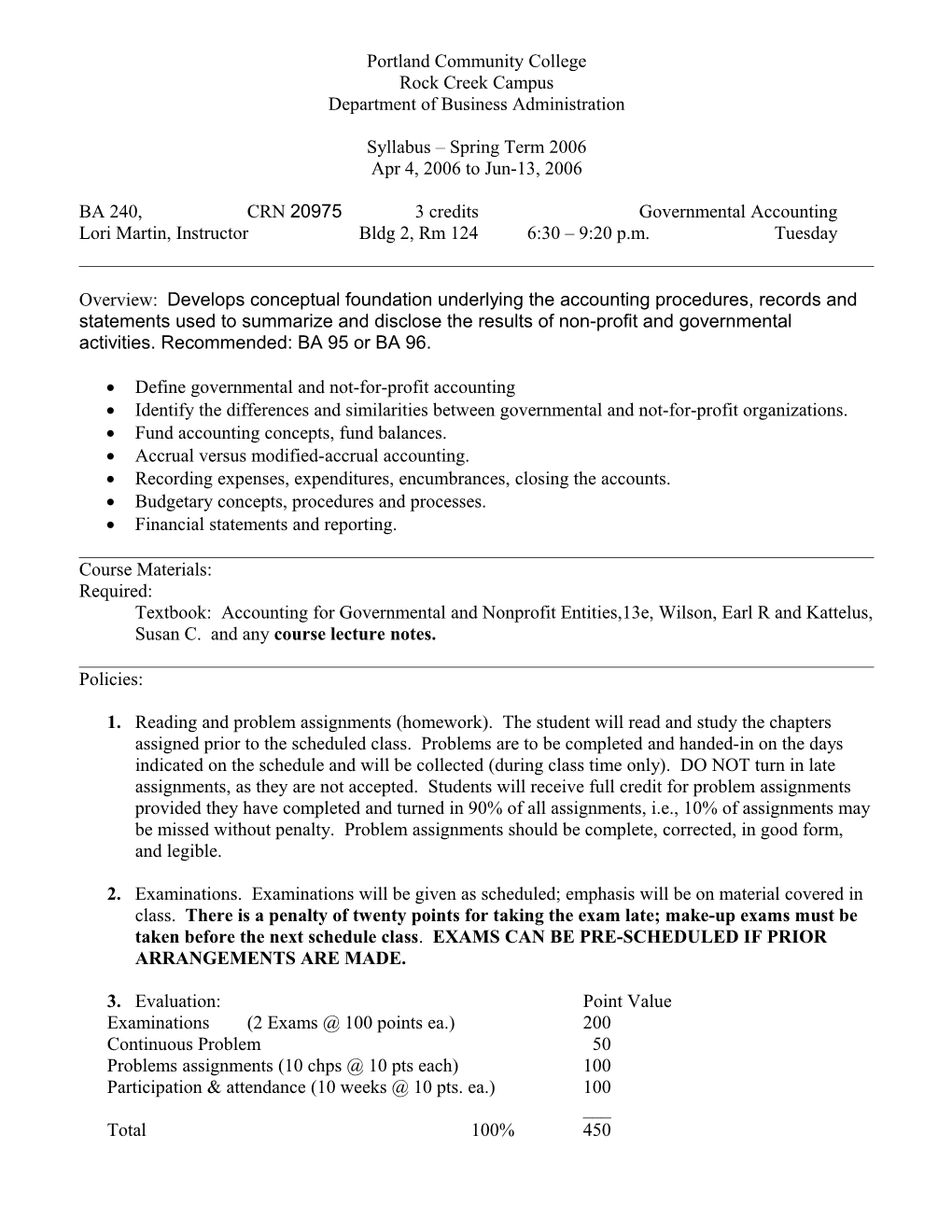

Portland Community College Rock Creek Campus Department of Business Administration

Syllabus – Spring Term 2006 Apr 4, 2006 to Jun-13, 2006

BA 240, CRN 20975 3 credits Governmental Accounting Lori Martin, Instructor Bldg 2, Rm 124 6:30 – 9:20 p.m. Tuesday

Overview: Develops conceptual foundation underlying the accounting procedures, records and statements used to summarize and disclose the results of non-profit and governmental activities. Recommended: BA 95 or BA 96.

Define governmental and not-for-profit accounting Identify the differences and similarities between governmental and not-for-profit organizations. Fund accounting concepts, fund balances. Accrual versus modified-accrual accounting. Recording expenses, expenditures, encumbrances, closing the accounts. Budgetary concepts, procedures and processes. Financial statements and reporting.

Course Materials: Required: Textbook: Accounting for Governmental and Nonprofit Entities,13e, Wilson, Earl R and Kattelus, Susan C. and any course lecture notes.

Policies:

1. Reading and problem assignments (homework). The student will read and study the chapters assigned prior to the scheduled class. Problems are to be completed and handed-in on the days indicated on the schedule and will be collected (during class time only). DO NOT turn in late assignments, as they are not accepted. Students will receive full credit for problem assignments provided they have completed and turned in 90% of all assignments, i.e., 10% of assignments may be missed without penalty. Problem assignments should be complete, corrected, in good form, and legible.

2. Examinations. Examinations will be given as scheduled; emphasis will be on material covered in class. There is a penalty of twenty points for taking the exam late; make-up exams must be taken before the next schedule class. EXAMS CAN BE PRE-SCHEDULED IF PRIOR ARRANGEMENTS ARE MADE.

3. Evaluation: Point Value Examinations (2 Exams @ 100 points ea.) 200 Continuous Problem 50 Problems assignments (10 chps @ 10 pts each) 100 Participation & attendance (10 weeks @ 10 pts. ea.) 100 ___ Total 100% 450 This is a graded course. A final letter grade for the course will be based on the student’s mastery of the course material, as evidenced by the student’s point total, consistency of performance, as well as class participation. Consideration will be given to the student’s performance relative to the class as a whole. Grades are as follows:

90-100 = A 80 89 = B 70-79 = C 60-69 = D below 60 = F

Students requiring special accommodations should contact the Office for Students with Disabilities for assistance in requesting classroom accommodations by calling them at 503-614-7576.

Students are invited to meet with me at a scheduled time to discuss any problems or please consult your academic advisor.

4. Classroom etiquette: Please arrive on time and remain for the entire class period. Cell phones or beepers should be turned off so that they do not disturb the class. Eating and drinking are tolerated as long as they do not interfere with your work or your neighbor’s work.

Contact Information:

Lori Martin Message: 503-648-4140 Email: [email protected] Tentative Schedule

Week Date Chapter Topic Assignments Due 2006 Date 2006

1 4-4 Syllabus, Procedures, Website Visit the PCC Website 4-4 Overview of Governmental Accounting For syllabus and book

2 4-11 Handout The Foundation of Governmental & Not- Exer. 1-1 and 1-2 4-18 For-Profit Accounting

3 4-18 2 Principles of Accounting & Financial 2-2 (1-10) & 2-3 (1-10) 4-25 Reporting for State & Local Government

4 4-25 3 Accounting for General & Spec Rev Funds 3-2 (1-10) 5-2 Exercise for Practice 3-3, 3-4, 3-5

5 5-2 4 Accounting for Governmental Operating TBD 5-9 Actvities

6 5-9 Take Home Exam chp 1-4 5-16 5 Accounting for General Capital Assets & Capital Project

7 5-16 6/7 Accounting for General Long-Term TBD 5-23 Liabilities & Debt Service and Accounting for Fiduciary Activities

8 5-23 8/9 Accounting for Fiduciary Activities & TBD 5-30 Financial Reporting of State & Local 9 5-30 10/11 Analysis of Governmental Financial TBD 6-6 Performance & Auditing of Governmental and Not-for-Profit Organizations 10 6-6 14 Accounting for Not-for-Profit TBD 6-13 Organizations

11 6-13 Final Exam Congratulations & Good Luck!!