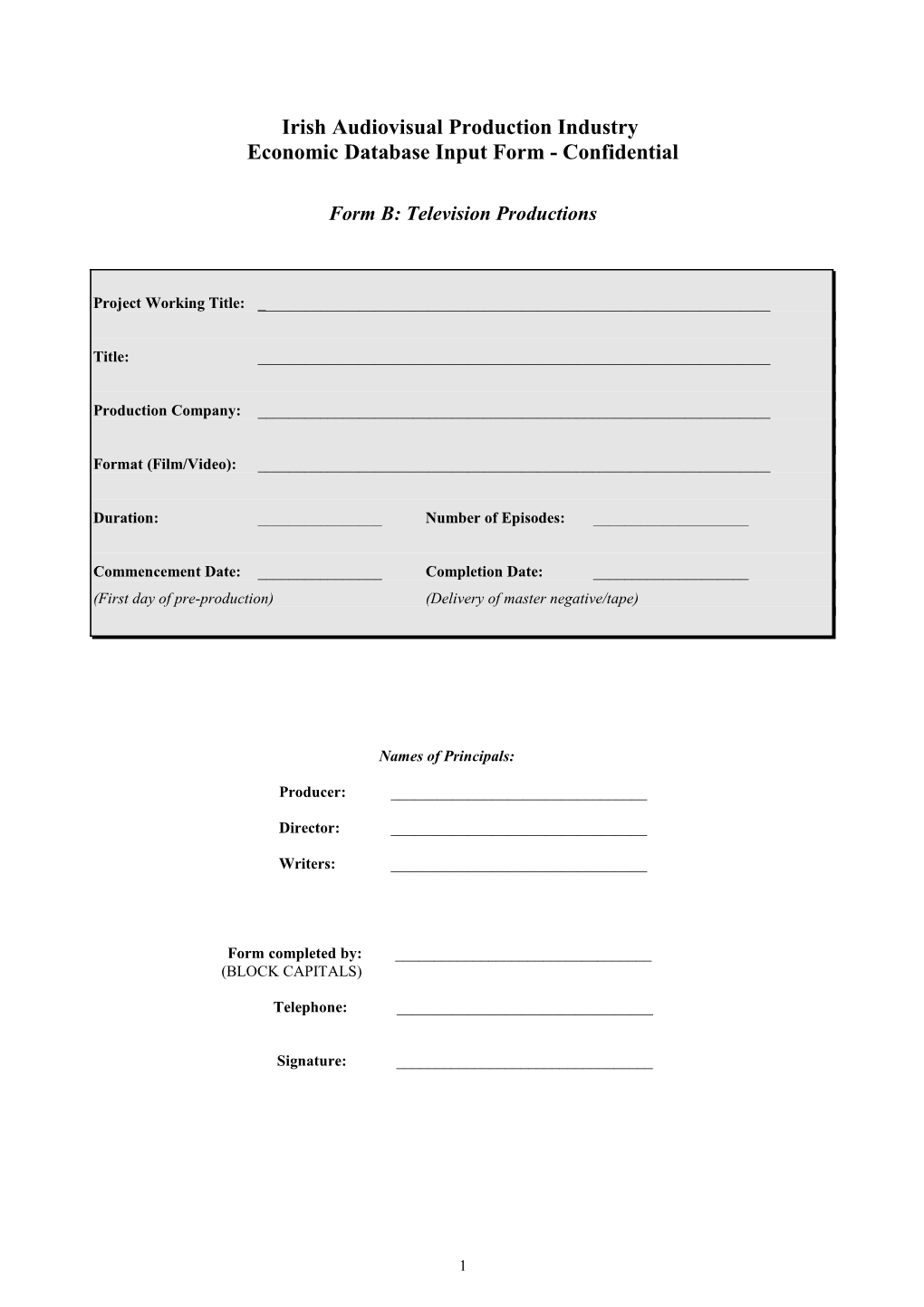

Irish Audiovisual Production Industry Economic Database Input Form - Confidential

Form B: Television Productions

Project Working Title: ______

Title: ______

Production Company: ______

Format (Film/Video): ______

Duration: ______Number of Episodes: ______

Commencement Date: ______Completion Date: ______(First day of pre-production) (Delivery of master negative/tape)

Names of Principals:

Producer: ______

Director: ______

Writers: ______

Form completed by: ______(BLOCK CAPITALS)

Telephone: ______

Signature: ______

1 1) Type of Project (Note 1 – see Explanatory Notes)

Please indicate below with a the type of project TV Programme Drama Variety/Entertainment Documentary Children/Young People

Factual Other, please specify

2) PROJECT FUNDING (Note 2 – see Explanatory Notes)

Source of Funding Please specify below Amount IR€ sources of funding where an * sign is indicated IRISH - Bord Scannán na hÉireann/Irish Film Board

- Radio Telefís Éireann

- Teilifís Na Gaeilge (TG4)

- TV3

- Section 481 (total amount raised)

- An Chomhairle Ealaion/The Arts Council

- Private Equity

- Deferments

- Other (please specify) *

NON IRISH (note 3)

- Broadcasters *

- Eurimages

- MEDIA Programme

- Other UK Sources *

- Other EU Sources *

- US *

- Other (please specify) *

TOTAL NOTE: Total Funding must match Total Expenditure on Page 3

2 SUMMARY DETAILS

3) EXPENDITURE (Note 4 - see below) Calculation of VAT foregone (Note 5 - see below) Total Expenditure on Expenditure on Expenditure on Expenditure Irish Accommodation/ Petrol in Ireland IR€ Labour/Goods & Catering/ Car Hire € Services IR€ in Ireland IR€ (This must match Total Funding P2)

Note 4: Expenditure on Irish Labour / Goods & Services would include all wages/salaries fees (incl PAYE & PRSI spend) and all expenditure on services, including sets, catering processing, transport, accommodation etc (where applicable).

Note 5: ‘Accommodation / Catering / Car Hire’ and ‘Petrol’ – these are subject to VAT, but the VAT is not reclaimable and provides another source of revenue to the Exchequer. Two figures are requested, as different VAT rates are applicable, to enable the VAT foregone to be calculated.

4) NUMBERS OF PEOPLE EMPLOYED / IRISH WORK HOURS / IRISH LABOUR COSTS (Note 6 – see below)

Numbers Employed Irish Employment Irish Labour Costs Generated (Gross Wages/Salaries/Fees) Total Nos: (Irish Work Hours) (Note 7 – see Explanatory Notes)

Non-Irish Irish Subject To PAYE * Other (e.g. free lance)

Males Females

* If subject to PAYE, please give details of PAYE & PRSI paid in Question 5 below

Note 6: The term ‘Irish’ in relation to Irish Labour means ‘domiciled, resident or ordinarily resident in the state’. In relation to Goods & Services, ‘Irish’ means ‘goods & services provided by Irish resident companies or persons domiciled, resident or ordinarily resident in the State’.

5) RETURNS TO THE IRISH EXCHEQUER

PAYE PRSI Corporation Tax Total €

Total Taxes Paid

The data contained in this form is submitted to the IBEC Audiovisual Federation for the compilation of an annual economic report on film production in Ireland. This information, which will only be used in an confidential and non-attributable way, will be enormously useful in assessing the economic and employment contribution of the film industry sector to the Irish economy.

Please ensure that this form is completed in full and returned as soon as possible to:

Independent Productions Unit, RTÉ, Donnybrook, Dublin 4 Tel: (01) 2083429

3